United Airlines 1Q23: Company Comment

We look at how very bullish guidance and a strong recovery of UAL stacks up against massive capex and a high debt burden.

“Times change…more to come.”

We look at some key points from the 1Q23 disclosure at UAL as guidance for the major carriers remains bullish.

United boasts sustained capacity expansion and pricing power in a market where jet fuel promises to remain volatile.

UAL bonds trade like gold and are likely to stay that way, but the balancing act of credit quality vs. shareholder interests is still colored by a massive post-2019 balance sheet that will only be mitigated by sustained and aggressive debt reduction.

The health of the Big 3 carriers remains very favorable on industry fundamentals with Delta on top and United a close second with its impressive performance and very healthy guidance. The equity market reaction to the UAL 1Q23 conference call and numbers was swift yesterday at +7.5% on the day as guidance was bullish and the fleet expansion plans as usual were quite specific.

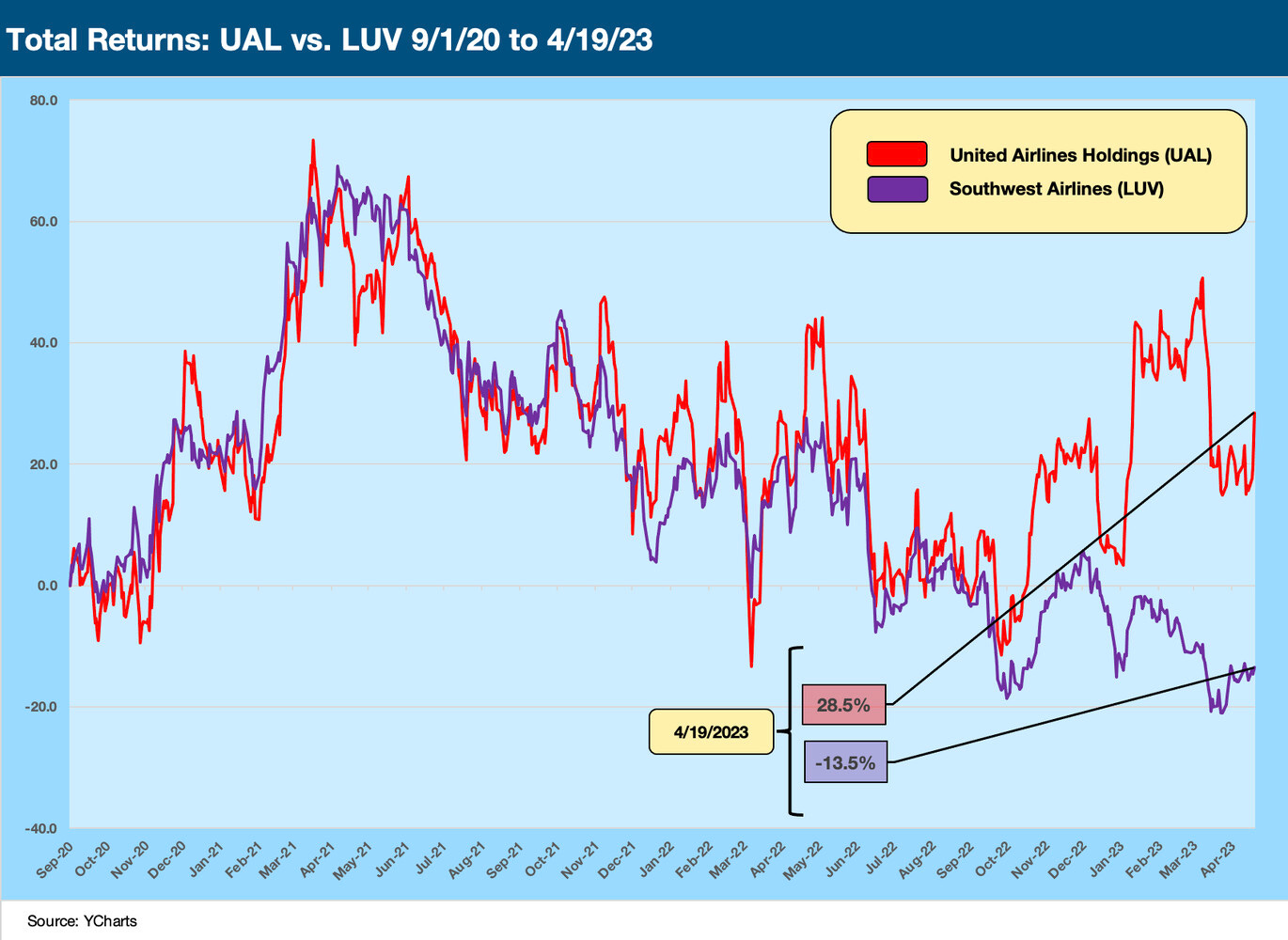

Below, we plot the Big 3 equity returns from early fall 2020 (Sept 1, 2020) just ahead of the vaccine headlines which hit the screen on Nov 9. The pattern shows everyone in the Big 3 doing well after COVID eased. In American’s case, the market awaits results and guidance on April 27. UAL came out on top for this time horizon. Delta wins if we start back in early 2019.

The lack of differentiation is consistent with the reality of the post-consolidation industry story that “when the industry does well, all the majors do well.” The UAL theme has been about fleet overhaul and a multiyear strategy to get more efficient with the next generation of narrowbody and widebody aircraft, and leveraging UAL’s strength in international to drive shareholder value.

UAL’s international presence and post-Continental hub structure (CAL acquired 2010) has always been a great part of the UAL story in the post-Chapter 11 years. We had looked at the Big 3 peer group after Delta’s earnings releases (see Footnotes and Flashbacks: Week Ending April 16, 2023), and the Big 3 equities remain in the red since the start of 2019. Over that longer time horizon, Delta stock was negative but posted some additional positive distance between itself the other two.

The years of United route network and hub evolution, ongoing fleet actions, the financial restructuring history (protracted period in Chapter 11), and the benefits of the Continental merger as travel dynamics shifted are for another day and a broader credit profile, but the news has been net very positive for UAL in 2022 and into 2023.

