New Home Sales: Struggle for Balance

The YoY pain is there in the declines, but the sequential improvements are sending good vibes on stabilization.

The year 2022 wrapped with a sign of stabilization despite the usual YoY plunge. The Dec 2021 to Dec 2022 decline was -26.6%. The good news is that the market saw three straight months of sequential sales volume improvement after reflecting downward revisions from August to November. The 616K sales in Dec 2022 moved up from the revised 602K in Nov 2022, 588K in Oct, and 540K in Sept. 4Q22 earnings releases kick into high gear next week when we will see results for most builders. DR Horton—#1 in Homebuilders—was the only major player in the sector to release results this week.

The ability to balance incentives across price and mortgage buydowns among other incentives is something we covered in past notes. The combination of lower rates and incentives appears to be working to stabilize month-to-month trends.

The regional mix showed the sharpest sequential declines in the Northeast at -19.4% (the smallest market) and in the West at -15.3%. Solid numbers in the South (the largest region) saw a +6.5% increase, followed by the Midwest at +35.2%.

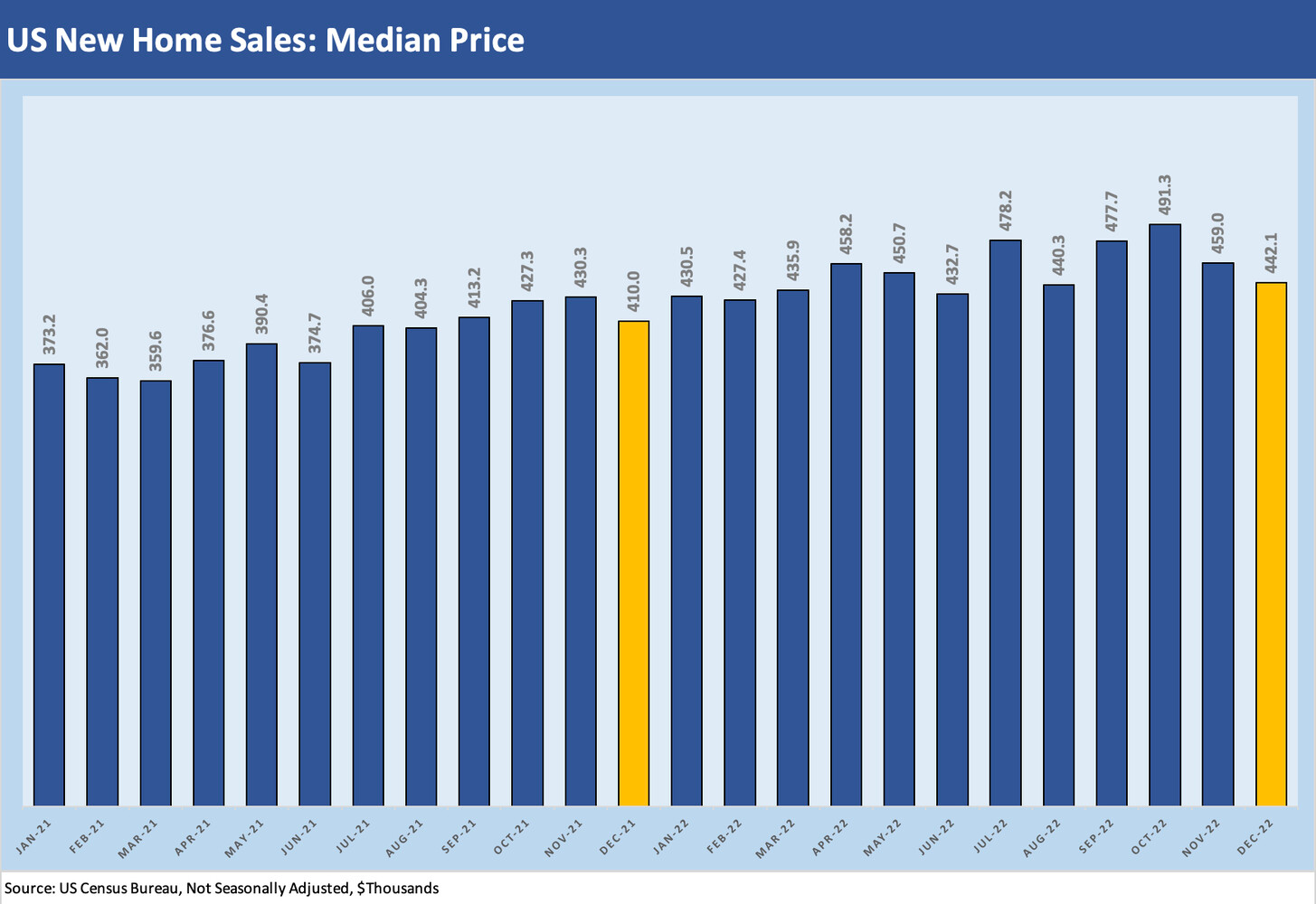

The median price of new homes sold weighed in at $442.1K in Dec 2022, up from $410.K in Dec 2021. That was down from $491.3K in Oct 2022. Pricing trends can be distorted by mix, but the main culprit on impaired comparability is the contracts entered into at earlier dates given the lag time before the collective toll of high mortgage rates took a more material effect.