Magellan Finds ONEOK: Company Comment

We look at the OKE/MMP deal in industry context as M&A comes back to life in midstream.

"How do we get to ONEOK?"

The ONEOK deal for Magellan might get stock investors in the space handicapping if this starts a trend even if heightened M&A would put bondholders on a mild alert.

A sector renowned for acquisitions across the decades and then a capex boom sees some fresh M&A in a sector searching for growth multiples.

The midstream issuer base has been characterized by high free cash flow generators since the capex cycle peaked and matured and new projects saw too many regulatory headwinds.

ONEOK made a major move with its $18.8 billion deal to acquire Magellan, a midstream operator long considered one of the higher quality assets in the space in the next size tier below the largest players. The headline version of the story is that OKE/MMP is a prudently financed deal (63% stock/37% cash) with synergies more tied to tax than rationalization.

The deal extends and diversifies the reach of the combined entities across more basins and end markets and more hydrocarbon buckets (crude, natural gas, NGLs, refined products). More size, a more diversified infrastructure base, broader regional breadth, and more free cash flow is a good start. And all wrapped up inside two companies that had been reasonably solid equity performers is not such a bad story to work with for bondholder comfort.

Both MMP and OKE are investment grade even if leverage is higher than some BBB peers. The pro forma 4.0x leverage metrics by year end is one that we don’t find aggressive at all given the free cash flow generation and depth of asset protection. In their presentation, OKE/MMP broke out the tax based synergies that supported free cash flow and their capital allocation programs that will leave $1 billion per year in free cash flow after dividends.

The reaction of the stock market was decidedly negative as evidenced by the ONEOK stock selloff (-9.1% on the day) with the financial media chatter mentioning the lack of commercial overlap and a full price for OKE to pay. MMP is regarded as a very good company in the midstream space, but MMP was a stock which often was tagged as rich by equity analysts. The risk of overpaying was in the conversation. As we cover below, OKE has also been an exceptionally strong stock performer, and a big M&A deal can get the “sell first, ask questions later” treatment.

The new entity has been described as the #2 “US pipeline company” based on market cap. Having followed the pipelines in the 1980s and 1990s, I was pleased to see the term “pipeline” in the headline rather than “Energy Infrastructure” or “Midstream.” I had thought it had gone out of style.

A look at the midstream equities…

Below we plot the path of OKE and MMP across a very busy mix of cycles for both upstream and midstream since 2011. We stop the total return clock at Friday, May 12, for this chart below before the Monday deal news and OKE sell-off.

On a disclosure note, I owned stock in both of these companies in 2021 and into 2022 and sold them at a profit. I probably should have held on longer, but I was getting spooked on the overall market and sold most of the Midstream along with the Upstream holdings. They were green (beats red!) and I wanted to build cash on an asset allocation view.

ET, MMP, OKE, EPD, and MPLX were my favorites. I was active in WMB and KMI, but those two had a tendency to really swing around. Both were disappointing but I got out of WMB at a gain before a bigger sag later. KMI just limped lower and has been a poor performer. WMB had a good brief run then did the big fade. Enbridge and TC Energy struggled despite their many attributes and scale. TC Energy makes Enbridge look good. Select names have ups and downs, but this sector is a logical fit in an income portfolio. There is diversity across the asset mix, regions, operating focus, and strategic game plans. I currently do not own OKE or MMP.

I mention the portfolio exposure for transparency, but the sector still has a lot of attraction if we can get past the Congressional think tank not blowing up the world (see Footnotes and Flashbacks: Week Ending May 12, 2023). The value of income in a less volatile energy subsector than upstream has some allure in what could remain a very uncertain market for the economic cycle as well as for oil and gas commodity prices and for energy policy. The attraction of healthy and safe dividends and fee-based revenues is clear enough.

