Footnotes and Flashbacks: Week Ending January 20, 2023

We look at a week where GS and MS diverged and the Fair Tax Act colored expectations for reasonable debt ceiling talks.

This Week’s Macro: Broad index returns, ETF benchmarks, debt ceiling game theory, the extremist Fair Tax Act, the housing recipe book, and the industrial production fade.

This Weeks’s Micro: Goldman-Morgan Stanley takeaways, Ally as consumer finance microcosm, Alcoa, and Kinder Morgan.

_____________________________

Below we flag some events or trends that captured our attention. We also frame some cross-asset returns and look at some strange developments in Washington.

Some comparative asset returns…

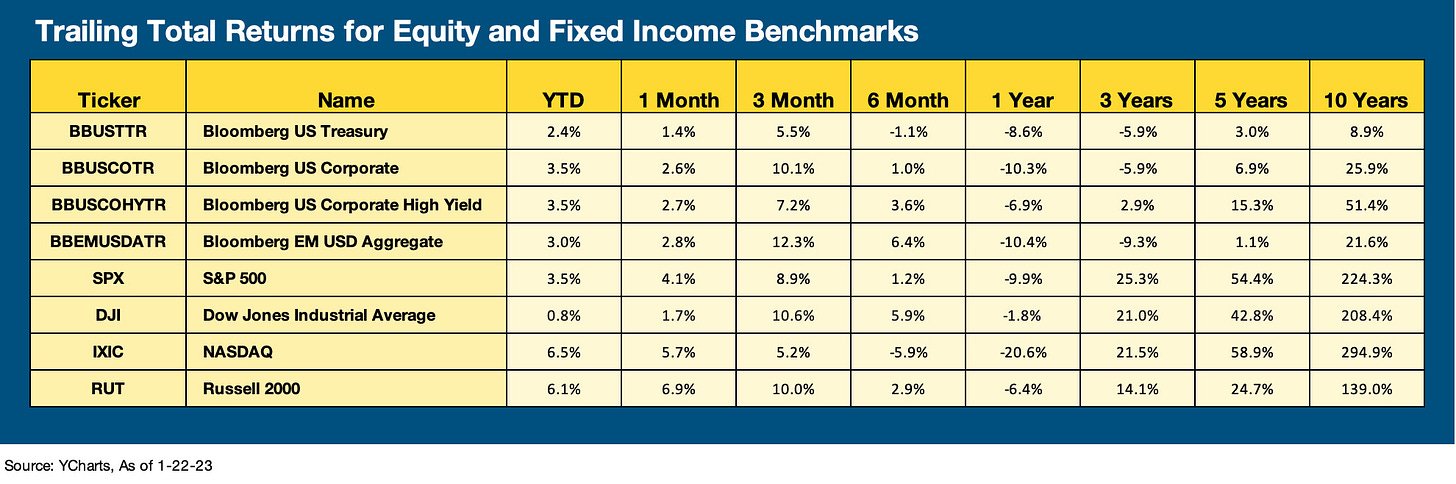

The asset performance to date in 2022 clashes with the somber tone we often hear around cyclical prospects and recession fears. The good news YTD, 1M, and 3M is that equities have performed well, credit spreads are doing well overall, and duration has brought some rewards.

Even just sitting in cash is not a bad deal on a risk-adjusted basis since foregone coupons are not what they used to be for many benchmarks. The refinancing at low coupons ahead of the 2022 yield curve migration mitigates income opportunities vs. 4% to 5% on cash. Cash allows for some de-risking of event timelines around inflation and the Fed. The 4Q22 earnings guidance is streaming out, so patience might not be a bad idea depending on risk appetites.

Among swing factors in risk, the debt ceiling is something we don’t dismiss as easily as we would in most markets. Some of these people are mentally “down a quart” and want to make history for their base. Holding up the Senate and White House is different than holding up McCarthy. That makes an application of logic potentially futile.

