Inflation Rorschach Test: Looking at Relief and Stimulus

The inflationary effects of the 2021 COVID relief payments get overstated relative to much bigger catalysts.

We zero in on the time frame when the CARES Act (Mar 2020), the COVID Relief Act (Dec 2020) and American Rescue Plan (Mar 2021) provided relief and economic impact payments.

Playing politics with the inflation variables is the norm in Washington, but it does not help get to the critical focal points of what really drove inflation with the Fed at #1 and the wave of supply chain problems #2.

When things get blurry and noise louder, we always get back to where those supply and demand curves set prices across so many product and service categories.

Some commentators routinely cite the last wave of payments (American Rescue Plan) in March/April 2021 as the main culprit in inflation, but the tone tends to be more about politics than facts. The trend line in PCE across the months and years of COVID volatility shows the consumption effect dissipating early in the 2021 experience. That was before the Delta variant wave added even more disruption in supply chains in the late spring and summer and set off a material shift in pricing across so many different goods and services.

In our view, the various rescue plan payments – whether in 2020 or 2021 – were not the key drivers of the supply and demand shifts along this ride to high inflation. We see the Fed, mortgage refinancing, a rapid job rebound, and then Russian actions as playing the bigger role.

With respect to the Dec 2020 relief bill or the American Rescue Plan of March 2021, anything that improves relative demand trends is by definition another input into how inflation played out, but filling a hole (employment trends, aggregate income weakness from COVID effects, etc.) is not the same as building a hill. The unemployment rate dropped from 8% handles in Aug 2020 to 6% handles in the “vaccine month” of early November when the Nov 9 headlines sent the market soaring. From the 6% handle unemployment rate in March 2021 to the 3% handle to end the year in Dec 2021, there was a lot going on and ZIRP still ruled at the Fed. That is a lot of bodies added to payroll and a lot of paychecks.

Factoring Personal Income and Outlays into the picture….

