Footnotes and Flashbacks: Week Ending January 27, 2023

GDP growth, PCE Inflation and Fair Tax Act in Macro. United Rentals, Rails, and the #1 Homebuilder in Micro.

This Week’s Macro: Broad index returns, ETF benchmarks, UST curve migration, thin 4Q22 GDP growth, PCE inflation and consumer getting full, Fair Tax Act stalling.

This Week’s Micro: United Rentals as proxy in nonresidential construction and equipment demand, Rails and Freight flashing some yellow, D.R. Horton as #1 homebuilder tells a peer group story.

MACRO

Below we flag some events or trends that captured our attention this past week. We also frame some cross-asset returns and look at some of the usual strange developments in Washington.

Some comparative asset returns…

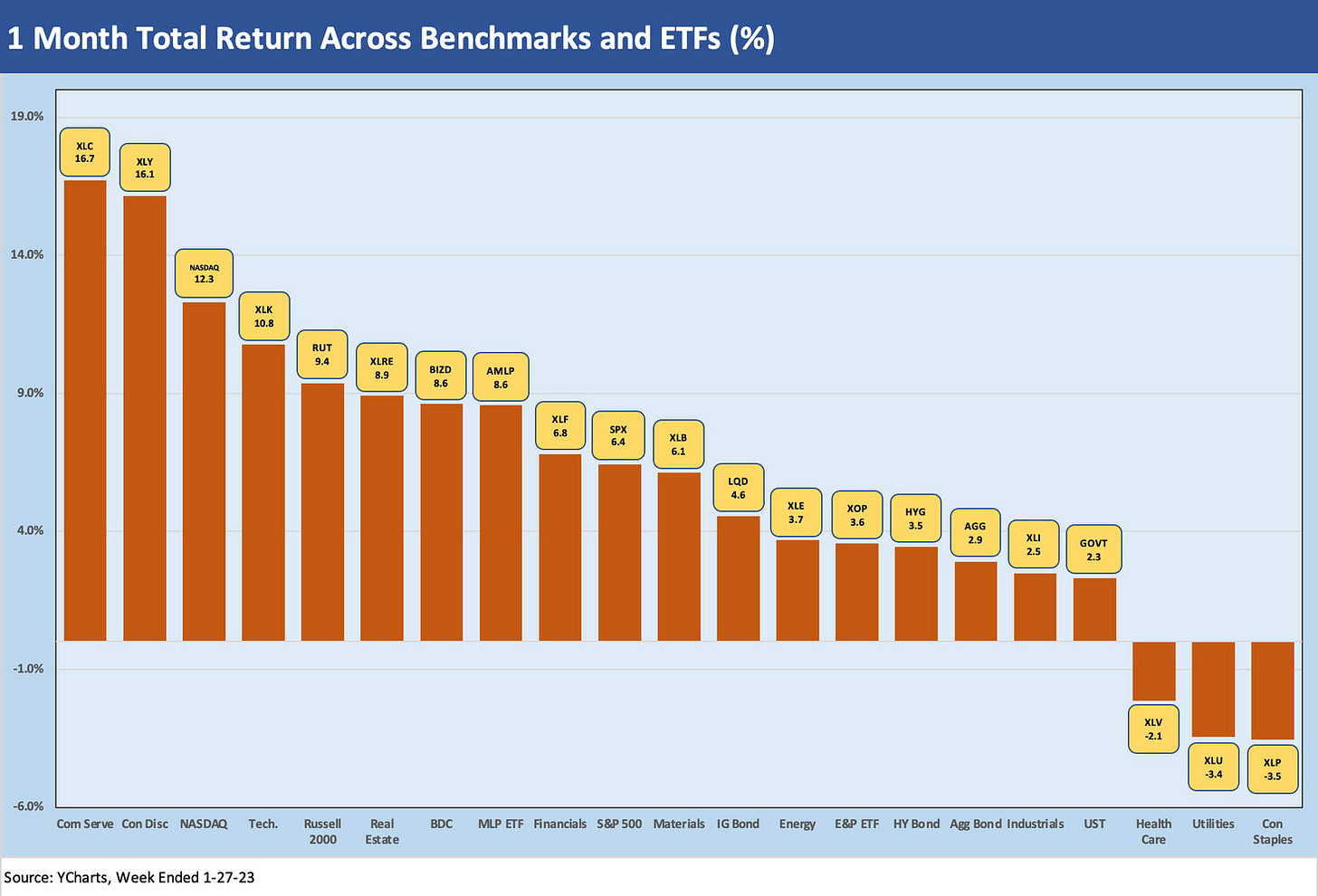

The chart below frames total returns for benchmarks across major fixed income, credit and stock benchmarks.

The year has been off to a good start for almost all risk assets with some subsector exceptions. There has been plenty of coverage on fixed income flows and interest in IG corporates and HY as well as money market funds. Spreads have rallied in US HY while IG showed a mild move tighter. HY swung in a wide range in Dec 2022 at almost 50 bps (source: ICE) and is now showing a similar swing in range but to tighter levels in Jan 2023. A lot of action lies ahead. The bulls can chase HY while those who split the difference on the credit cycle and duration risk favor US IG bonds. For 2023, we choose US IG for better total return prospects.

The menu has more choices in 2023. The ability to get around 4% on cash is almost like an old episode of The Time Tunnel. The penalty for cash is lower and foregone coupon costs are not as punitive. Money market cash yields are higher than some IG coupons for high grade bonds trading at very steep discounts. If a portfolio managed to have some profits to take coming out of 2022, moving at a measured pace has less opportunity costs in cash. The rebalancing costs are lower and can be slower. The inflows from asset allocation shifts can be managed at a less frenetic pace with some income to be had in cash as investors buy time around CPI releases and Fed meetings to get a clearer view.