Drilling a bit more into asset class subsectors…

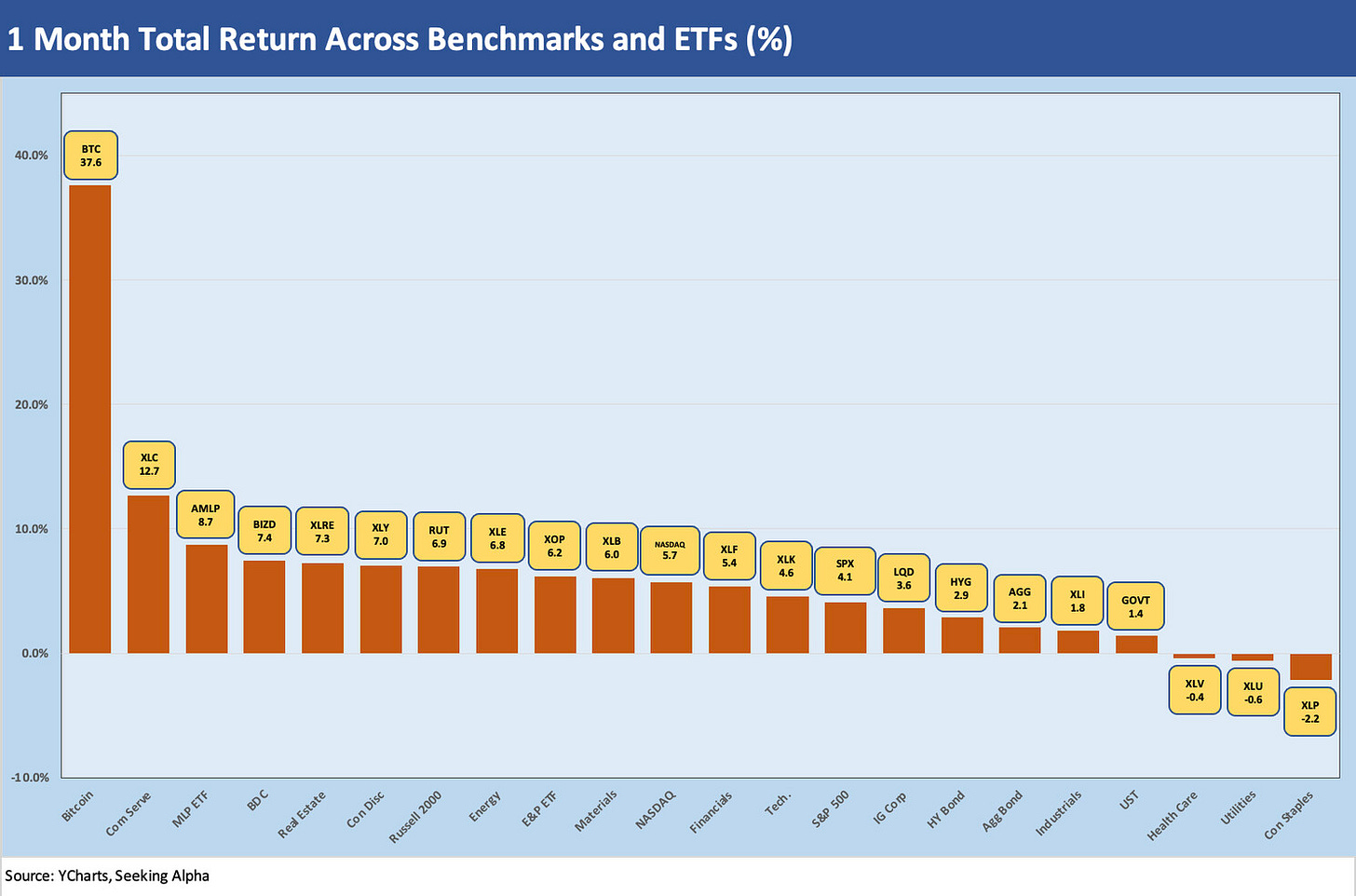

Below we add a 1-month trailing return chart to our weekly collection. We had been using a 3-month return version of this ETF heavy bar chart, but we thought we should add a second chart since the short-term action is likely to pick up. The ebb and flow of Fed actions and debt ceiling debates ahead could drive volatility. As a reminder, we look at a broad cross-section of ETFs for some industry groupings. We include the usual broad equity benchmarks as well.

As much as some commentators are now describing the crypto world as undergoing a “contagion,” Bitcoin distorts the list with its bounce as flagged in the bar chart above. We are more of the Jamie Dimon school after he dubbed crypto a “pet rock” this past week in a Davos interview. He has used the term “hyped up fraud.” The bankruptcies continue in the crypto world with counterparty risk setting off more waves of risk aversion and protective actions to preserve liquidity. As we have seen in other asset classes, contraction in credit (lending or trade) can create its own sell-fulfilling prophecy.

Among performance leaders, we see XLC (Comm Services) running ahead after a very poor performance near the bottom in 2022 (see The 2022 Multiasset Beatdown 12-31-22). We see solid numbers in MLPs and Midstream Energy with their solid free cash flow and safe dividends (in fact, dividends are biased higher). We see Business Development Companies (BDCs) getting some love with their floating rate assets and very high dividend yields with many around 10%. The BDCs are run by some of the most talented people in the credit space. It is one of those times when you have shared interests with them.

