Delta 2Q23: Bellwether Bliss

We look at the strong rebound at Delta in broader industry context.

We run through some Delta trends coming out of 2Q23 and what they say about the industry as numbers start to look more like 2019.

As we move further into peak travel season in 3Q23, the very high rate of free cash flow leaves room for DAL to continue repairing the massive balance sheet damage done by the pandemic with target leverage of 3x by year end and 2x handle levels during 2024.

DAL margins are back at peak levels last seen in 2Q19 with volumes still below the 2019 peak and room to sustain solid growth into 3Q23.

Credit quality continues to improve across revenue, cash flow, and the balance sheet with the outlook remaining favorable financially and operationally.

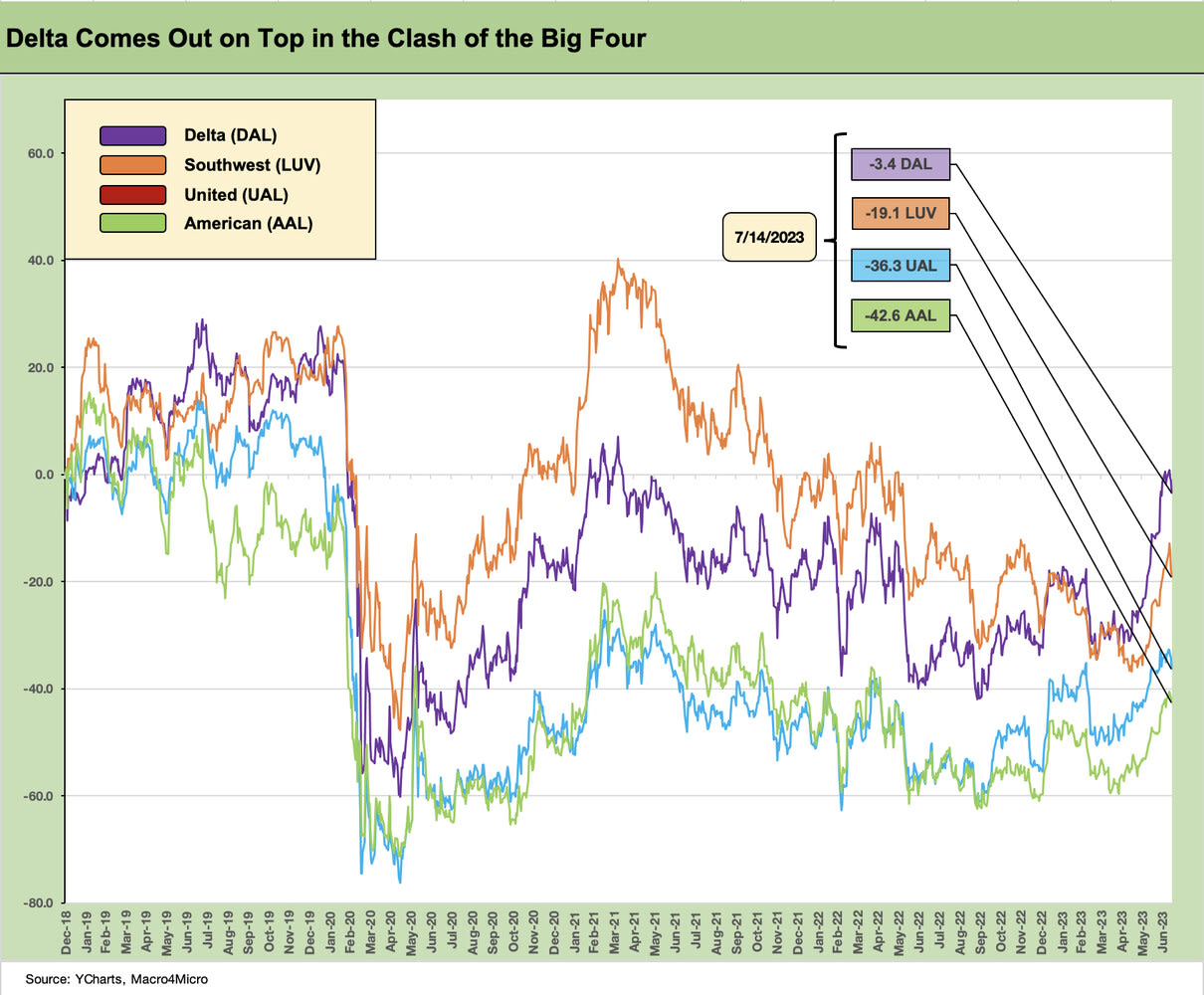

The stock chart above offers a reminder of the timeline turbulence since 2019 that saw government relief during the pandemic, grounded aircraft, assertive labor demands, and too many headlines around bad service. As detailed in the chart above, Delta is the stock winner for the Big 4 across the period from the start of 2019 through this past week and has been showing few signs of slowing down in its performance.

