A Fresh JOLT but No Shock

We update the JOLTS data in a month where it’s strong but on balance a little less inflationary.

Hopefully not hooked on hiking!

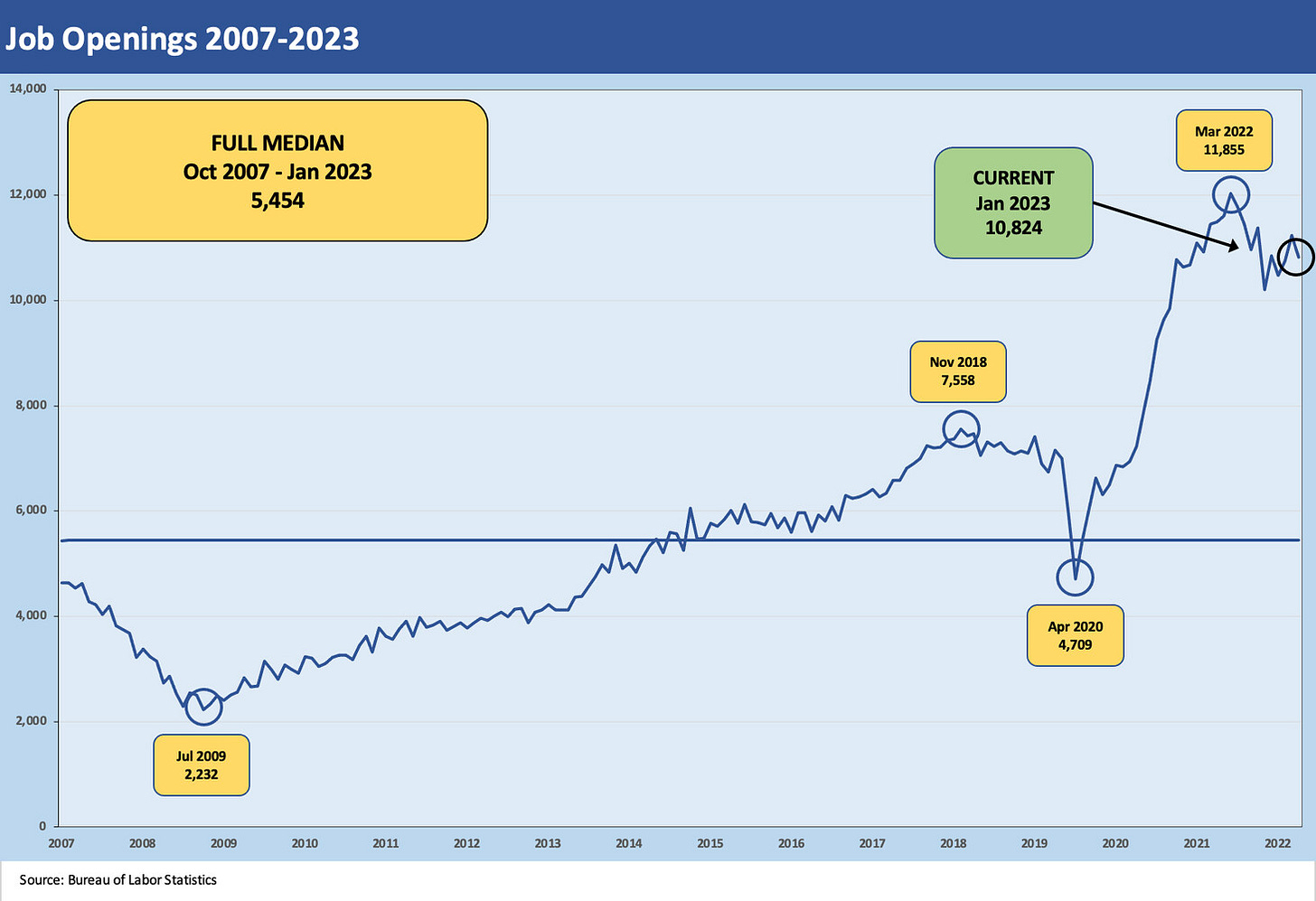

The JOLTS numbers for January (released today) show sustained healthy labor market demand, so the beat goes on around the same debate as the day before on inflation and handicapping the terminal rate and the new “6% solution.” Labor markets remain tight, the modest sequential decline in job openings to 10.8 million (-410K sequentially) beats the alternative in the context of the inflation debate. That 10.8 million number comes after a very strong set of numbers for December (see JOLTS: More Bodies for More Jobs, Demand is Strong 2-1-23).

