CPI: April Flowers??

We update our CPI checklist for April and break out the Big 5 categories and add-ons that comprise 86% of CPI.

"Inflation is only half the story. Debt ceiling dead ahead."

With the economic storyline seeing the forecasts taking on a binary flavor in many quarters around the debt ceiling (no landing vs. crash and burn), the CPI metrics are taking away some of the political ammo just on YoY math.

The shelter and rent metrics jump off the page at 8% handles, so that points at ex-Shelter metrics for a better sense of economic, sea-level reality and especially given the outsized share of Shelter (34.6%) in the CPI index.

The CPI trend line brought little bad news. The April numbers were in line with expectations, so the market was happy enough to start, but the takeaway is likely to be “the battle continues, the debate never ends” with services still tagged with the “sticky” adjective.

Food inflation moved from an 8% handle to a 7% handle while Energy remained in deflationary mode with double digit deflation on the important gasoline line ahead of peak driving season. Food at home improved to 7.1%, i.e., almost reaching a 6% handle. That still signals reduced purchasing power vs. wages, but the trend is at least going in the right direction for that critical consumer budget item.

We looked at the fact that the approach to looking at CPI needs to be done from a wider range of the “CPI ex” metrics whether traditional Core CPI ex-Food and Energy, ex-Shelter, or various Services “ex-metrics” (see CPI: Make Your Own Metrics 4-12-23). The recipe for the Fed has shifted around a bit. We also see the Shelter metric as far less useful for numerous reasons and are watching services more closely from CPI to wages and employment.

A look at some of the “CPI ex” menu items…

All Items less shelter: All items less shelter posted 3.4% in April or flat to last month’s number on release date. This 3% handle number makes a statement on the outsized impact that shelter metrics have on CPI. For the homeowner with no mortgage or the homeowner with a high 2% or 3% mortgage locked in, this metric arguably holds little significance. For the potential homebuyer, the mortgage rate is driving the bus on affordability and how much house you can buy, regardless of any lower average selling prices that may (or may not be) prevalent in an area.

Services less rent of shelter: Services less rent of shelter weighed in at 5.2%, which is well down from last month’s 6.1% on release date. As we have discussed in numerous other commentaries, Owners’ Equivalent Rent (OER) at 8.1% has the least relevance in a “cash in/cash out” world of consumers, and that line item carries a CPI index weighting of 25.4% in the CPI at this point. The Rent of Primary Residence line with its 7.5% weighting has direct “cash-in/cash-out” relevance, but more than a few real estate watchers put an asterisk on that metric in regional industry context.

The 8.8% YoY number for April 2023 is a very hard number to defend in today’s market. The potential for a hefty base of multifamily supply as well as strong demand for housing leaves that rent X-factor one to watch closely in 2023. We see plenty of discussion on both sides of the “up vs. down” expectations in the housing trade literature. The easy assumption is that the regional divergences will rule ahead in 2023 and will require more layers of analysis to get peeled back.

Services less energy services: We see 6.8% for Services less energy services in April 2023, and that is down from 7.1% on “CPI day” last month. With oil down and natural gas battered, the direction of energy services should be a line that sees some room for improvement ahead but the wage topics and general direction of the expense structure in the world of utilities along with rising interest rates and high investment needs will be a debate for the power analysts to ponder. We see Electricity services at +8.4% and a 2.5% CPI index weight (see “add-ons” table further below). The theory would be that low natural gas prices should translate into lower costs of electricity in time on lower input costs. At the very least, there would be questions around both the sequential and YoY trends.

All items less food, shelter, and energy: For those seeking an optimistic view on inflation, the 3.7% number posted in April is flat to March 2023. This is basically Core CPI ex-Shelter. For those seeking to manipulate concepts and choose selective facts to support a position (i.e., former trial lawyers who are now in Congress or are a member of the Administration) you grab onto this metric since wages outpace this number. You then blame Russia for Energy, tack on some concept-free price gouging accusations, and then add some of that same blame onto freight and shipping costs. You deride the shelter inflation metrics as inaccurate (that is the easiest part) and say “how far we have come.”

The blame game exercise for the counterpoint is that policy actions that undermine the Energy sector is the culprit (not Russia) and you counter with Services ex-Medical Care Services which stands at 7.6% and is bad news. Of course, at that point you run the risk of Obamacare being praised for its value in reducing health care costs. Medical care services posted +0.4% with a weight of 6.5% in the index.

For both sides, we can apply the age-old rule, “lie, damned lies and the CPI Index.” It comes down to where you want to put your plate at the CPI metrics buffet.

Our bottom line on the “ex metrics” is pay attention to them all. The BLS hands them to you each month.

The Big 5 CPI Categories at almost 75% of total CPI index…

We do this Big 5 CPI list each month. For those new to the reports, we fashioned our own version of Autos and related goods/services since too frequently the focus is just on new and used vehicles and that materially understates the cost of a vehicle to households.

