UAW and Autos: A Big Week for Wins

The UAW detailed some major progress on concessions. They are winning...

The UAW is winning the fight for supersized raises, elimination of tiers, COLA, and job security in what is shaping up in substance as a return to the Jobs Bank years and labor as a fixed cost.

Collective bargaining says you get to exercise your market power when you have the edge, and the UAW certainly has the edge and is sprinting (not leaning) into it.

The apparent progress being made in the “right to strike” means the legacy Detroit 3 sure better execute successfully on their plans.

The long shot ambitions for a return to defined benefit plans for post-bailout employees and a raise on pension benefits for all is still the White Whale for the UAW but a potential red line for at least GM.

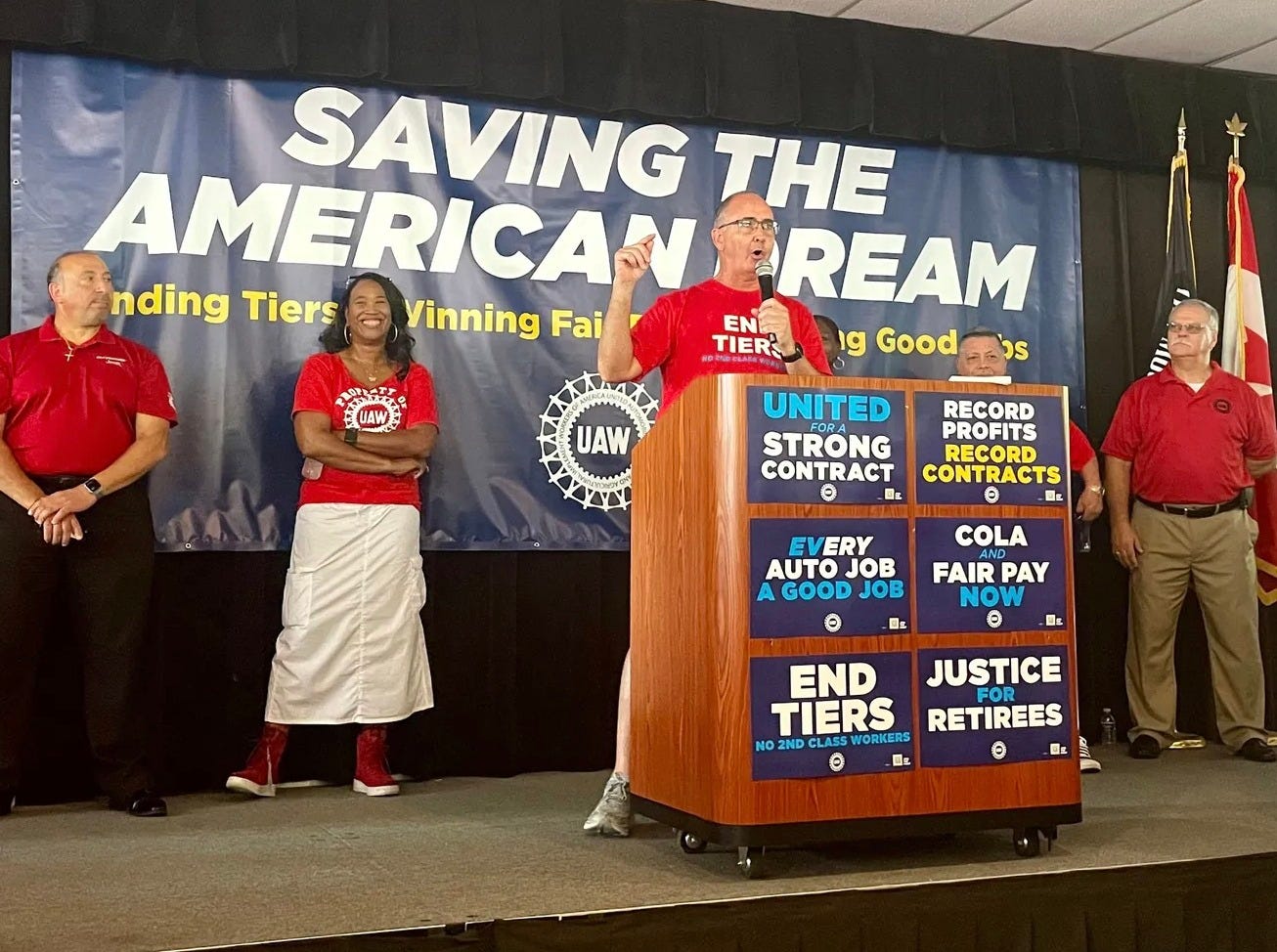

In the age of social media, the ability to make a process transparent has handed the UAW leadership some great tools to keep the rank and file pumped up and confident while also telling its story to the public. Whether you agree with him or not, UAW President Shawn Fain is doing a masterful job at it. His tone is one of a real populist as are the demands he is making (not a fake silver spoon/platinum ladle populist like some who dominate the headlines).

So far, Fain and the UAW are clearly winning this fight with the legacy Detroit 3 (“D3”). His weekly social media blasts with the Friday live statements featuring contract progress deadlines have been very effective. This week’s was a doozy for those who may have missed it. Below we summarize the main points:

GM blinks on battery plants and UAW demands for a “just transition.”

