Industrial Production: Steady Course, No Signs of Fade or Flourish

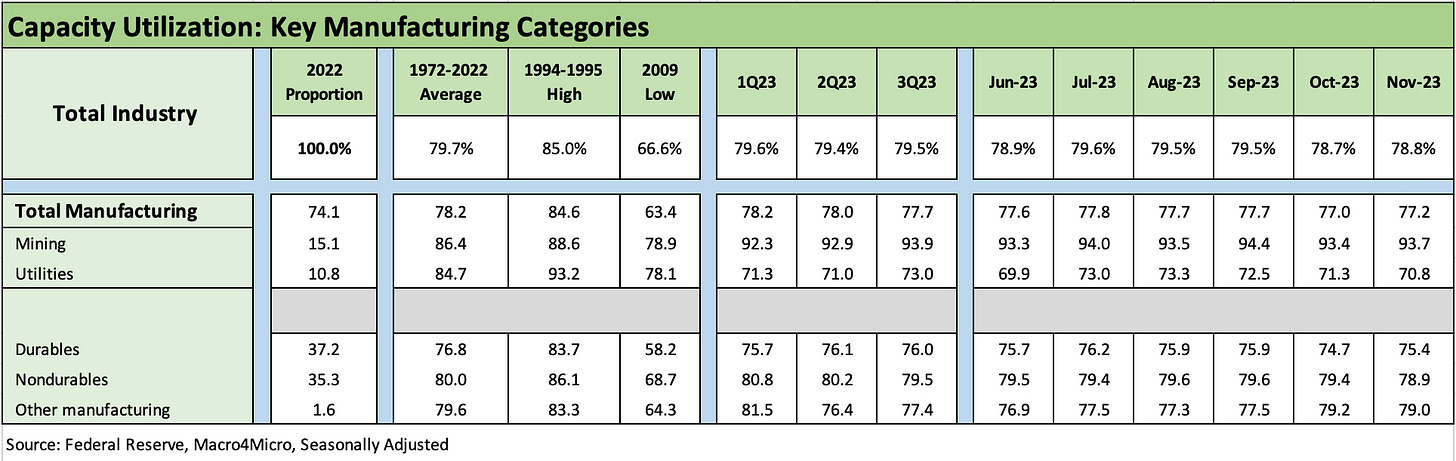

We look at Nov 2023 capacity utilization metrics across manufacturing and some broad industry buckets.

Manufacturing capacity utilization ticked higher sequentially with the critical durables sector more resilient to the upside than softer nondurables.

The improved UST rate outlook should be supportive of consumer durable and capex planning but on a mixed note the overall metrics do not shout “pricing power” in historical context.

Motor vehicles posted the best sequential move on the post-strike effects while the largest categories in durables of fabricated metals, aerospace, machinery and computers/electronics all ticked higher sequentially.

The 2024 scenarios will have (in theory) lower rates to flow into project investment economics and capex planning while reshoring and supplier chain risk management remains a megatrend no matter who gets the nod for the White House.

The profile of the capacity utilization numbers had a lot of similarity to last month in many cases (see Industrial Production: Pit Stop or Tapping Brakes? 11-16-23), but the headline number and numerous major sectors were sequentially higher. We tend to focus more on durables given the intrinsically higher economic multiplier effects that run from materials and the supplier chain inputs to freight and logistics and across to the finished goods line. Durables showed a good sequential move but is still below where the market was in the summer and earlier in 2023.

These utilization levels do not signal an excess of pricing power, but as we know from earnings season and guidance that many major manufacturers (along supplier chains to finished goods) show the ability to pass along costs (and more in some cases).

That said, durable goods and “commodities” (in CPI speak) have been a positive part of the inflation story. In Nov 2023, the durables YoY CPI line was -1.6% and in deflation mode. The nondurables CPI line was only +0.7%. Nondurables less food and beverage was in deflation at -2.0%. Commodities overall (which is basically “goods” in BLS terms), stood at 0.0% in the Nov 2023 CPI report, while Commodities less food was -1.7%.

If we drill into some of the lead line items, we see the five largest durables industry sectors detailed above holding the line at capacity utilization levels. We see that those five industry groups all ticked up sequentially but with most (4 of the 5 ex-Machinery) below the long-term average from 1972. That gets back to the question of where pricing power kicks in for that industry group in aggregate and how they might be positioned to be profitable based on the fundamental profile of individual companies as they roll up to the industry levels.

The moving parts (break-even volumes, product mix, pricing, etc.) keep moving, and manufacturers will be facing a range of factors from higher labor costs to supplier chains easing that can influence relative profitability. Some factors are good (supplier chain stress easing) and some can be negative in the picture (rising labor costs, adverse tariff structures, etc.).

Some industries have demonstrated more pricing power than others (e.g., Deere, the Auto OEMs, select Aero/Defense) to recover rising costs, but that most certainly is not the case with all. The rise of tariffs brought a mixed range of cost and pricing variables (in tariffs, the buyer pays, no matter what the political storytellers say), so bringing more manufacturing back onshore or “friendshoring” (usually Mexico) always entails a set of facts that have to be addressed at the industry or company level.

As we often cite in our commentaries on the manufacturing sector, the post-crisis manufacturing base was able to generate higher profits at lower cap ute levels vs. history based on a wide range of restructuring initiatives, productivity enhancement, and in some cases radical overhauls of their manufacturing base (notably autos). Technology and automation trends and downsizing were often the main events, but the use of low cost offshore supplier chains is now under siege.