July CPI: All About the Bass

We look at the July CPI numbers as the MoM numbers trump the YoY metrics on shifting base effects.

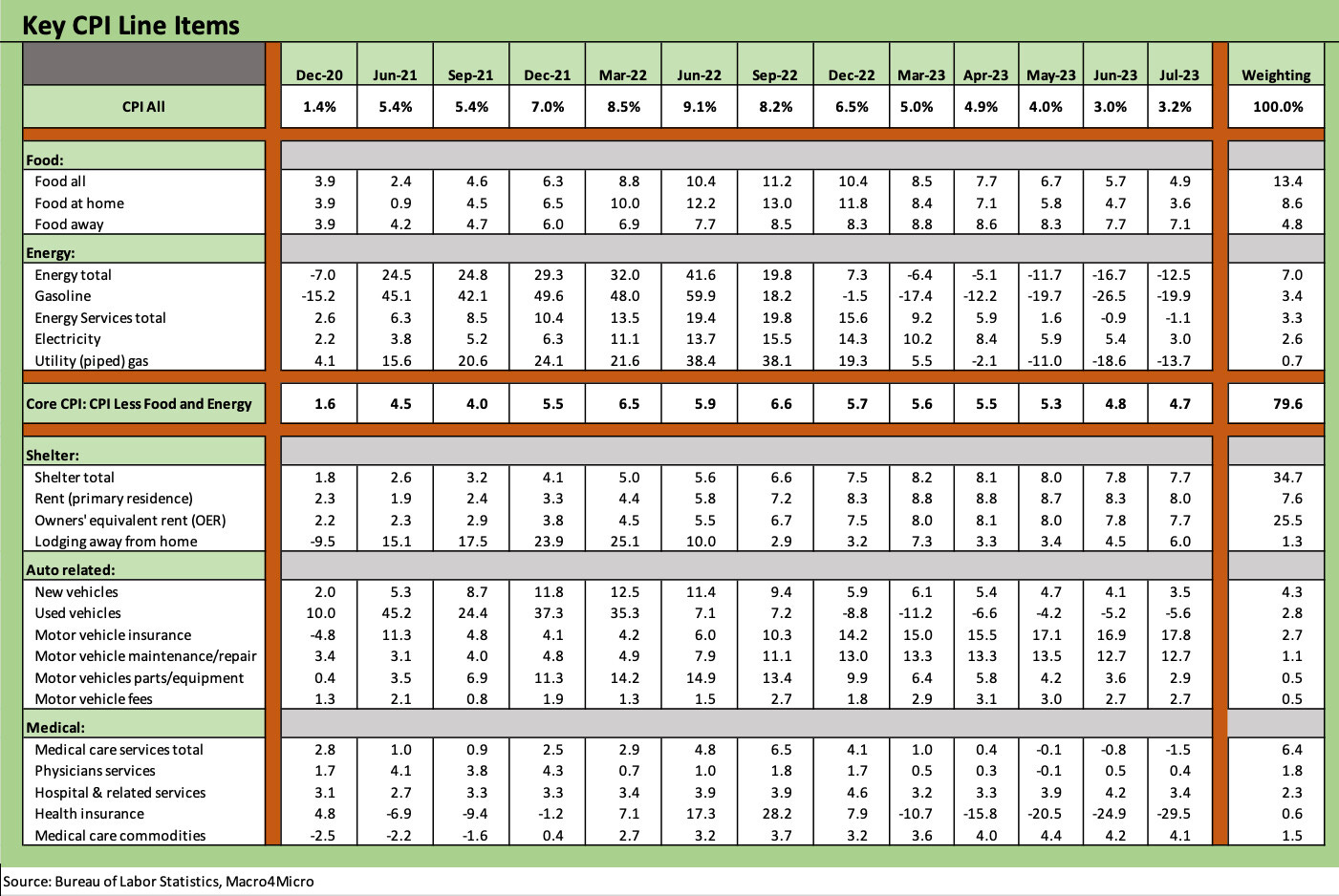

Headline CPI ticked up to 3.2% from 3.0% YoY in June while Core CPI posted 4.7% for a small downtick sequentially from 4.8% in June.

For the half-full crowd, “All Items less Shelter” sits at 1.0% YoY while the bears can embrace Total Services at 5.7% YoY (Services less rent of shelter is at 3.3%).

