Jobs Conundrum: Good is Bad, Bad is Good

High job openings and adds plus a 5% handle wage increase will keep the market on edge around 2023 Fed actions.

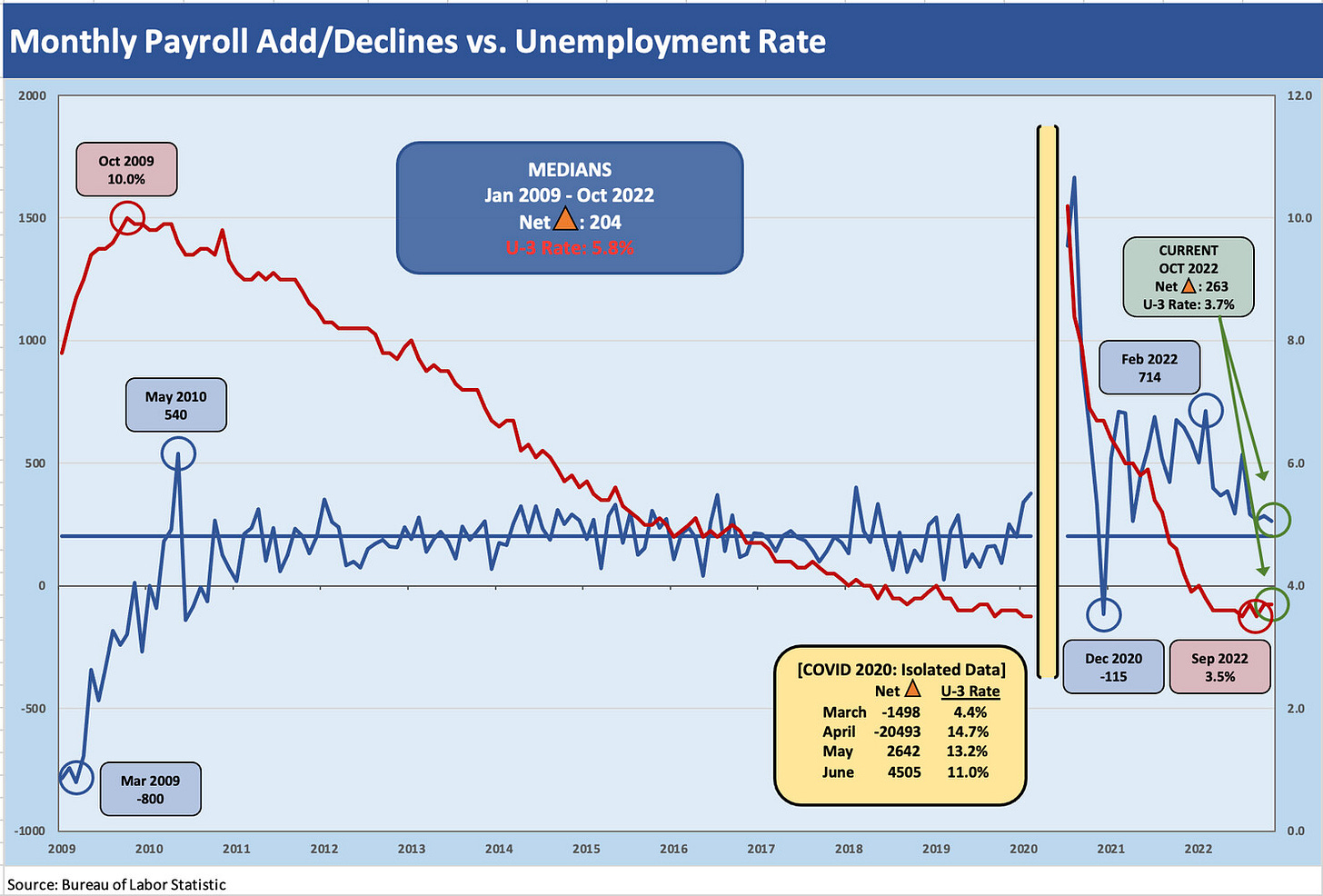

The Fed will have a hard time getting too dovish in their timing when payroll additions are well above the median for payroll adds since the start of 2009 (204K) and Job Openings (10.3 million) still rule the data.

Average hourly earnings at +5.1% for Nov 2022 brought a setback for inflation confidence after 4.7% in Oct and in a market that shows job openings dwarfing layoffs and exceeding total unemployed (6 million) by over 4 million.

Monthly payroll adds have been well above the post-2008 median each month since the end of ZIRP in March 2022, and that performance came after monthly payroll additions in 2021 averaged a multiple (2.7x) of the post-2008 median.