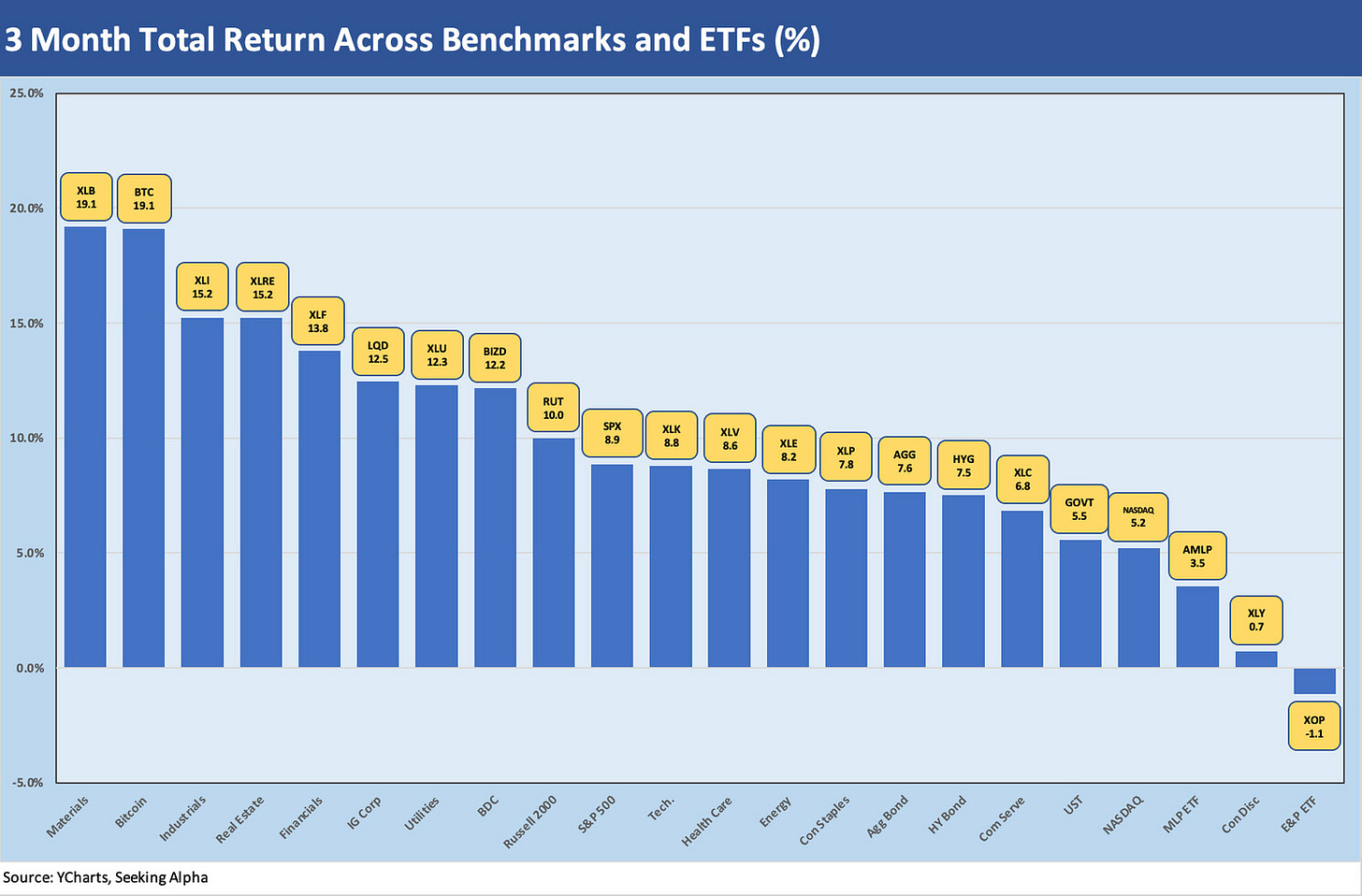

We look back three months on the same mix of assets below…

The rolling 3 months tells more of the cyclical story with XLB (materials) running quite strong and Industrials (XLI) and Financials (XLF) on the left of the chart. XLB and XLF was more middle of the pack during calendar 2022. XLI ran just under the top quartile in this mix during 2022.

We see that E&P sagged over the rolling 3 months along with MLPs. Both performed well in 2022 but the sense of crisis in the full chain of Energy (Upstream, Midstream, and Downstream) has eased somewhat relative to valuations. In credit, the curve migration has supported LQD while US HY has been a smaller beneficiary than IG on duration. HY has seen spreads swing in a wider range (good and bad subject to month).

