Regional Banks: The Credit Crisis Contraction Theme

Excerpts from Footnotes and Flashbacks: Week Ending May 7, 2023

We are in a market now where the “micro” (regional banks, subsector risks, and issuer-specific problems) end up as “macro” since the level of credit contraction at the regional banks and/or community banks becomes a swing factor (and a highly subjective one at that) for the Fed as it is framing (or rationalizing) its decision inputs. The expectation of credit contraction was immediate as SVB crashed and the risk factor of “push-button runs on banks” raced to the top of the list.

The debate immediately turned to how long would the credit contraction take to arrive in scale, how severe it would be, and then how to frame the transmission mechanism into problems across asset classes (notably commercial real estate, where small and midcap banks loom large) and more leveraged borrowers. The weaker credits would need supportive banks if a recession does unfold whether modest in scale (soft landing or otherwise) or in the event of more threatening scenarios (debt ceiling, more Fed tightening, etc.). The regionals will face risk management constraints ahead.

A regional bank peer group stock update…

Below we update how the regional banks have performed during what was another volatile week. We have done this exercise a few times. We chose this list back during the SVB crisis peak and whittled it down over time with First Republic taken out with this week’s action. The list runs across a wide range in asset size and market caps.

We line the banks up in descending order of stock returns from March 8, 2023. That marked the last trading day ahead of the SVB deposit run and stock crash on 3-9-23 before SVB failed to open and was closed and seized by regulators on 3-10-23. That brought wild times and risk aversion scenarios continue to be debated (see Risk Appetites Get Bloodied 3-15-23).

The past week was a strange one given the volatility of a few names mixed in with some calming action in some others. PacWest had the wildest ride of the group with a plunge and rally in the last week from low price levels. After a fresh reality check with First Republic, the result of even formerly “good banks” seeing equity and holding company debt wiped out does not leave much room for handicapping depositor panic even if the wind just blows.

Corporate clients have a fiduciary duty to be extra safe and uninsured depositors have low confidence their uninsured deposits will be safe. Many assume the same on insured deposits and question whether they are safe. That is irrational on the insured deposits, but that is why they are called panics.

Those who know a sub-$250K deposit total is backed by “the government” then turn on the TV to a debt ceiling crisis. The FDIC and UST get commingled in a blur for some. You can say “trust the regulators to be on top of this,” but then you need to brace for laughter or a stream of profanity after SVB. There must be a survey out there that covers that mix of insurance fund confusion and fear of regulators missing something.

The streaming headlines around changing the laws and FDIC insurance alternatives to mitigate the bank run risk are getting a lot of column space, notably for corporate accounts and payroll funds, etc. No one ever accused the average Congressional Rep of being overly analytical (even if they passed the bar exam), and one challenge has been to cleanse the ideas for rational solutions and limit the inevitable coloring of policy actions with ideology and political axes (you can hear Senator Warren saying “I had a plan for this” and “protecting millionaires and billionaires”) or some on the right saying “no bailouts, let the market work—even if we made them not work.”

The likely outcome will be new plans to improve confidence and mitigate depositor panic risk. There will also presumably be more accountability (aka blame game) for those who decided to go easy on asset-liability mismatches. After all, the Fed, FDIC, and OCC are supposed to be familiar with the idea of duration risk, and policy makers have been busy driving that risk higher. If you are a regulator, the idea of flagging the yield curve damage gets you sucked into the vortex of bile that has become Capitol Hill. That said, competence and high standards are supposed to be more than assumed. It is supposed to be demonstrated. That box was not checked in this regional mess.

The credit contraction question…

“Tight credit” or “credit contraction” are very amorphous term. The old school abbreviated approach was to turn to the “Senior Loan Officer Opinion Survey” (the SLOOS report) or mutual fund flows. The next SLOOS report is due tomorrow (May 8), so the market will at least have a benchmark. The SLOOS is taken from “up to eighty large domestic banks and twenty-four US branches and agencies of foreign banks.” The Fed pays close attention to it.

The SLOOS universe offers a very important indicator and base of lenders, but the term “disintermediation” of the banks has been around for a reason since the 1980s. Lending/borrowing outside the banks has been one of the dominant themes that launched the corporate bond market, the HY bond market, and the tradeable term loan market, which has grown to record size today.

Separate from the SLOOS report, there is still that massive and growing base of loans from pension funds and separate accounts and broadly from the burgeoning private credit sector. The old saying that “everything is AAA at a price” comes into play and that feeds the unknowns of cost of credit pressure on riskier credits (How much is floating? How much fixed? etc.).

Private credit has been an attractive asset class for pension funds and retail investors (e.g., BDCs) on the basis that the loans on their books offer very high yields that can be flowed through as high cash generating assets to direct or indirect owners. In other words, there will still be a lot of credit available, but it just might have to be repriced in the loan or bond markets. That is when the winners and losers among the owners of loans and bonds get shaken out. The same winners vs. losers game plays out for the borrowers.

