Industry Comment: Homebuilders Still Feeling the Love with Toll Brothers Results

Excerpt from Footnotes and Flashbacks: Week Ending May 28, 2023

The past two weeks saw a wave of housing crosscurrents (see New Home Sales: Volumes Up, Median Prices Down 5-23-23, Existing Home Sales: Will the Party Start? 5-18-23, Home Starts and Permits: Performing with a Net? 5-17-23). We also saw a bellwether high price builder reporting results (see Signals and Soundbites: Toll Brothers F2Q23 5-24-23). We found the Toll Brothers earnings call and results especially interesting despite their traditional focus and brand value as the kings of luxury.

The Toll management team on the call ran through their top-down view of the supply-demand imbalances, and how that has continued the shift from existing home sales to newly built homes in the total home sales mix. There was not much new in the theme itself, but they framed it into the hard numbers of what is going on in the market now, and how the same trends apply to their markets with over $1 million price tag average in their backlog. The mix of the golden handcuffs on low-cost mortgages for existing home sales and the improving supplier costs and supplier chain functionality have helped on the margin front.

The low cancellation rates for Toll were in part a function of heavy nonrefundable deposits, but Toll also showed the “money where your mouth is” commitment seen at other builders where they keep building more spec homes to have inventory ready for the current peak selling season.

Just for a frame of reference, we compare Toll stock above vs. Pulte (PHM) since the start of 2019. We also include the homebuilder ETF in the comparison. Both are in the IG index now, and both rank in the Top 5 in average home price of the 15 names we watch (Toll was #1 and Pulte #5 in the ASP comps). Both are major national players, but PHM is larger and more diversified by product segment. TOL is considered a premier player in its space, but other names are drawing more interest for the potential upside in volume and especially if mortgage rates moderate. The problem is that mortgage rates went higher of late – not lower.

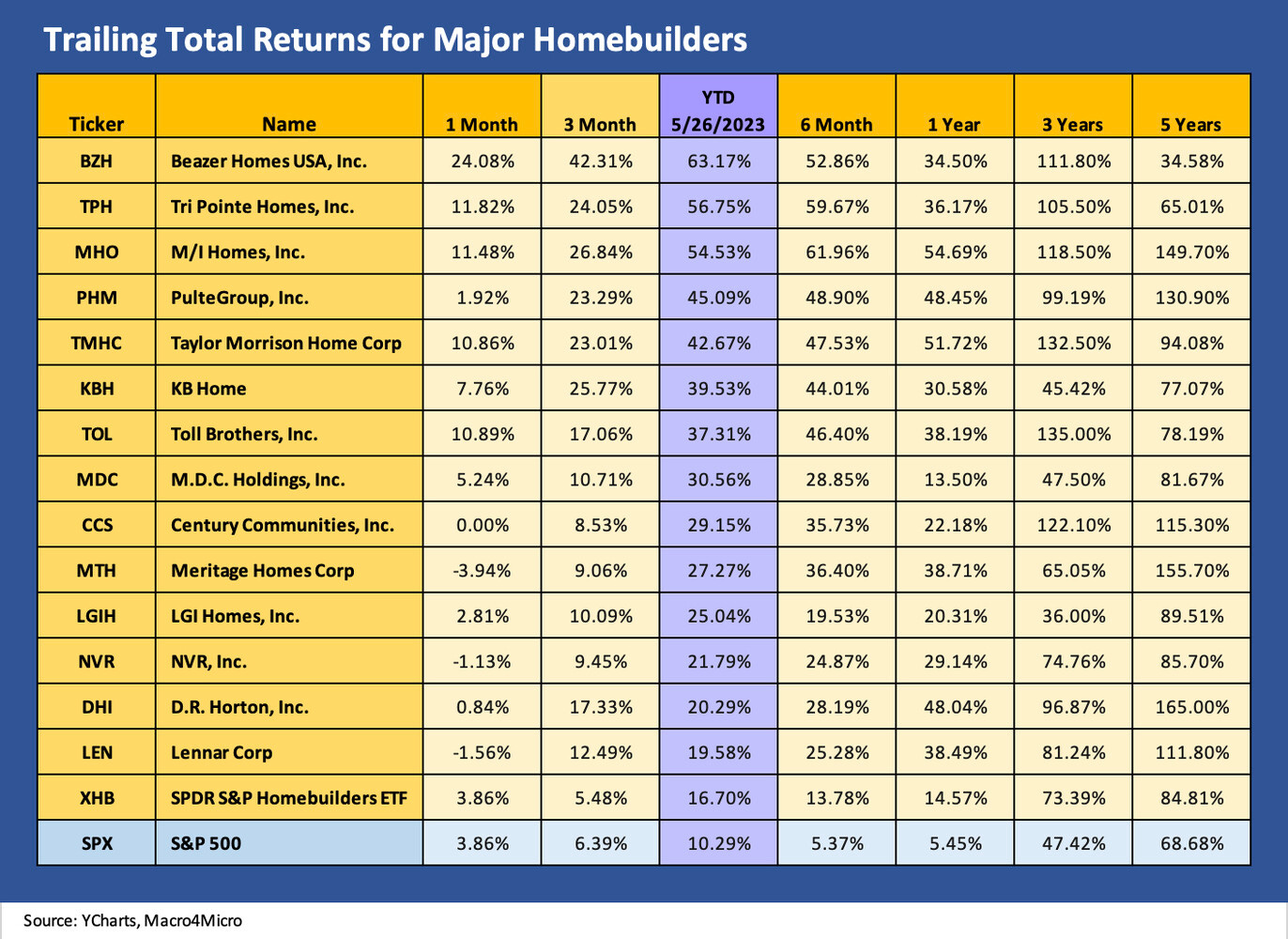

We take one more cross-peer group look at trailing equity returns for the homebuilders. We look at the builders equities across a range of total returns and line them up in descending order of returns on a YTD basis. Toll popped last week after its numbers beat expectations and the color provided on their call added to the positive tone and is up over 10% for the trailing 1-month period. Those are some very strong numbers YTD for the group in absolute terms and in relative terms vs. the broad market.