The UST curve had a quiet week…

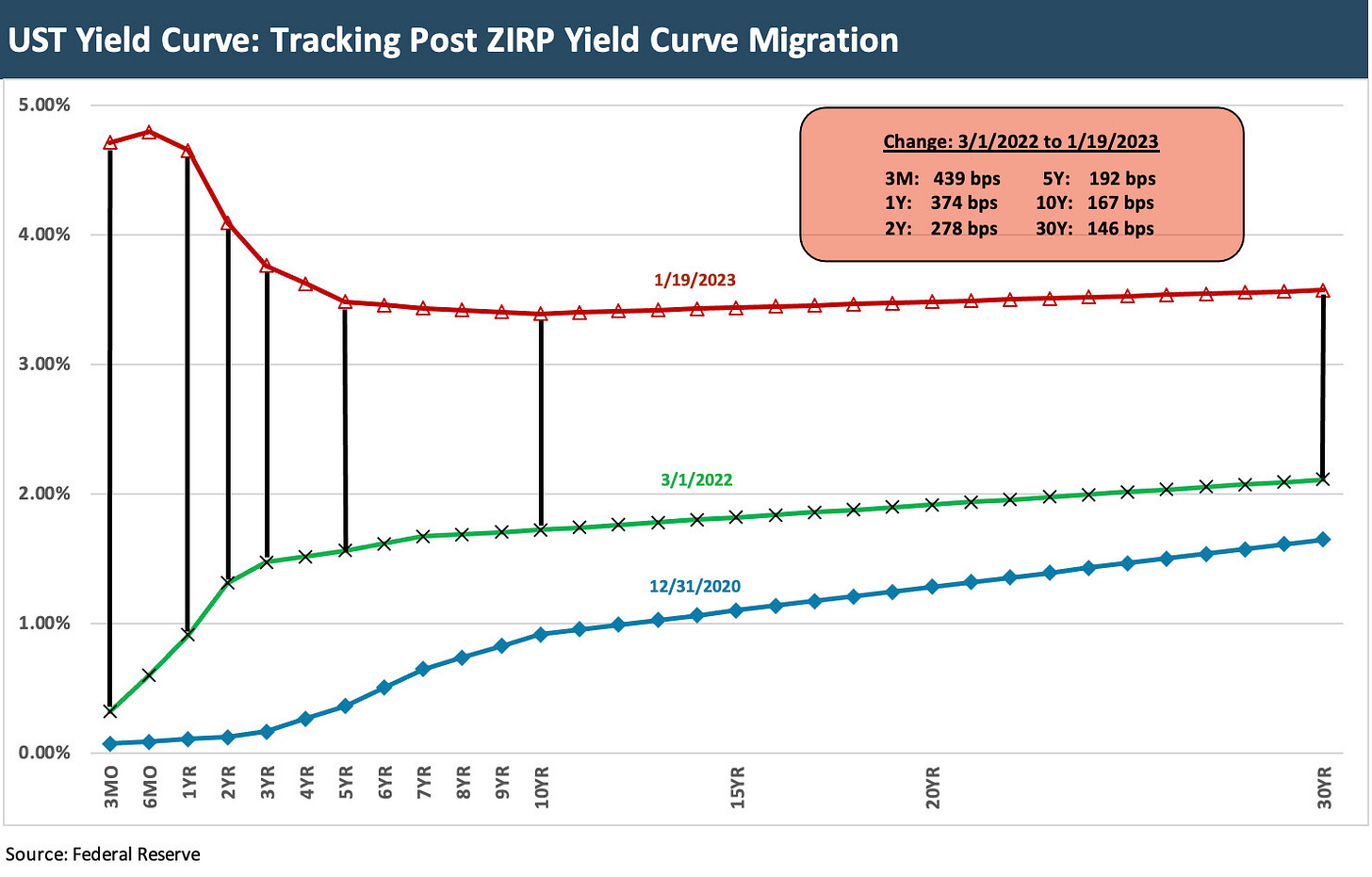

The chart below has the simple ambition of keeping us up to date on how far the yield curve has shifted since the March 2022 period when ZIRP came to an end. We also plot 12-31-20 as a frame of reference at the end of the year of COVID. We stopped the curve as of 1-19-23 as the Fed updates were slow, but 1-20-23 showed minimal movement. If anything, the news on the week was biased to the negative side fundamentally with weak retail sales and industrial production numbers as noted further below. The job cuts in tech have been getting ugly, but the headlines are small relative to the JOLTs positioning. Weekly claims remain extremely low and monthly job releases are solid (see December Jobs Report: Mixed Feelings 1-6-23, Employment Fixation: The Needle Will Move Very Slowly 1-3-23).

The UST inversion remains a fact of life that some people just cannot stop talking about as an indicator of recessions. We always get back to the slogan “the yield curve is a symptom, not a cause” and the real action is in the trenches with the causes of the weakness. The curve has been a good predictor, but at times more coincident and even lagging than predictive. We believe bottom-up fundamentals and guidance are the best inputs (see UST Curve: Slope Matters 10-25-22). We saw some critical indicators this past week in retail sales and industrial production that were soft, but the reporting companies also include some strong issuers with constructive guidance so far. A lot of guidance news flow lies ahead this week and next.

The curve has helped longer duration portfolios in recent months not only by stabilizing but also by moving down to 3% handles from 3Y UST out to 30Y and with the 4% handles from 1M to 2Y UST. The entire curve was above 4% just over two months ago (see High Speed Inversion Gains Altitude 11-6-22).

As the headlines keep blaring out, the market is not in agreement with the Fed on where the economy is heading and what will be necessary to rein in inflation. That sort of clash on policy is not unusual (Trump wanted to fire Powell), but at least the Fed has been clear on its mission (that beats 1994… see Bear Flattener: Today vs. 1994 and Aftermath 10-18-22). The 1994 bear flattener and upward shift also occurred early in the cycle with minimal inflation. In contrast to 1994, 2023 has plenty of inflation to worry about even if conditions are improving on some key CPI lines.

Macro news the past week…

Debt ceiling, game theory, and the kamikaze team: The headlines will not die down any time soon, but the countdown has begun the past week with the US hitting the debt ceiling of $31.4 trillion. The strategy around negotiations went on a ride this week as “no negotiations” morphed into “let’s meet.” The problem with the headlines and moves around what is possible on budget talks is you cannot tell what is real and what is posturing. That’s why they call it game theory. The term is used from small negotiations to big global geopolitical crises. History has been filled with near-catastrophic misreads (think Cuban Missile Crisis) and with conflict resolutions that generated massive relief (ok, think Cuban Missile Crisis again).

The worst outcomes can be found when one side is not negotiating in good faith and has an end game that is helped by the failure of the negotiations. In this case, the interests of the power-seekers in the small group of extremists that dictated the speaker challenge raise some questions. They could simply be in all-or-nothing mode. Win big and be a hero or stand your ground and get lots of donations and be a hero to the base who may not care about massive global market chaos (or don’t understand how it will affect them).

Their ambition may conflict with what the more mainstream historical GOP loyalists (more of them reside in the Senate proportionately) would like to see. The X-Factor could be finding a splinter group in the mix of the House GOP ranks, and that takes a level of standards and courage not in evidence. 10 people could easily defang this extremist crew in the debt ceiling debate. If those cannot be found, it might mean this could go to the cliff’s edge.

The motives and ambitions of the uncompromising ideologues were further on display this week with the evolving Fair Tax Act making the rounds again (see the comments on that directly below this section). The House GOP is calling for the abolition of the IRS and essentially all income taxes and payroll taxes (the ones that fund Social Security and Medicare). They want the administrative and functional oversight to move to the state level for collection and reporting, etc. This cockamamie bill has zero chance of success, but it was presumably one of the deals made to get the speaker mantle wrapped up for McCarthy.

The Wall Street Journal Editorial Board dubbed the Fair Tax Bill as “GOP Masochism” over the weekend since the bill would be used against them ahead of the 2024 election. The idea of a 30% sales tax (which the bill described as 23% with a failed Jedi Mind Trick) is not new in substance. The repeal of the death tax would appeal to many, but the repeal of payroll taxes would quickly be framed by the Democrats as designed to murder Social Security and Medicare in their sleep. The “Fair Tax” basic concepts have been kicked around for years (always failing), so what the current Fair Tax lacks in originality it more than makes up for with the grand scale of the political recklessness in rolling it out in a divided country with close House and Senate votes accustomed to voting along party lines.

The bill is doomed by definition, but one theory is that it is part of a game theory move that tells Biden and Democrats that “there is nothing our extremist wing will not do including blowing up the global markets.” The theory may prove effective at the negotiating table on budget cuts. The tactic is a page out of the famous Nixon approach of toggling between “brilliant Nixon” and “crazy Nixon” in peace talks. The problem with the House extremists at this point is that the brilliant tag gets an N/A in this small crew. There is, however, plenty of crazy to go around.

The McCarthy-Biden debt ceiling talks should be interesting when there is a bill proposed to destroy the revenue line on a theory that a 30% sales tax can be revenue neutral and can be effectively managed by the states. There are problems galore with the idea. One is imagining an infrastructure that does not exist (administrative logistics) at the state level. Then there is even whether a regressive tax carried by the high consumption states to drive the Federal revenue line are in fact subsidizing the “net taker” states. Some states now pay in much more to the government than they receive (such as NY). Maybe they can add in a fair provision that says “no state can receive more tax dollars that they pay in.” Now that would be fair.