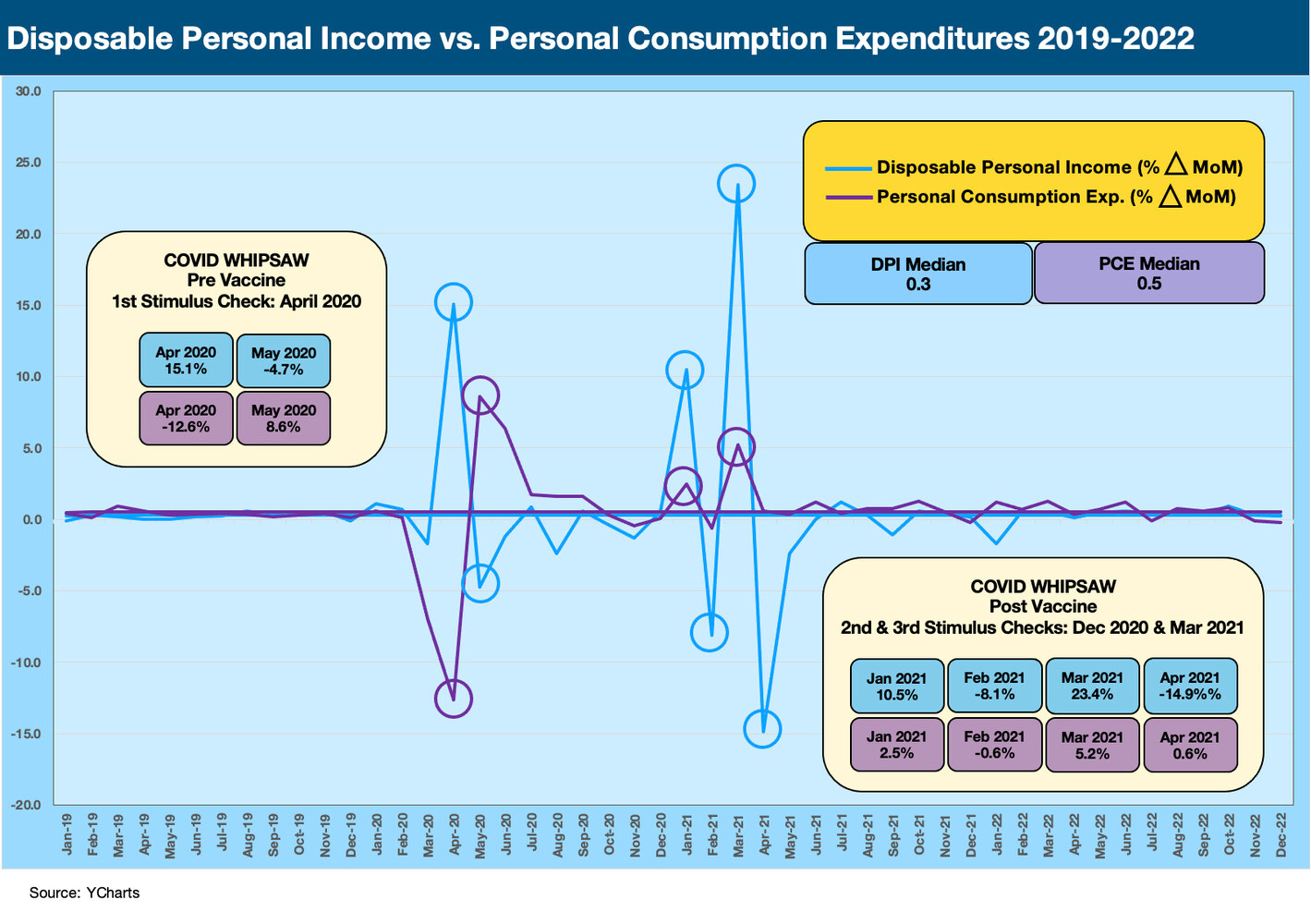

The chart at the top of this piece plots month-on-month % change in Disposable Personal Income (“DPI”) vs. monthly change in Personal Consumption Expenditures (“PCE”). The BEA defines DPI as simply “Personal Income less current taxes.” PCE is exactly what it sounds like. In the line chart, we also plot the trend for the months through 2022 for MoM % changes. In a table below, we also break out the BEA numbers for each month from 2019 to 2022 for a granular frame of reference.

The chart above uses the term “stimulus” even though the term relief and economic impact payments were tossed around back in those days. As far as I am concerned, it was all stimulus in the minds of most in Congress – whether for the economy or stimulus for votes. The growth numbers were set against the backdrop of a brutal stretch in US history, so the image of some income spikes on government support is logical enough. The last pandemic was 1918.

The consumption pattern and amounts awarded per person (mostly middle income and lower) are not the main event by any stretch in the inflation story that followed. The support to business and pent-up demand played a big role as did the “tax cut” from a collapse in oil and the cash flow boost from refinancing benefits on mortgages. In the fall of 2020, the vaccine in early Nov 2020 was the most important item for the capital markets at the time.

There is a laundry list of key inflation drivers, but the protracted and myriad supply disruptions and bad luck timing with the demand spikes of 2021 strike us as much more of the inflation catalyst than the fiscal demand growth in 1Q21. The initial wave of PCE spikes in 2020 and 2021 quickly saw the MoM PCE growth revert to low growth and more recently to contraction. There has to be a more complex story line, and there are easily identifiable and more important variables.

Our view is that anything in monetary or fiscal actions that drives demand can be inflationary. After all that means “demand.” That said, the other side of the equation – supply – also comes into play in any rational Econ 101 assessment. Unfortunately, talking heads in Washington on both sides of the aisle like to only pick the aspects of Supply or Demand that work for their narrative.

In the table, you’ll see PCE had a few pops with the stimulus payments, but the follow-on PCE MoM % changes in the timeline after the payments (April 2020, Jan 2021, March 2021) were underwhelming and even saw some negatives. That makes a tough case for a key inflation driver. The problem of supply only got a lot of attention later. Our simple point is that the supply chain had melted down in 2020 and melted down even more in 2021 as jobs and consumer demand both rebounded even without the stimulus payments.

Inflation blame games will continue even as it declines…

We have written plenty on the inflation topic (see archives), and we routinely update the main line items and weightings in the CPI index each month (see CPI Wrap for 2022: The Beginning of the End? 1-12-23). The Disraeli quote, “There are three kinds of lies: lies, damned lies, and statistics” is fair enough, but we always question those who come armed with no statistics, few facts, lots of opinions, and too much self-interest. That is the case on inflation these days.

There are causes and effects and factual developments that come with inflation. This is true whether it is the GOP blaming Biden for all of inflation or the Democrats blaming Big Oil for commodities inflation. The oil industry spin from some senior Democrats is especially silly after oil companies saw record default rates over 5 years from late 2014 with an oil crash and pressure on capex hammering the sector. For a while, the E&P sector was termed by some in the equity world as a sector that was not tradeable. So much for pricing power…

Below we check off some major areas of the inflation conversation. The Personal Income and Outlays stats from 2020 and early 2021 seem like ancient history now.

The laundry list of key inflation drivers is a long one, but some catch bigger headlines…

The Fed: The Fed’s slow move on tightening in the face of inflation will catch the most heat in the history books. Playing catch-up is not pretty. ZIRP and QE have now reversed gear into rapid hikes and QT as part of the most aggressive tightening cycle since Volcker. The impact on the curve from all the forces at work ran the full length of the yield curve, so all purchases with debt are more costly. A brief pop in consumption from government COVID support pales in comparison as a demand driver. That said, the Fed has a dual mandate and they sure took care of the full employment side of the mandate. That in turn sent the pendulum back the other way.