For stockholders and lenders, the main event is still earnings and cash flow and how it gets deployed, and the news there has been favorable even with a long way to go for the balance sheet to look like 2019. While the Big 4 are negative in cumulative stock returns from the start of 2019, we see Delta (DAL) coming out on top across the time horizon and Southwest (LUV) going on an especially wild ride. LUV always had the well-earned benefit of the doubt favoring its operational resilience and its lower financial risk profile, but that is slipping away of late. Now LUV has to deliver on the recovery. LUV is a topic for another day.

The booming travel and long lines and service setbacks at airports is common knowledge for many of the wrong reasons in the news, but the quarterly earnings season in 2023 offers a reminder of the upside for industry financial health. The Delta 2Q23 numbers discussed below were back to peak numbers seen in 2Q19.

The Big 3 global US carriers (DAL, UAL, AAL) were usually the focal points for the industry over the decades (as more majors disappeared and were consolidated). Away from the Big 3, Southwest was viewed as a uniquely strong low cost carrier who redefined the industry. LUV dominance on many routes and its distinctive operating strategy inspired more than a few competitors with variations on their approach (including JetBlue). In the current market, however, LUV has been dragged down by a range of problems from its fleet (all 737 fleet) to its lagging technology and structural underinvestment in systems. LUV’s systemwide problems during the recent spate of challenges for the company have reeled in their performance in the markets.

Below we expand the peer group of equity comps and look at more time horizons. We line up the company equities in the peer group chart in descending order of total return for the 1-year period. Since the end of 2Q22 through 2Q23, much has been going on from fuel costs to aircraft delivery challenges to more direct influences such as phased out COVID restrictions in many global markets.

The stock returns from the trailing 1-month back to 5 years underscores the pain of COVID with all 6 major carriers listed as having negative returns over the trailing 5 year period and badly trailing the broad market indexes during that 5 year time horizon. The major airline peers are framed against the S&P 500 and an equal weighted S&P 500 ETF (Invesco RSP). DAL is on top vs. the majors for the trailing 1 year, 3 year and 5 year period. We don’t show a trailing 10 year in the chart, but that has LUV modestly ahead of DAL with those two well ahead of the pack. The YTD performance of DAL, UAL, and AAL highlights the strength of the Big 3 stock performance tied to an impressive recovery of international travel.

Since mid-2022, the industry has rallied but with a big part of that rally YTD 2023. JetBlue (JBLU) and LUV have lagged badly over the trailing 1 year and YTD. We will hear from UAL and AAL this coming week as international and premium travel in general have been major factors along with rebounding leisure demand, lower fuel, and minimal COVID scares so far.

The major US carriers in general have been generating very strong numbers in their financial recovery, but the balance sheet damage to be repaired will need every dollar of this impressive earnings and cash flow rebound to reduce debt, offset rising labor costs, and to brace for any cyclical contingency and aviation fuel backdrop.

A few other wildcards along the timeline since 2019 include the Boeing production chain crisis and especially the disruptions in the 737 program. The airline industry also faces the unavoidable reality of an aging aviation infrastructure. That problem has been getting analyzed to death for years by regulators and industry experts as inadequate and remains under a cloud calling for massive upgrades.

In the meantime, the blocking and tackling story is about “Price x Volume” first and then “Revenue – Expenses”. That part of the industry story is going very well for the airlines and Delta right now. The healthy financial profile of Delta is that simple in many ways even if the road to repairing balance sheet health is more discretionary and overlaps with shareholder interests. DAL has been very clear that debt reduction comes first since that process benefits shareholders. The numbers from Delta as the first major to report reinforce that the year will be a very strong one as the summer season keeps on cranking out record numbers for Delta.

DAL 2Q23 results came in with upward revisions in guidance and a reiteration of the $3 bn free cash flow target. As we detail below in the metrics section, DAL saw + 18% YoY growth in volumes (RPMs) and plunging fuel costs that make for a good earnings backdrop. Load factors underscore the demand side that flows into pricing flexibility in the system.

Domestic travel (68% of passenger revenue) has been strong, but international volumes have been exceptional. That is notably the case in the trans-Atlantic business with DAL Atlantic volumes at +65% on passenger revenues, +41% on RPMs, load factors +4 points higher, yields up 17%, and “PRASM” (essentially unit revenue) up by 22%. Atlantic passenger revenues are 21% of total passenger revenues and benefited from the rollback of international COVID testing requirements. LatAm (7%) and Pacific (4%) combine for 11% of passenger revenues and have also shown superior unit revenue and load factor trends versus domestic.

