Footnotes & Flashbacks: Asset Returns 7-9-23

We look into a negative week for both equities and fixed income as both had a tough start to 3Q23.

We look at the asset return mix after a bad week for both duration and equities as the UST curve shift takes the market back to levels before the SVB collapse sent rates lower.

The FOMC and ADP noise rattled markets and built in the expectation of a hike as the next round of inflation data comes out this week.

For the rolling 3-month period, only HY remains positive in total return as the UST shift undermines YTD returns for high quality fixed income benchmarks.

The above chart updates our usual mix of asset class benchmarks across debt and equity as the 3Q23 period got off to a slow start, pulling back trailing 1-month returns in high quality fixed income and wrapping up a very underwhelming rolling 3-month period for bonds. The debt and equity asset classes in the chart are each lined up in descending order of YTD total returns.

We already looked at the relatively sharp moves of the UST curve this past week as that action weighed on duration and bond performance (see Footnotes & Flashbacks: State of Yields 7-9-23). We see the wear and tear on both IG bonds and UST as they rang up negative total returns for 1-month and 3-months and hold the bottom two positions in the YTD rankings.

Looking back at the 1-month period, only HY was in the black – and barely. The same is true for the 3-month period although the YTD pace is respectable for US HY. There will be some important fundamental gut checks ahead with guidance in 2Q23 earnings season.

In equities, negative numbers trimmed the rolling 1-month period after a very strong week to wrap 2Q23, but small caps are in the red for the trailing month and the Dow closer to zero than 1%. Small caps still held in with a solid 3-month run that essentially accounts for the full YTD return. The broad market S&P has built up a very positive YTD, but the skewed numbers from the Magnificent 7 profile of names drove the market-cap-based index to over 2.5x the total return of the qual weighted index. That is a recurring theme in 2023 even if the gap is closing. The tech story and NASDAQ remain at their own altitude.

With this type of first half performance for so many bellwethers and the next tier of equities closing the gap in recent weeks, the 2Q23 earnings season will be very interesting even as it crashes into the FOMC meetings (July 25-26) and its follow through on the hawkish pause along with a few rounds of CPI, PCE, and job counts across the 2Q23 earnings season.

The above chart updates the 1500 and 3000 series and a weak month is in evidence after what had been a very good trailing week and 1-month finish for some of the benchmarks at midyear (see Footnotes & Flashbacks: Asset Returns 7-2-23).

With this latest 1-month period, a good week drops out and a bad week drops in. Industrials still have held in very well in the netherworld between Growth and Value benchmarks. Energy is still sitting in the negative zone for 1-month, 3-months, and YTD. Financials are in the red YTD on the effects of regional banks and pressure on interest margins and worries around the next round of provisioning needs.

Comparative asset returns and ETFs….

