The BB-BBB Divide: Manageable Gap

The speculative grade divide is hanging around the median in what is arguably not a median risk backdrop as IG bonds are back in favor.

Quality Spreads: The BB-BBB Divide Revisited

In parallel to our updated analysis of the Hi-Lo HY spread differentials for BB vs. CCC tier risk premium (see BB vs. CCC Spreads: Choose Wisely 1-8-23), this commentary takes another look at the less volatile but critical relationship of the BB and BBB tier. We addressed this history in an earlier note (see The Speculative Grade Divide: BBB vs. BB Differentials 11-22-22). This updates the relationship.

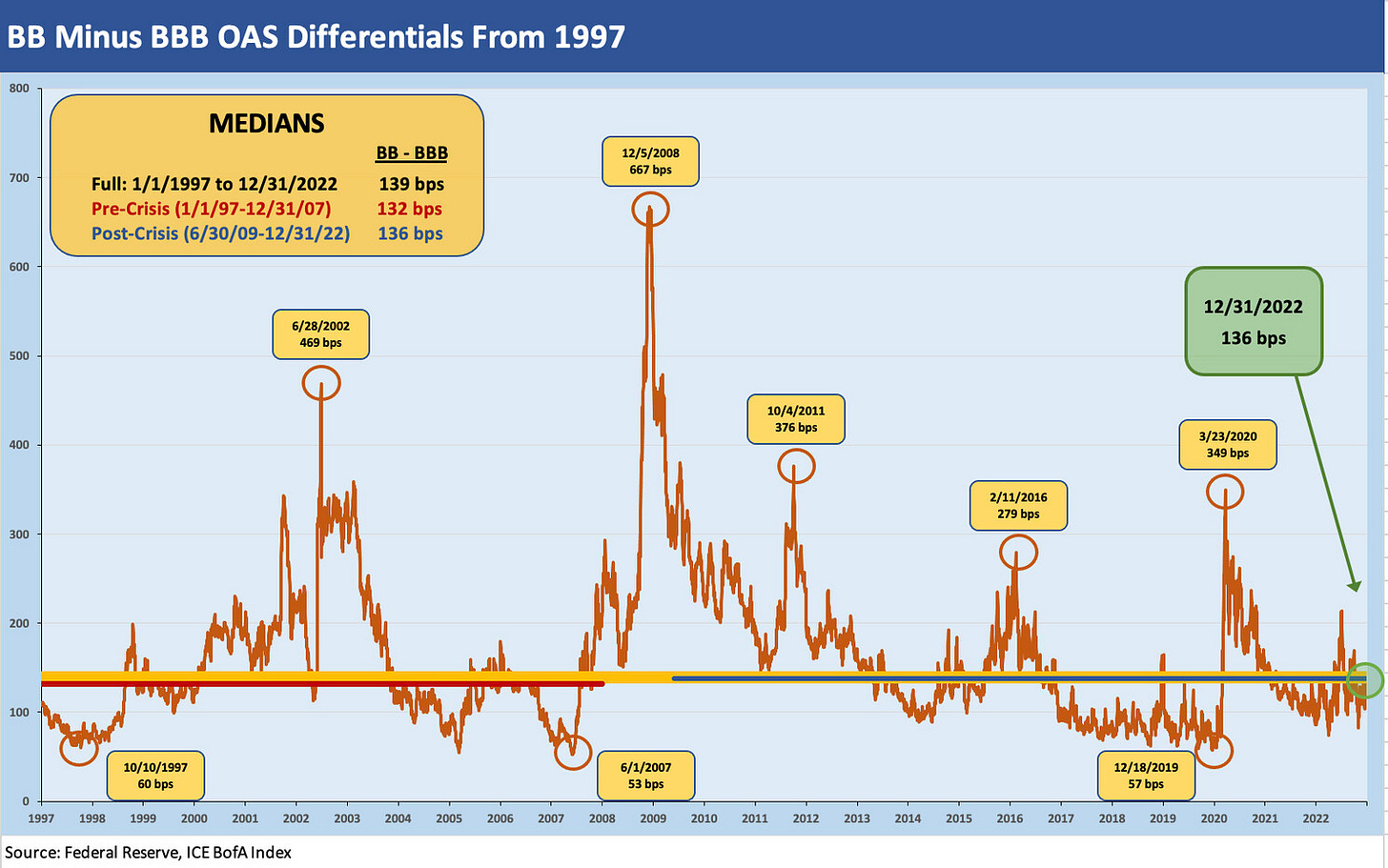

The spread differential chart below (“BB OAS – BBB OAS”) tracks spreads from 1997 through year end 2022. We plot the timeline from the TMT bubble and then across the housing boom years, the credit crisis, past COVID, and into the current expansion. The timeline includes the longest expansion and longest recession since the Great Depression.

