Residential Brokerage: Anywhere Real Estate and an Ugly Quarter

Excerpt from Footnotes and Flashbacks: Week Ending Feb 24, 2023

As last week wound down, most of the focus was on the Macro side of the ledger for inflation, another adverse yield curve shift, and how the Fed’s reaction could impact the cycle from the demand side. We had some notable industry bellwethers report. Some of the sectors have been feeling the pain more than most from the yield curve action with some of the same also seeing structural crosscurrents from the rapid shift in growth markets and how that flows into “emerging trends” in retail technologies. One of them was Anywhere Real Estate (formerly known as Realogy) and a leading real estate brokerage operation. The new ticker for Anywhere is HOUS. The other one was Carvana (CVNA). First, we look at HOUS and follow with CVNA.

Existing home sales serve as the life blood of HOUS with its commission revenue stream, and the largest publicly traded brokerage operation is feeling the macro effects. (Among the Big 3 of residential brokerage, two are private with one of them owned by Berkshire/Warren Buffet). The painful EBITDA run rates posted by HOUS at 4Q22 were even lower than the 1Q20 COVID quarter, so it was not good news. For HOUS, the near-term earnings prospects and current leverage metrics do not dovetail very favorably with industry cyclical volatility in mortgage rates and the battered economics of residential real estate affordability these days.

Hard to fight the realities of plunging volumes…

Below we include a drill down set of operating metrics for HOUS that adds a more granular twist to the existing home sales we update monthly from data supplied by the National Association of Realtors. The easy way to look at this data is that “sides” are the measure of volume (2 sides as in a buy and a sell). The home price line is self-explanatory. Price can get a lot worse in theory if mortgages keep heading north. Volume could keep dropping if prices do not move. We would argue price has worse symmetry from here than volume.

For companies such as HOUS, volume and price is revenue that is derived from commissions and royalties. There is a lot going on in the industry around tech and efficiency, so that requires sustained investments. As advanced as the tools have become, it is still mostly about “printing tickets,” and that is why so many of these firms are pouring money into tech while also offering exceptional terms to high-producing agents. The terms of deals and the value of producers sometimes undermines the natural stabilizing variable costs of a commission based business. Cost declines cannot keep pace and will be less resilient downward than in past cycles.

HOUS bonds have been battered of late with -6% excess returns MTD into the 12% to 13% range to end the week. The problems in their commission-based revenues were already flowing into the bonds even before the 4Q22 earnings. We see HOUS as in for a very rough ride in 1H23 as running EBITDA stays ugly and the turnaround in existing home sales comes slowly with mortgage rates staying high.

Last week was sobering for those hoping the bond market inversion implied rate relief was on its way soon. The idea that lower inflation expectations will show up in the Fed plan has taken a few weeks of beatings and weighed on total returns in bonds even while excess returns have been supportive. In other words, mortgage rates do not look like they will be on the side of existing home sales for a while.

We will need to drill down into HOUS in a stand-alone report given how complicated the company’s operations are in a market where legal threats to the industry have taken on the nature of a World War Z of contingency lawyers. The gamut of legal claims runs from damaging sellers to damaging buyers to violating antitrust laws. This is one of the mainstay business lines and employers of Main Street America as well as the high price NYC, LA/San Fran, and Miami crowd to name a few of the pricier metros that favor luxury tier brokers. Unlike Big Tobacco and Big Pharma in massive class action cases, the residential broker litigation does not come with a trail of bodies. There are still existential stakes to some broker names that are every bit as threatening. More on that another time.

Business risk meets financial risk…

In past years when we had worked on Realogy bonds (since renamed Anywhere in 2022 in a brand change), the main negative angles on the company’s financial risk were more about leverage and the secular pressure on the classic agent-heavy business models. The idea was that agent-heavy and bricks and mortar franchises were headed for secular pressure if not the scrap heap.

Much was made of the rise of Compass as a usurper of the luxury throne, the disintermediation of old school brokers by tech, and the rise of low cost online players that could push commissions toward 1% handles (e.g., Redfin). The theory was that Redfin with its discount commissions was going to derail HOUS, but Redfin has not been profitable since its 2017 IPO and lost money during the three years before that as well. Compass, the would-be winner of the luxury buyer, generated bottom lines that are deeply negative before and after its 2021 IPO. At least HOUS was profitable each year after its late 2012 IPO (from its LBO) from 2013 to 2018.

Then came the story that the inevitable rise of iBuyers was the new thing as the successful business model. That has failed badly so far, and in some cases in embarrassing fashion. None of the main themes worked out for the most bearish on HOUS/Realogy, but the new problem in 2023 is more about core fundamentals and basic “price x volume” issues. The critical downside drivers cut across inflation, a mortgage spike, and a rising affordability crisis for so many buyers and sellers that are heading toward the sidelines (see Existing Home Sales: Still in Freefall 2-21-23).

As the stock chart below shows, the new breed of growth companies is getting hit even harder since their IPOs. The demands to innovate and embrace tech and compete for brokers lends an ironic twist to the “all about tech.” After all, the tech theme fades when the competition to lure away brokers has been cutthroat and pressured earnings for both HOUSE and COMP.

