Existing Home Sales - Supply Swing Factor

Tracking supply in existing, new, and rentals will help guide some idea of stabilization with demand and market pricing.

Sustained weakness in existing home pricing will likely continue, but it is worth highlighting that pricing remains higher (for now) year-over-year, inventories are moderate, and the “typical” (NAR’s term) number of days on market is still a relatively short 21 days, with 64% of existing homes on the market for less than a month.

Precipitated by the mortgage spike in 2022, the rapid pace of volume decline is signaling just how fast the cyclical downturn has been coming on for housing.

The monthly swings in existing home sales are not a surprise given the rapid rise of inflation and with the Fed hanging tight to ZIRP until March 2022. In contrast, finding a floor for home construction will be a more complicated analysis looking ahead with a few moving parts, including mortgage rates, employment, the supply of homeowners willing to sell into a weak market, and the inventory rollout by builders in new home supply.

Supply vs. demand is still the guiding light. The balancing act of existing home inventory will go a long way to framing up how much the homebuilders will need to moderate their construction plans and in what regions and price tiers.

Existing home sales data frames homeowners vs. buyers in an increasingly unfriendly market…

This past Friday, Existing Home Sales numbers were released by the National Association of Realtors (“NAR”) just one day after the release of the New Residential Construction data by the Census (see Market Menagerie: Homebuilder Fits, Starts and Permits 11-18-22) . Earlier, I framed some of the moving parts across the housing sector broadly and builders narrowly (see Market Menagerie: Housing Questions to Ponder 10-27-22). There will be much to work through in coming months. The statistics for October do not reflect November’s biggest one-day decline in mortgage rates since 1981 so soon after running above the 7% threshold in October.

The trend line of these monthly statistics are useful objective metrics in gauging the multiplier effect on economic activity. The knock-on effects reverberate across the building supply chain into the world of retail (remodeling, new appliances, and the usual “new touches” etc.) and various finance (notably mortgages) and insurance products. Monthly housing stats will be more important than usual in this market to gauge the reaction of the consumer sector to such adverse trends as rising monthly payments and the wealth effects of deteriorating home equity. Much of the housing and mortgage trade rags keep circling back to the next CPI release.

Existing home sales are the overwhelming driver of total home sales…

The chart below plots the volume since the pre-pandemic period of 2019 across the COVID crash and then into a spike in demand that sent inventory plunging in 2020 and prices soaring into 2021. The sharp rebound in volumes in 2020 and sustained price increases in 2021 were set against the backdrop of 3% and even 2% handle 30-year mortgage rates. We don’t need to revisit the “all time low” mortgage headlines, but the limited ability of homebuilders to meet the supply-demand shortfall and the unwillingness of many existing homeowners to cash out (vs. refinance) kept available supply (and inventory months) near record lows. The COVID year of 2020 ended with less than 2 months of supply at the current sales rate of the time.

For those who don’t closely track these monthly releases, NAR’s Existing Home Sales unit volumes typically comprise over 90% of Total Home Sales (Existing + New). The combined Existing + New ecosystem feed into the total supply-demand equation. That ability to satisfy demand from existing volumes, houses under construction, and the pipeline under developments sets the tone for the homebuilders in their planning.

What makes the current market so distinct is the demographic tailwinds, flexibility of existing home sellers, and the flexibility of the builders to adjust their targets (canceled options, reducing spec builds, etc.), all set against a sudden inflation spike not seen in over four decades. Credit conditions will tighten but the mix of “pros and cons” is different than in 2008-2010 or in the late 1970s. That is, conditions are much better today than those earlier dark periods, and the builders are more resilient.

Key Takeaways

Volume and price head south in a hurry: The headlines tell the easy part of the story with existing home sales down for the ninth straight month at -28.4% YoY vs. Oct 2021 and down -5.9% sequentially from Sept 2022. The median existing home sales price from all housing types was $379,100, which was up +6.6% year over year. After a string of double-digit increases, the YoY increase in the median sales price fell below double digits in July when it hit 9.5% (vs. +12.8% in June).

It is early in the game at this point, but a +6.6% YoY sales price increases does not qualify as a major industry crisis after what the housing market has experienced in the recent past (notably 2009 to 2011). Median prices are still almost 40% above 2019, and that leaves a lot of room for adjustment if costs (materials) also move lower in a weaker market. Wages will still move higher. Gross margins have been very strong for the major builders with their demonstrated pricing power, and those margins have ample room to compress without financial risk alarms going off. That expected revenue and margins pressure has been bad for homebuilder equities, but almost all major builders maintain very healthy credit profiles. (As an aside, I have a long-term position [<2% of my portfolio] in Lennar and DR Horton equity).