We update the main moving parts below. The summary for January is that job openings remain exceptionally high, hires are still running ahead of separation, and the quits rate declined.

The headline number for job openings was down but still quite high. The peak of 11.9 million was in March 2022, the month when ZIRP ended and the tightening process was about to kick into gear.

We continue to view the labor markets as a part of the menu that calls for continued Fed tightening. Our longstanding view on fed funds vs inflation is that the relationship between the two still requires that inflation come down faster or fed funds move higher. This is not the first time there was chatter around 6% (see Fed Funds vs CPI: Narrowing of the Gap 12-14-22). That would be consistent with history and an intuitive conceptual view of what a tightening process historically has done (see Fed Funds vs. PCE Price Index: What is Normal? 10-31-22, Fed Funds-CPI Differentials: Reversion Time? 10-11-22).

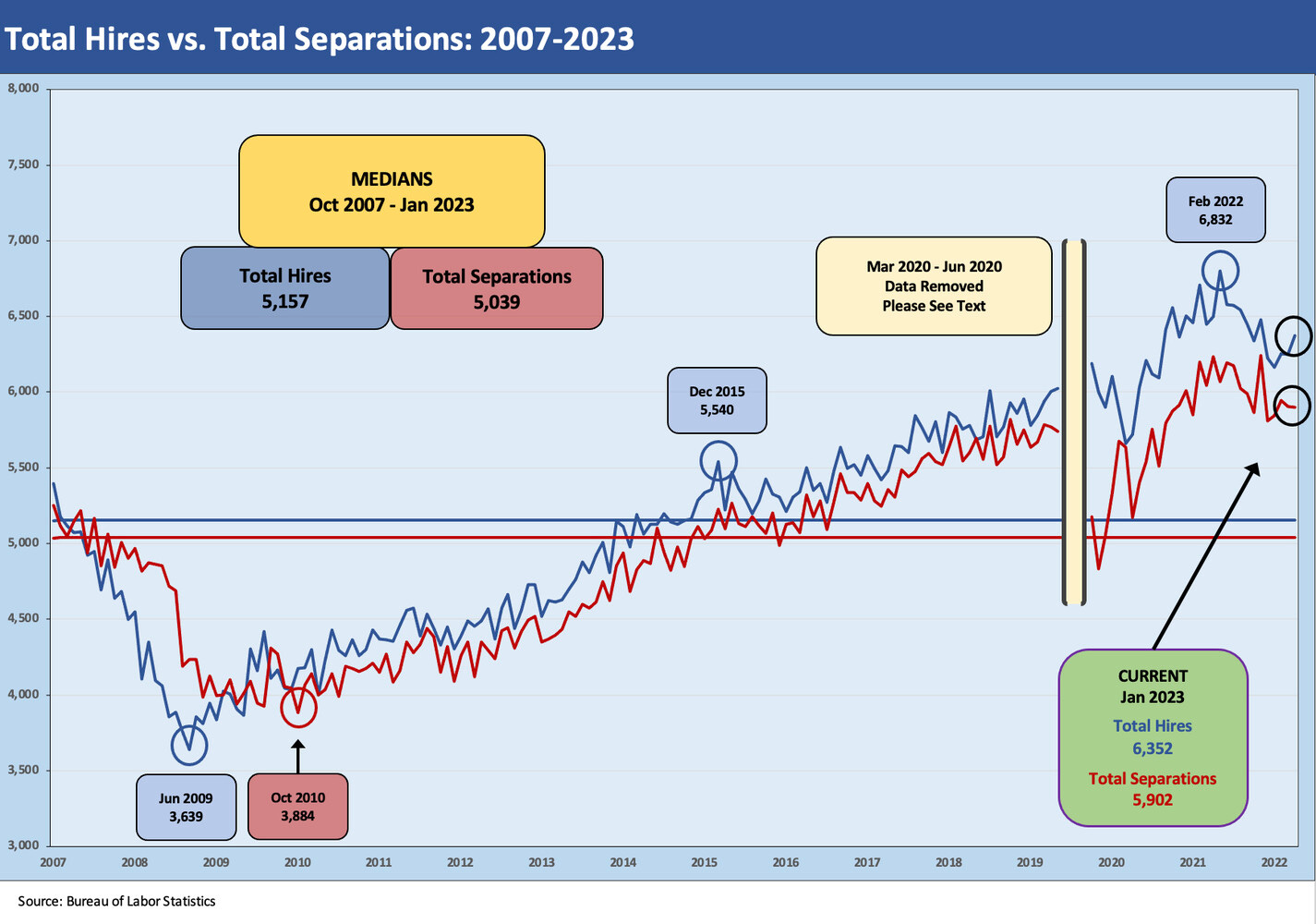

“Hires vs. Separations” are plotted above, and there are clearly a lot of both going on with record payroll numbers and a very active level of turnover and confidence in finding work as underscored further below in the quits rate.