The hot payroll numbers were all over the screen to start the trading day on Friday after another round of numbers in the weekly “good for inflation vs. bad for inflation” exercise. After an initial sharp sell-off, the equity markets settled down to minimal change with the Dow in the green. The past week included PCE inflation data that was down modestly (6.0% Oct 2022 vs. 6.3% in Sept), but most eyes are still looking ahead to the Dec 13 CPI release.

I keep pointing back to the threatening anomalies in the historical relationship of fed funds with CPI and PCE (see Fed Funds – CPI Differentials: Reversion Time? and Fed Funds vs. PCE Index: What is Normal?). Fed funds historically ran higher than CPI and PCE, especially when bouts of inflation fighting were unfolding. This means these inflation numbers (CPI or PCE) need to come down soon or fed fund needs to keep going up. The line items in the CPI accounts of late 2022 are not 1979-1981 style numbers, but the Big 5 categories will still remain a pitched battle (see CPI: The Big 5 Buckets and the Add-Ons). Housing and Auto inflation should ease with used cars already shifting into deflation mode (see Market Menagerie: The Used Car Microcosm) and houses seeing pricing pressure (see Market Menagerie: Existing Home Sales – Supply Swing Factor). Oil and LNG is a geopolitical wildcard and domestic natural gas a short-term decision by Mother Nature (degree days).

Jobs as the Jekyll and Hyde of cyclical and inflation handicapping…

Below I plot payroll data from two angles: total payroll numbers and total job openings. There are always many layers to labor market analysis, but a record high job count of over 153 million and job openings of 10.3 million is not a bad place to be in the debate about soft landings. We’re also at a place where the consensus is that we are past peak inflation. The challenge to the Fed is “How to hit the 2% PCE target?” without a recession or at least without a recession worse than the very mild 2001 downturn.

The 10.3 million job openings is almost double the median since Jan 2009. The ability to avoid wage inflation has not been at the top of the list since Volcker, but this profile of labor tightness is hard to manage by monetary policy without a dose of pain. We had a very event filled ride since 2009, and we mention some key market developments in the yellow boxes in the chart. COVID was an exogenous shock to the economy, but there were many capital market swings along the trail as noted.

Earlier this week, I published a review of the JOLTS report (see Jobs and the Fed: JOLTS Gets Heavy Powel Focus 11-30-22), and my own view is that the JOLTS monthly will (and should) be reviewed closely until the smoke clears on where hiring is trending. The JOLTs report was usually one of those quick glance monthlies (“What’s the jobs openings total?”), but that was across decades of low inflation. The stakes on those numbers are higher now.

Policy makers are looking to avoid seeing the term “wage-price spiral” come back into the regular market vernacular, so the industry moving parts of openings, hires and separations (and related mix variance in separations between “layoffs” and “quits”) could bring some telling signals. The logic is industries with pricing power are useful to watch for signs of labor tightness. Personal spending has been strong as covered in other recent economic releases, so demand and labor supply do not tell a good inflation story even if some key line items are easing.

In terms of Fed policy assessment, lower job openings and less hiring is supposed to be the next stage if fed funds are having the desired effect – less demand for labor means more layoffs. So far, the exceptionally strong job openings line still looms as a threat to the demand destruction themes on hiring and the idea that a few ticks higher on unemployment will do the job on inflation. Whether “less quitting” follows a decline in Job Openings remains to be seen. “Quits” are still near record highs in the mix of Total Separations relative to the Layoffs line items. I break that out in my JOLTS piece.

The monthly adds tell a story of sustained labor demand…

The charts herein plot the monthly increases/declines in payroll numbers starting at the beginning of 2009 (reminder: the recession trough was June 2009) through Nov 2022. I plot the unemployment rate alongside those numbers to underscore the rally to 50-year unemployment rate lows of 3.5% two months ago. The uptick to 3.7% for the past two months is still materially below the median, so the fact remains that the labor market is very tight. That is not an opinion. It is a number.

If we look back across the years at much higher rates of unemployment, we saw some strong capital markets backdrops for risky assets from equities to high yield even in markets with 7% and 8% handle unemployment rates. The Fed’s hope for a soft landing is tied to the scenario that they can thread the needle somewhere between 5% and 6% unemployment (the median from Jan 2009 was 5.8%). The goal is to get inflation down and see the UST curve shift lower with inflation closer to 3% handles. They of course hesitate to be that specific. The path to such a potential scenario will be what the market and street will be watching for as numbers roll out week to week and the 4Q22 earnings season brings guidance in late Jan-Feb 2023.