The long-tailed risk in the debt ceiling may see the House extremists do some tail docking…

The potential for a debt ceiling implosion and handicapping the cynical state of Washington has not caused a broader risk inversion infection thus far. The most bearish, dark theories have the hardline right wanting to go the distance to default with no compromise. The flip side of that polar extreme would be the hardline left being more than willing to hang the default around the necks of the “enemy” of the MAGA crowd in prepping for the 2024 election.

Another theory is that the left felt jilted by moderates and this is their opportunity to make a move to bring in new progressive blood for a White House run (progressive as in “not Biden” and new blood as in “not Sanders”). Of course, the new MAGA hardliners see this is their time to make a move also. Should make for an interesting 2H23 ahead of primaries.

The market will need to start planning at some point for a debt ceiling contingency. That goes for companies as well in their production chains, order books, and inventory planning. For now, it is too early. Since every debt ceiling has been raised before this one, history is on the side of a good outcome. The easy (sort of) comfort zone is that a lot of noise has always worked in the past for the “pols” to show off to constituents, but it ends up ok. The problem is the market now faces a new breed of extremists who are a breed apart (ideal for the next Aliens prequel).

These are the types of binary legislative scenarios that do not stop people from going about their economic lives. Some might wait longer on buying that house or that new car, but the consumer wheels keep on turning, and households keep getting created, vacations get planned (at very crowded airports), credit card lines get utilized, real estate of all kinds gets constructed (including waves of construction underway now), and job hires/fires roll along every month (weekly claims, JOLTs report, monthly employment). The Fed still meets, and the banks keep lending. The Fed will have a plant for UST collateral and lines of credit, etc. 95% of the US HY market and over 99% of the IG market will go on servicing their debt even if it is during some material mark-to-market swings or in a debt ceiling crisis.

In the end, any sidebar handicapping that we all do on more extreme “event risk” still needs to end back in broader portfolio context. It is easy to make lists (see Risk Trends: The Neurotic’s Checklist 12-11-22), but the continued economic activity on the screen every day from M&A to plant construction to IT spending does not end on questions of “What if the US defaults?”

