Retail Sales Nov 2025: Holiday Cheer, Late-Cycle Feel?

November retail sales show decent growth across headline and core as consumers look to finish out the holiday season on a positive note.

Retail sales release continues to play post-shutdown catchup with the latest release covering November during the onset of holiday season activities.

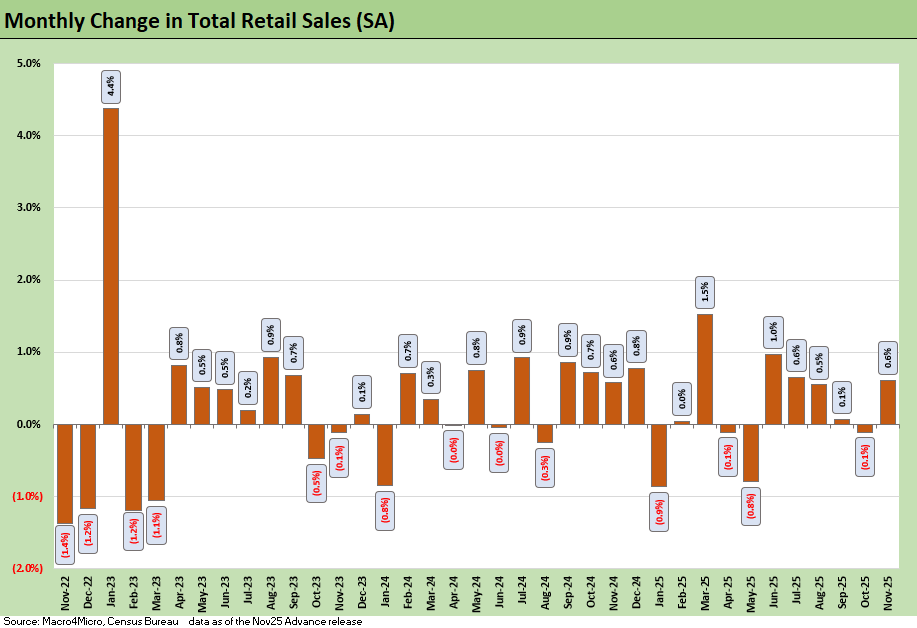

Retail sales rose 0.6% MoM in November with core retail sales growth slightly lower at 0.4% MoM, a firmer holiday season read than earlier in the fall. With this print, headline retail sales is running up 3.3% on a YoY basis but the real gains are modest with inflation still remaining stubborn near 2.7%.

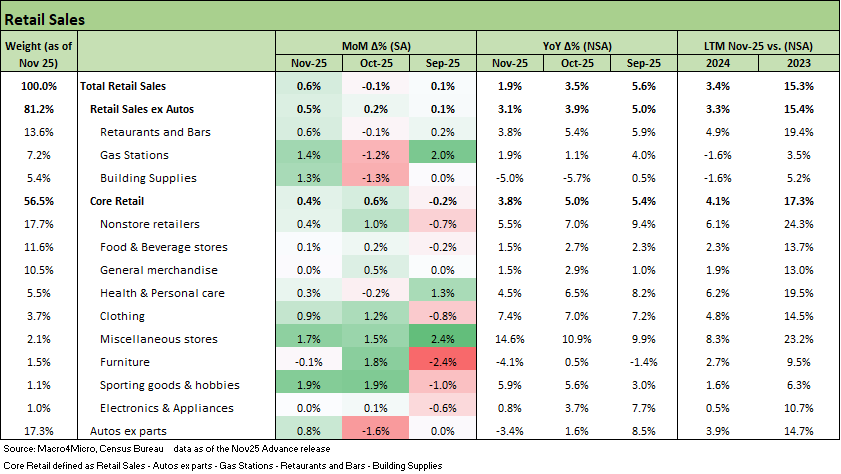

The underlying details show notable monthly gains in restaurants and bars (+0.6%), clothing (+0.9%), sporting goods & hobbies (+1.9%), miscellaneous stores (+1.7%), and another bump to nonstore retailers (+0.4%). These provide support to where holiday spending played out across discretionary categories. Staples like food & beverage (+0.1%) and general merchandise (+0.0%) were quiet on the month.

Early bank earnings reiterate that the consumer remains healthy from a credit perspective with little movement in delinquencies as 2025 closes. On the other hand, the K-shaped economy continues to show higher income earners are driving the majority of growth and outpacing lower income cohorts by a large margin. Across lower income brackets, this shows up as continued strong preference for promotional items and smaller ticket sizes with staple items becoming more price sensitive.

Looking ahead into 2026, the latest CPI is still well above the target inflation rate, and a weakening labor market still leave questions around where cracks may form. This morning’s PPI print does not help the inflation story, as it remains stubborn and reignites concerns around when the wholesale inflation will pass through to consumers.

High income cohorts are likely to continue to drive spending growth, but the growth in instalment tools and heavy dependence on promotional activity points to where weakness is emerging among lower income individuals.

The monthly changes to headline retail sales above show a moderate November bounce as holiday spending got off to a solid start. Total retail sales rose 0.6% MoM in November which is more consistent with the 3½–4% holiday growth that trade groups and card networks are seeing. We still see the 2025 retail sales activity as modest in real terms given still elevated inflation and current dollar reporting, but at least this is the kind of seasonal lift is something we had not really seen earlier in the quarter.

Outside the core mix, building supplies (+1.3%), autos ex-parts (+0.8%), and gas stations (+1.4%) all bounced back from weak October prints to bolster the headline reading. Overall, the headline is being helped by a mix of discretionary categories and gas rather than a broad-based surge. That matters as we look ahead to which trends will remain durable in 2026 once promotions and holiday effects roll off.

