Personal Income and PCE: Inflation Stickier

PCE inflation watchers are likely disappointed, but those looking for a steady economy can feel better.

“Sticky inflation gooing up the storyline.”

Inflation indicators were adverse but crowded out by debt ceiling realities, but the consumer is alive and well on the PCE line despite the binary risk profile of the debt ceiling in coming days.

PCE outlays in Goods rebounded materially while Services were higher and steady.

PCE inflation ticked up to 4.4% from 4.2% while core PCE inflation rose to 4.7% from 4.6%.

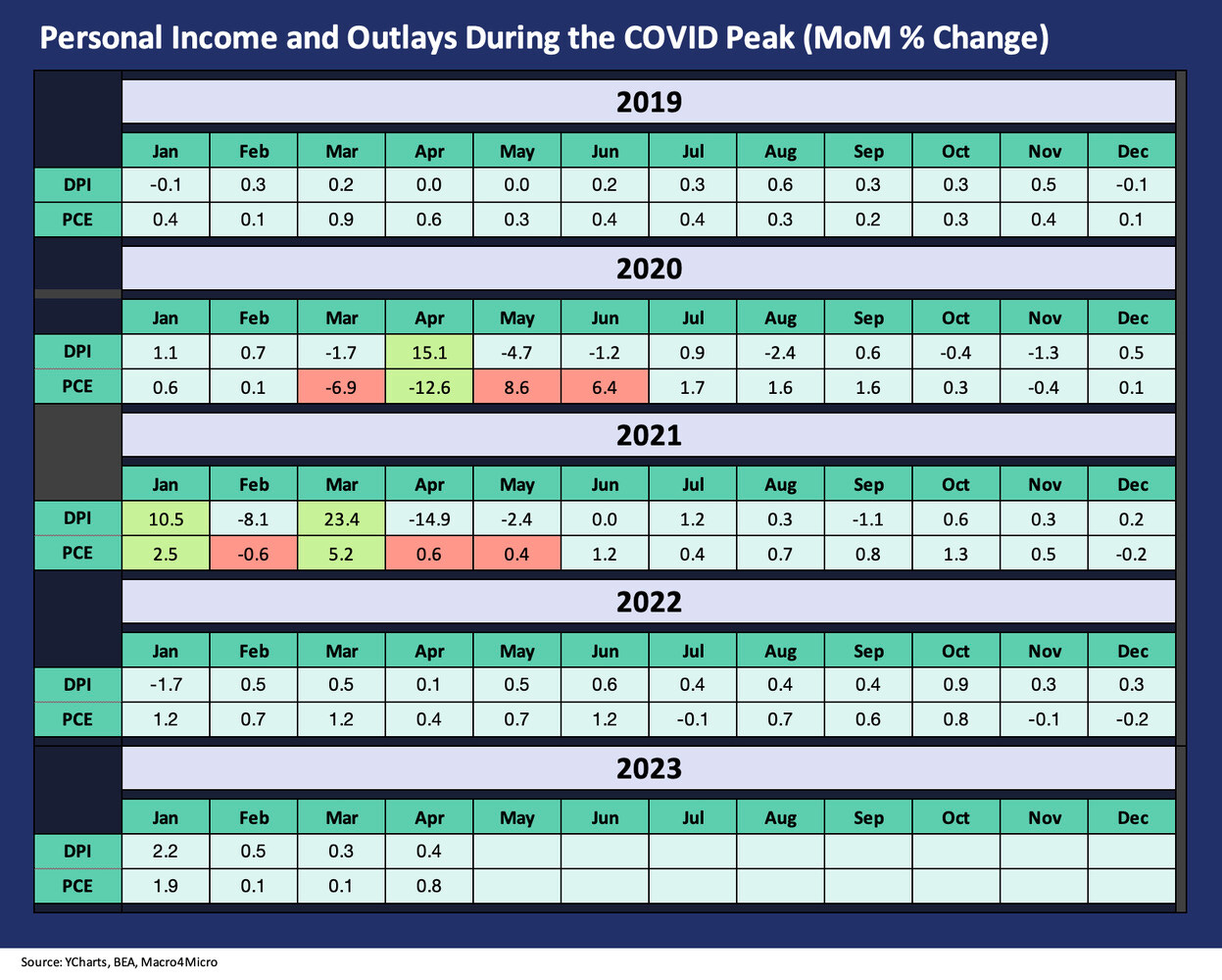

The timeline across the inflation and tightening period is plotted above for PCE vs. DPI. For April 2023, the PCE line is the most newsworthy item as it popped above expectations and outpaced disposable income. For monthly sequential trends, we saw a +0.8% in current dollar PCE (0.5% in 2012 dollars), ahead of expectations, while DPI was +0.4% (0.0% real terms).

The same old rule about “don’t bet against the US consumer” held serve this month. Real PCE outlays came in at +2.3% YoY. The Goods line came in at +1.5% with Durables at +2.6%. Autos were strong (+28.8% change in monthly spending for Motor Vehicles and Parts). Real PCE for Services was +2.7%.

As we saw last month (more revisions in April release) Goods PCE was strong in 1Q23 at +6.3% with Durable Goods at 16.4% on rebounding automotive activity. Services at +2.5% in 1Q23 had ticked up from the +1.6% in 4Q22. Bullish employment trends certainly cannot hurt expectations ahead (see Employment April 2023: Post-COVID Deep Dive by Occupation 5-5-23), but that debate will continue on events (Washington) and macro questions (tighter credit, etc.).

The table above posts the month-to-month timeline for Disposable Personal Income and Personal Consumption Expenditures each month since the start of 2019. A Congressional clerk should probably hand out something like this in political debates to see if they can hash out which legislation actually was inflationary and what was in substance filling in a hole (see Inflation Rorschach Test: Looking at Relief and Stimulus 2-7-23).

The Fed has been getting mixed signals for a while from CPI and PCE (see CPI: April Flowers 5-10-23, Employment Cost Index: Slow Motion 4-28-23, Personal Income, Outlays and PCE Prices: Calm Before Confusion 3-31-23), and this latest round of numbers on PCE inflation do not help the story. That said, some other releases today are touting declining inflation expectations. Those are not mutually exclusive since there is much to play out in coming months on the macro front – let alone next week on the debt ceiling.

The above chart updates the timeline from January 2019 through today. We like to update this time series to remind ourselves of the magnitude of the COVID chaos and the swings in DPI and PCE around legislative initiatives and Fed actions used to reassure markets and households alike.

The supplier chain dynamics below the surface flowed into serious price dislocations on product availability (old school supply and demand), and we would love to hear any politician saying they wish their constituents did not have the means to buy those goods in those markets (that is a specific question they are never even asked, and they sure do not volunteer a view on that). The good news at least is that those low and relatively balanced lines following that period bring us to where we are today with sharply lower inflation than the 2022 CPI assault and with more than 50-year lows in unemployment.

The demand side of low unemployment and higher waged seldom works into the commentary in the “you caused inflation” diatribes. That trend line could have used some time to play out, but now the markets (and beneficiaries of record payroll counts) get to lie down in the crossroads of a debt default intersection and hope that record high payroll does not see a truck run over it. That would certainly change the employment ranks and reduce demand. It is hard enough with the Fed tightening financing costs. A debt default would be tightening a noose. Jobs are obviously important to DPI and PCE!