Digging Deeper into the Fair Tax Act:

We start the discussions of the Fair Tax Act in the debt ceiling note above since the brinkmanship on the debt ceiling gets into what the more extreme elements seek to achieve in debt ceiling talks. The new routinely quoted phrase is they want to “blow it all up.” The only way to do that is to threaten default and then be willing to carry it out. The Fair Tax bill sends some signals on the weapons the Freedom Caucus types want to wield. Some of us do not pay attention to the Squad any more than the “Gazpacho” police looking for “Marshall Law.” The reality is that the Fair Tax Act is a reminder that such voting blocs need to be taken very seriously.

Surprisingly, the Fair Tax Act has not received much media attention though it’s been lurking around since the beginning of the year. That said, most have probably heard that the House introduced a bill to overhaul the US tax system in radical fashion.

So, I did a little digging. The bill is sponsored by Earl “Buddy” Carter of Georgia. The plan calls for the repeal of the income tax, the repeal of payroll taxes, and the repeal of the estate and gift taxes. Besides the basic principle that one should never support legislation sponsored by a guy named “Buddy,” the idea of “shaking the etch-a-sketch” on almost all traditional sources of government revenue had better be based on more than a theory that has been kicking around for decades. It’s never gone anywhere for many reasons.

The basics of the bill propose elimination of the following:

Federal income taxes: The IRS and income taxes will be eliminated. The legislation as first drafted calls for the repeal of the Sixteenth Amendment of the Constitution (passed in 1909 by Congress, ratified in 1913). The first income tax was established during the Civil War (that is no small irony) but a later income tax in the 1890s was struck down by a 5-4 vote of the Supreme Court. The bill calls for a sunset on the sales tax they propose if the Sixteenth Amendment is not repealed in 7 years. I am not clear if that means no revenue at all in such a case. Of course, the country would then be required to rebuild the infrastructure for income taxes that would have been eliminated.

Capital gains tax: The capital gains tax would be eliminated. This is one of several sugary individual tax sweets that get wrapped around the macro arsenic inside. To be honest, elimination of the capital gains would taste pretty good for those of us who save or invest. Sweet. They want to get you hooked on that promise (I start to hear Curtis Mayfield’s Freddie’s Dead playing in my head). Then again, the fact that there is a risk of a deep PCE recession on a 30% sales tax could mean there will be a lot of stocks that would not be showing capital gains for a while. Cap gains being eliminated was cited by Trump as well while Biden wanted it to be ordinary income (he was talked out of it since it would lose him a lot of support).

Repeal payroll taxes: This is where the political toxicity will be highest. The Democrats will say this is the Trojan Horse being used to gut Medicare and Social Security. The move will also be a way to throw the unemployed under the bus and free up cheap labor as individuals accept whatever job they can get. It is a warm and fuzzy underlying current. The counter is all that sales tax will cover the legacy retiree obligations. If the sales tax theory does not work, what does the government say? (“My bad”?). Trump has made clear his view that you don’t mess with Social Security and Medicare and he repeated that again of late. The hard cores are trying to think for themselves, but they may lack the skill set.

Repeal death taxes and all estate and gift taxes: The death tax has always been a hot topic since the goals of the Democrats often ignore the realities of private small business owners whether they own 5% or 100% of a private enterprise. If an owner dies, the family gets a cash tax bill. I heard officials such as Janet Yellen mouth the spin of “we protect family businesses and farms” during Build Back Better debates, but they use farms to deflect and to shift topic off the liquidity crisis that can cause for a family when an illiquid asset is taxed. The Fair Tax Act addresses that damaging aspect of the death tax as another recruiting tool for more support for their crazier elements of the bill. If they cherry picked some of those sane elements in a separate bill, the extremist groups could recruit a lot more support. They instead go after Social Security and Medicare through the payroll tax and lose their potential audience. Their marketing and spin on sales tax covering those falls flat. It is a pitch only their mothers (or an idiot) would believe.

The sales tax of 23% on gross purchases: The sales tax is described as a 23% tax on the gross payment for property or services as defined. In some math classes, that is a 30% tax on the price of those goods and services. Under the 23% methodology they use, a 100% sales tax would be a 50% tax, so fun with numbers is also alive and well. As a side note, those who face federal, state, and city taxes that total in excess of 50% are familiar with that 50% number (a common CA and NY malady which deserves no sympathy for the well-compensated). The high tax states might even find some support for this bill just on personal greed.

The idea overall is that a national sales tax can handle the spending load that is currently “covered” (not entirely) by the income tax even with the total absence of the infrastructure to handle it. That is known as “frictionless wheel planning” on a white board. The assumption is that everything goes as planned and that the infrastructure and admin mechanisms can be magically developed overnight with qualified personnel and all necessary space, tech, training needs in the blink of an eye. The parties related to this action are if anything noisy, but they don’t elaborate below the first layer. That may be because they are completely unqualified to make that assessment, but that has never been an obstacle to committee appointments in Washington (on either side).

A 30% sales tax in theory will not undermine demand (as they assume) or be inflationary to the consumer. That is the cornerstone of this idea. The government revenue line is now girded by income taxes and not consumption levels per se. So, the revenue line being dependent on consumption sounds like it has some assumptions that Herbert Hoover faced in 1929. People do consume more when they are confident. The transition to such a sales tax model could make the US revenue line dependent on the consumer via his behavior. A recession with people on the payroll being taxed is different than high unemployment, fear, and lower consumption. The idea of a functional elasticity of demand reducing sales tax revenue also does not seem to be in the discussion. The theory is “after all he has more money after tax in his paycheck.” That is a theory the revenue line of the US will depend on.

