CPI: Feb 2023 Big 5 and Add-Ons

CPI comes in more or less in line after SVB sets a high bar for what it takes to cause anxiety.

“Powell warms up for FOMC meeting.”

The headline and core numbers come in line (more or less) as today’s CPI release brings the same message around the stubbornly high Services numbers with Services ex-energy at 7.3% and Services Ex-Rent of Shelter at 6.9%.

The Silicon Valley Bank and regional banks swoon pushed the bar a lot higher on what to be nervous about, so an in-line reaffirmation of an inflation problem does not make the short list of worries this week after such a grueling weekend.

The handicapping of whether the Fed will pause or go 25 bps is still the main event for next week with oddsmakers now at 25 after being closer to a 50 bps hike last week with the inflation headwinds built up from the employment stats.

The wild swings of the Silicon Valley Bank drama (see Silicon Valley Bank: How did the UST Curve React? 3-11-23, Silicon Valley Bank: Depositor Frames of Reference 3-12-23, ) and the ensuing support actions by the Fed and US Treasury (see SVB Reprieve: Hail Powell the Merciful 3-12-23) have raised the bar on what it takes to be anxious. Those events appeared to have taken 50 bps off the table for the next FOMC session next week per the market reaction.

There is also the common sense of what Powell and Yellen just had to do to stabilize deposit outflows. Powell is definitely in the hot seat for next week as he tries to balance the bank turmoil and Fed policy. He went through COVID, so he is battle hardened. Prices vs. employment vs. financial stability priorities present a juggling act right now.

The reaction among noisemakers to the de facto support by the Fed and UST of uninsured depositors got the expected reactions from left and right ideologues. The left and right weighed in according to formula and we even had hedge fund kingpins bemoaning the end of capitalism (the unstated message is to keep the world safe for short sellers and maximum price dislocations to profit on the way down and the way back up). Let’s be open-minded (even Marx and Engels played the stock market while complaining of “fictitious capital”). It is safe to say that the present values of cash flows generating an asset value (e.g., a stock or bond) is still intact even if SVB depositors are not screwed by management incompetence and regulatory laxity.

There are some good points to be made around regulation and criticizing the regulators for not being on top of the burgeoning risks of unrealized losses. As investors made their lists of unrealized losses framed vs. securities values and capital etc., they are calming down and returning at least one eye to the CPI trend. Both eyes return to the Fed next week. The relevance of all this noise is to gauge how the Fed reacts to the balancing act of an apparently fragile regional bank base and a hair trigger depositor mix. The CPI numbers at least were not at full burner with a major surprise of any sort.

That said, the pursuit of P&L maximization and industry clout expansion at the expense of risk management is not new. That is where regulatory and management failures come in. SVB is a massive bank with a very capitalistic client base (to accuse VCs of wokeness is pretty funny as they count their money on Sand Hill Road. If there is money and AUM in it, they will be involved). The problem at SVB was the conceptually comatose on risk management and not wokeness. As we have heard before, stupidity is not a crime while recklessness is more a civil issue.

