Industrial Production: Mild Weakness in Capacity Utilization

Capacity Utilization trends show some more soft spots in pricing power.

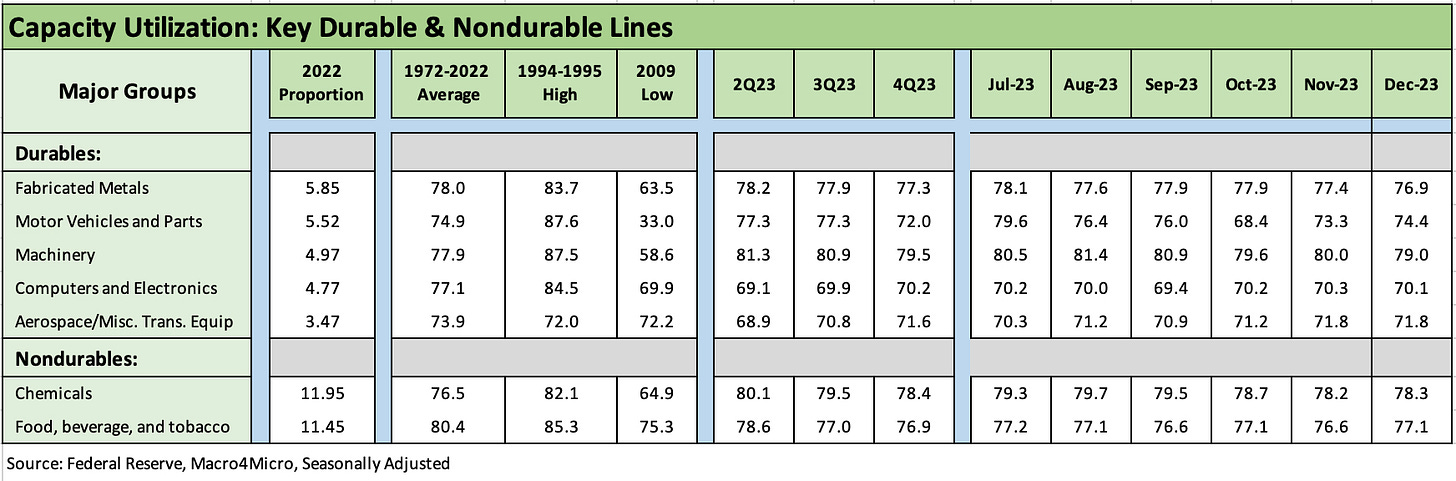

We update capacity utilization trends by major subsector and industry group with the overall picture being slightly weaker in durables and some firming in nondurables as the main takeaways.

With capacity utilization as a useful indicator of relative pricing power trends, the balance of the goods market shows less rather than more pricing power at this point.

With labor cost rising, such a trend makes it an industry and issuer level exercise, but weaker industrial demand globally and improved supplier chains should reduce major expense threats to earnings from the materials and supplier chain inputs as we saw signaled in the PPI release.

As always, hydrocarbon costs are a wildcard with oil and freight and logistics costs posing a challenge to any pricing power theories.

The above chart shows total industry “cap ute” flat and total manufacturing flat, but from there it is more mixed. We saw durables tick lower, and we tend to have a bias toward the durables sector with its extensive economic multiplier effects and supplier-to-OEM relationships.

Diminished pricing power has already been evident in the goods sector with a touch of deflation in durables (see Dec 2023 CPI: Big 5 and Add-Ons, the Red Zone Challenge 1-11-24), so these numbers are consistent with the CPI line items and adjusted indexes we look at each month.

The above chart shows the largest industry groups, and we see 3 of the 5 that we track in durables lower with one higher and one flat. Nondurables shows two increases with one up half a point (Food, Beverage, and Tobacco) and the other just slightly higher (Chemicals).

In durables, Fabricated Metals, Machinery, and Computers ticked lower but Motor Vehicles and Parts rose with Aerospace flat. The automotive sector saw the fall season dominated by collective bargaining agreements with record wage increases. Some of that labor cost pressure has been spreading to the transplants to stay remotely in the same world as the unionized operators.

The challenge with auto OEMs will be how much the legacy Detroit 3 will look to pass on to the customer, how much the manufacturers will “eat” in margin, and how much they will try to take out of the hide of supplier chain players by enforcing cost reduction through contract pricing terms.

When the smoke clears, this is a weaker report despite being flat at the headline level. For the daily test of the prevailing winds, the separate Retail Sales numbers were more significant (see Retail Sales: Another Solid Consumer Month 1-17-24).

See also:

Industrial Production: Steady Course, No Signs of Fade or Flourish12-15-23