Industrial Production: Holding Pattern

Industrial Production weighs in constructively alongside healthy Retail Sales.

The trend line in production and capacity utilization held in well enough to disappoint UST bulls with Durables and Nondurables both on the positive side of “mixed” with capacity utilization ticking slightly higher at the category headline level.

The UAW strike actions were not big enough to creep into the Sept numbers, but that piece of the manufacturing puzzle is still a problem-in-process.

Defense and aerospace will stay busy but needs to see a government funding bill at some point to frame investment decisions.

For end markets, the high nonresidential construction activity and supplier and materials categories that serve construction look to hold the line ahead.

The view on Manufacturing has been guarded for so long around the surveys (ISM etc.) that expectations have become a routine tossup with a bias toward the negative side. The ISM numbers have hovered around the lighter side of expansion vs. contraction, but the Industrial Production and Capacity Utilization numbers have hung tough and did again in September.

The net takeaway from today’s release is on the net favorable side for Manufacturing performance even if it comes with the asterisk that the UAW strike numbers really have not rolled in with full force.

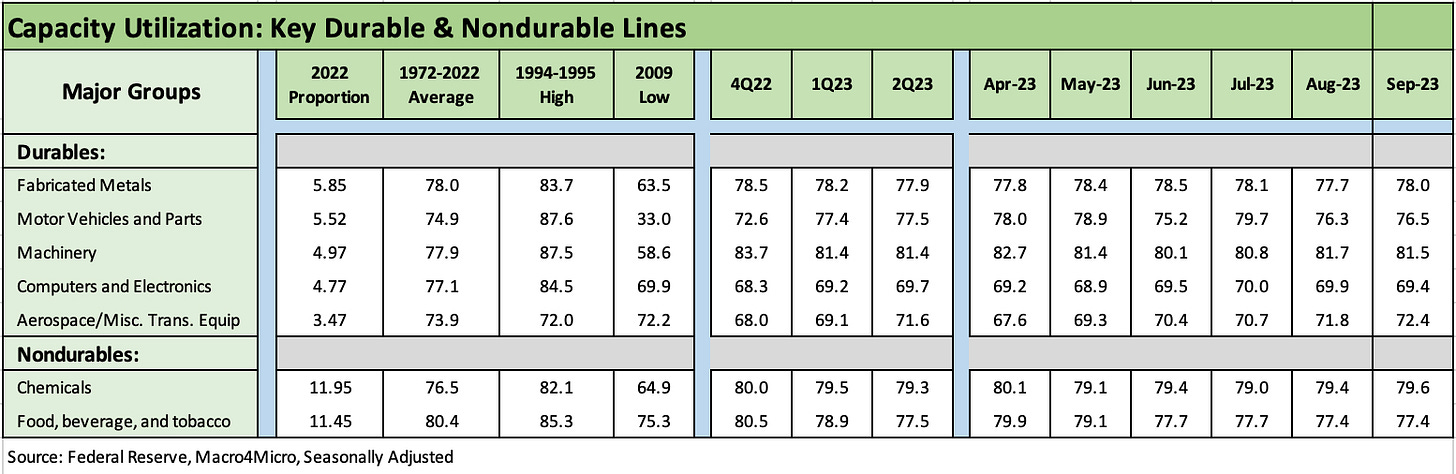

As a reminder, we like to focus on Capacity Utilization trends (an Industrial Production sibling) given the intuitive connection to pricing power. The supporting variables in Capacity Utilization cut across a mix of markets including Fabricated Metals in Durables and Chemicals in Nondurables.

Construction markets help both of those line items given the downstream needs. Infrastructure bills, CHIPS Act benefits, and EV/transition capex demands among others have helped the industrial side of the equation via nonresidential construction growth with its multiplier effects (see Construction: Project Economics Drive Nonresidential10-2-23). It is not everything, but it is something.

The above chart updates the broad categories, and we see some strengthening from August on balance (see Industrial Production: From Rock Steady to Rocky Road 9-15-23). Total Manufacturing Capacity Utilization ticked slightly higher and the same for both Durables and Nondurables. Mining ticked higher and the more volatile Utilities line was lower sequentially. The only meaningful move lower on the headline category list above was Utilities.

The above chart gets into the largest categories in Durables and Nondurables. In Durables, we saw Fabricated Metals, Motor Vehicles, and Aerospace move higher. The UAW impacts will be more evident in the October numbers if the strikes keep going in the direction they seem to be.

Machinery saw a small decline as did Computers and Electronics. Nondurables saw Chemicals move slightly higher while Food, Beverage, and Tobacco was flat.

The question marks around any disruptions in government funding for key defense programs and the threat to auto production and supplier chain fallout from the UAW strike are the main events for the next two rounds of IP and CapUte data.

Recent Research:

UAW: Going to the Mattresses 9-23-23

Industrial Production: From Rock Steady to Rocky Road 9-15-23