Sept 2023 JOLTS: The World is Flat for Now

A steady set of JOLTS numbers with flat Job Openings signaling strength.

We see flat Job Openings in September, which was a month that already posted very strong payroll growth earlier this month.

No signs of weakness in the Sept openings, but we get the real deal for October on Friday after the ADP news this morning that showed solid wage growth.

You can see these JOLTS numbers as a nonevent, but the absence of weakness is “an event” these days.

The JOLTS data does not carry as much clout as it did during the peak of the inflation anxiety and tightening worries, but this month like last month underscores the steady employment strength (see JOLTs: Staying Alive 10-3-23). With a 1-month lag on JOLTS, we already got the specifics of a very strong September jobs picture (see Jobs ‘R’ Us: The Perils of Plenty by Occupation 10-6-23). With Powell teed up for the FOMC news later today, he will not have much new to point at to reassure on tight labor markets.

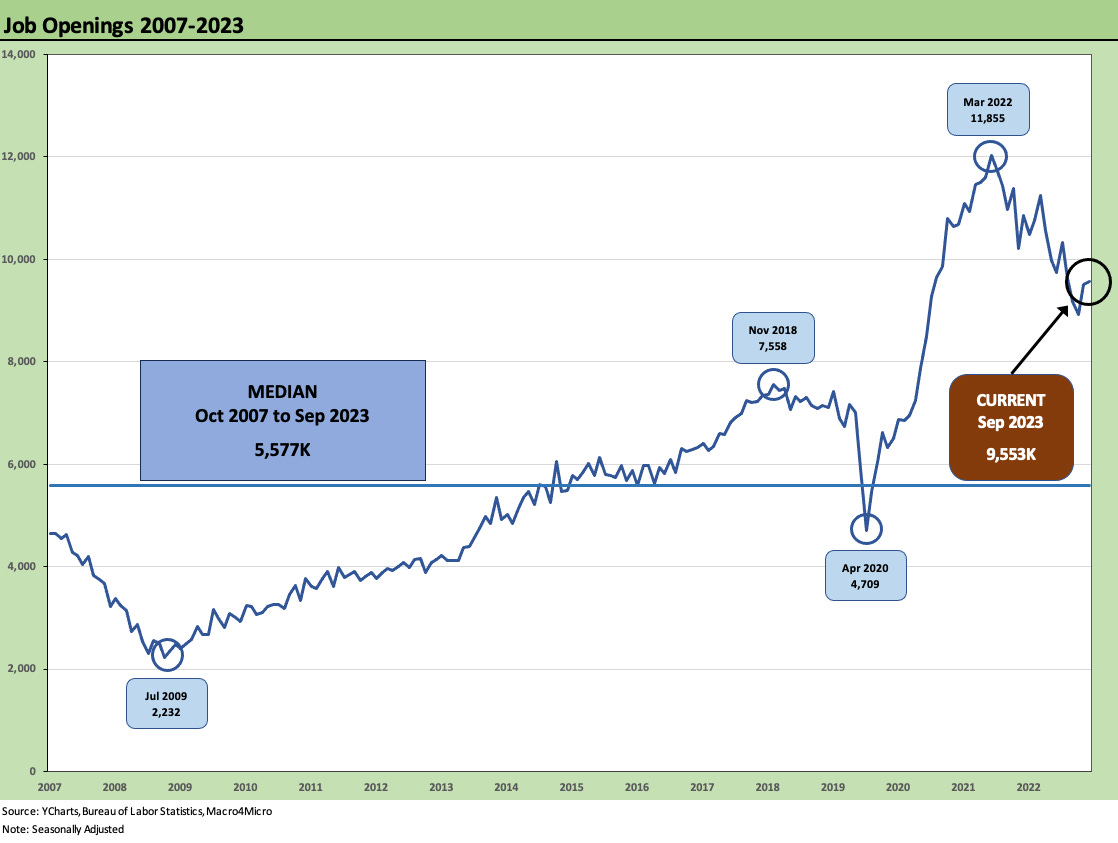

The numbers show the Job Openings slightly higher from 9.50 million to 9.55 million on a SAAR basis. Private rose by 137K and Government declined by -81K. The South rose the most by 126K with the Northeast by 26K while the West and Midwest declined. Job Openings remain well above the post-2007 median of 5.6 million. The Sept numbers are down from the 11.9 million peak of March 2022 which were double the long-term median.