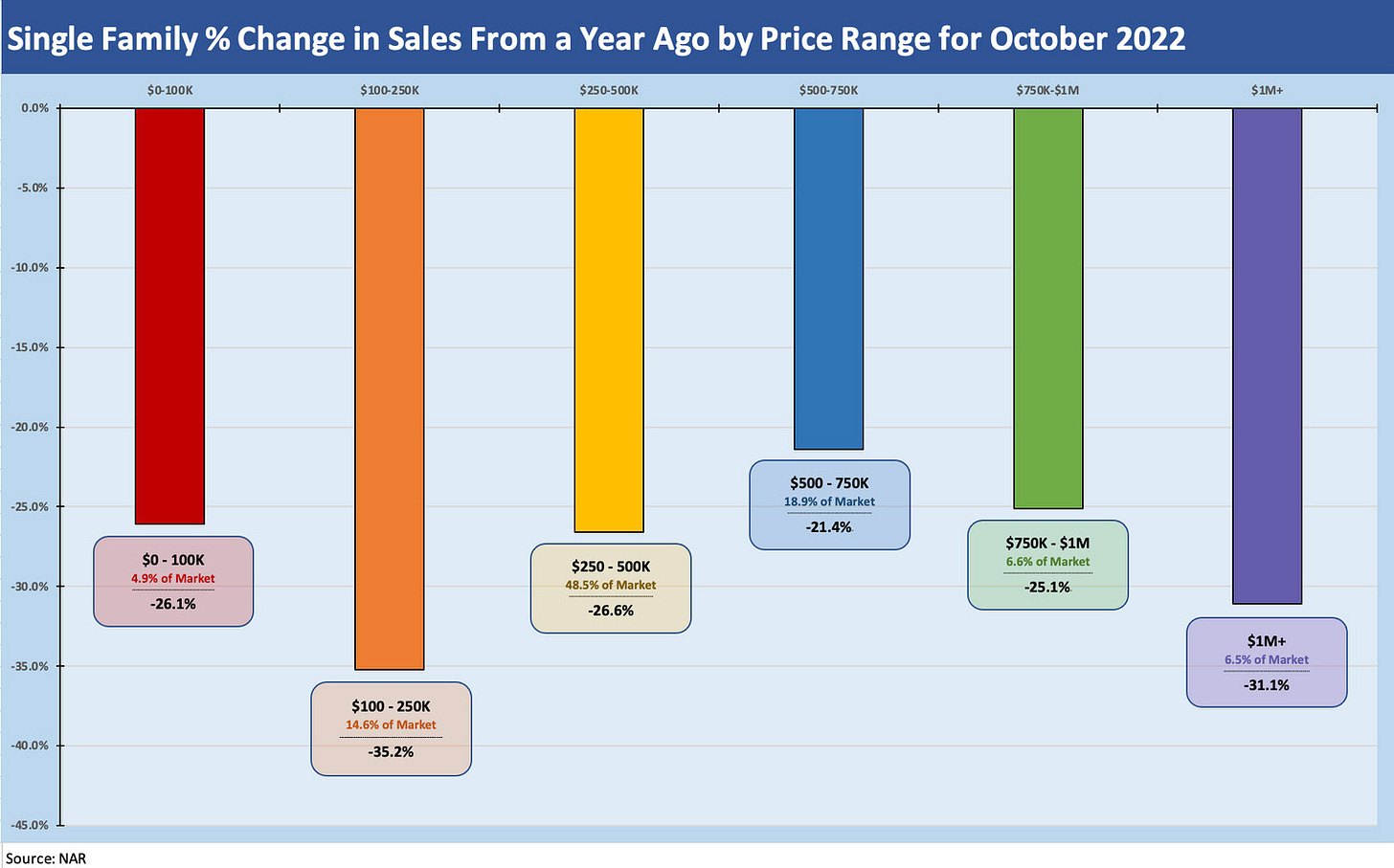

The product mix, price tier, and regional shifts are layers to consider: Those median prices come with an asterisk around product offerings and regional mix that can shift over time, but the median does in fact reflect the action in the market. The price tier and regional mix gray area is why the NAR provides numerous other interesting charts that look across broad price range buckets (see chart below).