The Big 3 rally comes after some government support and intensive operational planning kept the Big 3 out of a fresh trip to bankruptcy court, which was important for an industry that gets Chapter 11 frequent flier miles. That is, they know the bankruptcy drill. Grounding planes and more lease defaults would not have helped the broader economy. Shutdowns on routes would have damaged many businesses and compounded layoffs and eradicated swaths of small businesses.

The strong performance of UAL equity has been impressive when framed against all the headlines of airport meltdowns, cancelled/delayed flights, weather disruptions and spiking fuel costs. “Now imagine a year without such disruptions” is the bull case. For now, UAL sees high teens % capacity growth in 2023 (18.5% for 2Q23) with 14%-16% revenue growth in 2Q23 as the near-term trend line.

UAL vs. LUV…

The outperformance of UAL vs. Southwest Airlines is another anomaly in the recent cyclical histories of airlines. UAL’s strong position in Houston and Chicago (among others) make LUV a factor for UAL just as LUV is a factor for AAL with its Texas hub (DFW). We look at UAL vs. LUV equity below over the same time period as the above chart, starting just ahead of the COVID vaccine news that turbocharged the recovery in travel.

The iconic leader of the Low Cost Carrier revolution, Southwest Airlines, is seeing some bad karma payback for keeping costs so low in an industry that is being tortured by infrastructure needs from the air traffic level down to the bookings and reservations level. As someone who remembers standing in line with a numbered, wooden tongue depressor to board a LUV flight in Texas long ago (first come, first serve), the low-cost strategy sent the industry into a multidecade secular shift (note: I was following LUV at the time). Payback comes when the lack of investment eventually takes a toll, but that is a separate story and history for the industry and especially for Southwest. LUV can certainly afford to speed up the rate of investment.

As detailed above, the balance sheet of UAL understandably exploded in the COVID scramble for liquidity. The chart frames the debt footnote version of debt (ex-leases and unfunded pensions) that shows total debt of $30.7 bn for 1Q23, up from $14.55 bn at 4Q19 ahead of the COVID crisis. Net of cash and short-term investments, the 1Q23 total narrows at $13.5 bn vs. $9.6 bn, so UAL has room to keep putting a dent in the total if it can stay in a free cash flow mode.

As the fleet grows, adjusted debt could be a different story in the trend line since lease exposure could go in the other direction. The good news on the leasing line item is it involves accretive assets in the form of new aircraft. Pensions exposure is a wildcard heavily tied to accounting conventions and the estimates, but rising rates sends the GAAP version of pension liabilities lower.