Some subsector numbers and ETF performance metrics…

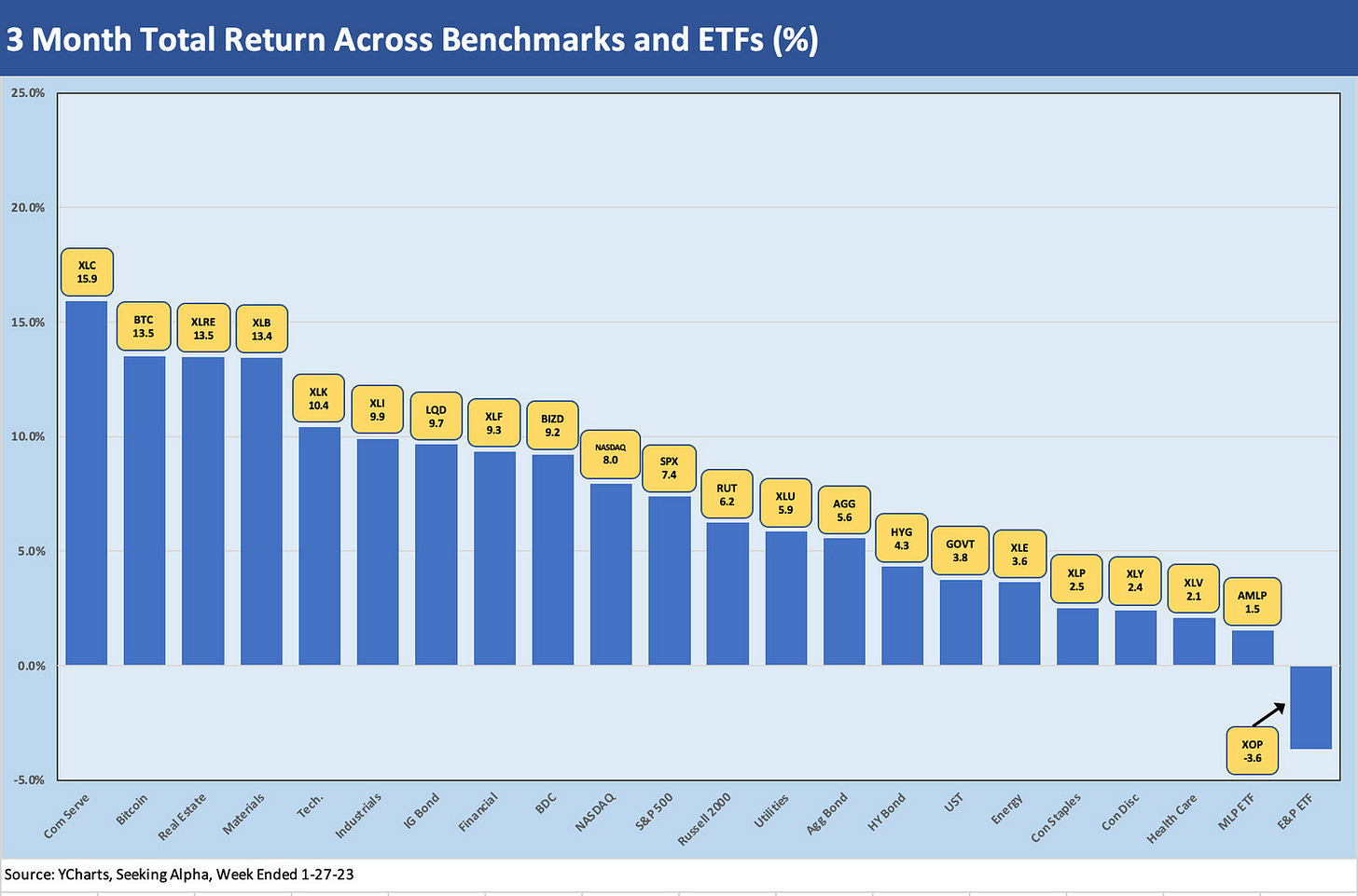

Below we update our 1-month and rolling 3-month subsector returns. We primarily use REITs with a few benchmarks thrown in.

The performance over the past 1-month time horizon for these ETFs and benchmarks tell a story some would describe as “risk on.” We prefer “the dimmer” imagery over the “on-off-switch,” and the numbers do show the lights getting turned up. The weakest performers over on the right are the more defensive names. The superior performers were the more volatile and risky asset subsectors that posted the weakest results in 2022 (see The 2022 Multi-asset Beatdown 12-31-22).

During 2022, XLC was the worst performer of the ETF mix we track with only Bitcoin worse. XLY (Consumer Discretionary) was second worst on our list to wrap 2022) with NASDAQ, XLK and XLRE next moving up from the bottom in 2022. The chart above shows a “worst shall be first” rally of the sort we have seen many times before after a weak asset return period.

For this chart, we had excluded the 1-month bitcoin (BTC) return results since it was over 42% and messed up our scale. BTC was -65% in calendar 2022 so that is quite a rally. We include BTC (ticker BTC-USD) in our 3-month version of the chart further below. We have been watching the cable personalities and their guests (often crypto advocates) trying to explain the BTC rally amidst bouts of contagion and domino fears across this bizarre ecosystem. They have not been able to explain it well (neither can we, but there is a “more sellers than buyers” 100-year-old joke in there somewhere). A drinking game might be counting how many times a Crypto advocate uses the word “blockchain” where in 2021 he would have used the word “crypto.” At this point, fortune favors the forcefully ambiguous.

The 1-month total returns are impressive when considering all the recession headlines that the markets get barraged with. That is not a shock with inflation declining and an all-new P&L year kicking off in the hope-springs-eternal month of January. Months of material UST curve migration and painful repricing of equities in 2022 starts a fresh game clock in 2023.

The rolling 3-month returns detailed above show more balance in the mix on the left side of the return rankings. Growth stories and classic cyclicals (Materials, Industrials) and interest rate sensitive real estate (XLRE) all held up well. LQD was tops in fixed income ETFs. The broad benchmarks (SPX, NASDAQ, Russell 2000) are hanging around the middle. The Energy winners from 2022 (E&P and Midstream) are over on the right as winter fears around natural gas subside and oil prices moderate relative to some of the more draconian scenario-spinning heard when Russia-Ukraine got uglier. The more diversified XLE ETF with more integrated names and suppliers did better than the less diversified XOP and AMLP. The latter has a mix of high dividend payers.

Yield curve update…

The above chart is our weekly update on where the “bear flattener for the ages” stands as of the end of the week. As a reminder, we update how much the various maturities have moved since the start of March 2022 when ZIRP ended. The movement in the UST curve has not been material the past few weeks in the context of the wild moves of 2022.

The trend line in inflation has been favorable with CPI (see CPI Wrap for 2022: The Beginning of the End? 1-12-23) and PCE (see PCE Inflation Ticks Lower, So Does Spending 1-27-23) moving down off the highs. Services have been stubborn, and labor remains tight. We will get jobs numbers to end this week but first the FOMC meeting and press conference Tuesday and Wednesday.

4Q22 GDP ends Biden year #2: After a 5.9% GDP growth rate in 2021 on the COVID rebound effects, Biden Year #2 weighed in at an annual 2.1% during 2022 despite the two negative quarters in 1Q22 and 2Q22. The growth rates generally have been low since the credit crisis, so it is important to keep in mind that line items such as private inventory and trade flows lines can drive material relative moves in the headline numbers (see GDP 4Q22: Thin Sliced 1-26-23, 3Q22 GDP: It’s the Big Little Things 10-27-22). Inventory and trade flows added around 2.0% to the GDP number in 4Q22.

For 4Q22, Government spending numbers also pumped up results with Federal consumption adding 0.39% to 4Q22 GDP and State and Local adding 0.25%. The quarter counts as a “W” in the win-loss column, but it is a sloppy win. Fixed Investment at a -1.2% contribution is telling a tough story on the investment cycle. Debt ceiling threats might not inspire ambitious capital budgeting decisions for some subsectors and companies.

The last three terms of Presidents (1 term Trump, 2 terms Obama) never saw an annual GDP growth rate above the 2% handle range (note: I said annual, not quarterly), so none of these Presidents have partisan bragging rights. The growth has been low or negative for years despite the imaginary “facts” tossed around by some who have claimed grand results and unprecedented achievements. Reagan and Clinton were in a different zone in terms of economic growth achievements. That is not an opinion. It is a set of numbers.

The 2.1% annual growth for 2022 falls barely short of the 2019 GDP annual number (2.3%) before the COVID damage (-2.8% in 2020). That was after 2.9% in 2018 with the tax cuts and 2.2% in calendar 2017. As we have covered in past commentaries, the years after the crisis had some higher highs and lower lows in quarterly swings, but the annual numbers ran low with the one exception of 2021 after COVID. We took that data from the most recent updates from the BEA.