One interesting item in the mix shows that the highest YoY declines in sales volume occurred in a barbell pattern with the highest-price ($1M+) and second to lowest-price ($100-250K) tiers showing the biggest moves. The $100-250K segment (14.6% of the total market) was down by -35.2% as more buyers were priced out of the market on mortgage rates among other factors. The next highest decline was in the $1M+ bucket, which was down by -31.1% (7% of the total market). The lowest decline of -21.1% was in the $500 to $750K bucket (18.9% of total market). I should highlight that the $0K-100K represents only 5% of the total market, while the $250-500K represents over 48%.

The high-price CA market brings a heavy mix of the upper price tiers that flows into the West category. The West regional mix weighs in at 35.9% for the $250-500K range with the $500-750K bracket at 31.5% of the West. The next highest concentration in that $500-750K price range is the Northeast with $500-750K for 22.0% of total existing home sales. CA continues to be set apart in price mix with 16.7% of its sales at over $1 million, with the Northeast next highest in the $1M+ range at 7.2%.

Monthly payment shock is evident in the sharp volume declines: November just saw the sharpest one-day decline in mortgage rates since 1981, but that was not reflected in the October numbers. The rise from 3% mortgages in Oct 2022 to over 7% before the recent pullback to 6.6% is a payment-pain-threshold-too-far to cross for many in making the decision to buy. Many potential buyers also strike out in credit approval at those levels for the type of home they want.

Waiting out the market for buyers and sellers alike is a logical response. Sitting tight as a homeowner with a low mortgage rate in hand is not a major economic risk to take. The first-time buyer is a different matter. Waiting to see how inflation and the mortgage rates play out makes sense for many potential buyers. Sellers also could find more willing buyers. Demand for rentals could get more complicated as a variable if renters stay in place and new ones emerge. That is another reason to worry about rental unit demand not declining as quickly as hoped for in some regions. Redfin’s rent index rose by 7.8% in October, so the next leg in rentals and how that flows into Owners’ Equivalent Rent (OER) in the CPI numbers is going to be an area of focus. I will look more at rentals and OER another day.

Existing home sales as the X-factor in homebuilder supply planning: The softer (even if not “soft”) landing scenario for builders is that a record refi wave and a very impressive base of positive equity that has been built up will leave many potential sellers in a wait-and-see mode. That would depress total supply when factoring in potential sellers of existing homes. If sellers are selling in order to move into a new home, they will not only be facing onerous monthly payment burdens, but they will also be selling into a market where lower prices are the swing factor to attract buyers who face the same. The builders can plan their communities, product mix, and pricing strategies with an eye toward how much competition there will be from existing homes in overlapping areas. It is anything but clear at this point. The homebuilders can also factor the existing home supply swing factor into their willingness to build spec homes vs. work more narrowly on a build-to-order basis.

Inventories of existing homes are rising as measured by current selling rates: The monthly NAR release updates “months of inventory.” For Oct 2022, the rise to 3.2 months from 3.1 in Sept 2022 marked a small uptick but well above the 2.4x in Oct 2021. In historical context, 3.2 months is not a problem level at all since pre-pandemic 2018-2019 registered a lot of 4 and 3 handles. The inventory balance that flows into that 3.2 months was 1.22 million units, which is below all of 2019 and the first 11 months in 2020. The selling rate in Oct 2022 is the problem driving the inventory months number higher since everything shifted so quickly this year. For example, 2020 ended the year below 2 months as prices started to ratchet higher in 2021.

Mortgage payments at the new median price: While the market sees “monthly mortgage payment” commentaries all the time in the press, I thought it was worth revisiting at the October median sales price. There are mortgage calculators all over the web, but I use the simple calculator for 30Y mortgages on the Mortgage News Daily site. The median sales price was $379,100 for October. We can compute the simple mortgage on that price assuming a 20% down payment.

If a buyer puts 20% down (80% mortgage), then the monthly payment at a 7% 30Y mortgage is $2,016. This monthly payment contrasts with $1,187 at a 6% 30Y mortgage. That is $199 per month difference for a total $2,388 per year. The real shock in the monthly payment numbers come when we look back a year to Oct 2021. At the 3% 30Y mortgage rate of Oct 2021, the mortgage payment was $1,277 per month at that $379.1K price. The monthly payment at 3% is $739 per month lower than the 7% rate for an $8,868 difference per year. At 6%, the monthly payment would be “only” $540 per month higher or $6,480 per year.

Given median incomes in the US (approx. $71K in 2021 per US census) it is clear why the market will get some sticker shock at 6% to 7% mortgage rates. The swing factor is price. The economics of this situation signal that an existing homeowner would want to sit tight unless circumstances or non-economic desires dictate otherwise. As a side note, I highlight that Oct 2022 sales included 26% all-cash transactions, so it is not just about mortgages.