The agent hiring battle does not change the need to invest in tech, tools and data analytics from lead generation to screening targets for maximum broker productivity. The investment demands and competition hit HOUS and generated losses in 3 of the past 4 years (without adjustments for write-offs and goodwill impairments). HOUS did post a very strong 2021 that was consistent with the high profits from 2014 to 2018.

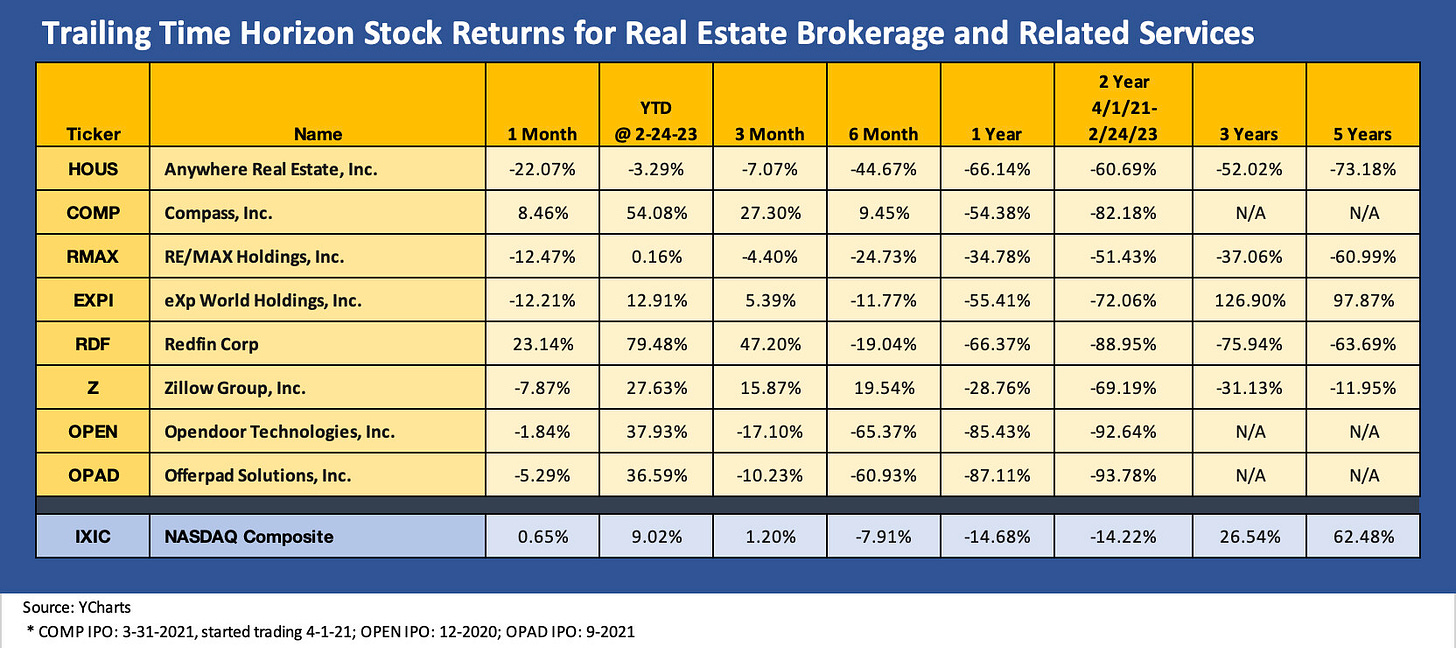

The stock chart below shows how some of the new school and old school made out over the past 5 years of constant innovation and IPOs.

As you look at the list above, most were not public companies 10 years ago, so we left that column off this one. The Big 3 (Home Services of America, Anywhere, and Keller) has only one public company. Upstart Compass just priced its IPO at the end of March 2021 and started trading on April 1 (thus the column above named “Almost 2 years” since we wanted to get COMP equity in the mix).

The level of activity in the real estate related business models is reflected in the waves of tech-centric startups and IPOs. Some of the more notable companies that have seen IPOs in the post-crisis era are in the chart above. iBuyers were crushed and more seasoned names were battered when they stuck their nose in iBuying (notably Zillow). Data was quickly becoming commoditized, so the latest web-based upstarts (Zillow) quickly looked more like incumbents.

The theory has been that the retail models on residential real estate are the most antiquated, inefficient, and thus overpriced in terms of services delivery. Those who make the case can make it sound very believable, but then they need to contend with the reality that the overwhelming majority of home sellers end up working with a human broker even if they extensively research the game plan for their transaction on the internet. Such surveys are not hard to find on the web or in the trade rags (though real estate publications are often rather axed on the topic). The empirical evidence is the agents matter.

The result of the push to add more tech to residential real estate has attracted many billion in capital from venture money to IPOs across data, transaction tech, lead generation, and all along the food chain to discount brokers looking to reprice commission structures to iBuying as the next new, new thing. Many of these ventures have made entrepreneurs and private equity backers very wealthy before the post-IPO deals started falling flat on their welcome mats in the face of their first big financial and cyclical tests. Some of those major underperformers are in evidence in the list above.

In the narrower context of HOUS, they have shown they can adapt to tech-based tools and data and exploit the services being made available through even more start-ups to arm the agents. The problem for them now is earnings and cash flow. They did a great job lowering their secured debt mix and extending liabilities, but the bonds have been battered this month. The multiples of EBITDA do not stack up well against the debt balances with bad EBITDA trends ahead and static debt levels.