Please note we removed the insanely high swings of the COVID period for purposes on the visual scale in the chart. This applies to other charts as noted in this commentary. We have looked at the COVID spike numbers in detail in other pieces (see Jobs and the Fed: JOLTS Gets Heavy Powell Focus 11-30-22).

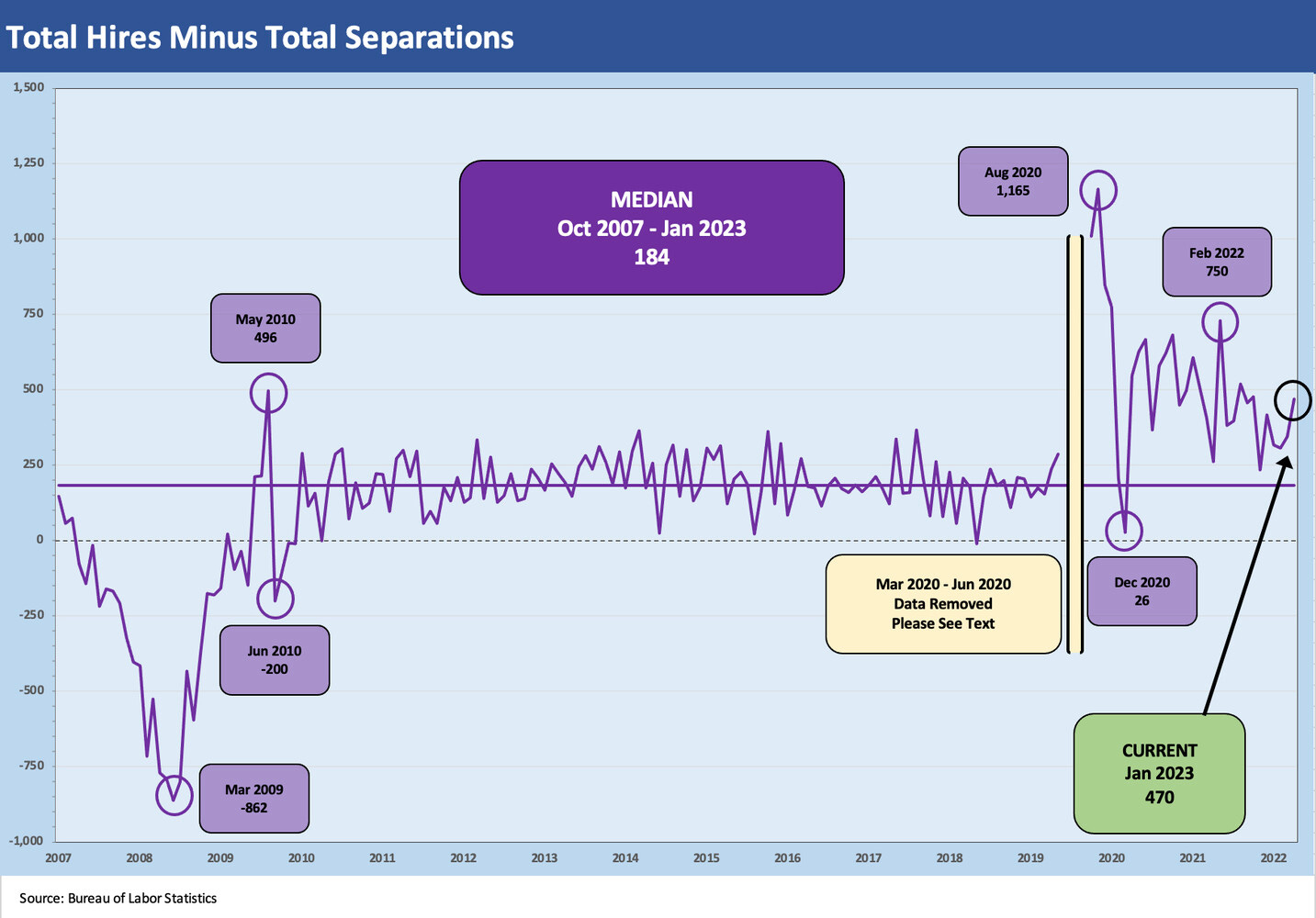

“Hires minus Separations” is a very common-sense metric, and current excess of hires vs separations is well above the long-term median as noted. The excess grew sequentially to 470K in January. That offers another data point showing a labor market that is finding employment on the other side of separations or new additions to the work force.

