Housing Questions to Ponder

We look at some of the color offered by builders on cancellations, pricing, incentives, land spend, and impairments.

The Very Short Form:

I have been digging through the housing sector commentary this week, and there is lot of management color to sort through. The main theme is a rapid reevaluation of investment planning and a “re-underwriting” assessment of pending investments. The rise of cancellations by homebuyers is also seen on the homebuilder side with lot options getting cancelled. The stabilizing actions that homebuilder take to build cash flow and support balance sheet metrics are going to unfold in coming quarters, but the expected price and volume pressures are showing in the equity markets and for good reason.

The homebuilder space is one of the economic multiplier effect subsectors that will impact a lot of businesses along supplier chains from materials to appliances to finance and insurance. We already saw a steep contraction in the Residential fixed investment line of GDP in 2Q22 and will see more contraction ahead. In future commentaries, we will follow up on the issuer level 3Q22 information flow.

The problems in housing are not a major mystery…

The headlines on inflation, mortgage rates, plunging affordability metrics, and the multiplier effects of a sharp rise in monthly payments for homebuyers (new or existing) have been part of a constant theme – housing sector contraction expected ahead. The tough household cash flow decision on homebuying can even be taken out of the hands of the buyer on impaired mortgage eligibility. The shift has been very rapid, and that adds to the confidence problem.

The result of the yield curve shift cuts many potential buyers out of the mix for a while until the economic situation and inflation fighting program show some results. Many potential buyers need to get a better sense of their own economic uncertainties. The Fed’s fight to fix inflation only creates more fear that the solution will in effect need to be a recession (even if that is not the policy goal). That further adds to the anxiety in pulling the trigger on a home purchase. The higher mortgage payment is often a zero-sum decision in cash use for a normal household. The home purchase is also an investment, and that’s a question of the right price. There are some clouds around timing and valuation even if buying a home is positive long term investment.

The mortgage payment pain rules the analysis…

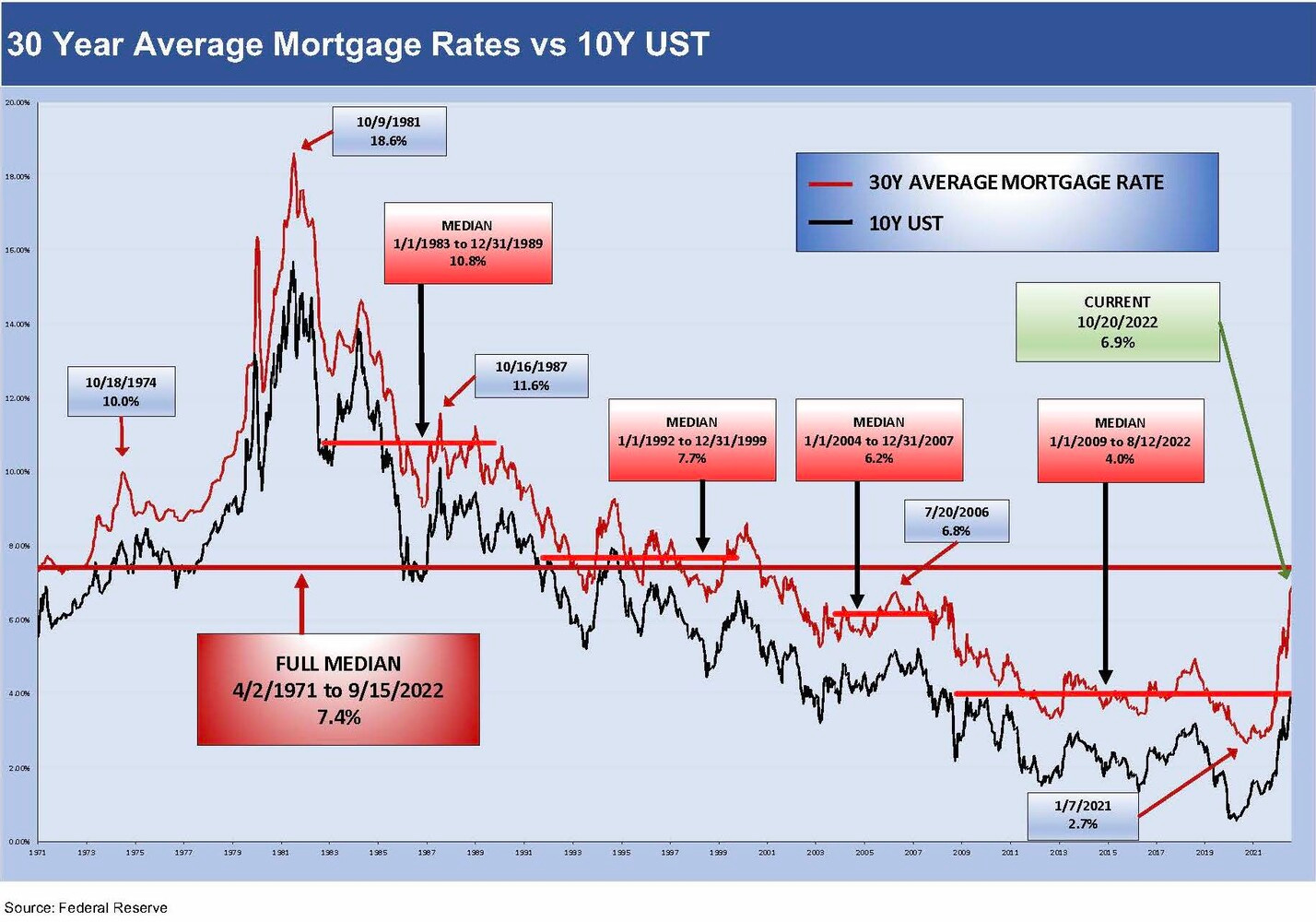

Below we detail the history of the 30-year mortgage average plotted against the 10Y UST. The reality of the mortgage market is the 30Y mortgage tracks the 10Y UST in lockstep as the mortgage trade rags constantly hammer home. That is clear in the chart. What is also clear is that 7% mortgage rates are not new to the markets. The median from 1972 was a 7% handle.

