GDP 4Q22: Thin Sliced

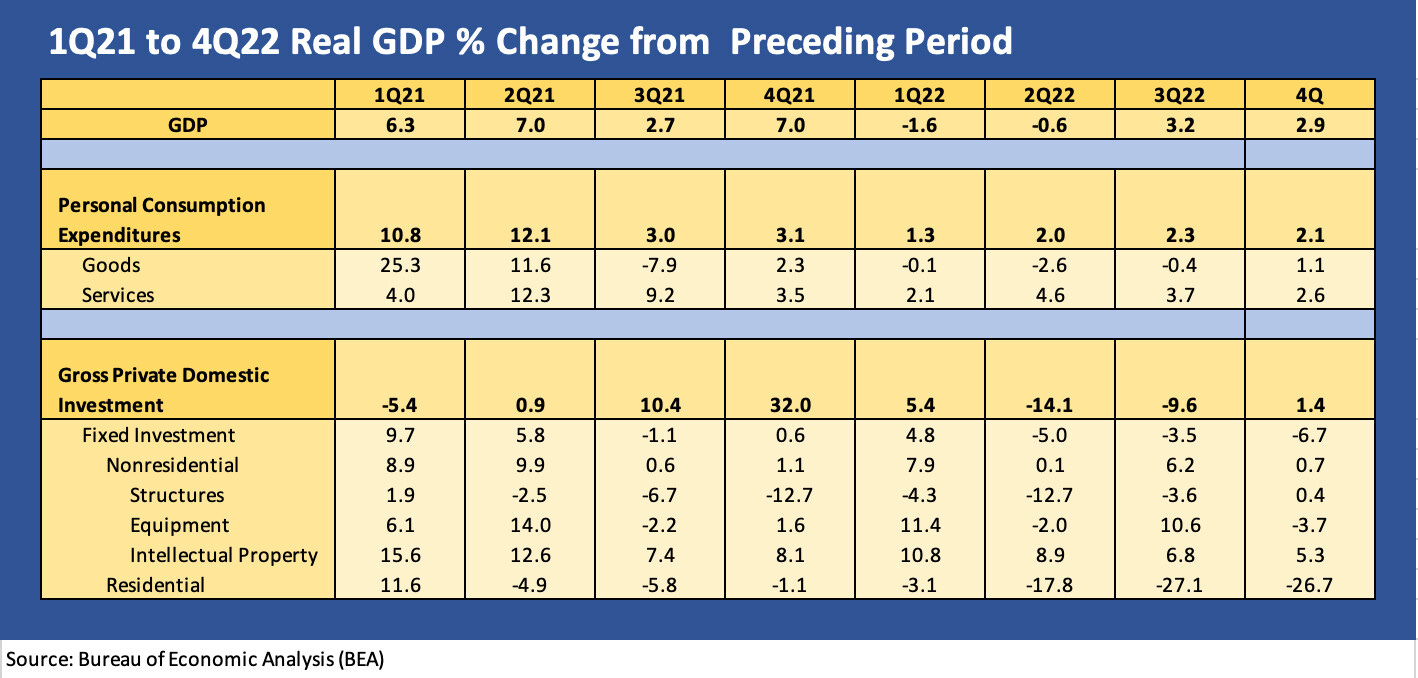

The 4Q22 GDP weighed in at 2.9% and the full year at 2.1%, but 4Q22 got a lot of help from inventory, trade, and govt.

We see a +2.9% headline number, but that includes a +2.0% contribution from inventory and trade.

Residential getting hammered again at -26.7% while Equipment flipped back to negative at -3.7%

The GDP story still turns on PCE at +2.1% with Services leading and Goods a few steps behind.

Sometimes the bologna needs to be dressed up to make it more appetizing. That is sometimes the case on how the GDP line items roll up to growth. The GDP trend line has been moving in the right direction in 2022 after negatives in 1Q22 and 2Q22. So this was a good number in the sense that positive beats negative (How Do You Like Your Landing? Hard or Soft? Part 1 12-23-22). Looking ahead, we see some close calls in the bigger picture as you get into the line items. We would summarize the release as “consumer holds, investment fades.”

When we broke down the 3Q22 numbers, we reviewed how low GDP tends to swing on the back of line items such as inventory and trade. Those two in particular have a disproportionate impact on the headline number (see 3Q22 GDP: It’s the Big Little Things 10-27-22). The 1Q22 and 2Q22 numbers were not as bad as they looked, and 4Q22 is not as good as it looks in terms of the key drivers in the private sector. This month we saw inventory provide a boost at a +1.46% contribution to the 2.9% GDP (see Table 2 of the GDP release) and trade (Net exports of Goods and Services) provide a +0.56% contribution to GDP. Government consumption weighed in at a +0.64% contribution.

Hard vs. soft is still a debate, but we still vote soft…

Handicapping hard vs. soft landings needs to set the odds on the setbacks that could be on the horizon. The consumer? Spike in unemployment? Fixed investment moves in equipment, structures, residential? A pullback in inventory? In Washington, will the debt ceiling drive a pullback? Credit contraction by the banks? The fixed investment line is clearly vulnerable, and housing is already delivering pain. We look at some of the history for Gross Private Domestic Investment across the cycles in a recent note (see Hard or Soft Landing? Part 3: The “Capex” Lines 12-30-22), and our expectation for 2023 is that the investment lines keep fading and the consumer hangs in.

We had detailed the main moving parts across the business cycles from the early 1970s stagflation (the Nov 1973 to March 1975 recession) through the credit crisis recession (see How Do You Like Your Landing? Hard or Soft? Part 2 12-28-22). Those included some soft landings (2001) and some hard (the rest of the downturns). The history of hard landing will keep the market on edge. The Dec 2007 to June 2009 recession was the longest (18 months) since the Great Depression. That is still a scar on the markets but the major banks and consumer finance companies have been weighing in well this quarter.

The transmission mechanism to recession was clear as most earlier recessions unfolded (oil spikes, soaring inflation, structural change in economies, housing bubbles, etc.). For some downturns, the scale of the problem was better understood only in retrospect. The 1980-1982 double dip and later the waves of regional contraction, real estate excess and financial system stress was clear by 1989 ahead of the 1990 recession. The slowing was in the numbers by 1989, and the tipping point was the Mideast War nerves and oil spike. Commercial real estate did not help on a national scale. That adds up to credit contraction and some risk aversion as the brokers also were hammered in 1989-1990. The TMT downturn in the real economy was very mild.

During the credit crisis of 2008-2009, the depth of the problems was only later fully grasped. The weak subprime underwriting and reckless credit was more obvious, but the bank system crisis was heavily tied to bank system interconnectedness and unbridled derivative exposure. Wouldn’t it have been nice to know that the US and European bank system hedging was linked to the fate of AIG as the systemic risk buffer? In the case of the major US banks/brokers and European majors, the counterparty concentration that was not disclosed in the public domain became an existential credit risk in a hurry.

With these 4Q22 GDP numbers in, we get back to pretty much the same debate as the day before, which is whether the consumer will hold up (jobs is a big part of that) and whether investment will keep on fading with Structures and Equipment following the Residential line. If pessimism prevails, next quarter could see Inventory go the other way.