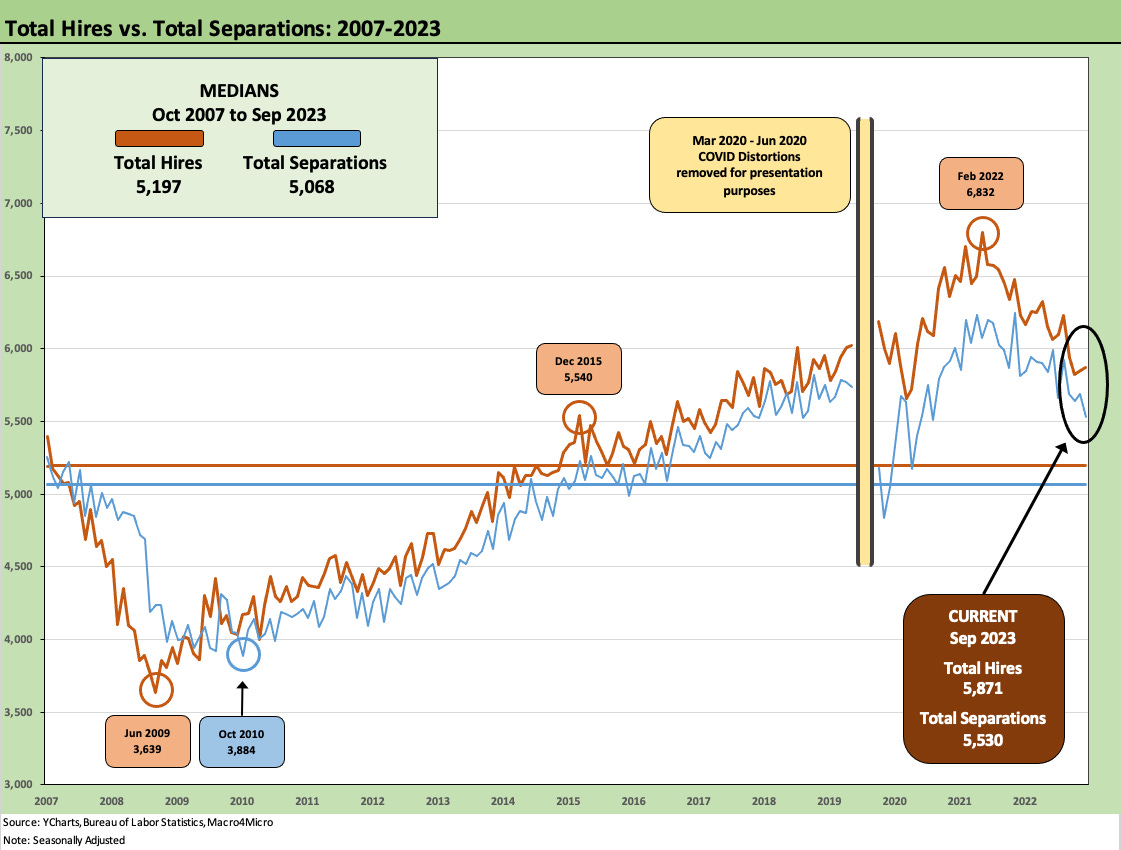

The above chart updates the Hires vs. Separations tally with the Hires still in the lead. Hires were up by 21K while Separations were down sequentially by -157K.

