Midstream Energy: ONEOK-Magellan a Sign of More Consolidation Ahead?

Excerpt from Footnotes and Flashbacks: Week Ending May 21, 2023

Last week saw a major midstream M&A deal when ONEOK and Magellan agreed to a merger that caught some headlines and some grief on the equity side for ONEOK (see Signals and Soundbites: Magellan Finds ONEOK 5-15-23). We expect this sector will be one with more “events” in 2023 as more names seek growth opportunities via M&A or seek to deploy cash flow in ways that will raise the hopes of shareholders for better strategic positioning ahead.

With LNG expected to be a major focal point and the barriers to expansion possibly coming down on project approvals, the competitive strategies will get debated across names with an eye on policy changes a key ingredient. There will be a lot of discussion on energy sector dynamics in an election year, and this sector is still seen as somewhat fragmented and ripe for more action of the sort seen this past week.

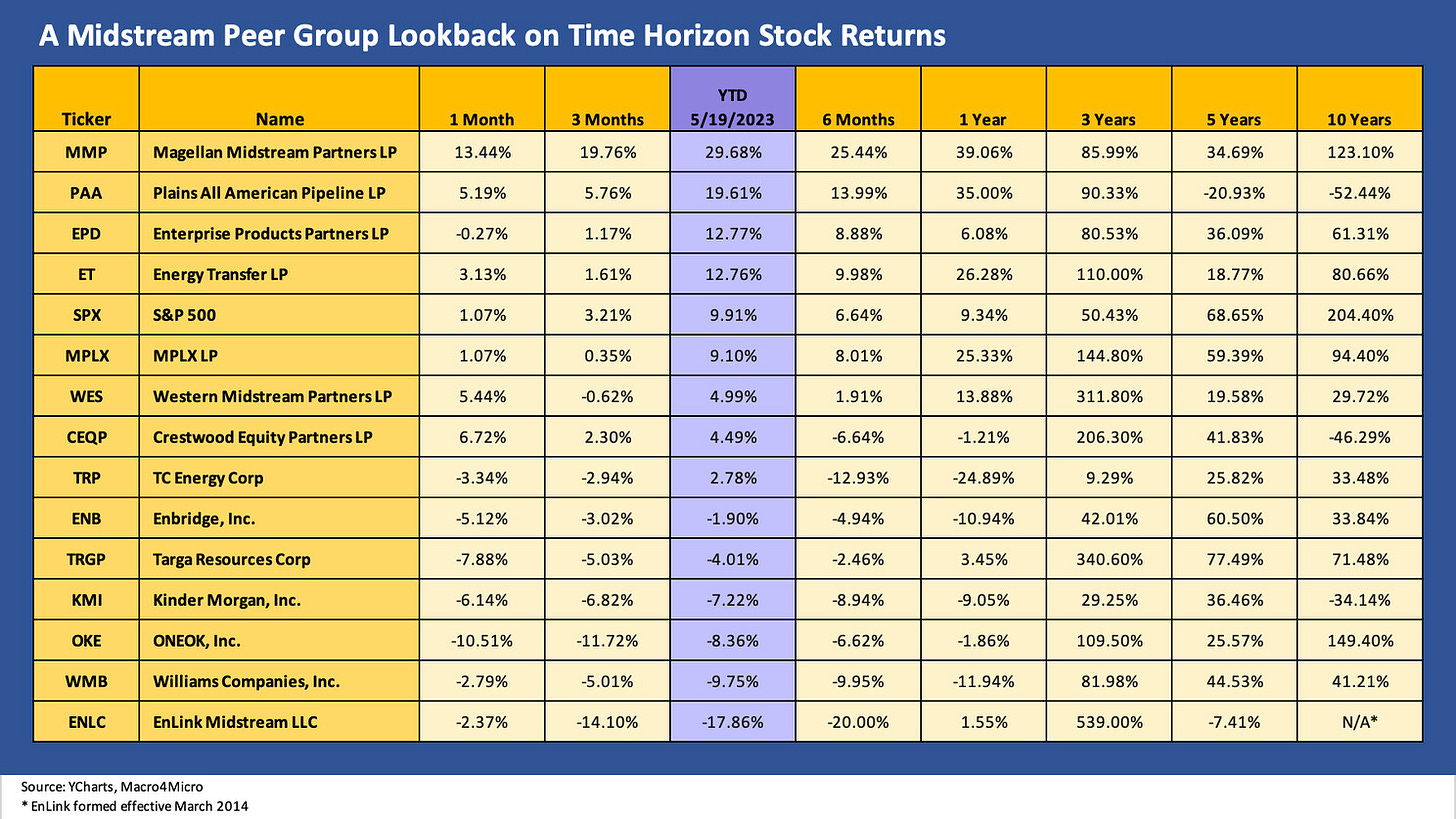

The running total returns across the midstream equities are detailed in the above chart. We add some more names than we included in the earlier commentary this week. We line them up in descending order of YTD total returns. We see quite a range in the returns with a Hi-Lo range of around 48 points. Selection counts and pays.