The market reaction immediately focused on the solid monthly moves with 4 of the past 5 months at 0.2 or 0.1 for all items (two months at 0.2 and two months at 0.1).

We run through the Big 5 CPI buckets that comprise around 75% of the CPI index plus a handful of key household add-ons that bring the total mix of the CPI index we address to around 86%.

The CPI derby continues as July 2023 CPI came in with constructive numbers. The market now needs to start digesting YoY comps with the market past the June 2022 inflation peak of 9.1%. The market reaction was immediately evident in equities and along the curve with stocks in the green for the morning and the UST curve being quiet (for now).

Below we frame the moves in the Big 5 of the CPI Index that we break out each month across the consumer buckets we select. The tally of the Big 5 is almost 75% of the index with a disproportionate share in Shelter at 34.7% of the index.

We will not revisit the common gripes about the Shelter Index that are shared by many (lack of household cash flow relevance for OER, estimates that do not in any way reflect current rental rates in the market, etc.), but we use it as an excuse to cite a 1.0% CPI index for All Items ex-Shelter. That is not too shabby in light of the “worst in 40 years” mantra that gets replayed over and over like a skipping album.

Our Big 5 include a tailored Automotive collection that often gets neglected in the headlines with too much focus just on New Vehicles and Used Vehicles while deemphasizing some of the most challenging inflation trends that the average vehicle owner faces in supporting services.

The Big 5 tell a constructive story in the trend line with a big assist from the recent deflation in energy ahead of the peak driving season. Food also continues to moderate sequentially even if the new price lines are ugly and have outpaced wage growth. With travel and pent-up leisure demand evident, we see Food Away from Home stickier on the downside. Anyone who has been in a car on the road for business or leisure or at airports and on planes this summer knows the story.

Energy was the story of 2022 and was a material driver of inflation stress from the household uses to the raw material inputs driving the cost of goods and passed through the producer chain. After oil and natural gas plunged, relief was had by all.

Now the cartels (OPEC, OPEC+, and the Saudis unilaterally) are back in action, and oil has rallied along with the lagging flow-through into gasoline prices as the coming weeks unfold. Oil (WTI) is just under $84 as we go to print after being in the mid-$70 range a month ago. Energy services were feeling the higher input and fuel costs and lagged on the downside with Electricity (heavy on the natural gas side for power) still posting positive CPI lines as noted above.

The auto mix we have customized above is only slightly smaller than the Food category in the overall CPI mix once you add them up. The auto inflation lines underscore the high cost of owning a car across insurance and repair and maintenance. Used cars are starting to deflate after a period of COVID distortion tied to supplier chains that undermined new vehicle production.

Shelter at +7.7% YoY is still disconnected from the reality of what a homeowner experiences with a low fixed rate mortgage and a lot of positive home equity. The same is true for market rates on rental of primary residence. The numbers are just wrong and ex-shelter is the more relevant CPI metric these days.

Medical Care inflation is led by Services but overall had a favorable month in the context of the consumer cost trends. Health care always comes with a big asterisk that gets back into the topic of insurance coverage quality and what the needs are for any given household. Many policies have a high deductible and charge you for breathing.

The “Add-Ons” are line items that resonate with many households. Recreation inflation staying high is a sign of good times but not low inflation in those services. Apparel has stabilized in a 3% handle range and the same for tuition/fees/childcare.

Telephone CPI is low, but Internet has been ticking higher. Airline fares have moved sharply lower on plunging jet fuel costs and some intensifying domestic competition that has hit some of the more US-centric players. In contrast, the Big 3 airlines (DAL, UAL, AAL) are “crushing it” in international profitability and have the edge vs. names such as Southwest and JetBlue.

The bottom line on July inflation was that the numbers were good news and you need to make mental adjustments for the YoY base effect. That topic has been picked over for months in anticipation of the comps adjustments one needs to make. We always like to look at YoY anyway as we have the same habits as most on the shorthand measure to cite. The MoM metric that economists focus on become the more realistic metric for a while. The monthly code from March through July was 0.1/0.4/0.1/0.2/0.2 which adds up to good news on inflation. April was the only hiccup.

See also:

Employment Cost Index: Rings of the Redwood 7-28-23

Chasing the Dragon: 2% Handles Beckon for PCE Inflation 7-28-23

June CPI: Big 5 and Add-Ons…A Big Win 7-12-23