Oil Sands: Canadian Natural Keeps Winning but Suncor Counterattacks

Excerpt from Footnotes and Flashbacks: Week Ending May 12, 2023

The Macro worries we discuss this week (see Footnotes and Flashbacks: Week Ending May 12, 2023) are not doing wonders for the price of oil that drives the benchmark major Canadian names we watch. We are getting ready to get back out in print on some of the Canadian oil sands names we picked up after the oil crisis in prior lives. Suncor reported last week to wrap the oil sands sector reporting season. The massive free cash flow has turned some of these companies into major repurchasers of stock at the same time they are hiking dividends and playing the role of income stocks (Suncor dividend yield ~5.2%, Canadian Natural ~4.4%).

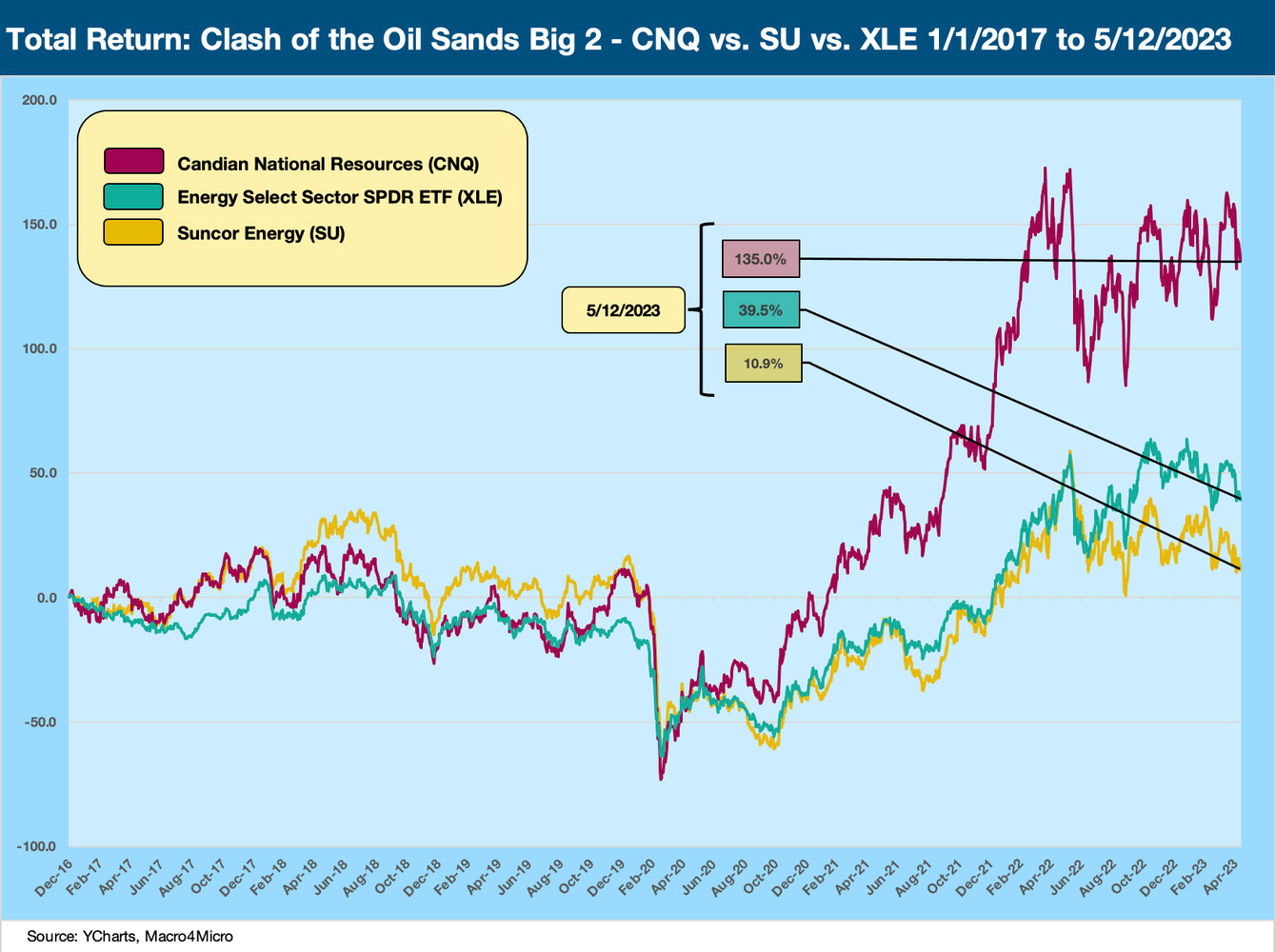

Below we look at some of the relative returns across the sector and notably in the clash of the Big 2, Canadian Natural and Suncor. CNQ had a rougher ride across the wild swings of the oil crash of 2015-2016 but has since that time dramatically expanded via M&A and new projects coming online.

In our view, CNQ is a cash machine and is more like a smaller OPEC nation (with higher production than more than a few). Suncor has had to wrestle with shareholder activists and management turmoil. The diversified asset base and strong downstream position makes it an interesting compare-and-contrast with CNQ. Both make for very solid core BBB bond holdings, but CNQ is the more interesting equity play and has multiple means of growth by acquisition or reinvestment.

The above chart plots the ride for Suncor vs. Canadian Natural from the beginning of 2017 as it pulled away from Suncor on strong execution, a favorable position as the largest upstream operator in oil sands, a favorable performance in integration of major acquisitions across the past energy cycle, and healthy free cash flow and a growing focus on shareholder returns.

Suncor had been the industry leader and #1 in market cap, but CNQ pushed past them as the “Canadianization” of the oil sands sector saw waves of asset sales (notably by US and European sellers) offer opportunities to be exploited by well positioned buyers such as CNQ, who executed on a mega deal to buy a 70% stake in the Athabasca Oil Sands Project from Shell and Marathon back in 2017.

The opportunities opened up to Cenovus as well, and CVE was also aggressive in their acquisition plans (notably with their major ConocoPhillips oil sands asset purchase in 2017). It took a while for the market to buy into CVE’s game plan. In contrast, CNQ’s track record and scale was more easily embraced by institutional investors.

The above chart posts the relative returns of the Big 4 of oil sands (CNQ, SU, IMO, and CVE) along with MEG Energy as a major player (but a distant #5) as well as Baytex and Athabasca to round out the group even though that last two are not as useful as “comps.”

Baytex is moving in the direction of US expansion (Ranger Oil acquisition) and Athabasca is a materially smaller player. We use the US-centric E&P ETF and larger more diversified Energy ETF (XLE) as measuring sticks. Only CNQ among the Canadian names beat the ETFs over the trailing 3-month period, but the sector overall was getting beaten up along with Energy equities broadly.

The good news for holders of the BBB tier bonds of Suncor, Canadian Natural, and Cenovus are that these companies boast very strong free cash flow and operating cost metrics that have stood the tests of some material volatility this past decade from the 2015-early 2016 crash through the de facto market collapse during COVID. The Canadian oil sands players had an anomalous plunge in prices in 4Q18. That is a separate story and notably how the Alberta regulators executed in quota systems.

We found this sector and these major oil sands companies very interesting and distinctive in their analytical framework. We will be out with more company-specific research on them in the immediate future, starting with the Big Two: Suncor and Canadian Natural. We also covered CVE and MEG in the past and will be getting to those as well.