March Jobs: Head Scratcher

Consensus jobs numbers leaves the market in a waiting game as we look to CPI next week for better sense of inflation risk.

“Fish or cut bait?”

March jobs numbers came in generally around expectations with the Fed perhaps finding some slight comfort in hourly earnings, labor participation, and payroll mix but not so much in job adds and the unemployment rate.

The expectations for the more bullish and bearish players on the UST curve were likely frustrated and will need to wait for more data with next week’s CPI an obvious focal point.

The +236K in adds included a slight negative in Goods that was dwarfed by a few lines in Private Sector Services (+196K) and in Government (+45K)

When you hear and read “around consensus” in the monthly employment numbers, the next move is often to tune out after you scan the major line items up or down. At times like this, however, what did not show up in the numbers can be as important as what did. What did not show up was jobs weakness. The +236K was well down from the +326K (as revised) in Feb 2023 and the +472K (as revised in this release) in Jan 2023, so payroll counts keep hitting highs even if the rate of growth is pulling back.

How employers will react to the March bank volatility is still in the prelim stages. On average, staffing was a struggle for many, and the reaction time will be measured in pace and tied more to their daily demands and order books and not on the theories of credit contraction. We expect that credit contraction will be a negative variable for reasons we have laid out separately, but the moving parts still need to play out including for industries with some spring and summer seasonality.

The payroll adds for March were down sharply vs. Jan and Feb 2023 at 200K handles vs. 300K and 400K (see Employment Feb 2023: Forcefully Ambiguous, Definitively Mixed 3-10-23). It is worth keeping in mind that there was a time in the first few years of the post-June 2009 expansion that 200K jobs were a cause for calm and happiness since that recovery was a slow one for the first few fears trying to get back to Dec 2007 levels in the first Obama Administration. The current jobs watch each month is looking past the jobs to the Fed and the worries around more hiking.

The above chart plots the job numbers from Jan 2021, which kicked off a major boom from the COVID lows as interest rates were low and the vaccine was getting traction. We highlight the March numbers for 2021, 2022, and 2023 in a different yellow. A combination of explosive jobs growth and extreme supplier chain imbalances was going to bring the first serious bout of inflation in decades. The bar chart tells an obvious demand story.

