Existing Home Sales – Hammer Meets Nail

Existing home sales faces the obstacles of costly mortgages and potential sellers sitting on low mortgage rates.

Despite a decline in total inventory units from 1.22M to 1.14M in November, unsold inventory remains flat for total inventory months due to the lower sales pace for single-family units. For a single family, inventory months increased from 3.2 to 3.5 versus 2.2 months in November 2021.

Lower inventory in units translates into lower housing supply as macro modelers try to handicap the range of housing alternatives in the “rent vs. buy” decision for the growing ranks of the employed.

Volume declines in existing sales and a slower rate of building as 2023 proceeds will offer some mitigating risks as the mortgage rate dramas play out in the coming months.

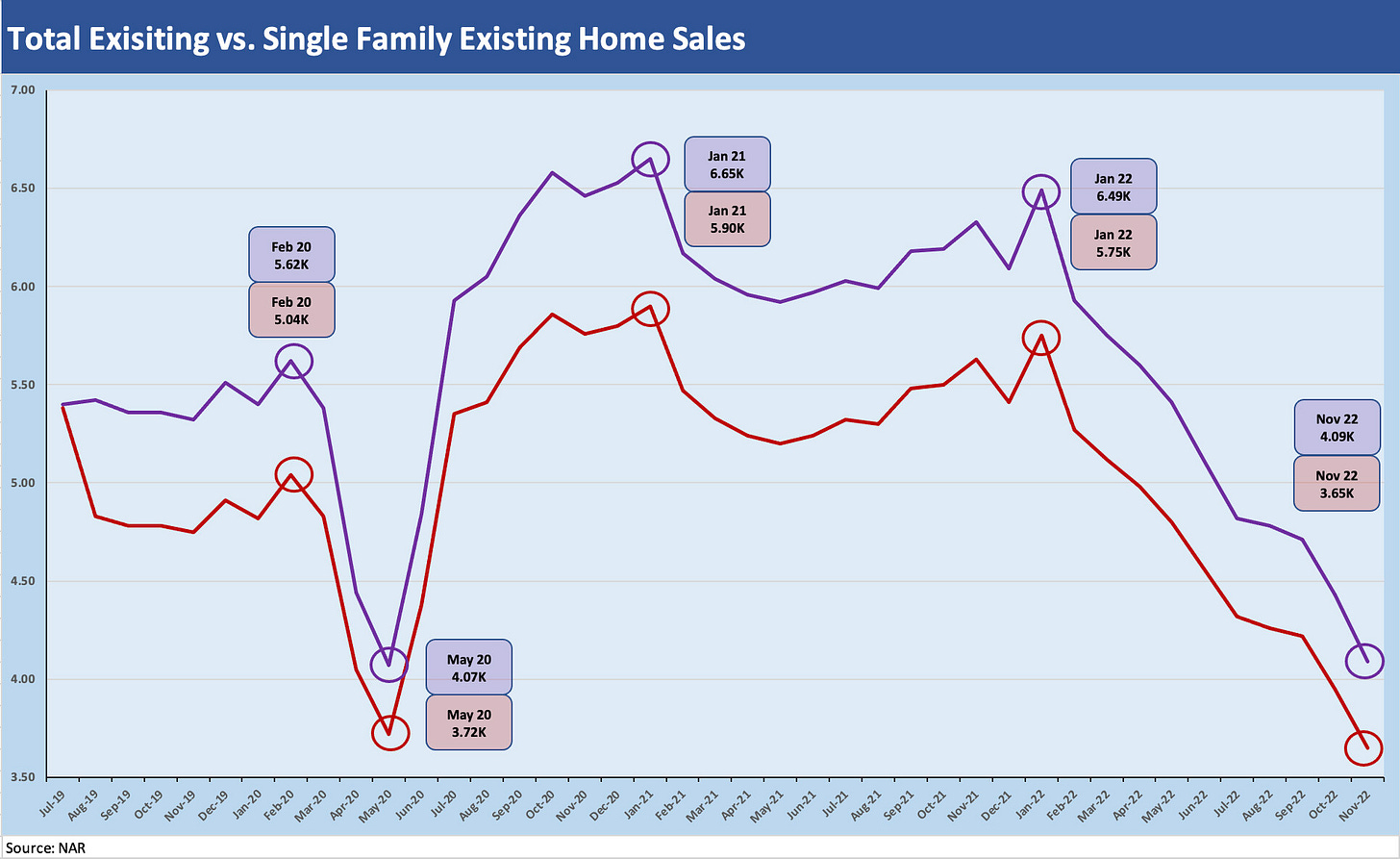

We update the existing home sales numbers for Nov 2022 existing home sales released from the National Association of Realtors (NAR). There is not much mystery in a total existing home sales decline to the tune of -35.4% YoY and -7.7% sequentially. That makes 10 straight months of declines with the median sales price of $370.7K down from the 2022 peak of $413.8K. The Nov 2022 median price was still +3.5% higher YoY. The chart below tracks the total volumes of existing home sales vs. the single-family-only volumes.