The good news in 4Q22 is that Personal Consumption Expenditures (PCE) were holding in well enough in the GDP accounts (Note: Dec 2022 PCE numbers from last week just pushed back on that). The bad news was that Fixed Investment swung even more into the negative zone at -6.7% from the preceding period. That Fixed Investment line ended up driving a -1.2% contribution to the headline 2.9% growth line that almost offset the PCE contribution to PCE of +1.42% (See Table 2 in the monthly press release). The Residential investment line was similar to 3Q22 at -26.7%, but the Equipment line piled on by swinging from +10.6% vs. the preceding period in 3Q22 to -3.7% in 4Q22. At least Structures swung into a slight positive after 6 straight quarters of negative.

With inflation peaking in the summer of 2022 (see CPI Wrap for 2022: The Beginning of the End? 1-12-23), the worry is that we are now entering the next stage of the inflation and Fed reactions. Reactions to tightening (customers and producers) and a reevaluation of end markets will lag. That comes as the earlier contractual commitments for capex starts to roll off. That means capital budgeting gets a fresh game clock looking into 2023, and we could be starting to see some of those effects.

Personal Income, Spending, and PCE Inflation: The month is wrapping up with some mixed news for the economic pictures and where the consumer sector was shaping up. The PCE inflation numbers kept moving lower and personal income was growing, so that was helpful. Fed funds is still running below headline PCE inflation, so that is unusual in historical context and notably during a tightening cycle to fight inflation (PCE Inflation Ticks Lower, So Does Spending 1-27-23, PCE Inflation: Wild History, Recurring Oil Volatility 1-29-23). Savings rates were starting to rise after a period of heavy consumer spending. While Ben Franklin was big on the savings idea, the US economy marches into battle on the back of an unflappable consumer.

The concern around economic growth was fed by the second straight month of decline in personal consumption expenditures. That data comes on top of weak retail sales last month and some slowing in industrial production. The likely 25 bps from the Fed this week will keep the handicapping game going as the market gets more visibility on guidance on investment plans. The market will get fed more information with earnings teed up across some bellwether industries and subsectors in manufacturing, transportation, homebuilding, energy, and services.

Fair Tax Act already in a stall: We wrote about the arrival of the Fair Tax Act two weeks ago not long after it was proposed as H.R. 25 (see Footnotes and Flashbacks: Week Ending Jan 13, 2023). Here we offer some updates and added information. The main takeaway is that leadership seems to appreciate what a messaging disaster they would have on their hands trying to approve a massive sales tax at a time of inflation. They will also be forced to fight the battle of “sales tax exemptions” with interest groups that will be directly impacted from services to manufacturing, from health care to autos to homebuilding, and all the while facing a defense establishment that will see budget pressures written all over it. The potential for massive embarrassment in the absence of a rigorous revenue model for the sales tax vs. income tax trade-offs will add to the list of problems for such a bill. The 2024 playbook will get written for the Democrats as they await the GOP cuts list.

As we covered in a separate commentary, the Fair Tax Act bill is pretty strange, ill-conceived (for decades), and not supported by much of any macro work that we have seen for this specific bill in this market (try surfing to find any). These types of bills usually have a hired gun academic to shill for its rigor. There is usually at least a paper written with a PhD attached that is light on the sea level real world details but strong on the ideology.

The problem here is that the same bill in substance has been introduced more than a few times since the 1990s. The significance of the legislation was more tied to framing how radical and how difficult the more extreme wing of the House might get in addressing the debt ceiling. In a way, the bill was a mind reading exercise to frame a “reckless quotient.” If the sponsors (some of the Who’s Who of the fringe) insist on bringing this bill to the floor, they must be inclined to go for broke on “all or nothing” and that colors the perceived risk on the debt ceiling as well. They want an undercard fight before the main event on the debt ceiling, so it appears. It would force votes to be on record.

A bill that failed in the 1990s and in multiple decades since is not a great legacy. We saw similar bills proposed in 2003 and brought in 2011. The 2011 bill had the same name, same basic goals, as well as a Georgia Congressman as sponsor. These somehow keep getting resurrected. It is a tribute to persistence or a sad comment on learning curves. The one in 2011 was also HR 25 at the time. There was also a bill in the Senate (S.13) in 2011 by a Georgia Senator (Chambliss). That follows the one in 2003 from some of the same sponsors in the Senate. We stopped looking for more. This starts to get weird.

The 2023 bill by itself in a vacuum is significant in terms of the mindset. On the other hand, the reality is the bill has zero chance of passage through the Senate and White House. In context, it is just another meaningless legislative gesture that both sides engage in along the way, but it comes with meaning in terms of extrapolation to what lies ahead. The strangeness of the times makes it worth a look, especially with the US potentially heading for default at a time with this many miscreants in the House. As a reminded, the proposal eliminates the IRS and all income taxes (corporate and individual), capital gains, and estate and gift taxes. That is no small economic event.

The topic of oversight, compliance and enforcement is not an insignificant matter. Evasion would end up as a major problem in many domiciles. Many vendors and states and cities would lack the systems to track sales taxes. The Fed sales tax and state sales tax would likely have different exemptions (food, healthcare etc.). That’s a mess.

No one likes the IRS until consideration is given to what is on the other side of the actions. All administration and enforcement would be pushed down to the states. Some states would seek to do it. Some would pretend. We leave to speculation which states would make weak efforts and go easy on their constituents. We assume that revenues would fall short of expectation. Then the budgets and cuts begin (Social Security and Medicare at the top of list).