Whether it is the 1% world of Greenspan into 2004 (see Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22) or Powell ZIRP’s world of March 2020, 2021 and into March 2022, easy money can move all lenders and especially consumer lenders. That is a lot of margin on credit cards and consumer loans. We also cannot ignore the ability of homeowners to “give themselves a raise” by locking in 2% and 3% handle mortgages. That had little to do with middle and lower income households getting some checks in $1400 increments in the rescue plan of Mar 2021. Lower mortgage rates frees up a lot of monthly discretionary household cash flow for other spending.

Supply Chain: The scale of the disruptions tacked on even more painful unit cost effects across both variable and fixed costs. The price tag of working capital and all categories of goods felt the impact of cost hikes from shipping to trucking to warehousing. That had to be recovered in price (if possible) plus something extra for profit margins if the market would bear it. The reality was pricing power was there plus some extra for the shareholders. Welcome to the market economy.

Freight and logistics are not the only supply chain factor in the supply disruptions. China lockdowns undermined the supply of critical components in the finished goods chain. The supplier setbacks also slowed delivery of many categories of consumer products. That in turn undermines supplies to retail. Then the corporate sector customer overcompensates and shifts to “just in case” inventory management from just in time. Then there can be too much inventory as some industries have seen of late. If demands fades, there is then too much inventory and prices for some inventory falls. The supplier chain is the gift that goes on giving.

The chips shortages stole the headlines in autos by driving prices higher for new cars and further distorting the relationship with used cars. The chips problem helped send new car prices into a supply-demand shortfall that in turn sent used car inflation into a long stretch of double-digit inflation in the CPI accounts (30% and 40% handles were impressive!)

The complexity of global supplier chains is much more appreciated now after some ill-advised and economically inefficient tariff policies started off the problems in 2018-2019. That had started disruptions and freight and logistics breakdowns that turned into massive – and very costly – chaos with COVID. We thought those problems would subside during 2021, but the Delta variant then accelerated in late spring 2021. Then China COVID policies took the disruptions a notch up again but at a time when demand was soaring for goods and services alike.

Russia-Ukraine and oil and gas spike: Oil and natural gas gets associated with transportation and home heating and power generation broadly, but the carbon family goes well beyond those. The petrochemical chain is the building block for a list of durables goods and consumer products that is like an old Manhattan phonebook. Those unit cost flowthroughs are as important in the inflation story as the fuel surcharges are for delivery of products by sea, air, and land.

The oil industry started to come up with clever ads on how pervasive the hydrocarbon chain is via plastics of specialty chemicals. My favorite commercial was the blind date where many things they were wearing or carrying, such as clothing items, shoe parts, hair gel, makeup, phone components, etc., started to disappear. That is inflation risk. That would go under the “supply” category! Commodity pricing cannot be simplified in soundbites.

Fiscal stimulus: This is where the action gets political and was one reason why we produced the charts above in the first place. Government spending can support demand, and it can support supply. The CARES Act was there primarily to support demand (or prevent a cyclical collapse and mass unemployment, evictions, an inevitable crime spike, and a lot of human suffering). The COVID relief actions of Dec 2020 had small business support as its largest line item in the $900+ million bill as well as unemployment benefits.

The American Rescue Plan was there again in March to support demand even if it can be interpreted as an overtly political act (so was the Trump tax reform…welcome to Washington). The timing was tough for prices since an unfolding demand rebound (vaccines, reopening effects, etc.) was difficult since employment was ramping up, confidence lent itself to spending, mortgage savings was soaring at an annual run rate on refinancing, and jobs (payroll heads with a paycheck) were climbing. The American Rescue Plan was at most a cherry on the triple banana split of demand support. You only get so much of a party to throw with a $1400 check to a middle class working (or unemployed) person.

China swing factor: China as the X-factor can be a moving target in the rankings of inflation effects. China has been the incremental buyer of “all things commodity” for a long time as it went through explosive growth. China dictated metal and steel prices globally. In downstream processed metals (e.g. aluminum, steel), its supply capabilities built up over the years also made China a recurring threat to those industries globally if their economy slows down.

The idea is that China would look to dump excess on the market. That is where the WTO and tariff policy comes in. In the immediate period we are discussing since COVID, China was tied more heavily into supply chain issues as its role as a systemic risk to the US supply chain came into focus. COVID only made life worse for China supply issues.

Energy policy in the US: The topic of Energy policy in the US turned into a climate food fight that often degenerates into discussions of the other guy’s mother. With Russian aggression and OPEC complicity, the issues of oil and LNG especially have become national security issues than even during the worst of the oil embargo. In the end, creating chokepoints for oil and natural gas whether with Canada (Keystone) or Appalachian natural gas (Mountain Valley Pipeline) or restricting expanded pipeline capacity for a wide range of oil, gas, and liquids products, results in the constraint of deliverable supply. The supply curve is unforgiving in the inflation debate. Some of those supply constraints are even worse in Canada, much to the chagrin of Alberta.