The above chart shows a timeline for a collection of the usual key operating metrics that capture volumes (RPMs), fleet utilization (load factors), fare structures and unit revenues (yields, TRASM) and cost structures (CASM and “CASM ex”). The main takeaway is that the news is obviously good considering how much political and media noise there has been in this sector around labor costs and airport meltdowns. DAL guided to lower nonfuel unit costs in 2H23 on its earnings call while holding to mid-teen operating margins in 3Q23.

With such demand for travel, there is no question it is a good time for unions and labor to ask for a lot. They will after all get a lot since there are massive profits to generate and they have leverage at the table. Delta for its part highlights its very strong profit-sharing programs and the fact that it was the first of the Big 3 to successfully close a pilot collective bargaining deal. Striking a deal and getting it ratified set a template for the other pilot unions and associations.

The pilot deals are a mix across the Big 4. Along with DAL, UAL works with the Air Line Pilots Association (ALPA). American works with its Allied Pilots Association. Both UAL and AAL recently struck deals well after DAL, and the ratification process continues for those two. The Southwest Airline Pilot Association (SWAPA) contract talks had grown very ugly of late. That one has been especially tense.

The wage and benefit battles will get fought as they usually do across the various union groups, but labor has better cards this time around. The ability to recover such costs (labor or fuel) in fares given the pricing power of airlines is evident in margins being back at mid-2019 levels for Delta.

The fuel factor…

Fuel has aways been on securities holders’ radar screens since the first Gulf War (late 1990/early 1991) sent industry icon Pan Am into oblivion. Delta was a major beneficiary when it picked up some of the most attractive European assets. The industry has been more resilient to fuel costs and war travel fears this time around after those experiences and the upheavals of the early 2000s in the Middle East after 9/11 and later Middle East conflicts. Then again, COVID was all-new ground.

Fuel is a critical driver of expenses as well as fares, and thus the “CASM ex” metric to frame unit costs ex-fuel. For Delta, the fuel expense line was lower by $707 million in 2Q23 YoY on a GAAP basis. With 997 million gallons consumed by DAL in 2Q23 (1.89 billion gallons in 1H23), it is easy to see the scale of numbers with a YoY decline for DAL in 2Q23 of $1.22 per gallon. A $1 move in that quarter translates “in isolation” into almost $1 bn in operating expenses and earnings exposure for a company that had pre-tax income of $2.3 billion during the quarter.

The words “in isolation” are important since the logical question is “How do fuel prices as a variable cost impact fares?” That gets back to the supply and demand side of the question by routes and the level of competition. It is one reason why the Department of Justice has a stroke every time someone seeks to merge and more lately to buy a low-cost carrier (e.g., Spirit Airlines by JetBlue after they stepped in front of the Frontier deal).

With more competition, there is more room to see more of the fuel cost savings flow to the consumer via lower fares that come with lower fuel costs. With less competition, the fuel flows to the bottom line for the carrier. The history here has been traveled before with the fare wars of the early 1990s as price leadership was getting murky in the face of low cost carriers seeking to grow.