There was little on this subject in the news when it came out, and it did not make much of a ripple until the questions ramped up this past week. McCarthy and Scalise are already moonwalking on this legislation with both reported to be opposed (based on reports from the political rags). Bringing it to the floor reportedly was part of the House Speaker deal. The Wall Street Journal had immediately accused the GOP of masochism since they would get pounded for even promising to bring it to a vote. The upshot was “bad strategy, bad bill, bad timing.”

The debt ceiling backdrop made it especially bad timing since the GOP will already be getting beaten up for a list of their cuts for the debt ceiling fight. Social Security used to be the “third rail” of politics. Some in the House are apparently going to try running on two rails (or go horseback). With the Fair Tax Act in the picture, the sponsors will get hammered for their “revenue model” on sales tax and cuts at a time when McCarthy, Schumer, and Biden will be turning up the heat on specifics. Modeling that one likely has not even been tried by state. That might even be funny if the sponsors tried. Facts and specifics matter in budget forecasts even if not in politics broadly. Conceptual integrity never matters in Washington.

The 30% sales tax on new retail goods and service items was going to give the Democrats a field day of talking points. With an estimated 40% of households not paying income taxes in 2022, you face a tough start being down in popularity with that 40% who would all pay higher taxes. Then you add in those selling goods such as new homes when the housing sector is already under strain from mortgages. The South is the largest single family home market by far with Texas and Florida. Land developers and builders might have a view on that tax idea. So will the supplier chain. The list goes on.

Health care affordability would get hit hard. That is not a great idea with Medical Care Service inflation rising in 2022 and labor shortages a major problem. The defense establishment might be making some calls on how unrealistic the 30% number might be in funding record defense spending in a dangerous world and possibly leading to anti-Ukraine sentiment in the budgets on defense support.

The car market is already producing at recession levels, and this hits affordability. Used cars will be outside the sales tax from what we understand. That will flip preference to used over new. The bill sponsors said they don’t want a slippery slope of exemptions, but once committees start on it, the revenue line will keep going down or the 30% sales tax will need to keep going up. It is likely too low already.

Concerns over inflation in so many different areas make it hard to tell the consumer they need to pay another 30% tax, and the working class earning below the median income line might take exception to the idea. Past studies under other administrations claimed the burden falls hardest on middle and lower income tier households.

Many of us are hoping to see a real study done on the revenue forecast by the proponents of the bill. Right now, it is a lot of ideological talking points and adjectives. We even have the Fair Tax organization saying the bill is “progressive.” That may not mean what they think it means. It is explicitly a ludicrous misstatement of fact and basic math. They will need to defend that in numbers and models that can be challenged. The idea of a national sales tax is not new, but this one deletes the national revenue line on a leap of faith in theoretical execution with apparently little detailed scenario analysis attached to it. To even bring it to the floor to lose would require a respectable performance. Failure to show one would color the debt ceiling talks.

A look at the co-sponsors on the list does not signal an assembly of the all-star econometrics team. Past debates on the exact same bills (also a 30% sales tax and 23% gross tax) were conducted back in the late 1990s, and the proposal was shredded when it was put under scrutiny. The same concept popped up later, and some felt a 50% to 60% sales tax might be needed to offset the revenue loss. After all, it is not every day a proposal has a list of sponsors that reads like an election denier fraternity (and a few pardon seekers).

A collection of assumption caveats reminds us of the 20% Border Adjustment Tax of 2017 (“BAT Tax”) getting tossed out. That was a time when the GOP had full control. That bill was inflationary and potentially cataclysmic for retailers and would have materially raised sourcing costs in too many areas to list. It also would provoke retaliatory tariffs as nations called a spade a tariff.

That BAT Tax bill seemed to assume the dollar appreciated in direct proportion to the trade flow currencies across all trade partners. The currency adjustment was the idea behind the case that it would not be inflationary as dollar purchasing power grew (the pedigreed Professor who did the legwork was not big on currency realities and global dollar denominated products). The Professor did not get the memo on some nations managing exchange rates or pegging loosely to the dollar. That tax was championed by House Speaker Ryan and Rep Brady (R-TX) and was designed to eliminate corporate taxes. The tax reform that year took shape out of the Senate pushed for straight income tax cuts and an overhaul of the global corporate tax structure.

This current fair tax proposal has a lot less analytical support (or so it appears) or the forecast is well hidden. There is also the potential for GOP-on-GOP violence from the Senate side that could inspire some House members to rediscover courage. We suspect most do not want to vote on it at all. Many mainstream (or closet mainstream) GOP members would likely prefer not to be in a position to approve a massive sales tax on the working class that would exacerbate household affordability on many items from goods to services. The immediate strain on weekly cash flow would not be a small political risk. The press has been light on this topic, so it will be interesting to see how House leadership tries to bury it. McCarthy is out of collateral after the Speaker adventure.