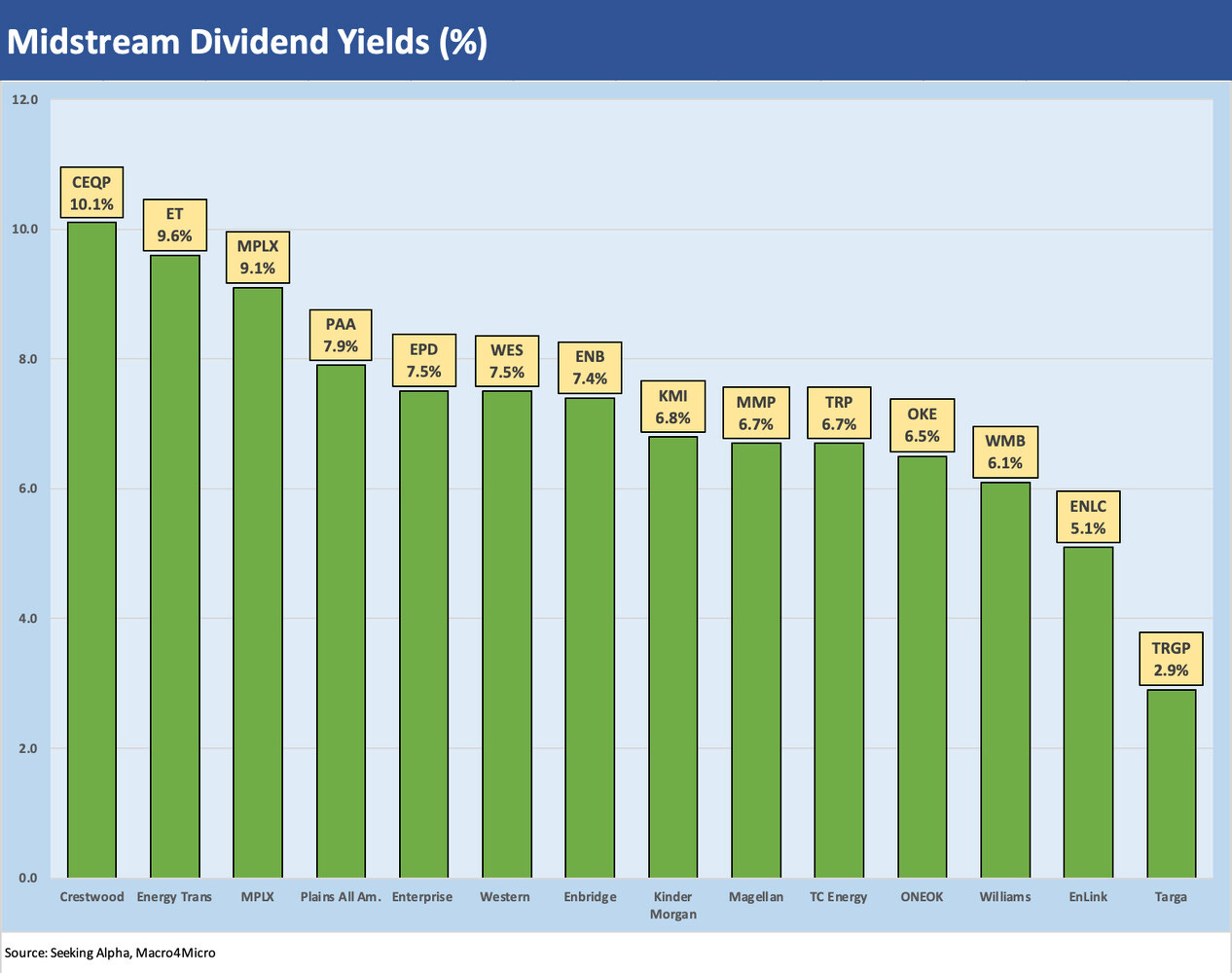

The midstream names comprise a very popular subsector for those with income stock portfolios, and we played in a healthy share of the mix and actively managed the equity exposure before downsizing that mix opportunistically in 2022 and early 2023. We have not traded any lately and do not intend to until the smoke clears on all the debt ceiling noise. We liked the sector fundamentally, and it is a lot easier to get comfortable with the income safety factor than the game plan for some names to grow and inspire the stock market with respect to multiples.

Evaluating the free cash flow dynamics of the names is a first cousin of credit analysis and more in our comfort zone than handicapping which basin and subbasin priority will set the agenda for each midstream operators based on their current asset profile. The question of which shift in product and service mix will serve the stock valuations best is a question we have to look at whenever we frame an issuer, and the ONEOK-MMP deal left many wondering about synergies when the move was in substance a major diversification play.

We try to frame those strategic and competitive nuances when we look at the names, but figuring out credit quality is more straightforward in most situations. A major reignition of a fresh round of heavy growth capex in this sector does not appear as likely as more realignment of ownership, more roll-ups and more bolt-ons if private equity players start cashing out of some of their holdings. There is an ample mix of newer names smaller in scale, so those wanting more scale are likely to be out hunting. Those are topics to explore on other days. The return rankings above show some will need to play from behind and start a comeback.

The chart above details the dividend yields across this mix of MLPs and C-Corps as a frame of reference for those who might be looking at bond yields. It is just food for thought with no intent to make a stock recommendation at all. The tax position of the portfolio, the MLP vs. C-Corp nuances and the relative risk of each is an analysis each investor must handle. I looked at these names when ZIRP was still part of the consideration and income was hard to find. The yields on these names run the gamut, but for 2H23 and into 2024 the strategic twist that can drive stock value will get more important than they were in 2021-2022. There is a very solid base of free cash flow as a starting point. There is a wider range of alternative yields in the market, so this time around the selection is off a bigger menu.