Industrial Production: From Rock Steady to Rocky Road

We look at solid August production numbers in the calm before the storm of the UAW strike.

As hard as it has been to get too excited about Manufacturing in light of weak ISM and PMI noise across 2023 and now the reality of a massive strike underway in autos, the solid August industrial production and capacity utilization numbers offered a reminder of cyclical resilience.

Unfortunately, the next few months could look ugly for line items such as Motor Vehicles, Fabricated Metals, and Chemicals among other major industries that will be touched (maimed?) by the strike (if the legacy Detroit 3 do not quickly fold) since autos are a major downstream customer for so many products from metals to semis.

The push-forward effect on demand and inventory rebuild will get here someday unless customers head to the transplants, but that is all wrapped up in a labor contract game theory where the UAW “ain’t playin’ around.”

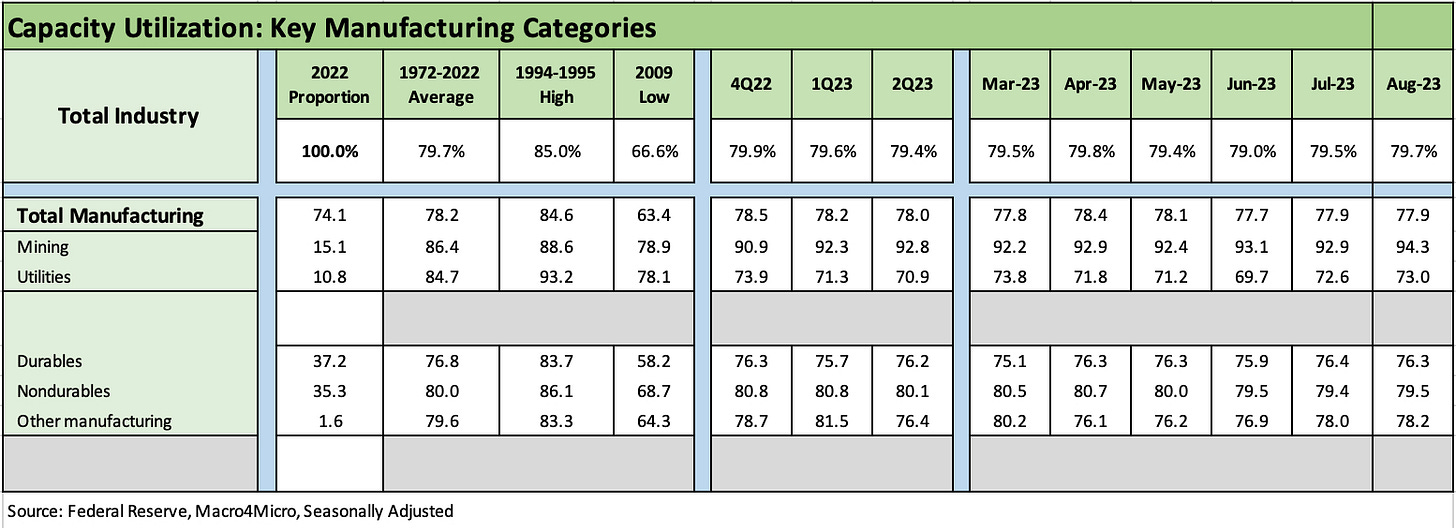

Below we run through surprisingly strong IP and Capacity Utilization numbers for August that beat consensus. The results showed that “all other things being equal” the manufacturing backdrop has been resilient with only a minor easing from late 2022. The main problem now is that “all other things” are “anything but equal” as the UAW goes to the mattresses.

The need for the UAW to dig in at such a critical inflection point in the evolution of the auto manufacturing industry structure cannot be underestimated. The EV transition will flow across the entire supplier chain, and there is much at stake for all stakeholders from employees to shareholders and lenders and the full supporting cast of related service sectors (dealers, freight and logistics) and industries from textiles to semis, etc. We will look at those issues in separate commentaries.

The August numbers will flow into a lot of sector noise in coming weeks as investors handicap how much damage is being done and how much is being ceded to non-UAW assembly plants in other states in the “Transplant Belt.” Add in a dose of politics (Biden with his union commitment, Trump with his already vocal “cancel EVs”, etc.) and this one is ugly now and will get uglier. Based on history, we would expect the legacy Detroit 3 to fold on many issues.