Fain cited the plan to shut down GM’s Arlington Texas plant (assembly of the iconic full-sized SUVs) with a strike as the trigger point that extracted some important concessions from GM. With concessions in hand or progress on key issues, Fain called off the planned strike in his weekly game of plant roulette. The victory lap saw him announce that GM agreed to place the EV battery manufacturing work under the GM UAW Master Agreement.

That is a huge win for the UAW on the battery plants but also assures that the plants will not be cost competitive with the transplants in a subsector of the market that has been mired in price wars. For the UAW, that GM concession falls under the heading of a “just transition.” The UAW won that one.

As we have said before, all is fair in love, war, and collective bargaining. Fain cited GM’s desire to wind down ICE engine/transmission plants and then roll volumes into low-cost battery plants. The UAW just pushed back.

Pro forma wage numbers keep on rising…

Fain cited progress on wages. The new wage offers are 20% or more with 23% at Ford while GM and Stellantis are at 20%. His bragging rights include the fact that the offers are 2 ½ fold where the offers started.

COLA is gaining traction…

Ford and Stellantis have agreed to COLA according to Fain while GM is not there yet. COLA is controversial in a market where comparisons to inflation-cycles-gone-by in the 1970s have been common. Stagflation was heavily impacted by COLA being in so many union contracts. The term “wage-price spiral” conjured up a lot of bad images, but COLA is a much smaller part of the US labor picture now. The D3 can hope the Fed gets inflation under control (so far, so good) or at least hope that they still have the pricing power demonstrated in 2023 (despite a pocket of EV price wars).

Tiers and Temps going the UAW’s way in part… “Progression in progress”

The UAW is battling for wage raises for “temps” to $20-$21 per hour at the D3, but the UAW is still fighting for commitments on converting temps to full time. This temp issue also ties into the wage tiers issue for full-time employees. Longer term, the UAW does not want groups of UAW members with competing trade-offs in wages and benefits. They need to show they also fought hard for pension and health care for all workers.

If tiers are eliminated and more temps become full time, that is a literal multiplier effect on wages and benefits and a material hit to the cost line and margins. When GM and Ford are promising material cash payouts to shareholders based on free cash flow, you can see what the UAW brings to the table for leverage on behalf of the employee stakeholders to leverage concessions. Welcome to the return of the zero-sum game.

The “progression” topic was flagged by Fain and relates to the timeline of workers to get to the top of the pay scale. Before this deal, the timeline was 8 years. Per Fain’s statement, the timeline has been cut to 3 years at Ford with GM and Stellantis at 4 years (so far).

Profit sharing remains a battle…

This lacked specifics, but Ford and GM were looking for concessions here and the UAW said, “HELL NO” (all caps were Fain’s). This one seems in flux.

Job Security a mixed picture…

The right to strike and related progress for the UAW was murky. They claimed Ford made some concessions on the right to strike over plant closures, but the description of GM and Stellantis terms were murky at best. Allowing unions to strike mid-contract over plant closures would be risky to any exposure in a cyclical downturn. That should in theory be a “for sale” sign on D3 securities if they face both massive pay increases and an inability to adjust their cost structure for any deep recession or model failure.

For the UAW, one way around the strike rights for plant closures might end up being a return (in substance) of something equivalent to the Jobs Bank plan of years gone by. You get paid almost all your salary whether you are working or not. The right to strike on plant closures means they can negotiate some combination of very high “buy downs” and/or model commitments (or no more Mexico, etc.). Overall, that means materially higher breakeven volumes for a given price structure and mix.

Pension and OPEB…

Fain reiterated the UAW demands for a return to defined benefit and OPEB plans. The demand includes pension pay increases for the legacy employees on the pension plans and reopening the old plan or setting up new defined benefit plans for the new tiers of employees and temps who convert to being new employees. This would bring a major new debt-like structural overhang into the picture. Ford cited a $7 bn cost disadvantage vs. competitors in its March teach-in on new segments. Defined benefit pensions and OPEB would not help.

On health care, we covered that in our earlier commentaries, but a return to OPEB would be a flat out negative for equities and credit quality. The OPEB commitments have more claims risk teeth under collective bargaining than for salaried workers. The transplants have an inherent cost advantage already in unit costs all-in, but more OPEB payouts would add to that. Some transplants have programs such as capped stipends that the workers can use toward Medicare. One challenge in OPEB is the retired workers who are not eligible for Medicare (e.g., the 30-year employee who retires in his 50s).

The health care problem was one of the drivers that sank the Detroit 3 in the new millennium. The transition from OPEB to the VEBA plan in 2007-2008 funded by tens of billions in debt and equity is a topic to revisit on another day, but those VEBA plans at GM and Chrysler were bailed out also. Ford sucked it up and paid those notes down (and refinanced) as early as 2010. GM’s massive burden on VEBA moved over into the “new GM” created during the Section 363 Chapter 11 game in the bailout terms. That history recap is for another day.

Recent Research:

UAW: Going to the Mattresses 9-23-23

Autos: War Stories & Anecdotes 9-23-23