The problem with the bill can be detailed ad nauseum since it clearly has much to clarify on how such a bill could even be administered. We think back to the Border Adjustment Tax bill of 2017 with its 20% tax at the border to allow for deep tax cuts in the US. That was heavily pushed by the House Leadership (Paul Ryan, Kevin Brady) before being crushed and unceremoniously tossed by the Senate GOP. The border tax was seen as inflationary and the equivalent of a tariff war. The relatively lame assumption was that the dollar would be so strong that imports would actually be cheaper was also rejected by critics (for good reason). The all-star team academic that the GOP had recruited was an advocate and wrote a paper (I read it) that was rife with caveats on many issues and notably on currency effects. Numerous retailers said the bill guaranteed Chapter 11. The sales tax theories here have some of the same “fat tails from tall tales” aspect to it.

Bottom line is that is has no chance but will bring fresh rounds of accusations anyway…

The charm of the proposal is that numerous areas of focus resonate with a lot of different people who have major gripes with the IRS and the Democrats’ tendency to want to always tax you more, eliminate capital gains tax to make it ordinary income, and then tax those with material wealth at their death even if the tax comes in a cash liability and the “wealth” is in highly illiquid (possibly totally illiquid) private stock in a small business. The other “wealth tax” of the mega-rich is a separate topic and more popular, but even that exposes the Democrats to the “socialist” counterattacks.

The macro risks in the Fair Tax Act are not going to be the main event for the Democrats since they often ignore those as well. They will focus on the highly regressive nature of the tax and tout the idea that it is a giveaway to the rich. They will also (and should) sound every alarm they can on the backdoor attack on Social Security and Medicare.

The elevator music from the left and right seldom changes, but the Fair Tax Act is acid rock cranked up to max. It is over the top and ill conceived in terms of application. They say “don’t trust the government” but then ask you to trust the government to overhaul what will then be dependent on the government to implement effectively. Good luck collecting sales taxes in states with a high per capita concentration of AR-15s.

Spending this time reviewing the Fair Tax Act may seem like is a waste since the bill has a chance of becoming law that rounds up to zero. However, the bill takes on more significance when the US just crossed the debt ceiling threshold. It flags the intent to radically shake up Washington in a way that would leave scars. A default would do that. The bill’s co-sponsor list is not exactly the College Bowl Economics All-Star Team, so businesses will give a lot of feedback quickly I assume. The list of sponsors on the legislation has more than a little overlap with the folks who held up McCarthy’s speaker election and a few of them show up on the “asked for a pardon” list as well. Quality people to trust.

_____________________________

Housing Sector:

This week saw a flurry of releases in housing with Housing starts up first (see Market Menagerie: Home Starts, Permits, Construction Dec 2022 1-19-23) and then Existing Home Sales (see Existing Home Sales: Inventory Radar or Sonar? 1-21-23). This coming week we see new home sales. The bigger picture in housing is major declines YoY but there is a mixed picture on where it can go from here. Mortgages are down over a point in a market where employment is high and job openings are also at levels well above historical levels. The existing home sales inventory gave us an excuse to refocus on the supply-demand effects of how lower inventory (existing homes), declining rolling new inventory, and some tapping of the brakes in multifamily will start to get investors looking ahead to pricing stabilization and even a rise.

Industry production and capacity utilization:

A broader fade on the manufacturing side was covered in one of our commentaries during the week (see Capacity Utilization: The Fade Begins 1-18-23). With retail sales sliding and capacity utilization weaker across a broad range of industry subsectors, the Fed is supposed to start thinking some pricing power is getting run out the system. On a side note, with goods inflation fading, the timing might not be great to pitch a 30% sales tax from the House. That would be seen as inflationary over the short term and would make working capital risk higher for businesses and service providers.

______________________________

MICRO

We look back at a few notable events in the week as earnings blitzes out. There has been so much to read in the financial sector that it is hard to keep up with the trends. There were some notable winners and losers this past week (Morgan Stanley won, Goldman Sachs lost). As we laid out last week (see Footnotes and Flashbacks: Week Ending Jan 13, 2023), our core conviction on hard landings is that it takes a weak banking system, severe credit contraction and major asset quality stress or some sort of external shock to get us there. That is especially the case if we use the past cyclical downturns as the metaphorical “curve” to grade against. The inflation threat has been real but not in a league with the Volcker stagflation years.

We saw the health of the bank system supported in the numbers of the first wave of earnings from 4 of the Big 6 last week with JPM, BAC, Citi, and Wells weighing in first. This week saw Goldman and Morgan Stanley go in very different directions on earnings day. Then the range of big and small regionals were weighing in with some benchmark consumer finance operations such as Ally (which we look at below).

There is plenty to watch around the potential squeeze in net interest margins and cyclical erosion in consumer and corporate credit quality, but that is not on the level of oil patch stress or a severe setback in commercial real estate seen in the past. We covered some of the longer tailed risks that can change this constructive view in Risk Trends: The Neurotic’s Checklist 12-11-22. The handicapping of event risk and systemic shocks is never easy and often you don’t see it coming in pace and/or magnitude (e.g., COVID, the oil meltdown in late 2014 on Saudi actions, the sheer scale of undisclosed counterparty risk in 2008).

Goldman Sachs vs. Morgan Stanley: The headlines are always bigger when Mighty Casey strikes out (No Joy in Mudville, etc.,) but the good news for the market in the bad news at Goldman was that the losses were not reflective of a broad market turmoil issue or asset quality problem that could easily be mapped to others among the financial leaders. Loans and credit card quality problems at Goldman had many peers in the generic space across bank names that did not see those kinds of numbers. It was a company-specific business line failure and major execution problem.