The trade-offs of credit quality vs. shareholder rewards are self-evident. Over the next two years, the capacity and pricing power factors will be watched closely to see how much progress can be made in generating free cash flow to actually pay down the non-lease, non-pension debt.

Capex has multiplied over a few years, so financial debt reduction or stabilizing cash balances is not a foregone conclusion as capex approaches $9 bn in 2023. Costs are always a wild card with jet fuel such a volatile factor and massive line item (see operating metrics below). Balance sheet planning needs to play out.

The “adjusted debt” number that UAL breaks out each quarter tells a story that also serves as a stark reminder on leverage. After factoring in operating leases, finance leases, unfunded pensions and other financial liabilities, the number rises to $38.6 bn, down from $43.2 bn at 1Q22. If we look at the adjusted EBITDA line that UAL breaks out each quarter, that is a $6.36 bn line that can make shareholders and bondholders alike very comfortable.

UAL has guided to an adjusted debt to adjusted EBITDAR number for 2023 of less than 3.0x. The free cash flow line and how much debt can be paid down includes booming capex and decisions on what to do for shareholders. UAL was questioned on the ability to generate free cash flow with such a high capex line. They confirmed that was their expectation.

For bondholders, “comfortable” does not mean complacent since the cash and short-term securities still need to be deployed prudently and cautiously in an industry notorious for volatility. Meanwhile, fleet overhauls are very capital intensive. The 2022 capex line was $4.83 billion, up from $2.9 bn in 2021. The capex line guidance for UAL in the most recent release is $8.5 bn.

The major orders placed by UAL in 2021-2022 have a long tail with deliveries of next generation aircraft and more efficient aircraft. UAL continues to shift out of smaller regional jets on many routes (notably 50 seaters) and has generated some headlines in 2021-2022 with massive orders of both widebodies (787s) and narrowbodies (MAX 10s and A321neo and XLRs). The theme is efficient and higher capacity and less RJs.

The “fine lines” on the operating metrics are summarized above with a cross-section of the usual line items (we skipped some of them for focus on capacity and pricing). We selected these with a view to highlighting the trend line from 2019 across a wild 2020 and then an eventual recovery off the COVID disruptions.

Some airlines present 3 years of income statements (as usual), but they skip 2020 and instead use 2019 as the third year in the mix. We include the 4 years above just as a memory jogger on how devastating COVID was in objective metrics terms.

The white whale for the industry is to get back to the 2019 levels on capacity and do even better than 2019 on operating income and operating performance, regain investment grade ratings, and bring more shareholder rewards into the equation. That is achievable in many operating metrics, but the balance sheet will take a few years.

On capacity, the ASM line is more important in the above metrics than the aircraft number on the fleet line given the mix (new, higher capacity planes vs. regional jets, etc.) and the utilization (reflected in ASMs and load factors). UAL gives rigorous line item disclosure on fleet and aircraft mix and guidance on capacity each quarter. The mix shift in 2023 shows expansion of the 737 MAX count with the A321neo starting late in the year. A number of the MAX and 321 deliveries originally slated for 2023 have been pushed into 2024, but capacity growth and fleet upgrades will remain the theme. The jet fuel costs are other worldly when you look at price x volume (an incremental $1 move higher in jet fuel per gallon is $3.6 billion that needs to be recovered in fares.

For United and the Big 3 overall, a few decades of mergers, global consolidation, changes in point-to-point regional travel (vs. old time hub-and-spoke) has made for a global industry that looks very different. Those who had Pan Am or TWA frequent flier miles remember how Delta, United, and American scrambled to buy the assets of those two legacy leaders of US international travel (featured in major movies and not-so-major TV series).

The UAL profile today is a strong and diverse global route system with potential for even more growth as new routes get added. When the world seems on the brink of meltdowns and trade conflicts (or invasions and island blockades), it is possible to be too comfortable with international trends.

The result for United on the other side of all those changes across the cycles is a very strong international network. As cited by management in the 1Q23 conference call: “…long haul is moving into the lead over domestic” given the growth rates, new routes, premium services, and more opportunities for UAL. Some legacy routes are struggling with Europe under pressure, and the geopolitics of Europe and Asia are not exactly stable.