Unlike the epic Caterpillar UAW war of the early 1990s, the opportunity cost is other worldly for GM, Ford, and Stellantis – but especially GM and Ford. Autos lack the flexibility to replace workers on the assembly line. Quality concerns do not allow a GM or Ford the flexibility that CAT demonstrated in its epic clash as it locked out the UAW and broke the strike.

August by the numbers…

Using August numbers in a vacuum, we see a solid but stable sequential performance for total industry that is the best since April. Manufacturing overall was flat, but Mining was a star with Utilities ticking up. Durables and Nondurables combined were flattish.

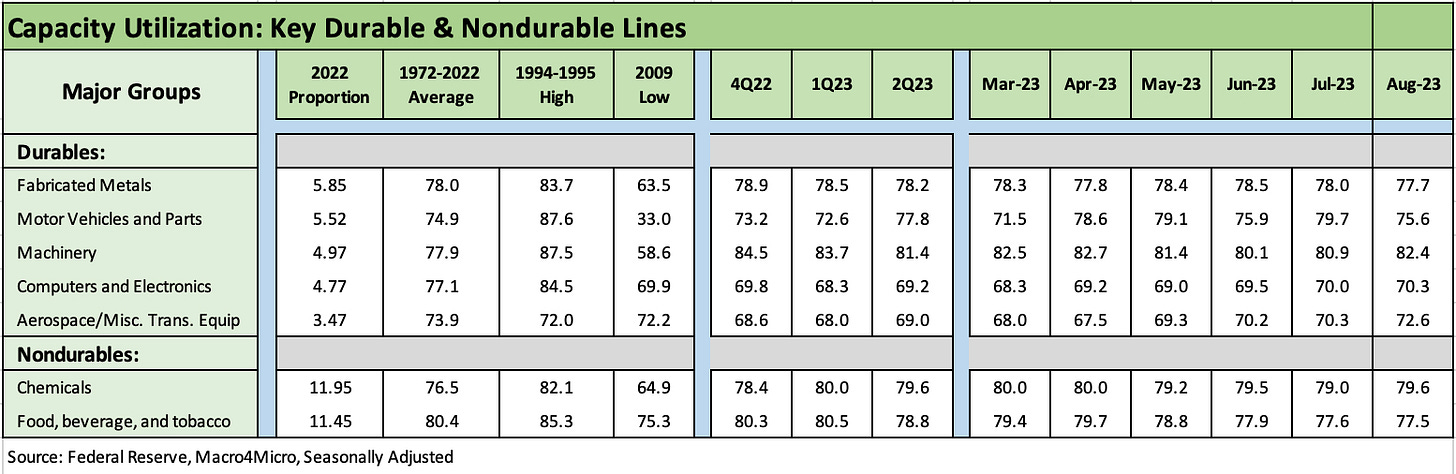

The above chart gets into some of the weeds of the largest line items in Durables and Nondurables. We see 3 of 5 Durables subsectors higher with Motor Vehicles off more than the pack (and that will be worse in September!). Nondurables saw mixed results with Chemicals stronger and Food, Beverage, and Tobacco slightly weaker.

We will be interested in all the obvious issues around the direct impact on OEMs and supplier chain credit quality, but also will be trying to see how dealers (used or new) approach the pricing fallout for vehicles if shortages start to become a reality. The dealer lot drawdown will be something to watch in the trade press and the used car values at wholesale or retail.

Trade-in used vehicle supply would presumably shrink if this in fact proves to be a protracted strike. Auto finance volume will drop off. There are a lot of economic costs in the picture. That all comes down to “How long?” and “How ugly?”

Manufacturing Inventories were also reported this week with the inventory to sales ratio for autos at 1.67x for July 2023 vs. 1.46x in 2022. The ability of the non-UAW OEM to step in and fill orders is a competitive threat where the sale “goes away” and the opportunity cost for the legacy Detroit 3 becomes real. That starts to be a reality when strikes last months more than weeks. It has happened before, but the OEMs will likely think short term on what they can give and what they need to avoid. The macro picture thus could get a small cushion from substitutes as other OEMs pick up more business. The questions will get answered soon enough.