MICRO

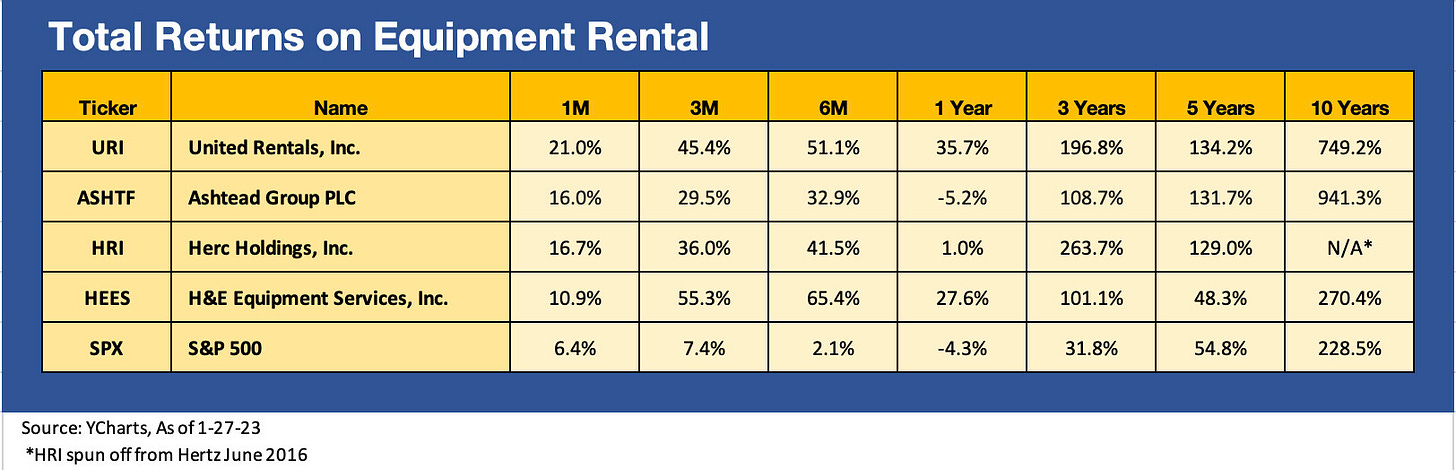

United Rentals: The nonresidential construction market is in the crosshairs of many as a highly vulnerable subsector of the GDP line items (see GDP 4Q22: Thin Sliced 1-26-23). Despite the mixed range of views, United Rentals (URI) weighed in with a bullish dividend, buybacks, and modestly positive guidance. As the #1 equipment rental player in the US, the company grabbed some headline time this week with a more optimistic view on its prospects. We see URI as a good proxy for activity in the nonresidential construction markets and a range of equipment-intensive industry groups. Their rental revenue mix is 48% Industrial, 47% Non-Residential Construction, and 5% Residential.

We have followed this company for some years in prior lives, and URI has been a major success story despite some periodic questions from some bears. They rose to the challenge in every recession and came through every volatile credit cycle positioned for more growth via acquisitions as well as organic capex. They were more acquisition oriented than Ashtead, another highly successful player in the space. We take URIs views on end markets very seriously since their touch points are so extensive across many equipment asset classes and regions and through an extensive branch network.

We look across the small peer group of major equipment rental operators in the chart above, and the industry leaders are trouncing the broader overall market with United Rental in particular a standout performer. United Rentals guided to free cash flow of $1.8 billion and initiated its first dividend to go with its substantial buyback program. The capex program guides to modestly lower on a net basis but appears to be balancing sustained expansion (including the recent Ahern acquisition) without risking pricing pressure on over-fleeting. The stock popped by double digits on the week.

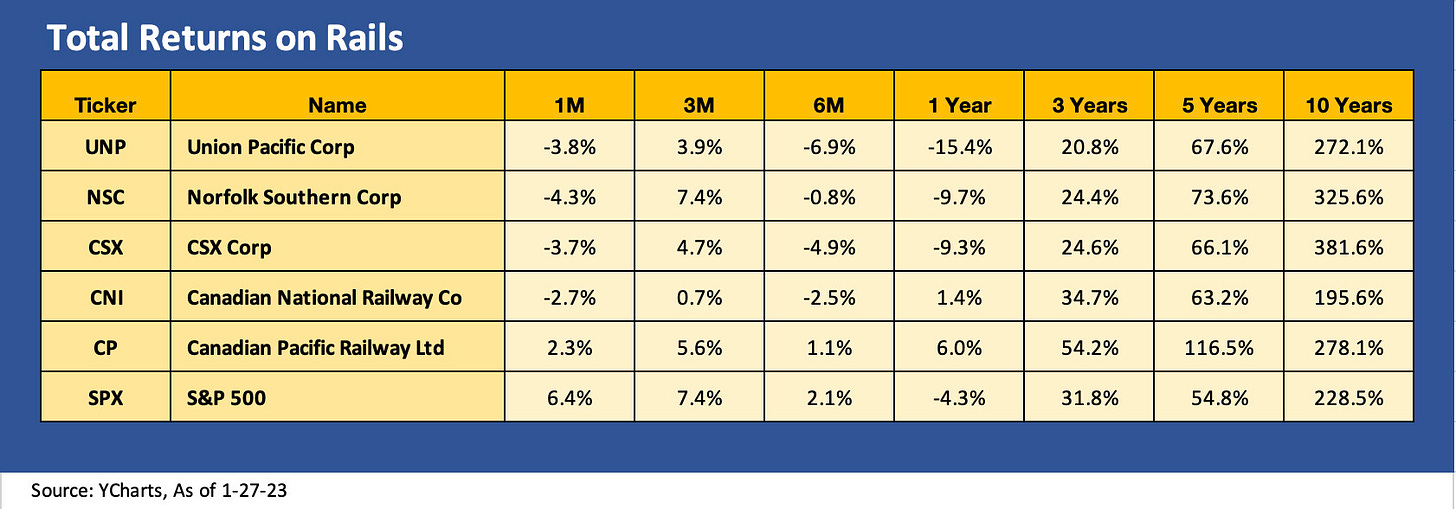

Rails and Freight: The market often looks to the rails and truckers for a read on the fundamental economic backdrop. That was an old-school approach in watching the “Transports” as market signals. After all the supplier chain noise of recent years, it may be making a comeback. There are numerous direct lines (pricing power and volume) that offer more direct input into the market realities. Volume and tonnage are the big parts of the story along with which parts of the freight mix (ag, coal, autos, etc.) are doing better than others.

