Political Economy: 45-Day Policy Death March or Snatched from the Jaws?

For now, disaster averted on the shutdown…6+ weeks to go.

The avoidance of an immediate shutdown takes one more item off the table and one less immediate catalyst for a more rapid backpedal on the consumer outlook. The countdown begins.

With the shutdown miss, we can start a new round of debates on whether the duration extension time is now, and what cyclical signals to look out for with this week teeing up construction, JOLTs, factory orders, and the payroll data among others.

While it did not get much press in all the chaos, McCarthy essentially reneged on his budget deal with the White House struck during the debt ceiling. That means deal risk remains high for 45 days.

The continuing resolution that was painfully guided through the House, waved in overwhelmingly by the Senate and signed by Biden in turn buys the market more time for those trying to frame what the fundamental impact might be and how the UST and equity markets might handicap what lies ahead. We look at the past week’s yield curve and asset return separately in our weekend Footnotes publication.

In terms of sector relief, direct fundamental impacts include such areas as aviation (the FAA funding) or in regional economies during hurricane season and in wildfire aftermaths (National Flood Insurance, FEMA, etc.). Disaster relief is always a seasonal fear in coastal regions, but FEMA is up to its eyeballs after wildfires (Maui at the top of list) and flooding (including places like Vermont). Then there is the amorphous, subjective variables of risk-reward sentiment broadly.

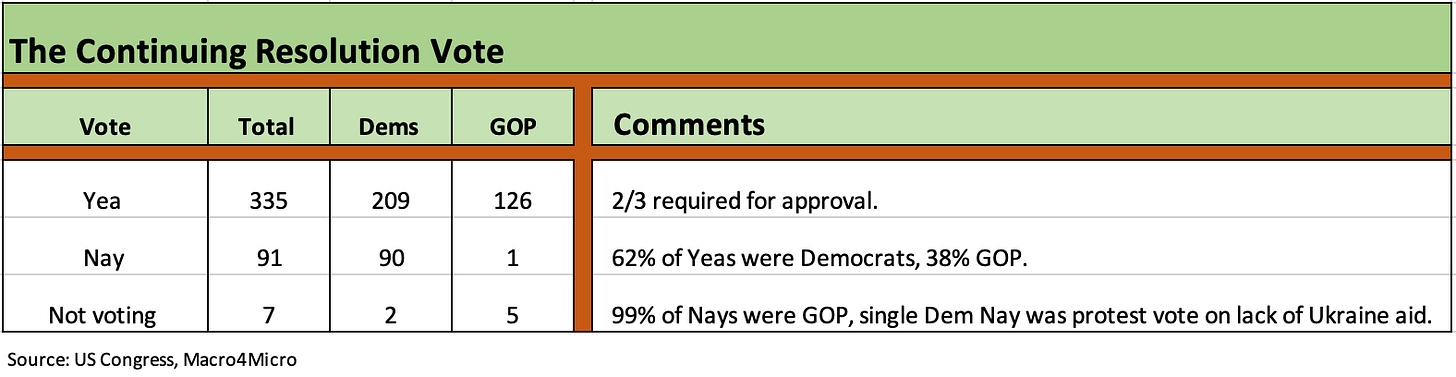

The above chart details the votes. Those are the facts, but the spin and nonsense on the weekend shows avoids the reality of what transpired. In order to get around the worst of the GOP extremists, the bill was offered up for a vote under “suspension” in a Parliamentary maneuver that requires 2/3 vote of the House. That sleight of hand allowed McCarthy to bring it to the floor for a full vote that was passed on the back of Democratic votes and also allowed the sane GOP members to weigh in.

Moody’s in the background…

The potential for the Gaetz of Hell to throw open the door next week for a change of leadership seems to be higher as we go to print after his latest tweet on Sunday. In contrast to the Senate GOP, the House GOP is not overly housebroken. Recall that a significant majority of the House GOP (147) voted against recognizing the 2020 election results. That is not a partisan statement. It is a fact. So when Moody’s joins in the discussion about governance and the US losing its Aaa rating, they have a case (see US Downgrade: Pin the Tail on the Sovereign Ratings Criteria 8-2-23, US Debt % GDP: Raiders of the Lost Treasury 5-29-23).

The good news is that the UST remains the deepest and most liquid market in the world. That will keep the UST as the “market’s AAA/Aaa” despite the high idiot ratio on both sides of the aisle. The idiots on the dark side of the extreme right are the catalysts for questioning the Aaa for now. As we note in the prior links, the fiscal side of recklessness is a bipartisan effort. The fringe of the hard right just seems to be uniquely deranged in threatening defaults and persistently trying to shut down the government.

Shutdowns vs. defaults…

The stakes in the default deal to end May were dramatically higher than in a shutdown (no comparison), but the recent events show the next 45 days will be no easy ride. The defense budget and Ukraine question marks will be high among the more notable sea level considerations for market watchers.