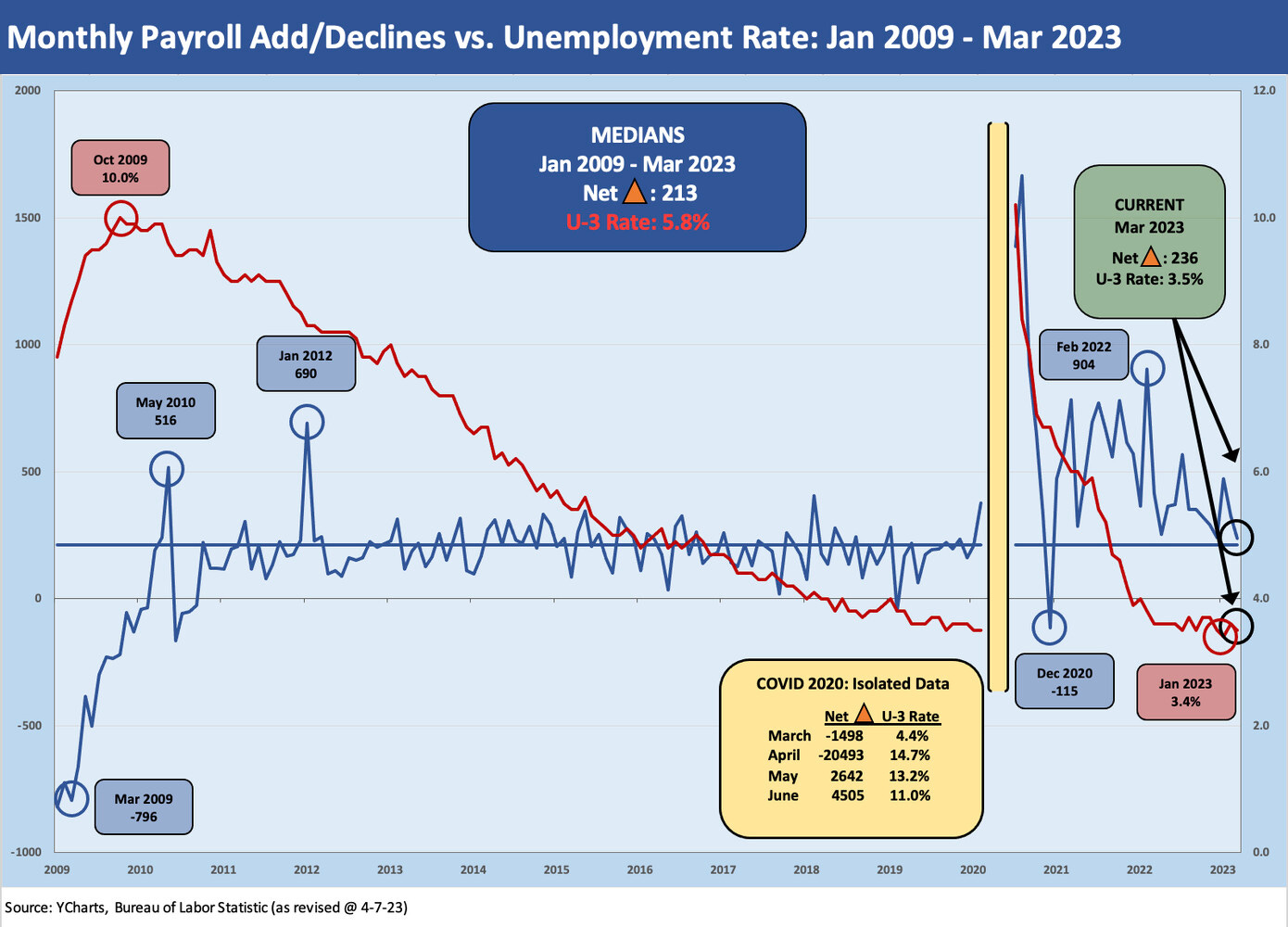

Below we add some history and data points which highlight where we are in run rates and monthly job adds. We break out some of the COVID timeline period from the chart to minimize scale distortion. We include the March 2020 to June 2020 numbers in the box.

These charts add some “memory jogger” boxes that detail some of the COVID plunge and start of a job rebound that ran on for months. There has not been anything like the COVID jobs swing in the modern capital markets era. Manpower allocation had not been that distorted since WWII.

The consumer sector appetite for goods challenged supplies and flowed into inflation. The story has been told many times at this point. As we look back to Jan 2020 and Fed 2020 just before the COVID crisis, the total unemployed tally was 5.8 million in Feb 2020 – the same as today. We also had a 3.5% unemployment rate with that Feb 2020 release – the same as today. The total nonfarm payroll in Feb 2020 was 152.5 million and March 2023 posted 155.6 million. The labor participation rate was 63.3% in Feb 2020 vs. 62.6% today.

Fed handicapping still rules the debates…

Coming on the heels of the sharp drop in job openings in the JOLTs report (see JOLTs: Partly Cloudy, No Lightning – Yet 4-5-23), the UST bulls were likely hoping for more signs of jobs weakness. On the other side, those looking for “no landing” and a sustained strong consumer sector and employee hiring did not come away with a clear read either. The decline in jobs openings in the JOLTs Feb 2023 numbers still were almost 10 million even if lower. The rate of decline sent signals just as the ISM data were showing erosion this past week.

Reading the Fed’s mind is something everyone takes a shot at even if it often proves fruitless. Despite the consensus overall jobs number, the March metrics were still interesting for the monetary policy handicapping. March showed some modest easing of hourly earnings and wage growth and a slight uptick in participation rate to 62.6%. More supply of labor is intrinsically better for inflation in theory. Even that comes down to what type of job profile and where the supply freed up. The wage inflation of 4.2% is down from Jan and Feb 2023. Hours worked ticked down slightly and might signal hints on the employer demand side.

The industry category deltas for the month are an easy scan in the monthly release. You can read the big moves in the text or just run your finger down the right side of Table B-1 (starts on page 28 of the 39-page release this month). The increases were led by Leisure and Hospitality at +72K, Private Education and Health Services at +65K, and Government at +47K (primarily State Government). Those groupings do not fall into the “multiplier effect buckets” that might inspire some optimism with Goods declining.

The main high volume jobs categories that still lag the numbers of the Feb 2020 peak and pre-COVID include Leisure and Hospitality, Retail Trade, and Government. Retail declined in March 2023 (-14.6K) but Leisure and Hospitality popped by +72K but is still modestly below Feb 2020.

Within the broader Hospitality and Leisure, Food and Drinking Places posted +50K. Healthcare and Social Assistance was +51K. The combination of factors led us to dub the recent jobs mix trends as the “get drunk and get hospitalized” employment recovery just on the sheer scale of the numbers in those categories. Health Care and Social Assistance is now well above the Feb 2020 level while Accommodation and Food is catching up (over 200K to go looking back at the Feb 2020 press release before ensuing restatements).