Footnotes and Flashbacks: Asset Returns, 6-11-23

Asset returns this past month show Industrial equities coming back to life with HY carrying the day in debt.

"Revisiting risk appetites?"

We change the weekly format and break out the Macro into sections with yields and asset returns in separate postings.

Asset return expectations in the aftermath of the debt ceiling deal are all over the map, and this week’s CPI and FOMC color are going to intensify the curve handicapping and what it could mean for the consumer and key markets such as housing and autos.

Note: This week we streamlined our weekly release to break it into pieces. We typically review asset returns and yields, but we will now break those topics out into separate “Footnotes and Flashbacks” comments with charts. We looked at yields and UST curve action in its own separate post (see Footnotes and Flashbacks: State of Yields, 6-11-23 6-11-23).

Political Risk Takes Back Seat for Now…

The good news as we head into a very important stretch of economic signals is that political turmoil in the US for now is more noise than systemic threat even with an indicted former President. Maybe the credit rating agencies will wait until after the 2024 election to downgrade the US when the next default threat may be tied to an even angrier crew of knuckleheads.

For the next leg of the journey, the crazies will be what they are (i.e., crazy), the gun freaks will stay freaky and be stocking ammo, and the left will lament the lack of progress in their core priorities of raising taxes and outlawing carbon. Meanwhile, a 134-pound former wrestling champion will be yelling “alternative facts” even louder while the Squad will pretend a swing voter is listening. The Senate will remain by and large functionally useless, with no material reform getting done with the filibuster and a GOP House squared off against a Dem in the White House. Good times.

The fundamentals are hanging tough while interest rate anxiety looms…

In the charts below, we run through a cross-section of asset returns in a market that is either a new beginning with a disaster off the checklist (debt ceiling, a potential UST default) or a fresh debate on whether the Fed needs to tighten more. The CPI and FOMC meeting this week might get the market warmed up for more confusion ahead on where the UST curve will be headed.

Comparative asset returns…

The above chart updates our usual debt and equity asset classes with each bucket listed in descending order of YTD Total Return. For debt, credit risk and a decent coupon are winning with US HY ahead YTD, 3-month, and 1-month. US IG has posted respectable YTD returns but lost ground with recent duration setbacks over 1-month.

To the extent the cyclical fundamentals stay strong and do not have a “landing,” the outlook would be that US HY will be favored on lower duration risk and higher spreads, plus its inherent income advantage. That is not our base view for the year as we still expect US HY to underperform IG. More on that topic on other days. There is an awful lot of year left, but the most “awful” part has been ducked on the debt ceiling at least.

