New Home Sales: Feels Like a Light Tailwind

We look at the latest new home sales release as the numbers look strong in a trailing year context.

“At least I think it’s a tailwind…”

The rate of YoY decline eased in a seasonally slow period, but MoM jumps from Feb 2023 with 3 of 4 regions higher from Feb 2023 to March 2023 with only the South sequentially lower.

Median prices rose sequentially again in March to just under $450K while inventory declined to 7.6 months at the current sales rate (SAAR basis), or the lowest since March of last year.

The market is waiting for more signs, but you can only learn so much in March with a “lot of game left to play” in mortgages, potential UST defaults, recession handicapping, and inflation all still serious problems for longer term market guidance.

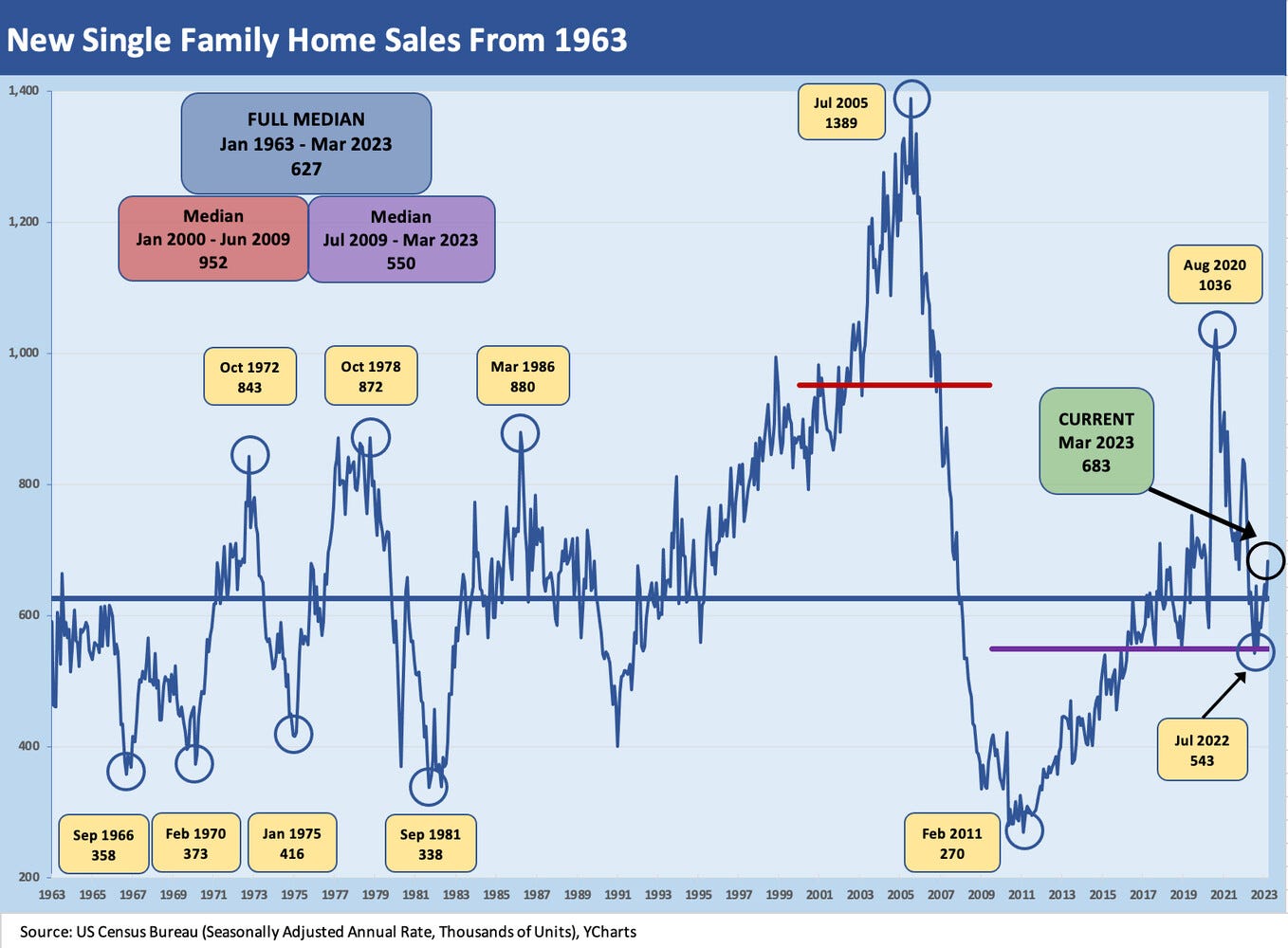

Below we update the new home sales time series from the Census for March 2023. New home sales posted a solid sequential move to 683K SAAR in March from 623K in February after 648K in January. The market is still weak and down sharply at rolling average run rates, but at least single family home sales are above the long term median. That comes with the asterisk of record demographic demand and a housing shortage in the country. In that context, these are still brutally low numbers when a record payroll count is seen in the employment ranks.

The +9.6% sequential increase in new home sales for March 2023 brought the YoY SAAR decline to only -3.4% with the 683K number the best month since March 2022. The home sales release by the Census came on a day when the #3 homebuilder, PulteGroup, turned in a good set of numbers for 1Q23 with PHM posting higher sales, higher average selling prices, and higher closings YoY (see Signals and Soundbites: PulteGroup 1Q23 4-25-23).

Last month was still very much a wait-and-see new home sales release (see New Home Sales: Holding Pattern 3-23-23); but with the spring selling season getting underway, the tone from builders and the numbers in the trenches are getting better. For the next handful of months into the spring and early summer, the main event will be mortgage rates.

Of course, UST will be wrapped around mortgage rates, so the threat of a UST default is a factor that flows into mortgages, counterparty risk, and credit risk appetites. We are curious how the mortgage market will frame that hedging framework! That’s a new one in the sense that debt ceiling threat is real this time. The thought of a self-inflicted UST default would be ludicrous in most worlds and ages of time gone by, but this backdrop in Washington is exactly what it looks and sounds like.

A hard landing recession would bring interest rates (whether by UST default or otherwise) down eventually and probably be a catalyst for an eventual rise in new home sales. Interest rates would be lower, and home prices would be lower. There would be a spike in foreclosures on soaring unemployment if it went on too long. Millions more would be unemployed. Chain reactions are what they are, but a default driven economic deep dive would be new ground. It is a strange topic to write about.

The main event for the builders will continue to be managing the rate of completions and spec home inventory with the potential for establishing a smooth and appropriate pace of home starts that does not pressure prices too much on excess inventory.

The pattern of more completed homes in today’s release is similar to last month. The number of completed homes at the point of sale and in the inventory count for sale continues a pattern seen in recent months – as they are at highs. The number of “completed homes” in the “for sale” inventory has doubled over the past year. Some of that is by design as more spec builds and selling later in the business cycles reduces the risk of cancellations and denials for mortgage credit.

As detailed above, the March median price of $449.8 was up from Feb 2023 and Jan 2023 but below the median prices from Sept 2022 to Dec 2022. Prices are still quite strong. The median prices also come with an “asterisk” of product segment and price tier mix. The loss of more entry level homes on affordability problems and lower mix of first time buyers together with the more resilient buyer base in higher price tiers such as “active adults” still can factor into the median price trends. That is in line with the color from some of the builders.