There are also indirect signals the sector sends around contractual commitments to volume and freight rates (vs. spot rates) with shippers. The confidence ahead of or during renewals can give the market some qualitative flavor that shows up in guidance (whether qualitative or hard numbers). There are worries now that softening demand, adjustments to inventory levels, and pricing pressure could upset the theme of stability that many are hoping for in 2023. The story still has to play out a bit more.

The past week saw such bellwether names as Union Pacific, Norfolk Southern, and CSX in rails and Knight-Swift in trucking weigh in. The overall flavor for rails in equities so far has been less favorable than for the truckers and diversified logistics services. NSC took a beating on its earnings day since the revenue outlook leaned towards volume headwinds. UNP, CSX, and CNI also reported. The rails were dragged down. Canadian Pacific reports this week.

The chatter around the equity circuit appears to be that the major rails could have a rare down earnings year for the group. That said, even flat volumes and some cost pressures that cannot be recovered in pricing and service improvements does not imply a recession. The rails overall seemed to deliver color that was in the stagnant growth camp but not flashing red. Weakness in home construction further out in the year and expectations of low auto production rates with some signs of an industrial fade (see Capacity Utilization: The Fade Begins 1-18-23) don’t add up to good news even if they don’t call for declines in volume.

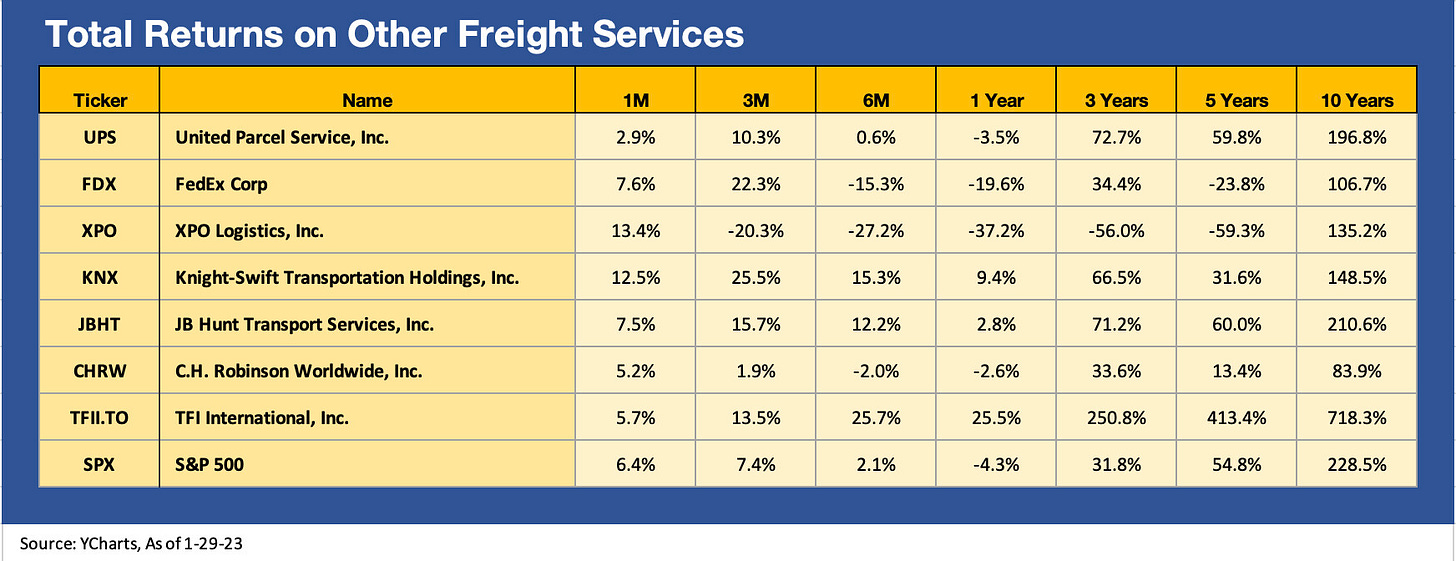

The other freight and logistics operators ex-rail show some relative optimism compared to the rails in their stock trends. We saw decent numbers and guidance this past week from Knight-Swift and the prior week from J.B. Hunt. This coming week we have UPS and C.H. Robinson (CHRW) teed up to release earnings with TFI International the following week. The 1-month stock returns have been mostly negative for the rails (CP an exception) but positive for the truckers and logistics services suppliers. The truckers and services operators also outperformed the broader market benchmarks.

Many freight and trucking services providers were badly disrupted by the supplier chain turmoil along with the entire sector, but the pricing power was very much on display across numerous subsectors of freight as the scramble was on to get delivery and moving goods from Point A to Point B and C.

A big part of the inflation story was freight costs, and the old rule of “one man’s expense/capex is another man’s revenue” applies. The complexity of the logistics from producer/manufacturer to transport hub to port, from port to hub to warehouses to customer, made the whole process into a Gordian Knot that US infrastructure and the regulatory framework could not deal with.

If we look back at the trailing 3-year time horizon to just before COVID slammed the market, the relative performance of the leading truckers (and related logistical services providers) is impressive vs. the overall market. These companies vary in business mix and relative asset intensity, but they are driven by many of the same variables tied to cycles, trade flows, freight mix, and the volumes relative to capacity that sets pricing power and unit costs.