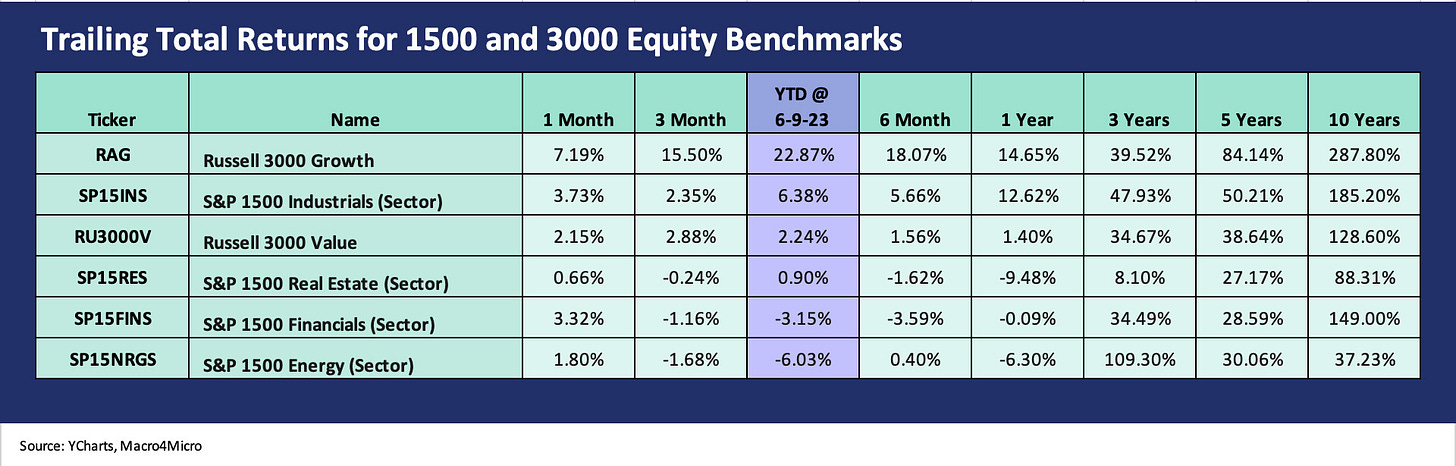

The 1500 and 3000 series has been a drag, but the longer tail is now showing some life the past month. YTD numbers have been all about growth, but Industrials and Financials are putting in a good stretch the past month as more economic indicators and the consumer are sending optimistic signals. Energy and Financials remain negative YTD, but Industrials are making a push.

We have the CPI and Industrial Production this week that should give some more important metrics that the bears or the bulls will look to cling to or run from. The FOMC language and messaging will get tortured with projections also due from the FOMC.