By the numbers…

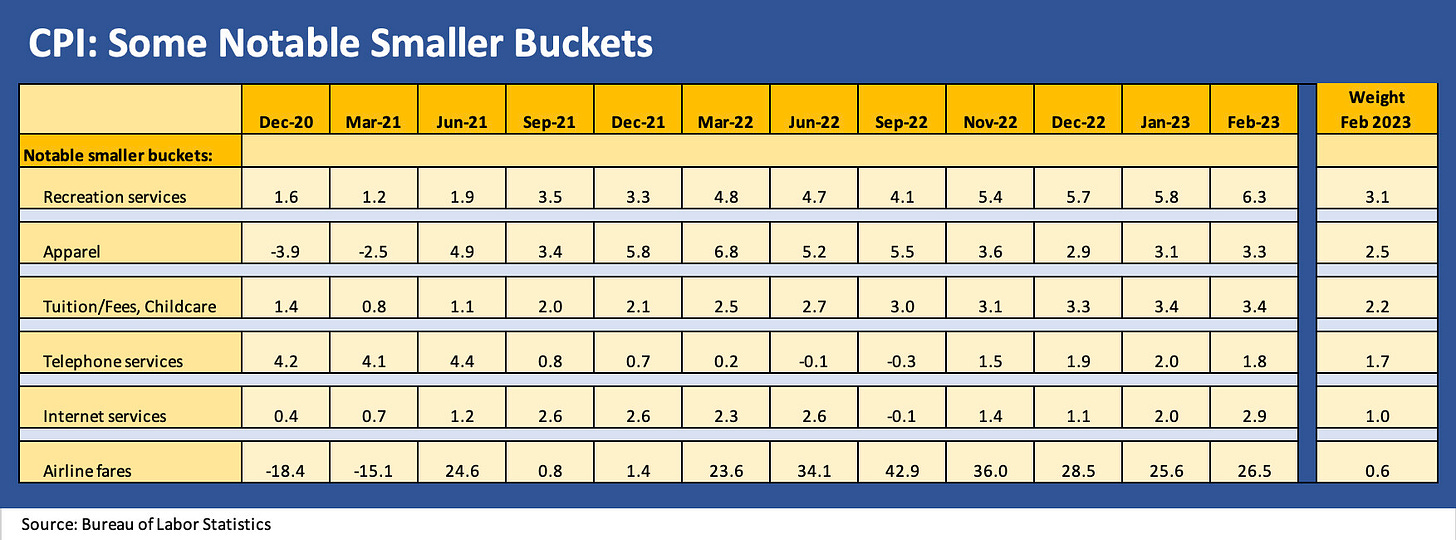

In the two attached charts we detail the Feb 2023 YoY unadjusted CPI numbers by major line items. We use the same approach and same line items selections we used in prior CPI commentaries (see CPI: January Big 5 and Add-Ons 2-14-23). We detail the weights for each category in the CPI index and post the most recent YoY unadjusted change (%). The Big 5 for Feb 2023 add up to almost 75% of the CPI index. If we roll in the “add-ons” further below, the total of the line items in these two charts is almost 86%.

A few observations on the Big 5:

Food: There is no way to put a mitigating spin on 9.5% Food inflation or double-digit Food at Home inflation. We will try anyway. The record high payrolls and rising wages put a dent in it, and the question from there is “How does the consumer react?” A shift in mix for overall spending? A change in mix across the aisles in the store and the brands on the shelf? Just assume that is what credit cards are for? The “price x volume equation” in overall household consumption needs adjustment by the consumer and that cuts across all discretionary spending. We try to watch for the adjustments (smaller apartment, smaller house, a different car model, late model used vs. new vehicle, etc.)

Energy: The YoY numbers are grim in some categories and easing at the headline Energy level to a 5% handle with the comparison to the last pre-Ukraine month of 2022. The sequential monthly move in gasoline from 1.5% to -2.0% (yes, some energy deflation) should offer some hope and the YoY comps certainly get a lot easier into the spring. The Energy Services lines are in double digits and both oil and natural gas have been weak of late. Let’s hope the role of Iran with Russia does not create any issues in the Strait of Hormuz or that Mother Nature does not bring more March and April surprises in temperature.

Shelter: We are not going to revisit the many asterisks on the Shelter inflation line, but the world knows the sequential trends will remain down for home prices and rentals as supply of rental units come on line and the price of single family homes (which has not been the CPI numbers since 1983) goes lower mix adjusted. The shelter lines still see Owners Equivalent Rents get modeled based on rental rates. Ex-Shelter metrics are the way to go for Services for a reason. We follow the builders and housing services sector, and the sequential trend there is going one way on strained affordability even if mortgage rates tick down to 6% again. The 6% would be good news but is a lot higher than the typical 3% (some 2% handles along the way) seen in the COVID housing boom.

Automotive: We roll up a range of line items in our Automotive CPI section that go beyond new and used vehicles. The category adds up to 11.5% of the CPI index by weight. The new vehicle market is still quite strong in pricing and average transaction prices (ATPs) are pretty easily tracked in the auto trade rags. The ATPs on new vehicles should top off while used cars are in full blown deflation mode as the new vs. used price distortions get wrung out of the market (see Carvana: Credit Profile 3-5-23, Carvana: Wax Wheels 12-8-22, Market Menagerie: The Used Car Microcosm 11-29-22). We see the high inflation on the labor side in the auto services mix in double digits. We also see aftermarket parts rising. Parts and Services are lucrative business lines for dealers.

Medical: Medical Services have eased materially in the CPI report. We find some of that as counterintuitive given the demand for labor and shortages of personnel. That includes the well-deserved demands from overworked and understaffed nurses. Health insurance has its own seasonal timing dynamics, but we see a deflation mode for Health Insurance this month. That surprised us, but it does come after a long stretch of repricing upward.

The “Add-Ons” are line items near and dear to many households. We see the health of the consumer and related demand in the Recreation Services CPI. Those markets show up in force in the JOLTs and Employment reports. Rising wage costs get passed through. The rest of the lines are steady but this past week saw some news that flagged potential for more normalized seasonal patterns in air travel. Lower oil costs also can get passed into aviation jet fuel as we move into the year and the comps also get easier vs. a brutal 2022. Refining products have had myriad supply distortions downstream that do not always track oil logically.