Retail Sales: The Consumer is Alive and Well

We look at the surprisingly strong Retail Sales spilling over to the UST curve.

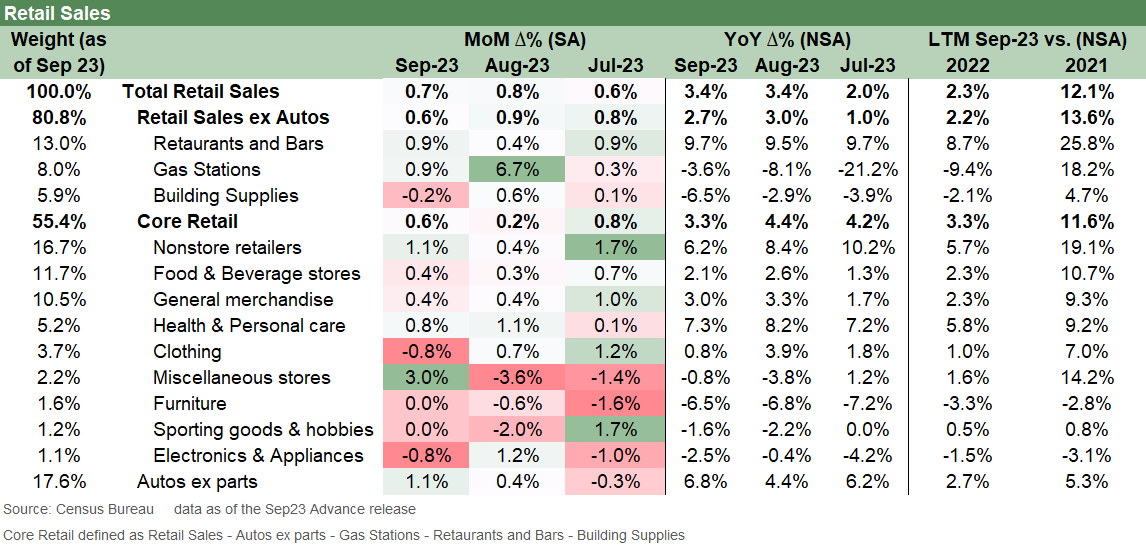

The Retail Sales numbers overall were strong and added to the upward pressure on UST yields as Industrial Production also joined in.

The Retail Sales ex-Autos held in well enough while Autos ex-parts was solid even in the face of weaker affordability.

The consumer keeps on recreating, dining, and drinking as the metaphorical hair of the dog has trumped a hangover from a steady consuming summer.

The sequential and YoY deltas make for a hard case to bet against the consumer just yet even if this is only one of numerous metrics to capture the trends across a fully employed household sector.

The Retail Sales number is not making life any easier for UST curve bulls and those calling for the consumer to crack. We see continued steadiness in numbers for September in Retail sales ex-Autos while Autos ex-parts also turned in very strong numbers as consumers keep on buying despite rising financing costs. Nonstore Retailers posted a favorable sequential variance with Restaurants and Bars literally chugging along.

At some point, the UAW strike issue could rear up and impact both Retail Sales on inventory shortages and flow into Industrial Production as well, but that has not happened in either case through the September numbers. The UAW has slow-rolled the strikes for maximum flexibility (and minimum strike fund drain) but also maximum social media visibility and airtime with “next action” drama maximized. The UAW strategy has been working, but it got uglier in recent actions in the move against Ford’s most profitable truck plant.

The Retail sales number was quickly followed by a decent trend in Industrial Production. Add in the theory (to be clear it’s a “theory”) around a better 24-hour news cycle in the Middle East, and the UST market is seeing upward pressure again on rates with the 10Y and 30Y up around recent highs. The 30Y is whispering to the 5.0% level as we go to print. The 10Y has climbed double digits bps again this morning already.

The theory in the slow move of flight-to-quality effects is hard to explain, but the second aircraft carrier strike force and Biden planning to travel to Israel and other Middle East destinations may have convinced Iran not to doubt US commitment. Iran does not want to give the US good reason to improve the economics of incremental E&P activity in the US with a less-than-friendly assured reduction in Iranian oil supply. Iran taking the wrong steps would change upstream planning and be very Keystone friendly. That would change the capital market dynamics in dramatic fashion as well.