ETF Returns, industry comps, and asset class proxies…

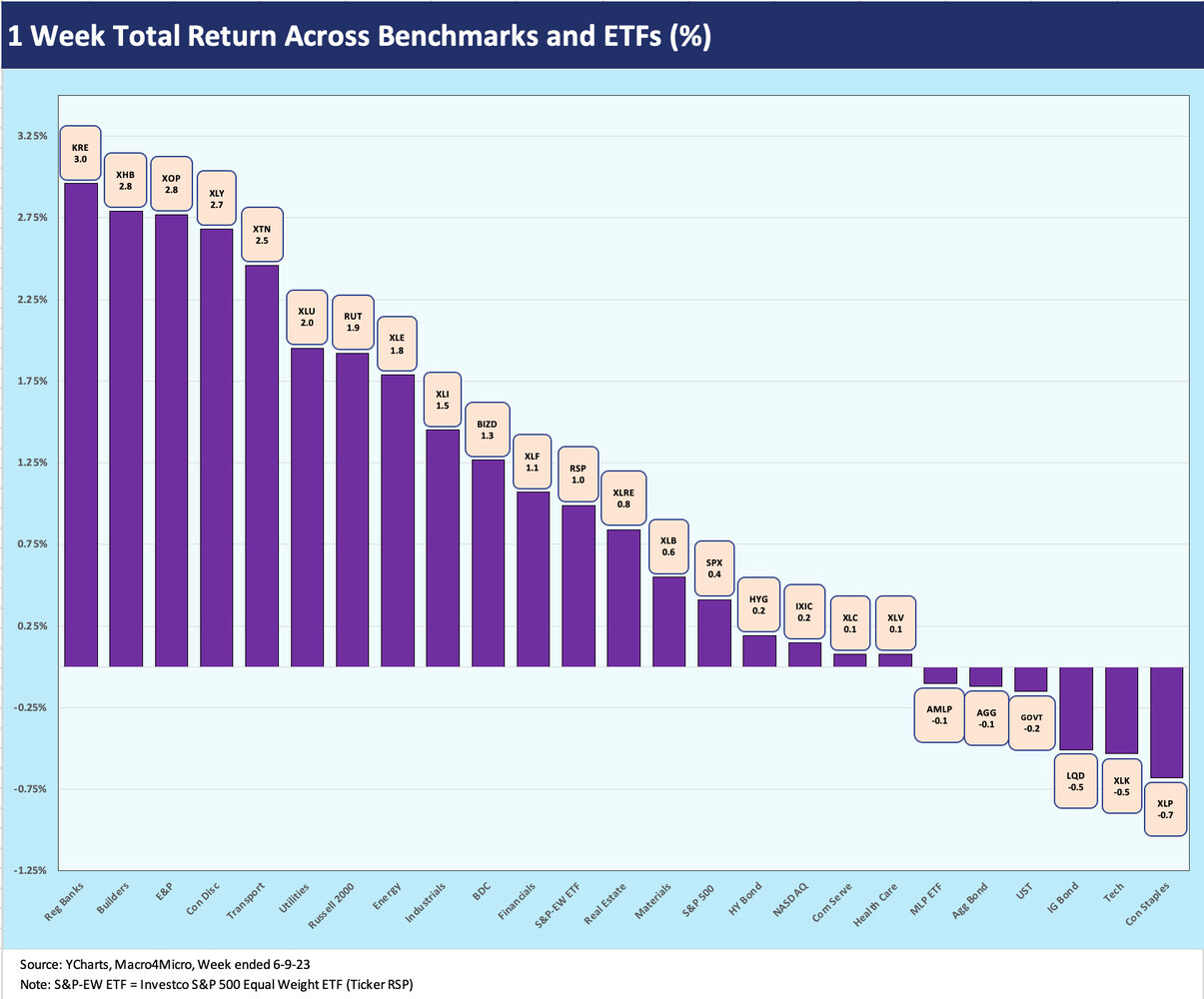

In the next 3 charts, we look across 25 ETF and industry benchmarks for the trailing returns of the past week, the trailing 1-month, and the trailing 3-months. We bumped up the ETF and asset benchmark count from 24 to 25 by adding an S&P 500 equal-weighted index (Invesco’s ETF ticker RSP). The distortions of the returns by the largest names in the market-weighted S&P 500 get too much coverage for us not to add another frame of reference (see Reversal, Takedown, or Escape? Market Weighted vs. Equal Weighted 6-6-23).

The above chart plots a solid week for equities with 19 posting positive returns and 6 in the negative zone. The curve move sent LQD, GOVT, and AGG into the red with HYG slightly positive. Regional Banks (KRE) and Homebuilders including suppliers (XHB) led the way. E&P (XOP) had a rare decent week in recent months on the OPEC news.

The 1-month time horizon also weighed in at 19-6 positive with 3 of the bottom 6 from high quality, duration-sensitive fixed income ETFs. Lower risk equity groups such as Staples (XLP), Utilities (XLU), and Health Care (XLV) are sitting on the bottom. Regional Banks (KRE) have been on the mend in the upper ranks while Tech and NASDAQ continue their winning ways.

Amazon and Tesla-heavy Consumer Discretionary (XLY) are distorted by high issuer concentration that are big winners. The same holds true for Communications Services (XLC) with Meta, Alphabet, and Netflix. The Russell 2000 (RUT) rally over the past month brings some relief to a benchmark that has had a rough ride in 2023.

The 3-month results really hammer home how ugly the Hi-Lo spread can be with the top performer (Tech, XLK) over +20% and the bottom performer (Regional Banks, KRE) worse than -17% for a Hi-Lo spread of almost 38 points of total return. We see 20-5 with positive returns well ahead. The Top 5 are heavy on Tech-centric sectors but with Builders (XHB) making it into the Top 5, edging out the S&P 500.

While the regional banks (KRE) are by far the worst performer (see box in upper right), the Energy ETFs are sitting on the bottom for the trailing 3 months, which is a long way from a solid 2022. Financials (XLF) are also sitting in the Bottom 5 just above Materials (XLB). Fears of a sustained interest margin squeeze and real estate asset quality is the headwind and discussion of choice for banks along with more fears of aggressive regulatory action on capital requirements. Materials (XLB) which are in the bottom tier, has 7 of the Top 10 names in the Chemicals sector, with other major companies including Freeport Mac, Newmont, and Nucor.