The ability to navigate the disruptions seen in recent years even with a shortage of drivers and myriad supplier chain disruptions (port congestion, COVID lockdowns, etc.) told a good story about this sector’s resilience. In some cases, such as XPO, the company has its own distinctive set of issues and story lines around spin-offs to reward shareholders, but that is a story for another day.

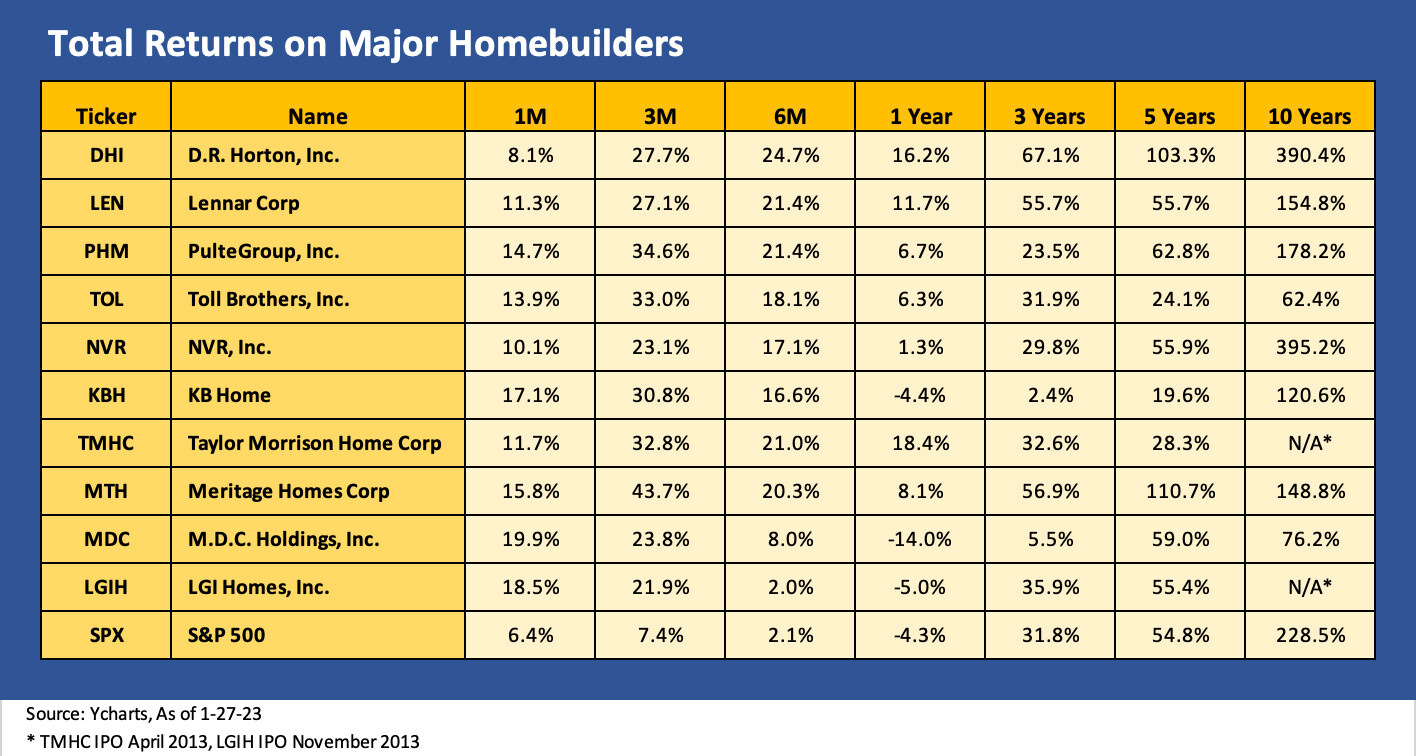

D.R. Horton: The #1 homebuilder by units and revenues reported this past week. DHI is always a good one to watch just ahead of the slew of homebuilder reports this coming week. The results were strong in context, but the real test for the builders lies ahead. The challenges of cancellation rates and mortgage uncertainty ahead resulted in minimal guidance from DHI and is a sign of the times.

The company has one of the strongest balance sheets in the business with cash + inventory ($25 bn) of over 4x total notes payable ($5.69 bn). The asset coverage and market cap of stock ($33 bn) tells a good story also. The inventory balance includes $2.9 bn in book value of rental properties.

The peer group for the above list of 10 major builders might surprise some since the larger well capitalized names materially outperformed the broad benchmarks on a trailing 1-year basis dating back to before ZIRP ended and the time when mortgage rates really started to weigh on the housing markets. The builders were beat up early in 2022 but then have mounted a solid comeback as they defended their ability to navigate the shifting markets and strained affordability.

With mortgage rates down off the highs and a better understanding of the builders’ game plans and cash flow dynamics, the market seems better adjusted to how the builder cash flow cycle and strength of some builder balance sheets make this sector more interesting than the superficial reaction the builders often get. (In the interest of disclosure, I own both DHI and LEN stocks in small immaterial positions in my personal portfolio.)

The long-term anchor for the sector is the fact that there is a supply shortfall in housing that anchors builders over the next few years. The tough part is navigating the building and inventory cycle across this mortgage drama. A challenge is handicapping the timing of any downward migration on rates. We looked at some of these issues after 3Q22 (see Market Menagerie: Housing Questions to Ponder 10-27-22 and Market Menagerie: Homebuilders from the Horse’s Mouth 10-28-22).