New Home Sales: Sequential Stabilization Beats a Sharp Stick

New home sales report has some favorable signs of stabilization if you look hard, but the mortgage wildcard will stay wild.

The #1 segment of the South rallies by 17% from Dec 2022.

Houses under construction slowly whittling down even if homes completed in inventory have risen.

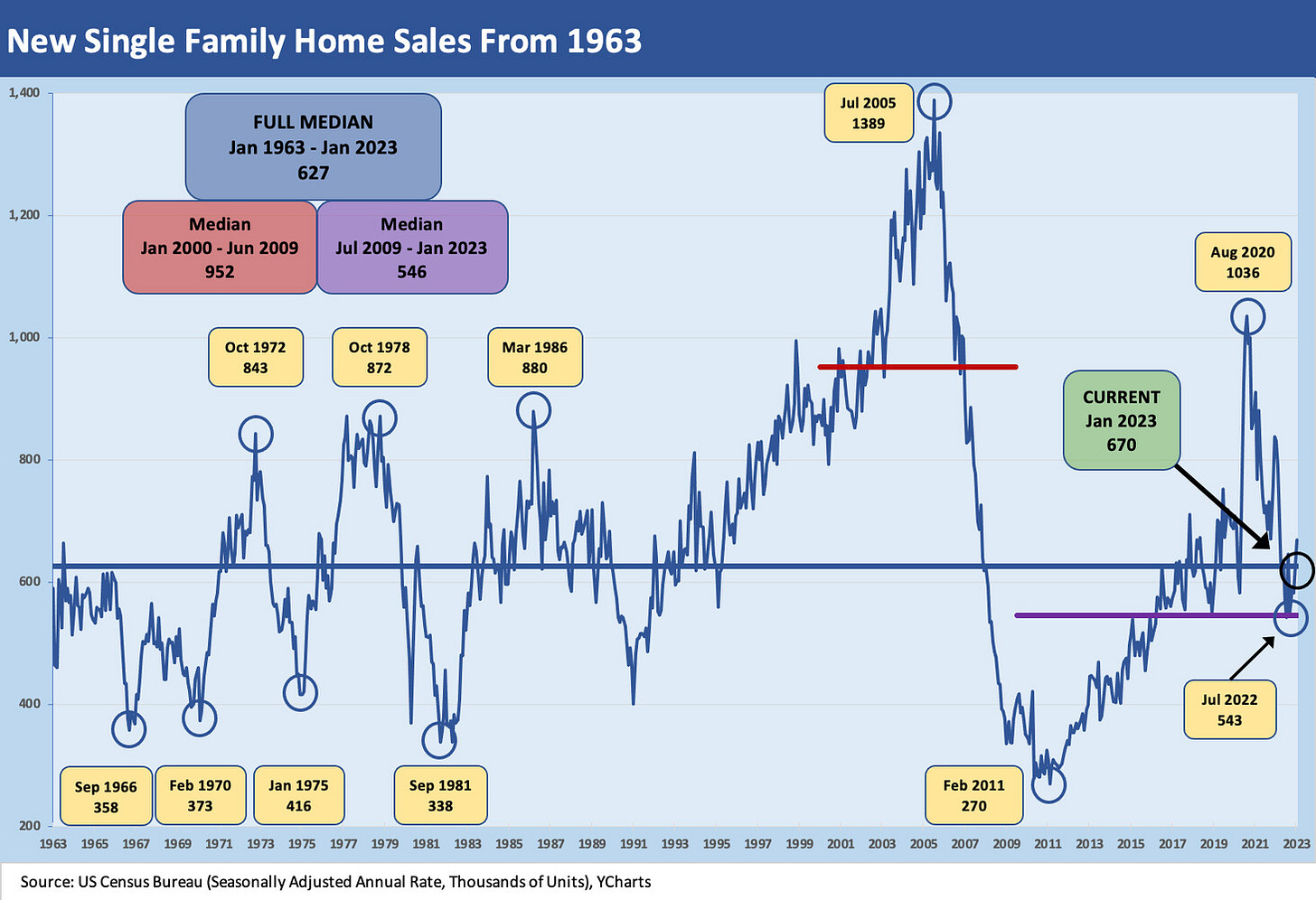

New home sales improve sequentially to best since 1Q22 while inventory stays in check. The New Home Sales numbers from the Census tell a constructive story (all things considered) in that the volumes hit a post-1Q22 high despite being down by 19.3% from Jan 2022. The sequential uptick was +7.2% for the US in total (seasonally adjusted) with the crucial South region up over 17% sequentially (seasonally adjusted) and +36% not seasonally adjusted. The Dec 2022 results had been revised up to 625K (see New Home Sales: Struggle for Balance 1-26-23), so the flavor was better than the existing home smackdown of earlier this week (see Existing Home Sales: Still in Freefall 2-21-23).

Homes for sale at the end of the period declined in unit terms and shrank to 7.9 months supply based on selling rates. In contrast, the number of completed homes for sale is rising while the number of homes under construction are declining. The builders have been getting praise for prudent inventory management in an especially grim time given how quickly the mortgage spike came on. The mix of numbers in the economic releases and color from homebuilders’ earnings calls supports this.

Stabilization does not mean good news. It is more just a case of builders doing their jobs the right way. The market was so strong in 2021 that inventory and contracts cleared up much of what might have been an inventory build if the homebuilders did not have both workers and supplier chain challenges. They went into this shock very lean in inventories in what was a stretch for a silver lining in this backdrop.

The time series of new home sales above tells the cyclical story line. Home sales have to be held up to the light of demographics and needs to be framed as part of a record sized working and retired population. The case has been routinely made that there is a housing shortage relative to the need. The trick is the right mix at the right price and the right affordability built in the right places. Easier said than done.

This past week we heard from LGI Homes who has a major bulk sale business with operators buying single family homes for rent. We also heard from Toll Brothers, a luxury homebuilder in the single family and apartment space. This underscores the range of the homebuilder markets. Those two names will be covered separately. Neither one liked this market but neither one appeared to be guiding defensively in their conviction around the resilient need for housing.

Mortgages still a developing problem with uncertain symmetry…

With the market seeking relief from mortgage rates, those watching are not getting much good news to end the week with 30Y fixed mortgages creeping back up to the high 6% range again. Another month of sequential increases for new home sales helps calm nerves in the builder sector.

We also saw Anywhere Real Estate report ugly revenue and earnings trends from its position as one of the largest real estate brokers across both franchised sales to the “real world” (Century 21, ERA, etc.) and its own captive operations that cater to a high priced crowd (Corcoran, Coldwell Banker, Sotheby’s, etc.). Volume and price both eroded for Anywhere (ticker HOUS), but the main problem was volume. Prices did not dislocate as badly as one might expect since both sides of the market (sellers, buyers) have headed more to the sidelines.

The price action in new home sales from today’s release is posted above with median home prices back to where 2022 started but still quite strong in historical context. Pricing will likely need to keep trending down in some economic variation depending on the use of incentives (mortgage buydown, fee relief, etc.) or outright price cuts.