The above chart plots the time series from the pre-COVID period through current times. The volumes are now right around the COVID lows. There is little sign of stabilization of demand in these numbers, and all eyes are on the migration of mortgages rates. Mortgage rates dipped to the low 6% handle range in Dec 2022 to wind down the year, which are near the rates seen in the peak housing year of 2005. The problem is that monthly mortgage payments are feeling the effects of inflation and UST curve migration, which flows right back to how far home prices will need to come down by region to keep more buyers in an affordability zone. The question of how many sellers will surface to keep supply available vs. new homes entails more than one moving part. The expectation for 2023 is fewer existing homes for sale and fewer new homes in the planning stage.

The high level of single family homes and multifamily units under construction (see Market Menagerie: Home Starts – Will Housing Nerves Infect Multifamily?) underscores the high level of activity in homebuilding that is ongoing in current run rates. The decline in multifamily permits was notable yesterday considering the relative boom this year. The debate over how inflation and the UST curve (from Fed to the longer end of the curve) is playing out among homebuyers and homebuilders, is identical to the one being played out in stocks, bonds and currencies.

From the standpoint of homebuilder risks, the steady decline in starts and permits are setting the stage for downsizing balance sheets and generating cash in 2023. Some will be planning on how to reduce debt to conserve room for more expansion in 2024, if the Fed gets inflation under control, and hit their ambitious targets. The builders’ desire to get back into expansion mode will be there but builders, like everyone else, need clarity around consumer health, unemployment trends, and how these might flow into builder community planning and the mix of land spend vs. development outlays.

The builders must remain very sensitive to existing home supply trends and available inventory, and what that means for their product mix and pricing strategy. The builders have a range of marketing alternatives from price cuts to mortgage buydowns to fee relief (see Market Menagerie: New Home Sales – Now the Leaves are Falling Fast). Builders need to keep their eyes open at the regional level on what the mix of listings looks like and what their options are for planning. The immediate move in 2022 has been to scale back and retrench on land spend.

The 2023 period also gets right into the process of builder planning for 2024 and continuing to deliver on their contracts and evaluate demand expectations by region and price tier. Meanwhile, most need to monitor the spec home segment of their business (where relevant). We would assume more are shrinking that side of their business into 2023 given the weaker demand backdrop. The color in earning season will give a sense of how defensive some of the builders are growing.

The above chart updates the sales volume decline by price bands in the single family home category. We post the declines in the box but also include the sales share held by that price range bucket. We see the $1M+ buckets down 41.2%, and that brings bad news to the luxury brokers crowd such as Anywhere Real Estate (formerly Realogy) and Compass. The $1M+ tier only comprises 5.5% of the total market (15.3% of the West region), but the weakness on the high end matters quite a bit to securities holders in the broker names. Anywhere Real Estate (ticker HOUS) posted a YTD 2022 total return of -59.4% while the tech-centric, post-IPO Compass is at YTD -75% and -88% since its March 2021 IPO.

One highlight in the takeaways from the chart beyond the obvious battering YoY on sales is that the biggest mix shift sequentially was a higher share in the $100K to $250K bucket, which saw its sale distribution share climb from 14.6% to 23.6%. The biggest decliner in share was the $250K to $500K share, which dropped from 48.5% in Oct 2002 to 43.8% in Nov 2002. Whether this was first time buyers just opting for the monthly payment they could afford (lower price to mitigate higher mortgage costs) or sellers “cutting and running” will take some digging and more feedback in earnings seasons from the builders.

One way to punctuate how bad the month was in Nov 2022 is to look back across time to the COVID plunge. Note the two bars in red in the chart above, which details the seasonally adjusted Total Existing Home Sales numbers for each month across 2020-2022. Nov 2022 obviously was bad in 2022 context, but it is close to the COVID lows of May 2020. We cite the total existing home sales for those two months in the box in the top middle/right. Both months round to 4.1 million units. It is a big chart for a small point, but we liked it.