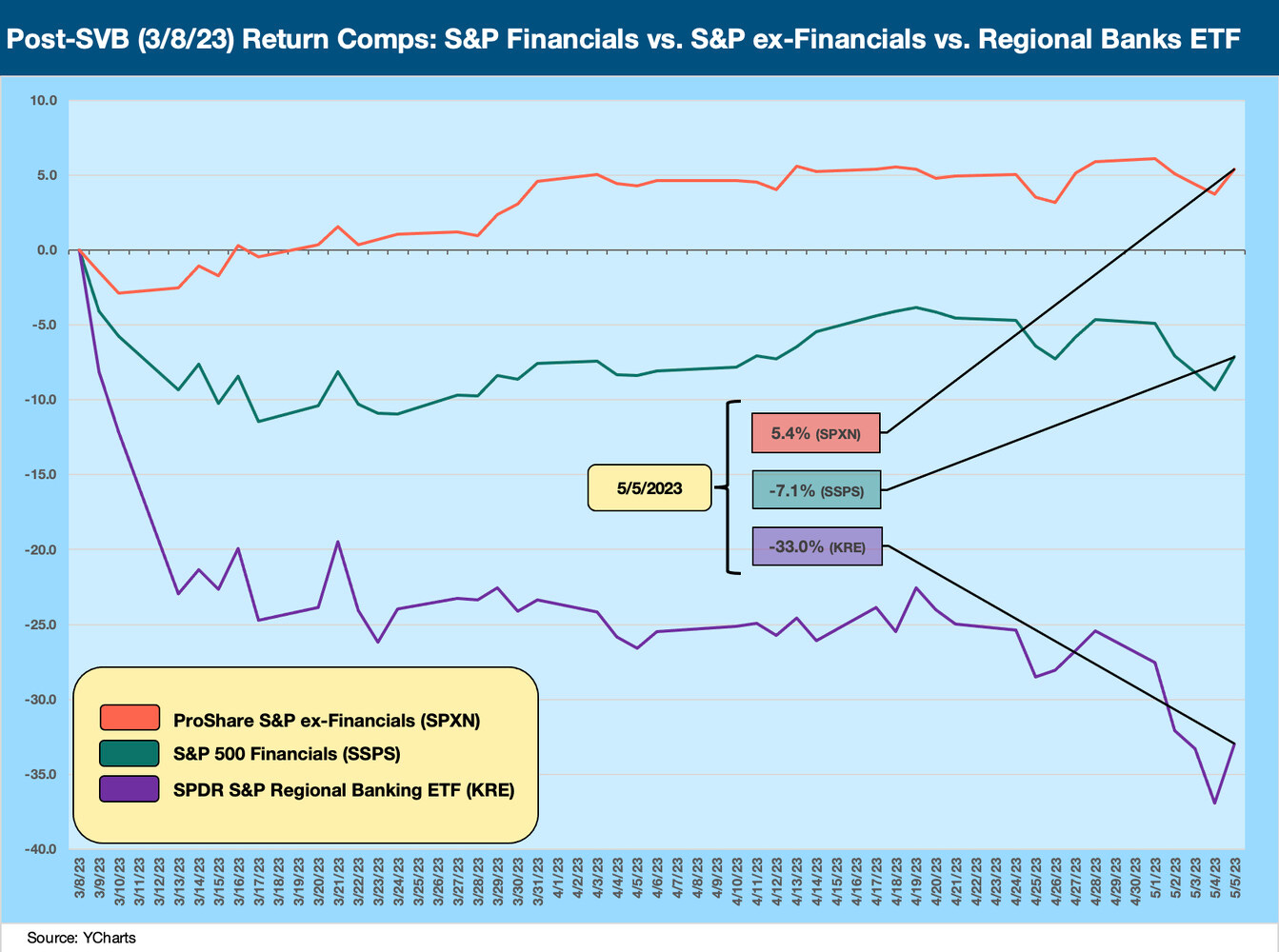

The above chart plots the total return since 3-8-23 (pre-SVB meltdown) for the S&P 500 Financial index vs. SPX ex-Financials ETF (SPXN) and vs. the Regional Bank ETF (KRE). The financial sector has been understandably less favored vs. the nonfinancials in the SPX. The regionals have diverged in much more dramatic fashion.

The flow of dollars and scale of loan commitments from the bank system across large, mid, small, and community level banks are obviously critical, but the regionals jump off the page as the subsector of banking that the markets are nervous about.

The major banks are not having it easy either since they have a lot to deal with ahead if the hard landing scenario does play out. The above chart plots each of the Big 3 legacy banks vs. the S&P 500 Financials. We use the same post-SVB timeline. JPM is the winner at essentially zero as of Friday close.