Retail Sales: Another Solid Consumer Month

Another strong retail sales month will keep UST bulls on edge with the Fed watching closely.

The morning saw a split decision with the UST bulls losing (but not by a knockout) as Retail Sales and the focus on the consumer was more negative than the Industrial Production stats were positive for the UST bulls.

Retail Sales tends to get more focus as a direct and more tangible link to the consumer than the soft sentiment indicators under the theory of “you spend how you feel” rather than “you say what you feel.”

We look at Retail Sales numbers below with the next stop this week being the housing sector tomorrow (starts) and Friday (existing home sales) and consumer sentiment on Friday.

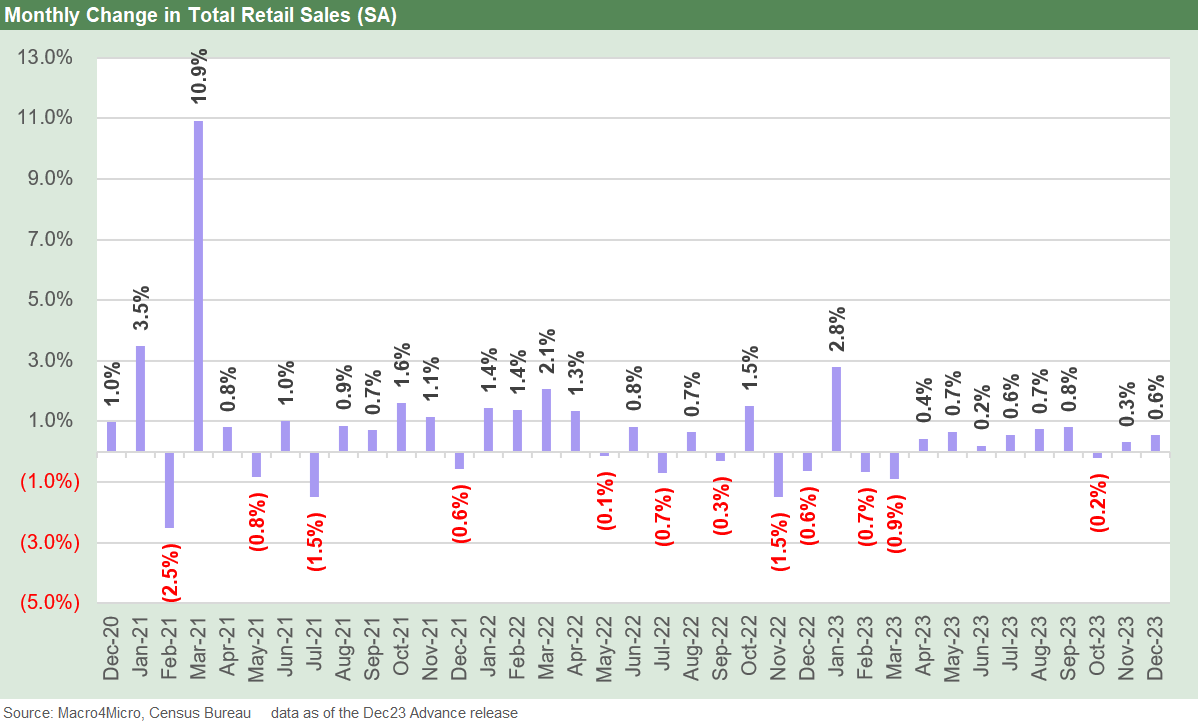

The above chart breaks out the mix with the consumer very much in the spending game in December. The numbers tell the story with total retail sales, ex-autos, and core retail running ahead of expectations. The immediate impact as we head to print is the front end segment of the UST curve moving higher quickly with 1Y to 3Y moving up by double digit bps after the same segment showed a material decline with the PPI action last Friday (see Footnotes & Flashbacks: State of Yields 1-14-24).

The retail sales lines had more the feel of the September 2023 numbers (see Retail Sales: The Consumer is Alive and Well10-17-23) that sent the UST market into a sell-off that lasted into later Oct before the monster rally to wrap the year in Nov-Dec. The collective data including manufacturing is still running with Goldilocks, but the consumer and job trends will keep UST bulls anxious. Manufacturing has been a friend of the UST rally.

The consumer will remain the key swing factor in the “landing” story line with payrolls (employed headcount) at record highs. We get income and outlays at the end of the month with PCE inflation, and the UST debate will be very much alive for a while regardless of how many Fed cuts and downward migration is being built into the UST curve. The market decides how to interpret the data and then build in their expectations, but the data might decide not to cooperate.

The above chart gives the total retail sales numbers looking back across the 2021 rebound and the more erratic 2022 stretch set against the tightening backdrop, a spike in inflation, and more than a little recession fear that was creeping into the picture. As we covered along the way, the consumer did not run for cover. There was some swinging across the categories along the way in 2H22 and early 2023 with some important line items (gasoline, building supplies) subject to material swings in nominal terms. Personal Income and Outlays will be very interesting at month end.