Obviously, there are a lot of items on the list that can shape the critical consumer sector, but defense spending in a very dangerous time will get dark and stormy since the budgetary needs are so high. The infrastructure and climate initiatives that are driving so much private sector spending will also be a drilldown topic.

Meanwhile, military families will get their paychecks. Military families have had enough trouble with a self-absorbed, egomaniacal former football coach (Tuberville) undermining the ability of families to plan their school years for their children (if he can do that with only one NCAA title, then let’s make Nick Saban dictator with his 7 titles. That would be the same Saban that Trump repeatedly called “Lou Saban” on a conference call back in 2020. Lou Saban was the former Buffalo Bills coach. Nick Saban was already honored in the White House by Trump. Talk about Biden lapsing…).

In terms of deal risk, Trump went all caps with “SHUT IT DOWN” after a recommendation to “Do a default” in his CNN Town Hall Meeting a few months ago. As of now, Trump’s recent Congressional record on blowing up the legislative branch is tied with his popular vote (as in “0 for 2”). The lingering takeaway for the week should be that politicians don’t honor deals (can you imagine breaking a bond trade where you said, “we are done” ???). In the case of Trump, he is lobbying for a shutdown. That does not bring out the courage of the average House member.

The next leg of the 6+ weeks will be around what can change after the GOP reneged on its budget deal and whether Ukraine aid will get back into the picture. That has strong bipartisan support in the Senate and closet support in much of the House GOP ranks. Many of those center right GOP members favor the Ukraine aid but have not been making their case for a JFK Profiles in Courage Award (note: that is given occasionally for bipartisan actions that exposed the recipient to party animosity). To be fair, there are not a lot of candidates on either side of the aisle.

We thought this topic was worth a comment (despite the politics) since the lines have been blurred between politics and economics in a way we have not seen for decades (think Great Depression and war time). We saw a merging of policy and economics during the credit crisis, but there was a lot of interest on both the GOP and Democratic side of the aisle crying for help. That made bipartisan action easier once you cut through the posturing rhetoric (“let the market work,” “Socialism”, “Wall Street vs. Main Street,” “millionaires and billionaires”, blah blah blah, etc.”).

Some governance signals worth pondering for economic stability…

As we look at the constant political battles that threaten the economic health of the country, it might be useful to be more nostalgic about the GOP of the past from Eisenhower to Bush I and II. The concept of being bipartisan is not dead yet. It is just seriously ill.

Sometimes it just comes down to the character and courage of the people at the table. In contrast to Bush I for example, can you imagine Trump on a dive bomber hurtling toward the Chichi Jima volcanic island (a great but gruesome book on the topic is Flyboys written by James Bradley, the son of one of the flag raisers on Iwo Jima).

Trump’s frequent perversion of patriotism is one of his techniques to disrupt the ability to execute on healthy policy compromise across the aisle. The tactics are getting even more extreme. Trump’s recent declaration that Mark Milley (former Chairman of the Joint Chiefs) should have been executed was one that did not enhance the optics of what the MAGA world means to political governance in the US. The silence on the topic from the GOP was deafening, which in turn keeps the toxic cycle going.

For the record, Milley descends from a line that includes a father who was a Navy Corpsman assigned to the Marines in some epic Pacific battles. His father fought on Saipan and Iwo Jima among others. Saipan is less known, but it is a bell ringer in the Pacific War history. Google that one for some real insanity including a 4,000+ man banzai rush and mass suicides (or watch the 1961 movie “From Hell to Eternity” with Jeffrey Hunter. The plot was based on the real life story of Guy Gabaldon of the Marines).

Remember in 2018 when Trump skipped paying tribute to the WWI Marines who fell at Belleau Wood? (He was worried about a bad hair day in the rain.) Those are the kind of gestures that make you wonder. Add to that the fact that Trump had major clashes with two Marine Generals in his administration (Mattis and Kelly), and it is safe to say that Trump tries to tear down those who demonstrate outsized courage. Some people show up when called upon to defend the constitution. Some don’t.

In contrast to the Milley family tree, Trump evaded the draft with a case of disappearing bone spurs. Further, the arrest of his father at a Klan parade in 1927 and the pro fascist vs. anti-fascist ethnic brawls in NYC got a lot of press back then and during the election. Fascist vs. anti-fascist conflicts are rearing their ugly heads again today.

On a side note, Trump Sr. made a fortune in wartime housing contracts (near Navy yards, etc.). So, “War is Hell” does not exactly apply to the Trump family.

Whose DNA pool do you favor? “Respect those who served” is not a catchphrase.

The year ahead will bring a lot more ugly politics, but we can always be optimistic that there will be less cowardice and more deals cut that work for the economy. After all, the debt ceiling deal ends in January 2025, and we don’t want to be back where we were in May 2023.

There will still be plenty of crazies in Washington looking to burn the place down. A center left/center right meeting of the minds could put some of the arsonists in a much weaker position. That takes courage.