The patterns are similar but of course less extreme. After all, the market events that skew to the downside push all quality spreads wider as real (or perceived) credit risks spike higher. In the OTC corporate bond market across the riskier credit tiers, the fear of heavy selling spills into anxiety around defensive pricing by market makers that anticipate more sellers and do not want to get caught long too early in any expected repricing cycle.

The chart above highlights a long term median of +139 bps between the two tiers and that is very close to where the year closed. We add in two other medians including a 1997 to 2007 median at +132 bps. The period of that median ends at the 12-31-2007 cyclical peak. We then pick a time frame from June 2009 (the cyclical trough) through the end of 2022. That median of +136 bps is pretty close to where we are now in the market and where the long-term median and pre-crisis median played out.

Below we update the time series for the peak and trough spreads for the two credit tiers. We then provide some historical color on the cyclical timeline.

The easy, brief summary of the chart and key dates…

TMT implosion: The peak in June 2002 is well into a period that produced the longest “default cycle” in US HY market history. The above-average default extended well into the next expansion. Technically, the recession ended in March 2001, but Greenspan stayed very locked in on supporting the markets well into overtime and the expansion (see Greenspan’s Last Hurrah: His Wild Finish Before the Crisis 10-30-22).

The angels were falling fast and furious in the summer of 2002, but the peak event was the WorldCom fraud that hit the headlines in June 2002. WCOM was downgraded along with a number of (formerly) Blue Chip Telecom Suppliers (e.g., Nortel, Lucent, etc.) as were some controversial issuers (Tyco was downgraded in June 2002. Arrests came later in 2002). The peak date noted above comes around the same time when WorldCom announced a massive restatement based on capitalizing billions in expenses and in turn dramatically inflating their earnings.

As a recently downgraded fallen angel, WorldCom and its fraud sent confidence plunging in accounting quality and auditor competence. The telecom and wireline connection infected other major BB tier TMT names as well. Everyone feared accounting quality disasters lurked everywhere. In one day, I recall WorldCom repricing the entire US HY market by a few points as the street backpedaled and sector fears soared.

Credit Crisis and the Bank/Broker spiral 4Q08: This has been picked over in books, movies and historical recaps, but the OAS differential spike was a reminder that IG banks had a hefty base of lower rated (speculative grade) structurally subordinated paper in the BB tier. Senior HoldCo paper was hot on the heels of sub debt in the downgrade fest as more major brokers and regionals saw their bonds getting hammered. Sometimes it is hard to remember how many banks of those days are no longer around. Numerous banks were folded into other larger banks. Some of those banks themselves received regulatory and financial support (whether they wanted the support or not).

The commercial paper dependent securities firms and legacy bulge bracket firms were all gone, were converted into bank holding companies (Goldman, Morgan Stanley), or were merged with banks (Merrill) by the time the smoke cleared. Bear Stearns was buried and merged into JP Morgan the prior March (2008) and Lehman was now gone with pieces sold off (Barclays in the US, Nomura in Europe) with a multiyear Chapter 11 process running in parallel.

Eurozone crisis and US downgrade on way to Oct 2011 spread peak: Sovereign systemic waves had been infecting the markets since May 2010 first saw Greece and then Ireland make waves. The late 2011 stretch saw a US downgrade and threats of a debt ceiling default. By the summer of 2011, the focus was on Spain and Italy. Bank issuers and HY spreads overall spiked given the short memories back to the 2008-2009 bank system whipsaw.

During the summer of 2011, some members of Congress were comfortable with a default outcome. We had a quick revisit to sovereign stress in May 2012 with more focus on Italy until Mario Draghi of the ECB spoke his famous “Whatever it takes” phrase in July 2012. That helped set off a massive risk rally and exceptional performance for bank paper. The HY market in turn threw its doors open to record HY issuance and CCC new issue volume in late 2012 and into 2013.