While the generic bucket of “consumer lending” can be mapped onto others, there were some special mistakes unfolding at Goldman. The financial reporting details the outsized reserve on both loan growth and asset quality weakness. The fact that the week ended with the news that the Federal Reserve is looking into their oversight of the business did not help. The earnings reporting day saw one stock plunge and one spiked for a 12.3 point return gap on reporting day. Goldman as slammed on the financial cable shows for its high noncomp expense ratio and massive losses in its headline growth initiative. Goldman’s full year provisions for credit losses of $1.7 bn in the Platform Solutions segment ran off the charts and generated a $2 bn pretax loss in that segment. The Goldman team will be getting grilled at its Investor Day on Feb 28, 2023.

When I came to NYC in 1980 and started working in finance in the bull market 1980s, Goldman and Morgan Stanley were the kings of the bulge. First Boston took a shot at it during the 1980s but lost its chance during the hung bridge years and the need to get bailed out by the Swiss. Lehman was out of contention after the banker vs. trader wars of the 1980s and the merger into Shearson under American Express (later the shell of EF Hutton jointed the party). Morgan Stanley struggled during the Dean Witter wars. Goldman and Merrill were the leaders with Goldman getting the edge on investment banking prowess.

The 1994 period had some rough headlines for Goldman in the bond turmoil of that year, but the last of the great ancestral partnerships went public in the spring of 1999. Goldman has held the top dog role since, but this latest setback hands the badge to Morgan Stanley until Goldman cleans up Dodge.

Merrill was rolled into BAC over Lehman’s crisis weekend. Lehman was dead and Bear already a distant memory of March 2008. That left Morgan Stanley vs. Goldman among the legacy major brokers who had to switch to Bank Holding Company status with the 2008 crisis.

We see the solid performance in MS equity above vs. the peer group. Goldman is no slouch either and will get back on track. Morgan Stanley had overhauled its business models after the crisis and has become a major success story in Wealth Management and Asset Management. With a lower exposure to balance sheet intensive loan operations and consistently high fee generation, MS has been a relative winner across a tough year for financial services. Goldman still runs a distinctive business mix relative to Morgan Stanley even without the platform solutions fiasco. We expect most will see the Goldman mess as an anomaly, heads will roll, and Goldman will get to fighting it out for top dog again.

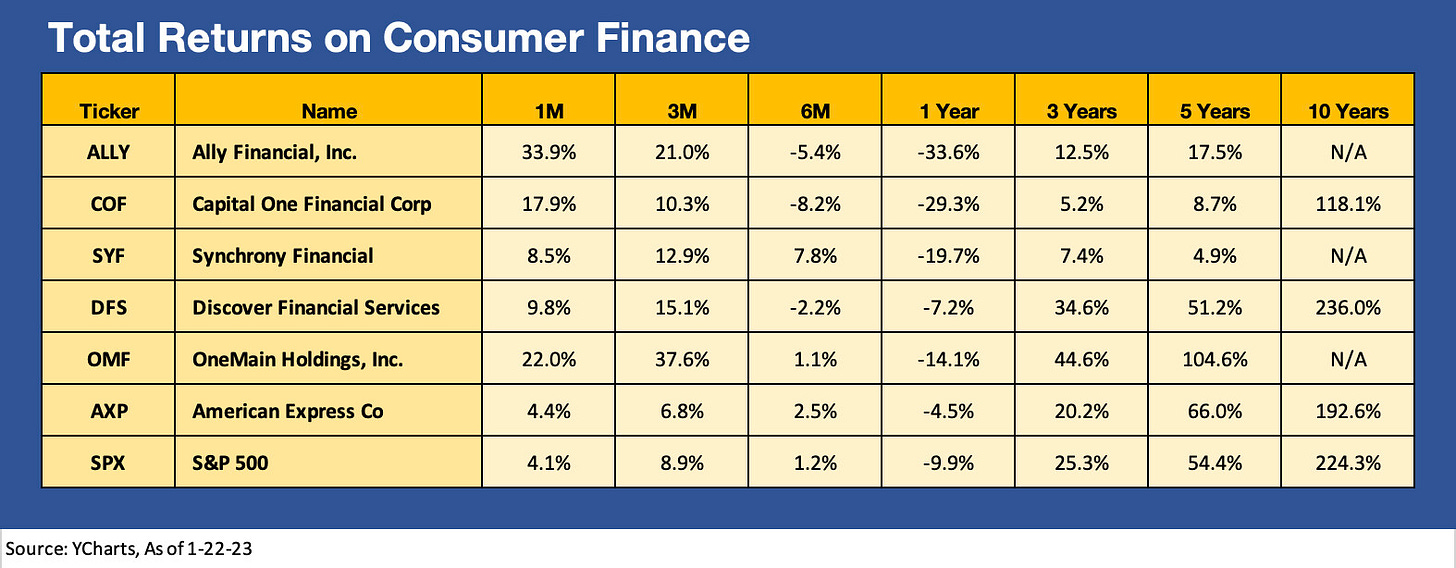

Ally Financial surprises to the upside: Ally surprised the market with solid numbers and guidance and was rewarded with a +20% stock move on Friday. The street flavor was pretty guarded on the name, and the results caught some on the wrong side of being bearish – at least for the short term. The idea that consumer credit quality will deteriorate, and net interest margins will get squeezed on funding costs is a common problem in the financial space. Declining used car prices also raise risks of loss exposure on repossession. The stock return table below shows Ally part of a consumer finance peer group with a broad range of results but Ally getting some favorable traction in more recent periods even as the used car market is faltering. That comes after Ally was one of the worst LTM performers.

Consumer finance is on everyone’s radar screen as the cyclical debates go back and forth and handicapping the health of the consumer sector continues. With savings rates low and consumption high and credit cards in heavy use, the asset quality cycle will remain under a microscope. With rates rising and recession chatter loud, the 50-year lows in unemployment will have to move a lot higher from here to really rattle consumer finance to a rate that would be in line with a steep downturn.