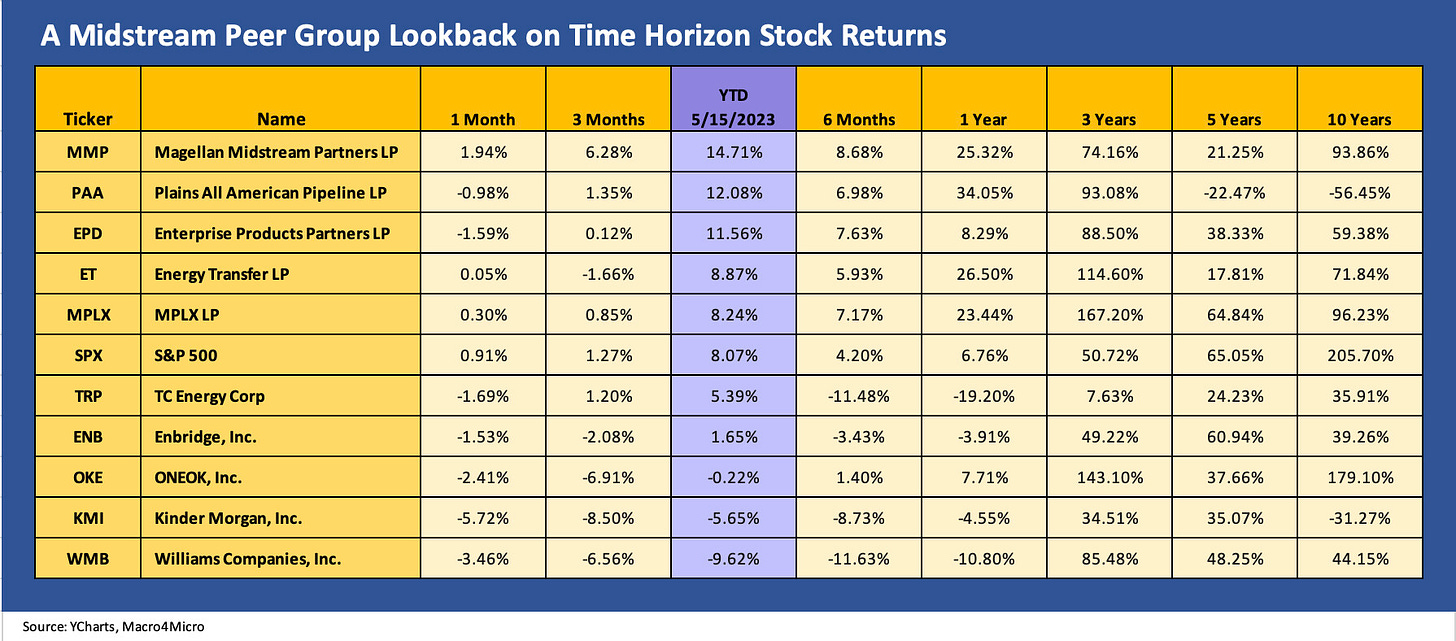

The detailed peer group returns above includes today’s results (5/15/23) with the OKE/MMP merger. We line up the companies in descending order of YTD total returns. The YTD period shows a wide range from high (MMP at +14.7%) to low (WMB at -9.6%). Liquids have led the pack.

The Midstream equity performance shows some notable dispersion across the group with the major refined products players and NGL leaders delivering solid results. Those best positioned to ride the Permian wave also showed solid growth across time in a frenzy of capex and M&A across the past decade. Most of these major names were well positioned when the capex programs slowed, and free cash flow climbed. The private equity players also were investing in assets and new, smaller players were entering the public markets that might make natural roll-up targets.

The good news for credit quality with all the free cash flow had the side effect of undermining equity valuations as investors raised questions of how this sector could get back to a growth multiple with production levels topping off in numerous basins and more midstream capacity coming online. The spike in capex and breakneck pace of growth in the early years left some unrealistically high expectations on equity terminal value. The 10-year time horizon in many models could not keep moving the goalposts. The result was some very disappointing stock performances vs. early stock price targets.

One of the bigger disappointments was KMI over 10 years. Looking back 5 years, we see ET let down investors. ET has been a good comeback play over the last two years. More recent periods have been muted for this group into 2023. The timeline in this chart could fill a few novels on the Energy sector. We will be covering more of the issuer level activities in separate pieces. Early in the time horizon captured, North American activity exploded from shale/unconventional in the US to oil sands in Canada and across all aspects of infrastructure expansion to keep pace with production growth.

When the Saudis executed on “Price War Part Deux” in summer 2014 (the first one was mid-1980s), there was a lot of turmoil in the markets and confusion around how to view the midstream players. Those are old stories for other pieces, but the second nightmare was COVID since that was about both volume and price. As the charts hammer home, OKE and MMP were very resilient across the timeline, bouncing back to what was a superior performance over 10 years and a very respectable 3 years as COVID delivered a heavy dose of energy sector pain.

The regulation on exports along the way also changed the strategic interest in NGLs as demand exploded, and that in turn drove demand for even more infrastructure from G&P to transport to export facilities. Then LNG captured the investment focus and will continue to be a global priority after the Russia-Ukraine crisis.

That downstream interest runs back along the chain to the field level and should make for some interesting trends to track for the natural gas heavy transport players separate from the G&P heavy operators and those with strong export infrastructure for a range of products.

As much as the market was unenthusiastic about the OKE/MMP deal, the concept of a much-enlarged midstream operator with a more diverse mix of markets and infrastructure from crude to NGLs to refined products at least will serve the needs of credit stability and strong free cash flow. Making a growth story out if it is a debate for another day. More diversification and more free cash flow is a very good starting point.