The consumer is once again showing up as resilient to end 2025 with credit metrics and spending remaining healthy. However, 2026 starts off across a worsening landscape with still elevated inflation intersecting with a weaker labor market. Tariff mitigation strategies are still lurking and need to play out. With health insurance premium hikes underway and tariff effects continuing to trickle in, the consumer faces a fresh set of challenges.

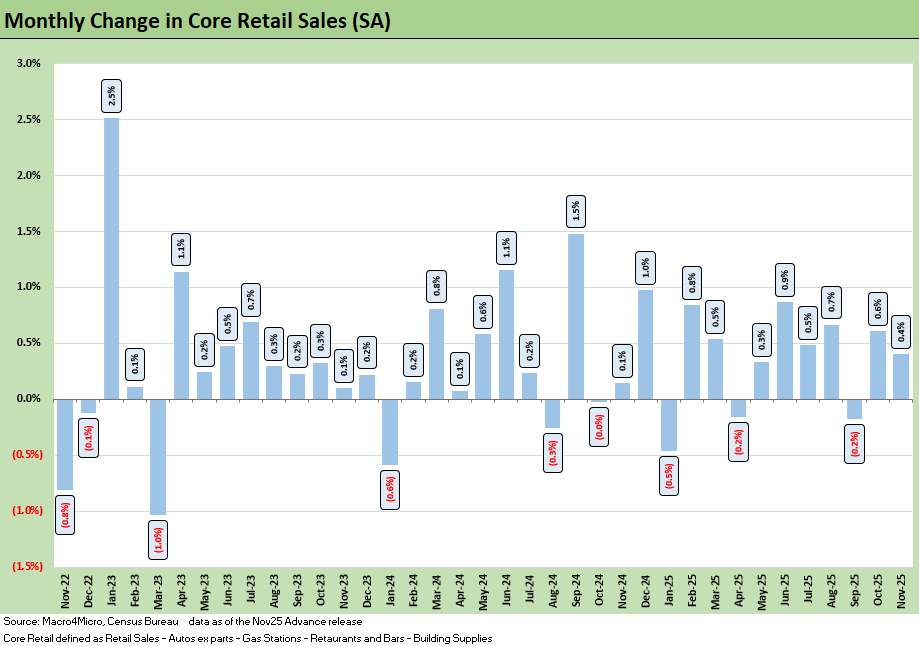

The monthly core retail changes are shown above, stripping out some of the noisier categories and this is where we see a still resilient consumer given the persistent affordability challenges faced over the past few years. Core retail sales at +0.4% this month adds another positive month to a fairly volatile 2025 and is on the weaker side of growth we have seen this year. Underlying this print, we see weaker

nondiscretionary spending categories this month and a continued weakness across larger purchases and durables. This points to continued growth next year that looks increasingly dependent on continued improvement in discretionary spending across more affluent groups.

The above breaks out the underlying categories alongside the ex-autos and core retail changes. We see a solid month for both restaurants and bars at +0.6% and a strong comeback for Gas Stations even as prices at the pump fell across the month implying some volume gains. As mentioned above, building supplies and autos ex parts similarly had good months as they bounced back from weak activity in October and September.

Moving to the underlying categories for Core, this print shows up with more nuance that frames where we may see some consumer spending trends shaping out. Though smaller categories, the October and November activity across clothing, sporting goods & hobbies, and miscellaneous stores is quite strong. This compares to marginal growth across that same time for staple goods categories that might give a better indication of what spending trends might persist into 2026. Staple goods leave less room for trade-offs and cuts are hard to make, leaving them insulated from stronger discretionary goods trends as seen above.

Another highlight in this report and across consumer spending trends is lower big-ticket spending. The activity above does show minimal activity in both furniture and electronics & appliances. Furniture saw a strong October (+1.8%), but that is framed against both -2.4% in September and down over 4% vs. last year. Lower propensity to spend on larger items may also point to where consumers are looking to save and aligns with the uptick in promotional and value-seeking behavior that is increasingly prevalent in consumer behavior.

Overall, the +0.4% in core is still a positive print and bodes well for the close of 2025 and that retail report. However, we remain cautious about the near-term outlook given the nuance of holiday vs. staple spending divergence and the continued shift toward value-seeking behavior. We see this as supportive of late-cycle positioning as consumers look to stretch strained balance sheets on the low end, but at least for now they are keeping holiday spending intact.

The coming year should see continued divergence around a K-shaped economy and growth will continue to be driven by high-income cohorts especially as the low end faces a worsening labor market. Health insurance premiums could be a material drag on lower tiers with a zero-sum effect on household budget share across retail line items.

See also:

CPI Dec 2025: Sideways Calms Nerves – For Now 1-13-26

Payrolls Dec 2025 and FY 2025: Into the Weeds 1-10-26

JOLTS Nov 2025: Job Openings and Hires Down, Layoffs Lower 1-7-26

2025 Spread Walks and Multicycle Return Histories 1-5-26

Annual Return Differentials: HY vs. IG Across the Cycles 1-3-26

Total Return Quilt Across Asset Classes 2008-2025 1-2-26

Cyclical Histories: Will Facts Be in Vogue in 2026? 1-2-26

3Q25 GDP: Morning After Variables to Ponder 12-27-25

Durable Goods Oct25: Core Capex Still in Gear 12-23-25

Market Lookback: Last Call for Unusual Behavior 12-22-25

Existing Home Sales Nov 2025 12-21-25

November CPI: Tricky Navigation 12-18-25