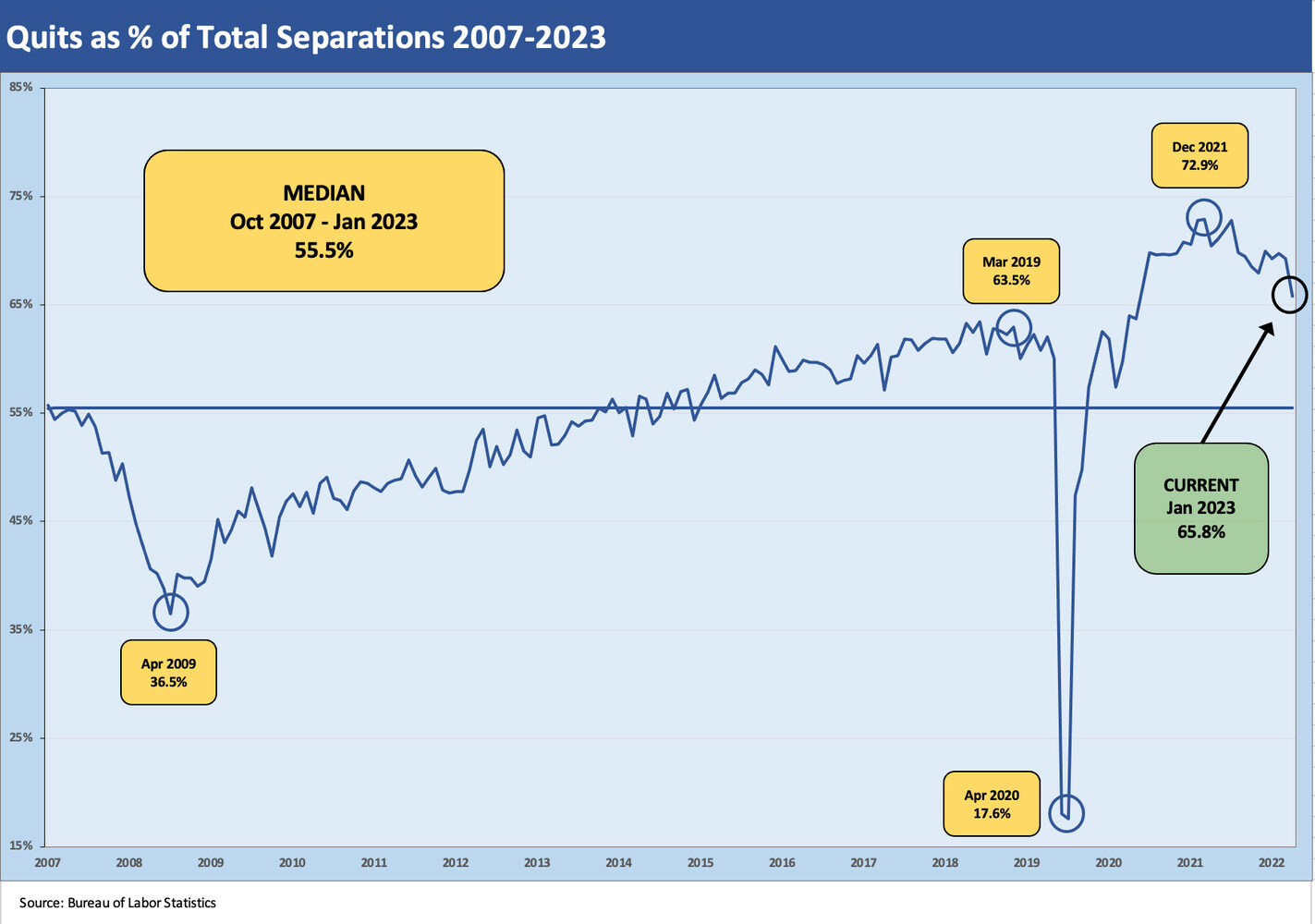

The Quits rate frames the mix of discretionary separations, and January 2023 is down to just under 66% after peaking in Dec 2021 at almost 73%. The long term median of 56% shows that labor remains confident. Such metrics come down to a review of mix, and there is a very heavy mix of turnover in lower wage services sectors. The two-way traffic runs in high volumes.