Industrial Production: Capacity Utilization Shows Manufacturing Edging Higher

We look at the latest set of Capacity Utilization numbers with the Industrial Production release. Still a soft story.

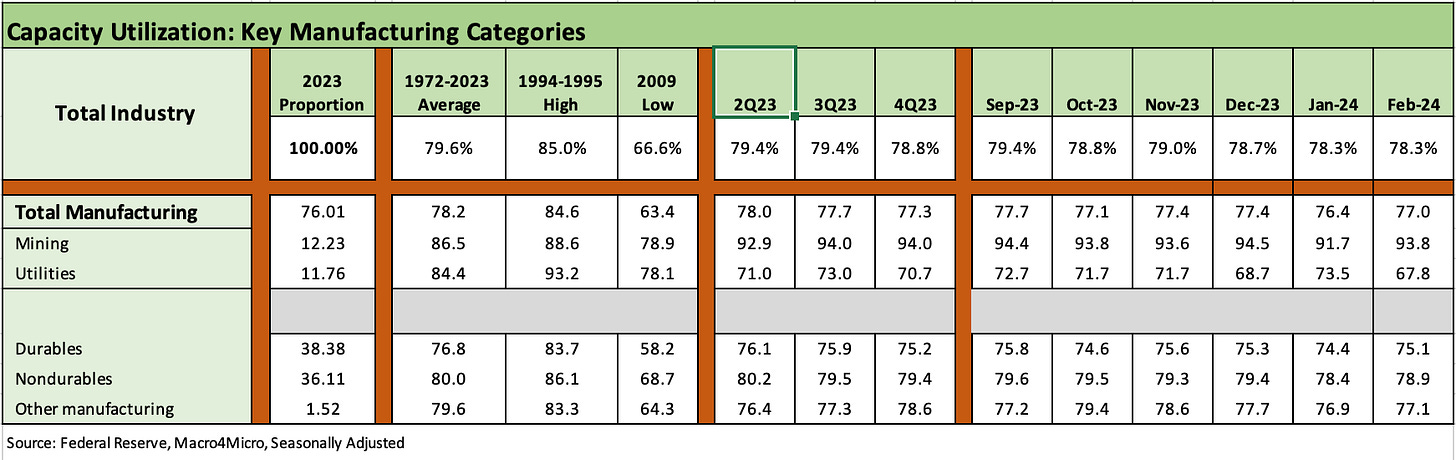

The latest round of Industrial Production and Capacity Utilization numbers show Total Industry utilization soft with a downward revision in Jan 2024, but the Manufacturing level (76% of Total Industry) firmed up sequentially from the revised Jan 2024 (76.4% in Jan to 77.0% Feb 2024) even if it is still running below the 4Q23 77.3% avg (and 3Q23 and 2Q23 avg. as detailed below).

Total utilization for all industry was held back by a sharp sequential decline in Utilities, which continues to run well below its long-term average while Mining runs well ahead of its long-term average.

The net takeaway from recent trends is that Manufacturing is modestly below the long-term average and pricing power is not showing much clout at the aggregate level as backed up by the CPI benchmarks for durables deflation (-1.6% in Feb CPI) and low Nondurables inflation (+1.1% in Feb CPI).

We started including the long-term utilization history across cycles and recessions in our last update on capacity utilization (Industrial Production: Capacity Utilization Limps Along 2-15-24). The above chart shows the long-term time series while the next chart further below tracks the “cap ute” performance vs. past recessions. In the chart above, we break out long-term medians and medians for some notable economic time periods.

The main takeaway on the cap ute numbers since the credit crisis years and waves of restructuring activity is that manufacturing companies had materially lowered their breakeven levels and were quite profitable at much lower utilization levels than one would see in a typical recession.

The question as this current cycle extends is how those shifting break-evens have moved (i.e., what volume does it take to break even assuming a given pricing and cost structure and product mix). Rising costs and prices always make for tough assumptions when solving for a moving target. For example, the SAAR rates breakeven rates touted by the automakers after the 2009 Chapter 11 filings and capacity restructurings must look very different today depending on the new UAW deal and heavy EV spending.

In recent years, manufacturing concerns faced with tariffs pressured import supplier costs even as domestic inflation drove upward cost pressure on the full range of inputs. Energy costs flow into everything from shipping to materials. Supplier chain disruptions were causing supply-demand imbalances all along the component chain as well as in finished goods. The moving parts within the ecosystem of cost structures are daunting. Last (but not least), the newly invigorated pricing power of labor is an adverse factor for many industrials even if quite good for many workers and their household income.

The above chart adds a few more angles on cap ute levels across expansions and recessions. The 77.0% of Feb 2024 is below the long-term median of 78.7% since 1967. It is also below the median of the Last Twelve Months (LTM).

Into the weeds for Feb 2024…

The above chart breaks out the higher-level buckets for Total Industry along with the 3 main buckets of Total Manufacturing (76.0% of Total Industry), Mining (12.2%) and Utilities (11.8%) that total the 100% for Total Industry.

We then break out the 3 pieces of Manufacturing with Durables (38.4%), Nondurables (36.1%), and “Other” (1.5%) adding to the 76%. We see Total Manufacturing and Mining up sequentially but Utilities materially lower. Durables and Nondurables both notched higher from Jan 2024 but are below 4Q23 averages.

The above chart looks at the lead industry groups in Durables and Nondurables. We include the relative weighting for each in the chart. For Durables, we see 4 of 5 higher vs. Jan 2024 and 1 flat. For Nondurables, we see both higher in Feb vs. Jan 2024.

When looking at 4Q23 averages for Durables vs. Feb 2024, we see 3 higher, 1 lower and 1 flat. That relative performance goes into the category of “muddling along.” For 4Q23 Nondurables averages vs. Feb 2024, we see Chemicals flat to 4Q23. We see Food, Beverage and Tobacco lower in Feb 2024 than the 4Q23 average.

See also:

Industrial Production: Capacity Utilization Limps Along 2-15-24