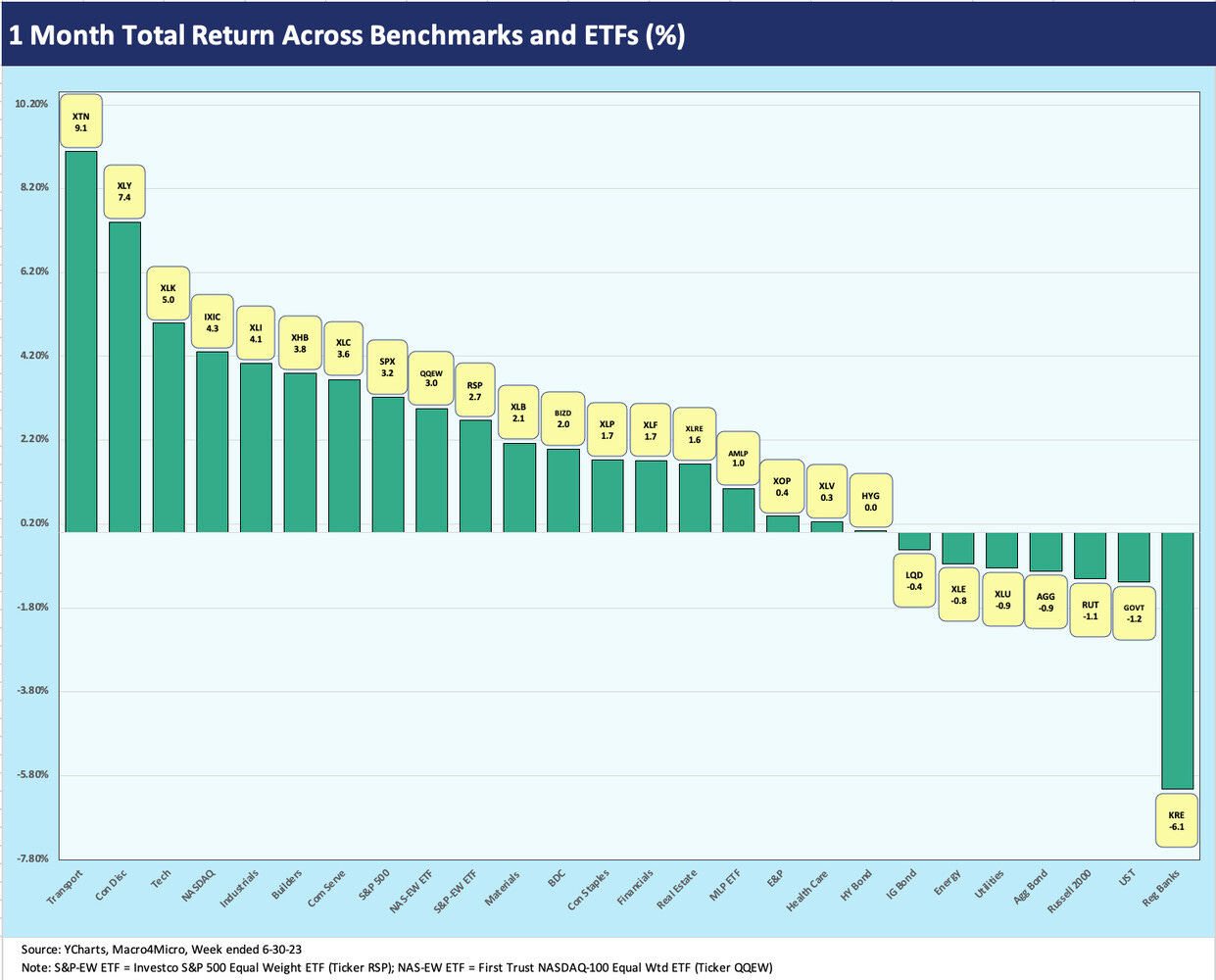

In our next three asset return charts, we cover 1-week, 1-month and 3-month time horizons. We look at 26 different benchmarks and ETFs that capture the performance across a wide range of industry groups and asset class proxies as well as the usual major equity benchmarks. We recently added equal-weighted ETFs for the S&P 500 (RSP) and NASDAQ 100 (QQEW) given the market cap weighted distortions in the total returns for those benchmarks driven by the mega-names.

1-week ETF returns…

The above chart weighs in at 5 positive and 21 negative on the week across the ETFs and benchmarks. Interestingly, the Top 4 are higher dividend payers with AMLP and BIZD at #2 and #3. KRE at #1 also has a higher dividend yield but has more than a few asterisks on its volatile week-to-week and month-to-month rankings in price return as well as total return. KRE ranked last for the trailing 1-month period at -6.1%. In general, positives for the week were low returns with 3 of the top 5 below 1%.

On the negative side, we saw Homebuilders (XHB) drop to last place on the week after a blistering run in recent weeks and months. The easy explanation is that an upward yield curve shift will call into question the direction of mortgage rates and housing affordability as 30Y mortgages are hanging around the high 6% area with some quotes north of 7%. We dedicated some time to mortgage rates and the quirks of this cycle in this week’s separate “Footnotes” State of Yield piece. We highlight the weak performance of the ETF fixed income proxies with LQD the worst of the four (LQD, AGG, GOVT, HYG).

1-month ETF returns…

The 1-month trailing returns still have most of a very strong June to hang onto a 19-7 advantage for positive returns. Transport at #1 is still a good sign of what the market is seeing in some major cyclical and freight and transport names. The Consumer Discretionary ETF, Tech, and NASDAQ still benefit from the Magnificent 7 presence in the mix. The strength of Industrials at #5 and Builders at #6 show some more votes favoring cyclical resilience.

We see regional Banks (KRE) on the bottom, and that group is in the early waves of 2Q23 reporting season. The focus on interest margins and legacy exposure in real estate lending catch no shortage of headlines, and the data and the response in Q&A will get a lot of attention. Deposit costs would seem slated to go only in one direction – higher. The discretion in provisioning will be up for some second guessing in the markets. The banks have had to endure the deposit scare and now face the FOMC side effects plus legacy commercial real estate neuroses.

3-month ETF returns…

Our last update chart covers the 3-month ETF and benchmark returns where we see a 17-9 advantage to the positive side. The bad news for fixed income allocation on the right side is that 3 of the bottom 5 performers were high quality fixed income proxies with GOVT, LQD, and AGG. We also see Energy (XLE) and defensive Utilities (XLU) holding down the last two spots.

Perhaps the bigger surprise in 2023 has been the exceptionally strong relative performance of the Builders (XHB) at #1 and Transportation (XTN) at #2. The next 4 slots are held down by mix of tech-centric ETFs, including Consumer Discretionary (XLY) with its heavy Amazon and Tesla exposure and Tech (XLK) with Apple, Microsoft, NVIDIA, and Broadcom. NASDAQ rounds out the Top 5.

We see the even weighted S&P 500 ETF (RSP) and income heavy midstream ETF (AMLP) straddling the median line at 4% handle 3-month total returns. Financials and Real Estate ETFs bracket those two.

We keep feeling like the interesting parts of balancing the FOMC and duration risk with fundamentals and cyclical trends are just getting to a more transparent stage when the goalposts keep moving. The market ducked the debt ceiling outliers and now the FOMC is threatening a cycle that has been too resilient for their inflation priority.