We saw 7% in the 1990s economic boom, and we highlight the median from 1992 to 1999 had 7% handles. We saw a lot of 6% handles in the housing boom (note summer 2006 rates at 6.8%). The 1980s was off the charts at double digits with 11% in 1987 even after a 1% CPI year in 1986. So the 7% mortgage rates are not an asteroid hitting the housing sector. As a reminder, the 1980s and 1990s were major bull markets in stocks and high growth periods. That does not help today’s problem, but it is at least a data point for those worrying about Germany in the 1920s or the US revisiting 1980-1981.

The speed of the change in rates is a “shock” given the magnitude and from a very low starting point. The pace of the move from 2.7% at the start of 2021 is telling. The increase brings fears of a material hit to the positive equity built up for many homeowners. The theory is that higher monthly payments can only be eased with a lower price. The math is dominated by the mortgage rate for anyone looking to buy with a mortgage – whether new or existing homes. The “existing” home sales numbers dominate the total home sales mix. Historically, the “existing” sale is routinely in the high 80% share and as high as 90% of the total home sales number.

The theory is the wealth effect and ability to easily tap cash-out mortgage finance can impact consumer behavior (“I am poorer and less liquid already”) even as recession fears create job uncertainty despite a 50-year low in unemployment. Furthermore, the color from the homebuilders in 3Q22 earnings season is revealing the rapid shifts underway in planning on land spend, cancelling options on lots, and generally reevaluating investment plans. The GDP growth line for Residential already saw a -17.8% number in 2Q22 with 3Q22 GDP growth showing weakness as well. Residential investment posted a -26.4% this morning.

The 3Q22 reporting season for builders peaked this week….

I have been digging through the 3Q22 homebuilder reports for more details and directional indicators, and the strong numbers looking back belie the troubled performance expected ahead. The tone of the calls struck me as a scramble to deal with the conditions unfolding as the mortgage rate spike came so quickly.

The reaction of the equity markets for builders this year is clear in the chart below as the market looks for demand to drive pricing and volume lower. There will be some added costs for cancelling options on lots and taking the smaller hits rather than spending billions more on land spend in 2023-2024. Development and inventory liquidation will be the priority and taking care of the balance sheet. We will look at the stabilizing financial mechanisms in homebuilders in a follow-up piece.

There is a lot to unpack from the conference calls and the numbers, so we will take it in a few shifts in the interest of brevity (sort of). Below I list some questions I asked myself on the sector as food for thought. I tend to be much more constructive on the financial risk profile of most builders since they have a proven history and identifiable levers to cushion the landing as the analysis moves from the income statement to the cash flow statement. Peak gross margins of this quarter are still riding a lot of the build-to-order momentum and movement of spec units before the uglier side of the market gathered momentum.

Questions to ponder:

After a housing and mortgage finance crisis that unfolded with the housing peak of 2005 and blew up in 2008, does this latest inflationary spike mean national housing markets head back to a “correlation of 1” again and defy the traditional (pre-crisis) model of regional variations?

Will we see more regional diversity in the housing sector performance ahead based on supply-demand fundamentals in a market where supply still falls short of demand and renting alternatives vary widely across metro areas?

Since monthly payments dominate the picture more than price, will volume crash but value erosion for the existing homeowner be more restrained after a sharp rise in home equity? If the positive equity spike did not trigger waves of sales of existing homes this past cycle, does the risk of supply-demand imbalances get countered in part on tight supply from existing homeowners who will wait this out? With the pullback by builders in 2023-2024, won’t supply remain very tight?

Do the demand-driven and demographically supported volumes in the housing market make all the difference when framed against the credit-driven period of the pre-crisis years (“Got a pulse? Get a loan”). Does the shift away from high LTV lending (“Here’s 125%, buy yourself a boat or another car”) that was seen in the markets of 2004-2006 also mark a major distinction vs. today? Shouldn’t that be reassuring and ease the “housing market crash” mantra from the most bearish?

Will the erosion of mortgage credit availability (whether on lenders tightening or a large swath of borrowers failing to meet the income and credit tests) also lead to a steep supply correction as the market waits out the questions to the inflation solution and next Fed policy moves? Will that ease the home equity panics that some fear?

Will the reality of a 50-year low in unemployment still put a floor on the “need a place to live effect” and drive more homebuyers to simply “buy less house” for their dollars? Aren’t the demographic tailwinds still compelling?

Will the imbalance of supply and demand in a market with high payroll numbers put more upward pressure on rentals or will that also be more varied by metro area? Where does the supply-demand balance go when new homes get reeled in, existing homeowners wait this cycle out, and rental units find the market clearing prices?

Does the wave of growth in single family home rental entities that have poured billions into the space now serve as somewhat of a stabilizer in the supply-demand balance?

The list of questions is much longer than this of course.

There is much to look at down in the issuer trenches as this housing cycle downturn gain steam. There will be overreactions and opportunities. The absence of reckless credit, lack of excessive subprime “experimentation” and low fears of a massive foreclosure spike make this a very different type of housing contraction. That is, unless the world turns especially dark, and the recession scenarios get far worse than anticipated. The checklist of tall tales and fat tails are for another day.

As mentioned earlier, we will take this housing topic in a few shifts.