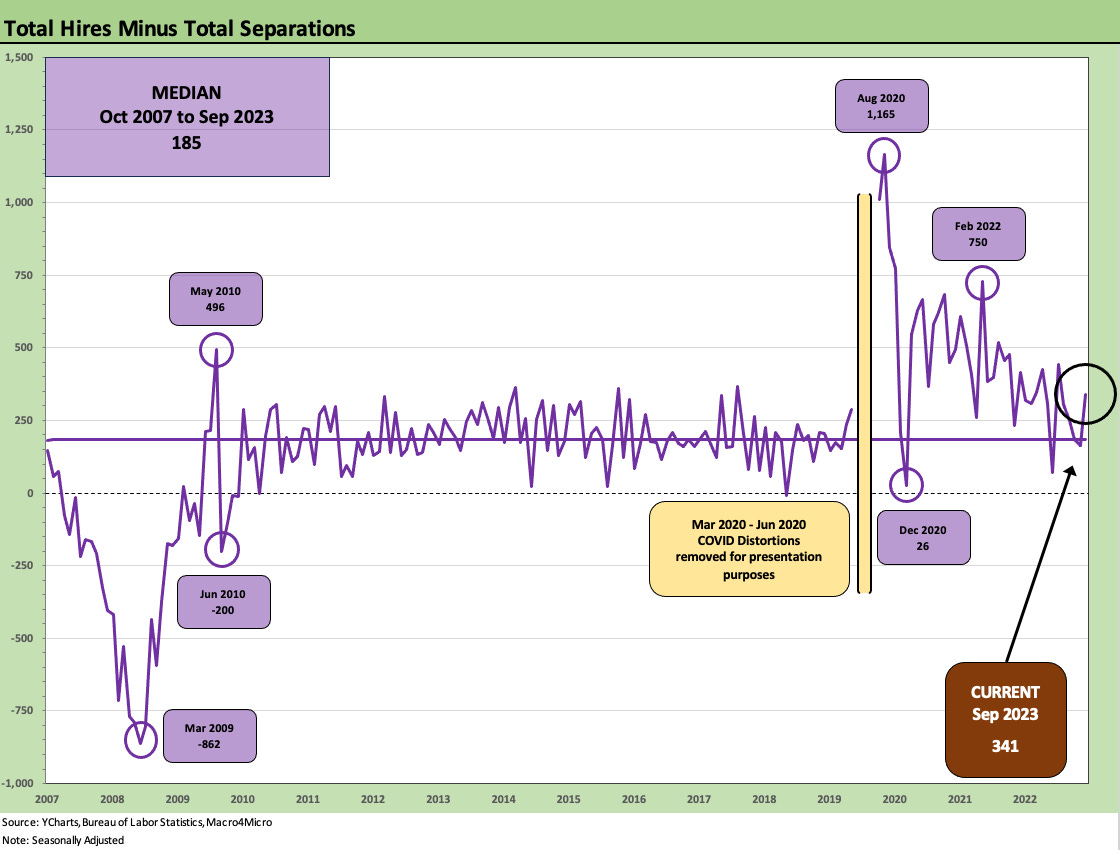

The above chart updates the Hires vs. Separations differential and that stands at 341K, which is above the long-term median of 185K as noted in the chart. These numbers do not send bearish economic signals.

We reviewed the layoffs and discharges trend lines, and those were down sequentially by -165K to 1.52 million from 1.68 million. The biggest decline was in Professional and Business Services with Construction and Manufacturing both lower sequentially as well. Government was down also by -32K.

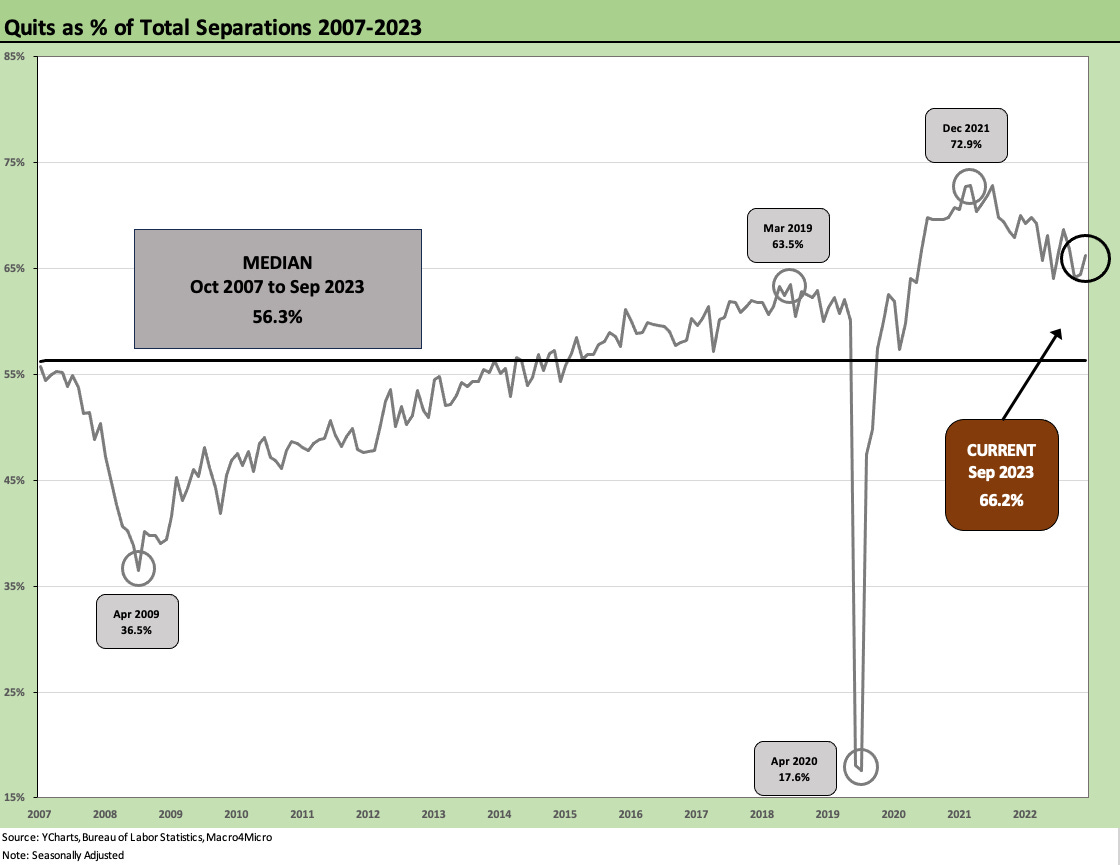

The Quits share of Separation of 66.2% is still comfortably above median even if down from the record highs of 72.9% in Dec 2021. Quits outright (Not Seasonally Adjusted) were down to 3.86 million in Sept from 4.54 million in Aug. The “Quits rate” (using NSA quits for the month vs. total employment) for the month was 2.5%, down from 2.9% in August and 2.8% a year ago.

The theory on the Quits rate is that is that it serves as a signal of relative confidence in finding a job. It is easy enough to punch holes in that theory, but if we use that as an assumption the Quits rate shows lower confidence. Or maybe less people hating their job. Or less people hating their boss. At this point…we don’t know.

The overall flavor this month on JOLTS is a steady course for the consumer and a tight labor market. That is status quo to this point. Stay tuned for Friday’s payroll numbers.