Retail Sales: Consumer Stands Firm

We look at another good month for retail sales as the Fed might still feel the heat.

The Retail sales numbers got a nice boost from some major Retailers summer sales like Amazon Prime Day.

The consumer is going to be the sector carrying the ball for the economy even if there has been a notable shift from Goods to Services in 2023 and fixed investment has picked up away from the consumer sector.

Consumer action + solid jobs will keep making life a challenge for the Fed, but the UST action was muted so far today after an initial pop higher in the 10Y before a retreat.

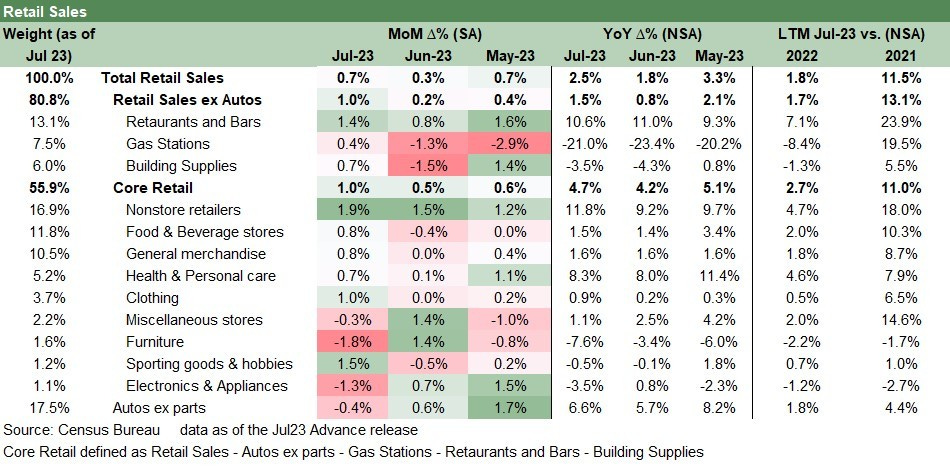

The above chart breaks down the retail sales numbers by bucket at the headline level and in Core Retail. The lines are self-explanatory with Retail ex-Autos stronger at +1.0% MoM. Nonstore retailers (aka ecommerce) strength at +1.9% MoM due to Prime day and other major retailer sales was a main contributor flagged in myriad media this morning. Upward revisions in June also tell a stronger story. We detail the weightings on the left for a frame of reference. We then break out the MoM and YoY numbers. The YoY comparisons are based on not seasonally adjusted data.

The good news for the consumer is the peak driving season costs are much lower this year with lower oil prices driving gasoline lower. The decline in oil flows into related costs (e.g. freight) also benefits services and goods providers. That lower gasoline cost literally feeds the Retail sales line in other categories on higher discretionary household cash flow for those on summer jaunts (day trip or longer). The lower jet fuel prices also flow into air fares as covered in the CPI numbers this month (see July CPI: All About the Bass 8-10-23). The next round of nerves around oil has been starting as the OPEC cartel supply actions trade off with worries about China. Gasoline is always a consumer wildcard.

The shift to services is evident in Restaurants and Bars with its double-digit weighting, but spending picked up in areas such` as Food & Beverage and General Merchandise. The mix of news beyond Retail sales is still showing a confused market as China worries pick up tempo and mortgage rates notch higher (see Footnotes & Flashbacks: State of Yields 8-13-23).

See also:

Chasing the Dragon: 2% Handles Beckon for PCE Inflation 7-28-23

Retail Sales: Canary Syndrome 7-18-23