Trump tariff residual effects: We should probably call most tariffs “Trump-Biden” tariffs at this point even though a wide range of the Trump 232 national security tariffs against allies were morphed into kinder, gentler quota deals under Biden. Tariffs are inflationary. Period. What the tariffs are there for in the first place is a more involved discussion, but our expectations is for more tariffs and more protectionism in the future (see State of Trade: The Big Picture Flows 12-18-22).

________________________________

We wrap this note up with a few comments on the CARES Act and American Rescue Plan.

The 2020 support actions, the CARES Act, and the PCE rebound….

Anyone who challenges the need for quick and massive swift action in spring 2020 is not worth debating with. The vote on the CARES Act was overwhelming even if some complained about it on the far right (let the market work, let the urbanites eat cake, etc.) and far left (corporate bailouts, billionaires and zillionaires, etc.). There was little risk for the extremist on either pole since it was an easy pass in the House and Senate. This was not a swing vote thing but an opportunity to speak with the wacky base types. The COVID situation was so bad that most anyone would admit that ideologies don’t pay the rent, feed the family, stock the shelves, pay the teachers, or pay the taxes (the tax base idea was new to some it seemed).

In the spring of 2020, asset risk in the consumer and commercial lending system was set to see asset risk spiral higher. Powell and Mnuchin ran a very successful tag team to ease panic in the credit markets. Refinancing took off. You could not even take people to court. Most courts were closed. The broadband connections would be quickly going out as well without the bill getting paid (there goes the advertising audience, etc.). The debate around whether to provide support in 2020 was easy to grasp just on the multiplier effects and the “If A then if B then C.” Economic dominoes would have started falling. Not a great election game plan.

In terms of transmission mechanisms to economic crisis and social upheaval, there was plenty to worry about from consumer spending (the biggest line item in GDP) to fixed investment. The sea level effects went well beyond the urban markets. The ag sector was set to take brutal blows. Besides retail goods stores, the restaurant and institutional food channels were melting down and a de facto collapse of the supply chain to the end markets was in process.

Using the Top 10 ag producing states (based on cash receipts per the USDA), we see 6 typically red states (IA, NE, TX, KS, NC, IN), 3 typically blue (CA, IL, MN) and 1 swing state (WI). The farm sector and major municipal were in the same boat. A barrel of crude was less than a Molson in Canada and went negative in the US in April 2020. We would argue the peak of the COVID crisis in 2020 was a potentially devastating crisis for food chain, for retail of all types, for real estate (commercial and residential), for asset quality broadly and delinquency risk.

The chart above shows the plunge in income and then the spike in the relief payments. The plunge in the consumer sector rebounded with a spike very briefly but smaller in scale. When one considers that as a de facto replacement for a collapse in private sector payments, it is hard to blame the CARES Act for much even if there was plenty of bad execution in PPP and too much money directed to the corporate sector. The plan was to curb layoffs and closings. That was part of the deal. History will be kind and impressed by the totality of the financial risk mitigation despite PPP war stories and failures of many states to execute in delivering the Federal relief flowing their way.

The 2021 economic impact payments…

The American Rescue Plan by Biden in early 2021 (a cool $1.9 trillion) can be viewed through a partisan lens or from a few different economic vantage points. Relief to the poor is one angle, economic stimulus is another, and inflationary tailwinds is another. Too much of politics is about buying love with money or psychic reward points (shared love, shared hate, etc.), so the view on the effects of that Mar 2021 bill vary widely.

The need for support payments come up all the time. Biden and the Democrats took a lot of heat for the payments in 2021 after the worst of the crisis was in theory over (the damage lingered). The Trump-Biden payments all around mitigated economic pain and supported demand at a time of supply constraints and disruptions. Supporting such demand was therefore inflationary in the technical sense. On the flipside, deflation is the road to Hell. The more accurate description is that all the COVID relief plans were well down on the list of contributing factors. Once again, filling a hole is not building a hill. The budget hawks will naturally point to the mountain of debt.

With respect to the support payments being made under the American Rescue Plan, the Biden policies were a form of income replacement with a heavy dash of scatter gun check-writing to many parties that did not need income replacement and many that probably needed relief but were hard to specifically identify. For the Biden payments, the income test and the mass distribution approach offered the easiest method. As far as politics go around the topic, you can bet a lot of folks with red hats were also in the metaphorical line with their hands out on that one. The irony of one party saying “you caused inflation” is over the top. Taking the cash offered by the government has always been a singularly bipartisan impulse.