The Big 5 CPI buckets brought some welcome news in Food All trends and notable relief in Food at Home. The 7.7% Food inflation line is still on the wrong side of the good news/bad news divide. Wages are well behind that number.

Energy is in deflation mode this year, so the fixation on commentary about “soaring energy prices” that get heard (I just listened to one in an interview with a smooth, fact-free Congressman) needs to hit the refresh button or attach a time horizon qualifier.

Gasoline at -12.2% ahead of peak driving season puts a few more coins/bills in the consumer’s pocket (or a smaller credit card bill). Refined products generally should also be a metric to watch for food given the importance of freight costs. Then there is aviation fuel and how that might flow into airline fares. Fuel costs are massive in the expense structure of airlines and need to be recovered in fares.

We will not belabor the points on Shelter, but we believe the numbers are more about theories than reality. The models don’t tie into reality effectively no matter how many IQ points are attached to them. Read the trade literature and watch the data alternatives. There are dozens of sources for rent and housing costs. These CPI shelter metrics are more about tradition since 1983 than utility. We cover housing issues separately.

Autos saw some reversal of the price action in used vehicles (but still YoY deflation) while new vehicles are still up around all time high average transaction prices. This comes at a time when auto financing is higher and all-in monthly payments and affordability are in a bad place. Motor vehicle insurance inflation trends are still brutal, and dealers are putting up record profits in Parts and Services. Skilled labor is pricey in the more tech-centric world of auto repair and maintenance while labor is tight for dealers.

Medical Services and “Medical Commodities” are a better part of the storyline for inflation. As with airline fares, the favorable inflation trend line still does not relieve the high absolute floor on costs. The medical CPI news is at least not part of the problem right now.

The “add-ons” and categories that carry household weight…

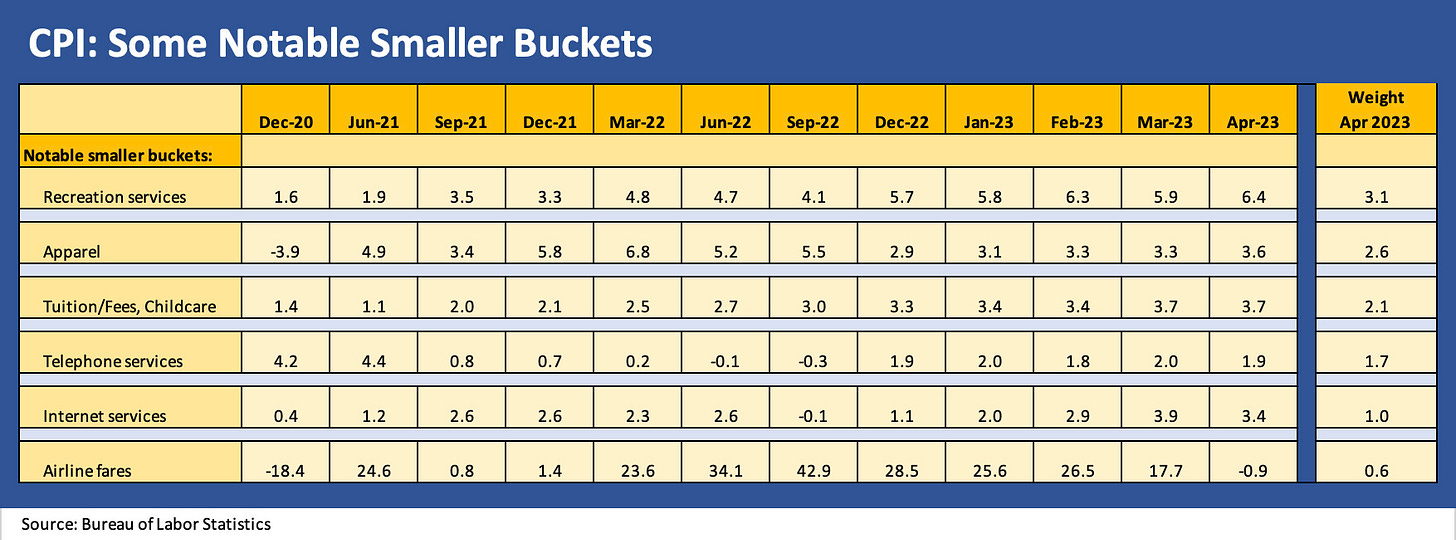

The “add-ons” total another 11.1% weighting in the CPI index, bringing our total in the two charts to almost 86% of the CPI index. We chose the add-ons for any combination of weights or their intuitive importance in the average household. Clothes, recreation, tuition/childcare, phone/internet, and airline fares resonate in varying degrees across households.

For this month’s results, we see the top two categories (Recreation, Apparel) higher, Tuition/Childcare flat, and Telephone/Internet and Airlines fares lower. The interesting twist on low inflation for some lines is that low inflation and even deflation is set against a very high floor for prices in those areas. That is similar to areas such as Health Care in the Big 5 categories, where low inflation still comes at a very high absolute price tag for even minimal services.