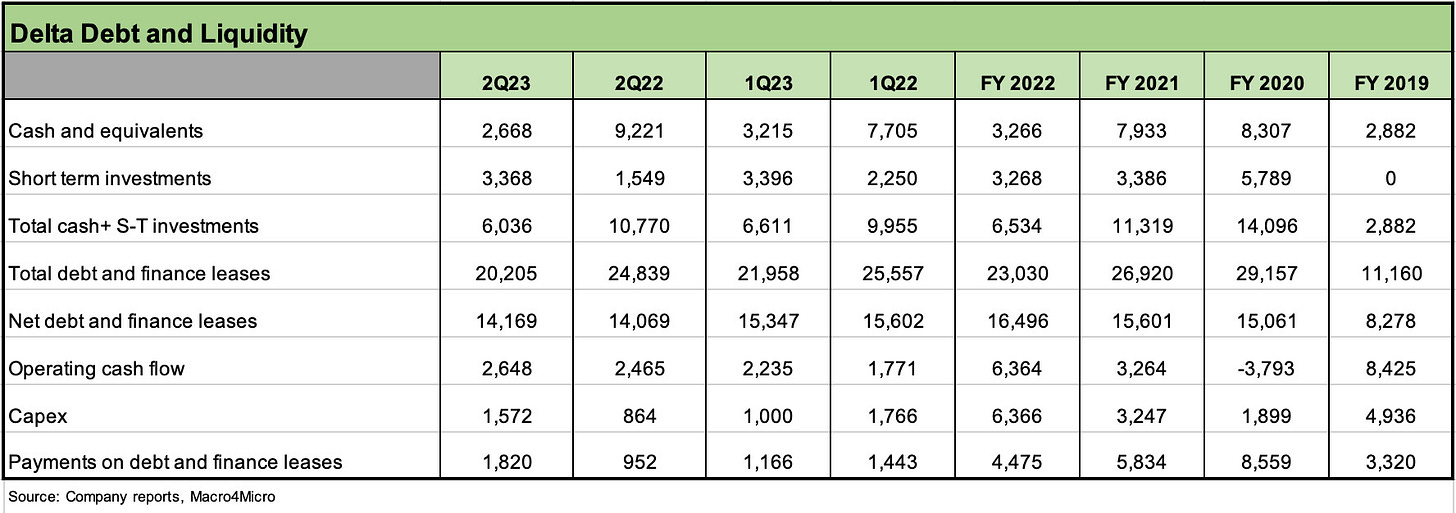

The easy news in 1H23 was the repayment of around $3 bn in debt including $1.4 bn in early repayments of high-cost debt maturing after 2023. Credit ratings outlooks were revised upward during 1Q23. Unsecured notes of Delta carry a BB1 composite rating. Leverage (Adjusted Debt/EBITDAR) declined to 3.2x at 2Q23 from 5x at year end 2022 on debt reduction and soaring earnings. The expectation is to hit 3.0x by year end and closer to 2.4x in 2024.

The healthier balance sheet and high free cash flow also resulted in a resumption of dividends at 10 cents per share. The dividend had been suspended back in March 2020 with the pandemic when the payout was at a 40.25 cents quarterly rate. The current dollar payout on an annual basis would be around $260 million vs. the $980 million paid out in 2019. While small in magnitude, the dividend opens up the investor base to funds or investors requiring a dividend.

The pension profile has radically changed in recent years as well with the pension to be fully funded on a GAAP and cash basis in 2024 (the two sets of books, GAAP and ERISA). GAAP unfunded pension obligations declined by $1.5 billion in 2022 to $90 million at 12-31-22 primarily on higher discount rates and a $4.6 billion actuarial gain. DAL contributed $1.5 bn to the plans in 2021, and that was part of lowering unfunded obligations from the $6.1 bn posted at the end of 2020.

Free cash flow story drives balance sheet improvement…

The good news is that debt reduction has been a cornerstone of the strategic priority list that can be traced to the balance sheet and cash flow statement. In its recent Investor Day, Delta laid out a clear plan to get down to the 2x handles on Debt/EBITDAR leverage by 2024. The average leverage was 2x handle from 2017-2019 (1.7x LTM June 2019), will be 3x for 2023, and plans for less than 2.5x by 2024. DAL stated on its call that any upside to free cash flow would be deployed to even more debt reduction. That sends a message to stockholders that lower debt and reduced financial risk will reward them as well.

The key is the $3 bn in free cash flow guidance in 2023, over $4 bn in 2024, and another $4 bn in 2025 with a declining debt balance framed against rising earnings. To get there, the relative asset encumbrance level will be reduced through debt reduction and refinancing. Refi and extension of debt is subject to prevailing rates and where the UST curve migrates. DAL is targeting $25 billion in unencumbered assets by 2024, up from an average of $15 bn across 2017-2019.

Capital structure evolution…

The timeline of the balance sheet trends since 2019 tells a stark story of the need to borrow to plug the gaping cash flow hole created during the COVID crisis. Year end 2019 total debt (ex-finance leases) was $10.1 billion at 12-31-19, and that spiked to just under $28 billon by 12-31-20. That is the starting point for the journey back to financial viability. That same “debt footnote” number for total debt (ex-finance leases) was $18.6 billion at 2Q23. That is $9.3 billion lower in total debt from 4Q20 to 2Q23. That is more than a big dent in the debt burden, and it can continue absent exogenous shocks that crush current travel patterns.

The variety of debt line items that were generated in 2020 are a testament to creative bankers and treasurers but also to no shortage of government support. Back at the end of 2019, the debt footnote was basically about unsecured notes at 55% of the total debt number with equipment certificates/notes another 28% of the debt and Special Facilities Revenue Bonds another 14% with some small “other” categories for the remainder.

The borrowing programs to assure survival in 2020 demonstrated the revenue and asset depth of the airline franchises with a very big assist from the government on payroll support programs (PSP) comprised of grants and loans related to COVID. We can’t address them all in this note, but the SkyMiles asset secured borrowings ($9 bn in 2020); the financings (bonds and notes) secured by slots, gates, and routes (approx. $5 bn in 2020); and the increased balance of revenue bonds during DAL’s rebuilding program (another $1.5 bn in 2020) piled up on the right side of the balance sheet. Those are being whittled down across time including tenders in 2022 across secured and unsecured.