We hear some of those same extreme US budget sentiments echoed in 2023 as brinkmanship has now become a fund-raising strategy. The words “default” was cited a lot this past week in the House Speaker drama. The market is glad that the Senate (bipartisan) and lame duck house Democrats got the funding bill done before the changeover to what the world saw this week in Washington. The US budget wars and debt ceiling will be a hot topic in the US in 2023 at a time when Europe is laboring under recession pressures, a major war, and high inflation. Italy gets a lot of attention again these days on the short list of sovereign stress points.

Oil market crash and 2016 peak spreads: The Saudis went back to the old market share playbook they had used before in the 1980s and a crisis unfolded in late 2014 before peaking in late 2015 and early 2016. The US shale sector sent US production soaring after the debt-fueled capex explosion of the post-crisis years. With energy the #1 sector in US HY by far, that sent spreads gapping wider in BB and BBB names. A name such as Chesapeake dropped from BB to CCC and waves of coercive restructurings soon followed.

Downgrades from BBB to BB were more the issue in this mini wave of higher spreads in BB vs. BBB spreads. The bulk of the E&P HY stress points were below the BB tier in the B and CCC tiers. The peak on 2-11-16 was the low point for the US HY index as oil credits were priced in a very distinct manner from like-rated issuers and industries. Fears of selling into weak markets attached a major liquidity risk premium to oils. That also spilled over to Midstream energy names with a heavy mix of BBB and BB names.

COVID crisis: There is not much news to add here. The memory joggers are back in the seasonal infection rate information in the US in 2023. China supply chain problems are still on most investors watchlists. The more interesting angle here is that the spread differentials did not spike more and very quickly recovered. We would attribute much of that resilience to very successful coordination of the Fed (with their credit crisis playbook at the ready and well researched) and US Treasury Department as well as with Congress. Powell and Mnuchin had a knowledge of the credit markets often lacking in the world of “Econ Wonks,” and their action served to quickly stabilize credit market access and set off a refi-and-extension wave in the IG and HY sector and in the household sector in mortgages.

Wild times in TMT meltdown and the Credit Crisis…

For anyone who has been around the cycles for a long stretch (I was in credit research on the buy side before the HY index even started and long before OAS had been developed), you can think back to what you might have assumed is the way cycles should unfold. Of course, then history proves such assumptions are not the way it always plays out.

One such assumption could be that the risks reprice from the bottom up since the weakest credits are the most vulnerable. The chart above reminds us that the trouble can radiate out from the high end as well. That was most evident on the lead-in to the credit crisis where the bank system was imploding on the back of an asset value crisis (mortgages) and a potential domino counterparty catastrophe. The nature of the structured credit and subprime mortgage waves took bank interconnectedness risk and turned it into a potential bank systemic killer.

The BB-BBB spreads differential peak in Dec 2008 reflected a mix of fallen (plunging) angels with a heavy mix of banks, brokers and financials and structurally subordinated securities in the mix. Weakness in banks translates into increasingly severe credit contraction and a secondary market liquidity crisis that sends the low end of HY plunging and refinancing risk soaring. Then comes the default wave.

We would like to say we will never see a period such as the Dec 2008 peak. Then again, we just saw the House Majority Leader take 15 rounds to get elected, and even that victory was with a minority of Congress (“present” votes are not in the denominator). That has not happened since before the Civil War.

The 2011 and 2016 waves are more logical patterns in a much-enlarged BBB and BB tier. Sovereign stress is real and still present in IG sovereigns. The 2016 waves were about a commodity crash. Those can happen again, but the systemic crisis of 2008 takes some worst case, long tailed scenarios (China-Taiwan, Putin loses mind, etc.). The BBB tier is very diverse and larger than many nations’ GDPs.

The BB tier looks nothing like the TMT years of 2001-2002 in terms of issuer and industry concentration. The types of events that would give rise to such a spike need portfolio context also. The equity markets and the B and CCC tier would be doing dramatically worse in price risk if such an event (or series of events) gave rise to such a crushing outcome for BBs. The theory is also that in a newly repricing UST curve, there would be some duration benefits for the BBB tier that would mitigate the effects of negative excess returns.

The BBB and BB tiers are now the new midsection of the credit markets. The old days of “barbelled” IG/HY markets (lots of single A names and lots of single B names) are gone. The BBB tier leads IG and the BB tier leads HY in dollar share.

Our bottom line is we expect the BB-BBB differential to widen during 2023.