Auto Retail and Carvana: Shifting Auto Retail Dynamics

Excerpt from Footnotes and Flashbacks: Week Ending Feb 24, 2023

Carvana is back with another very bad quarter…

We had looked at Carvana and shifting dynamics of the used car markets in past commentaries (see Carvana: Wax Wheels 12-8-22, Market Menagerie: The Used Car Microcosm 11-29-22.) The latest 4Q22 report just keeps the heat on some directional changes as the reality of the day for a company that has seen its stock plunge from $370 in Aug 2021 to an $8 handle to end last week. We also looked at the main Auto Retail themes at some length in a recent comment (see Footnotes and Flashbacks Week Ending Feb 17, 2023) where we framed how well the major players were doing in their new vehicle sales operations and materially outperforming the markets.

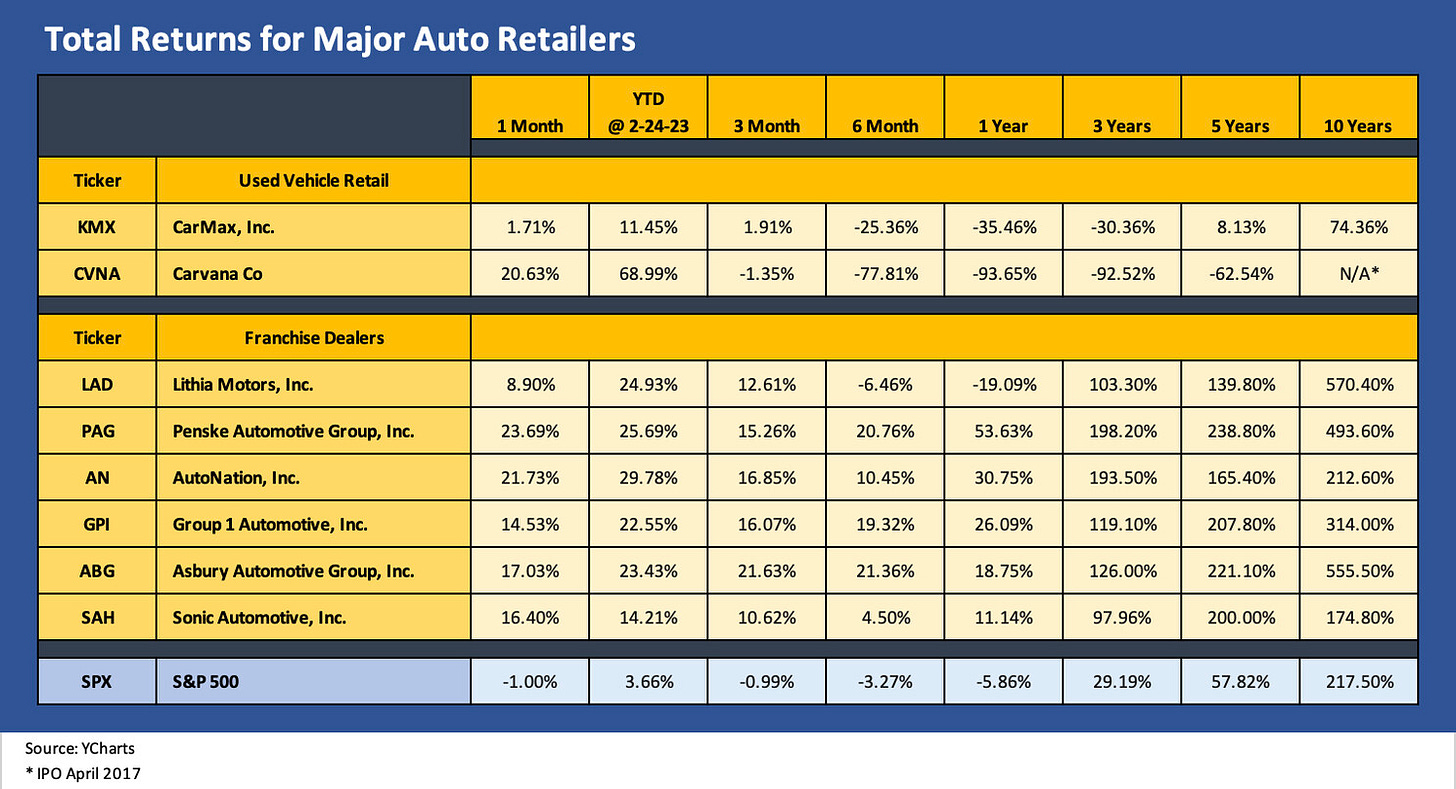

Some of those major players have invested heavily in any combination of online retail channels and used car operations including dedicated branding of used car retail units. Lithia and Sonic were the most aggressive in that area, and their stock hiccups affirmed that the used car investments are a longer-term payback period given recent trends. As the chart shows, both Lithia and Sonic have still had exceptional runs despite some used car setbacks. Lithia has been especially aggressive in investing in online used car retail. Industry used car leader CarMax is also showing some wear and tear. CVNA is squaring off with some large well-capitalized players.

The track record looking back a year tells the story for CVNA. The same for the 6 months period. The company bounces off lows occasionally with big percentage swings, but that is for a company that hit a $370 handle in Aug 2021. As with the earlier commentary on Anywhere Real Estate, some business lines in Auto Retail are going through rapid changes in distribution and ecommerce initiatives that require a lot of investment to compete with upstarts. In some cases, those investments are “just in case.”

Every edge will count in the competitive game for the major retailers, and the online players have been badly battered. Those sorts of setbacks for squaring off with large asset-risk incumbents is hardly a new development. It was true in online trading for bonds, in online retail banking, in online retail generally, in online stock investing, in online residential brokerage and in online used cars retailing. We see a trend in there somewhere. The trick for some (not all) of the incumbents is to neutralize the “new guy’s” strategy, take them on head-to head (or enough to make them feel it and dilute some of their innovator and disruptor gamesmanship), and exploit every advantage you have from your legacy business.

The problem for Carvana is that the incumbent auto retailers have a long list of legacy business advantages and most notably a natural source of vehicle supply on trade-ins and lease returns. They also have materially higher credit quality, established parts and services operations, established F&I business lines and deep management teams.

Asset protection helps when a company is expanding and needs to keep investing to serve its geographic reach for more customers and vehicle sourcing. The legacy auto retailers also have a ready source of new revenues and geographic expansion through the recurring M&A and estate planning of so many privately owned small dealer groups. The large public dealers just keep growing and have a growing supply of new and used vehicles to run through their own channels.

If this were Howard Cosell, he would be screaming “this fight must be stopped” (add his distinctive voice over). For CVNA, the super voting stock and recent moves to protect tax benefits as a defensive measure will keep this fight going. The franchise has value as an operation, but the debt-heavy balance sheet against consistently negative EBITDA is not an aphrodisiac for a bidding war.