In the meantime, asset yields on their books are high as Ally generated record net interest margin. Net charge-offs for retail were relatively low for the full year but are trending higher later in the year and credit quality “normalizes” (as in gets worse). The expectation is that the 2020-2021 vintage retail assets will drive higher losses in 2023. Provisioning will be important to watch in a higher rate environment with uncertain recession risks in looming. While the waters for auto retail are not untested in a stagflation environment for auto receivables, such a macro backdrop has not been tested for a long time. The guidance for 2024 was very measured and constructive with Retail net charge-offs only forecasted in the high 1% range and total charge-offs in the low 1% range.

Alcoa feeling the pain vs. the big boys: Alcoa is not the same Dow Jones Industrial of old (dropped from Dow in 2013) since the 2016 spin-off from the legacy entity that is now Arconic. As we detail below, AA is now a very small operation among some globally diversified giants. The smallest market cap on the list other than Alcoa is still a substantial multiple of AA. As an aluminum operator on the commodity end of the spectrum, AA is inherently volatile and subject to the swings in the global market.

The 4Q22 numbers for Alcoa were weak again with another quarterly loss after a loss in 3Q22 and now 4Q22. Free cash flow generation is solid despite the strained profitability metrics. The commodity swing factor for metals is usually China, and that is no different here. China also is a key factor in showing restraint in supply given its structural excess capacity. The longer term demand story for aluminum keeps many aluminum watchers optimistic, and Alcoa sited secular growth in transportation and packaging. Demand from EV and hybrid vehicles remain favorable growth opportunities.

The company has generally been a mixed performer vs. major global metals and mining companies looking back the various time horizons above. The challenge to aluminum producers in a high cost energy market includes the electricity intensity involved in the smelting process. As we routinely see in the CPI numbers, electricity costs are soaring. Europe has seen the most stressful challenge in unit cost pressures. Alcoa cited in general that some of the highest raw materials cost ever in 2H22.

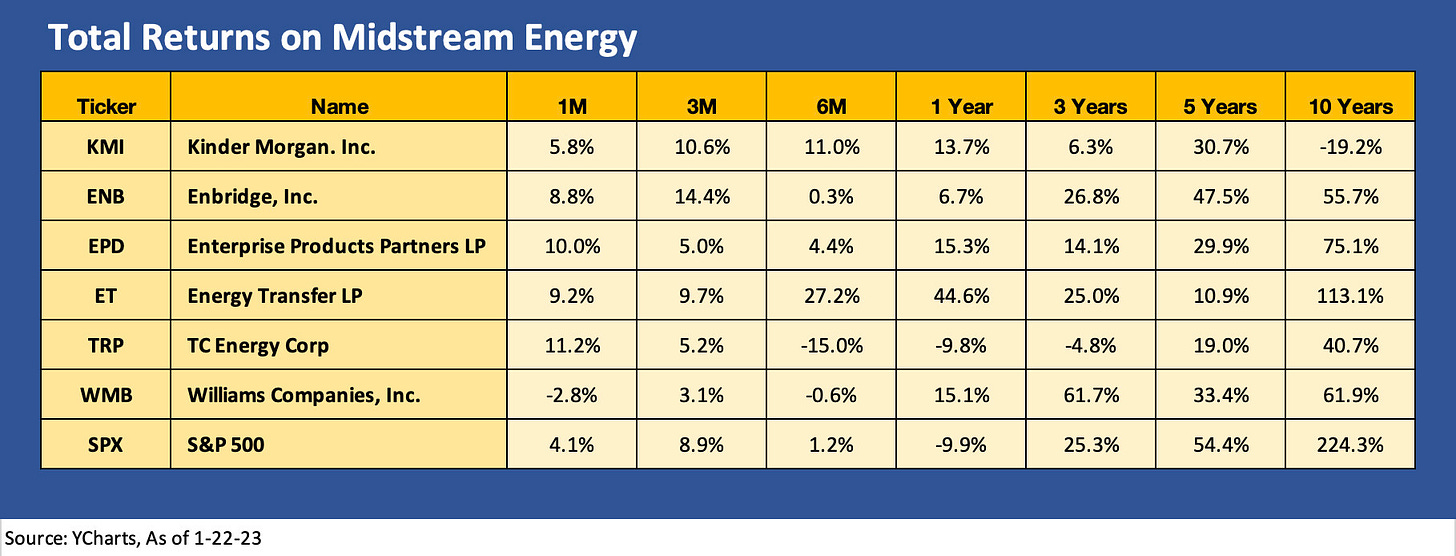

Kinder Morgan and the midstream free cash flow machine: Kinder Morgan (KMI) turned in strong numbers in 4Q22 and continues to generate substantial free cash flow for expansion and new investment initiatives. The company exceeded its planned DCF and EBITDA targets. KMI is cash flow rich, asset deep, and not overleveraged for its asset protection and cash flow fundamentals even if it ticks above peers. The peer group held up very well in a rough market and materially outperformed broader market benchmarks.

The Midstream sector overall has been a safe place to be in equities since it brings the merit of good fundamentals, high dividend yields, and healthy free cash flow. Most of that major midstream universe sees capex well down from the peaks with cash flow deployed by the MLPs and C-Corps in the space to a mix of shareholder enhancement, expansion programs, or acquisitions large or small. We also have seen some of the upstream players that have split these assets off buying back in some or all of the equity stakes in some operations. The heyday of capex binging and breakneck expansion is behind the sector in general and that makes for great free cash flow stories. The LNG buildouts still have a role to play in applying multiple add-ons to valuations for some, but the industry has matured with regulations making that an unavoidable reality on challenges to numerous major projects.

The above chart breaks out a group of major midstream players with KMI doing well against the broad S&P benchmark but a more mixed performance vs. direct peers. The longer-term comparison is unfavorable. Looking back past a year, we see ET and WMB as winners. Enterprise (EPD) offers a very distinctive asset base and notably in the NGL space. EPD has been a very consistent performer with a better set of financial metrics than most.