I think the chart above tells a useful cyclical story on monthly adds from Jan 2009 when the credit crisis recession was in full swing. I adjust the chart to improve the visual utility by isolating the March 2020 to June 2020 period which distorts the chart optics (and value). I include the monthly job add/declines for those months in the box within the chart. The COVID peak numbers were literally off the charts. The median line includes all the months; the outlying months do not change the median regardless. The April 2020 job loss of 20.5 million was certainly one for the ages.

The granular view on net Nov 2022 adds…

We do not need to get too far into the weeds on the granular numbers for Nov 2022. We see some of the usual suspects in labor intensive services categories. Leisure and Hospitality (+88K), Health Care/Social Assistance (+68.1K) leads the ranks. As I discussed in our JOLTS commentary, there is a lot of two-way traffic in those high-turnover categories with (generally) lower wages. Government payrolls popped by +42K with +32K of that in local government split between Education (small majority) and other state and local functions. Retail tailed off this past month at -29.9K with -32.2K in General Merchandise Stores (-21.8K of that in Department Stores). Department Store pain has been a secular trend as many bondholders have experienced.

The fact that Construction was adding jobs at a rate (20k) above the YTD average was notable with a major contribution from nonresidential. I would highlight that for all the headlines around a housing crash, the Residential construction lines were higher. The actual “Residential Construction of Buildings” payroll line for residential was down by 2.6K, but the “Residential Specialty Trade Contractors” payroll line was higher by 6.5K. As I looked at in some recent housing commentaries, there is a multicycle high for houses under construction and Multifamily is doing very well (see Market Menagerie: Homebuilder Fits, Starts, and Permits). Cyclical shifts in longer lead time industries do not happen overnight. Maintaining a skilled and semiskilled labor force has been especially challenging this past cycle in homebuilding.

After the credit crisis, we see the slow cyclical recovery across a ZIRP and QE heavy rally that was notable both for its volatility and for the slow pace of decline in unemployment rates for the first few years of the expansion after June 2009. The slow pace of growth in total payroll is also captured in the chart. The rebound in the capital markets – including record origination of the riskiest HY tiers across later 2012 and 2013 – contrasted with the slow jobs growth. The oil markets crash that roiled markets in the summer and early fall of 2015 also saw volatility in China that dislocated the markets. This turmoil did not alter the unemployment progress.

Jobs vs. economic growth vs. inflation risk calls for tough decisions…

As we look back across the years at the pace of jobs growth, none of the eight years of the Obama Administration exceeded 2% handle annual GDP growth rates. We did not see any annual 3% growth rates in the four Trump years either. Biden’s high 5% Year 1 GDP growth was inflated by the COVID contraction of 2020, but it still gets a spot on the scoreboard as the best annual rate since Reagan 1984.

The economic historians will debate whether the fiscal and monetary stimulus to provide COVID relief and give us such a strong 2021 brought on the inflation of 2022. The answer would presumably be the overall stimulus (both fiscal and monetary) did absolutely set the stage for high inflation. We are not sure if the economists will isolate the largest land war in Europe since 1945 in their model. That was very material to the analysis.

Whether political or economic, the main question is “Where does it go from here and what policy factors will be required to get us to low inflation and a soft landing?” I do not expect the policy mix will be a 2022-2023 version of President Ford’s “Whip Inflation Now” (he even had a sweater in that pattern). Ford lost to Carter in 1976 and Carter lost to Reagan in 1980. In other words, inflation has been a kiss of electoral death. I mention that with 2024 about to see a lot of candidate chatter in 2023.

Another tense week ahead on inflation drivers…

Beyond the jobs analysis, the immediate days ahead include a critical OPEC meeting (Sunday) and Russian oil cap tension ($60 seems to be the number as of Friday in the EU deal). Oil market dynamics have left oil executives highlighting the wide band of potential outcomes. As the week wound down, the CEO from Chevron on CNBC said oil “could break hard in either direction.” That was not a controversial statement at all. The scenarios around the oil caps and potential Russian responses to a cap bring some tail risk on oil prices. The checklist of scenarios has geopolitical handicappers having a field day (full shutdowns, sabotage, etc.).

We will keep seeing more headlines out of China on COVID effects and whether the uncertainty there could roil the supply chain picture again or alternatively flow into commodities prices on the demand side. At least the potentially catastrophic railroad strike and a fresh supply chain meltdown was ducked as Biden signed the railroad collective bargaining legislation on Friday. That annoyed some narrow interest groups, but there was massive risk in such a strike to the economy and inflation. That was a tough call for a very pro-union Democrat. The massive leverage the unions had was somewhat kneecapped by their traditional teammates in Washington. On the flip side, the “greater good” prevailed. Biden would have been blamed if inflation spiked again on a supply chain SNAFU. That is just the way it is.