John Deere Capital: Asset Quality Follow-up

We update Deere’s asset quality picture and take a look at some top-down farm sector stats.

We update the finance unit asset quality disclosure for Deere that required the John Deere Capital Corp 10K (filed Friday, 12-15-23).

The details do not change any conclusions from the original commentary with the trend line in write-offs showing very strong asset quality in absolute terms but trending unfavorably after near record low write-offs in 2022 and 2021.

The US farm sector generated record earnings in 2022, and that is now trending lower at a time when net farm sector equity (farm assets less farm debt) of $3.57 trillion offer a very strong starting point heading into a weaker ag cycle.

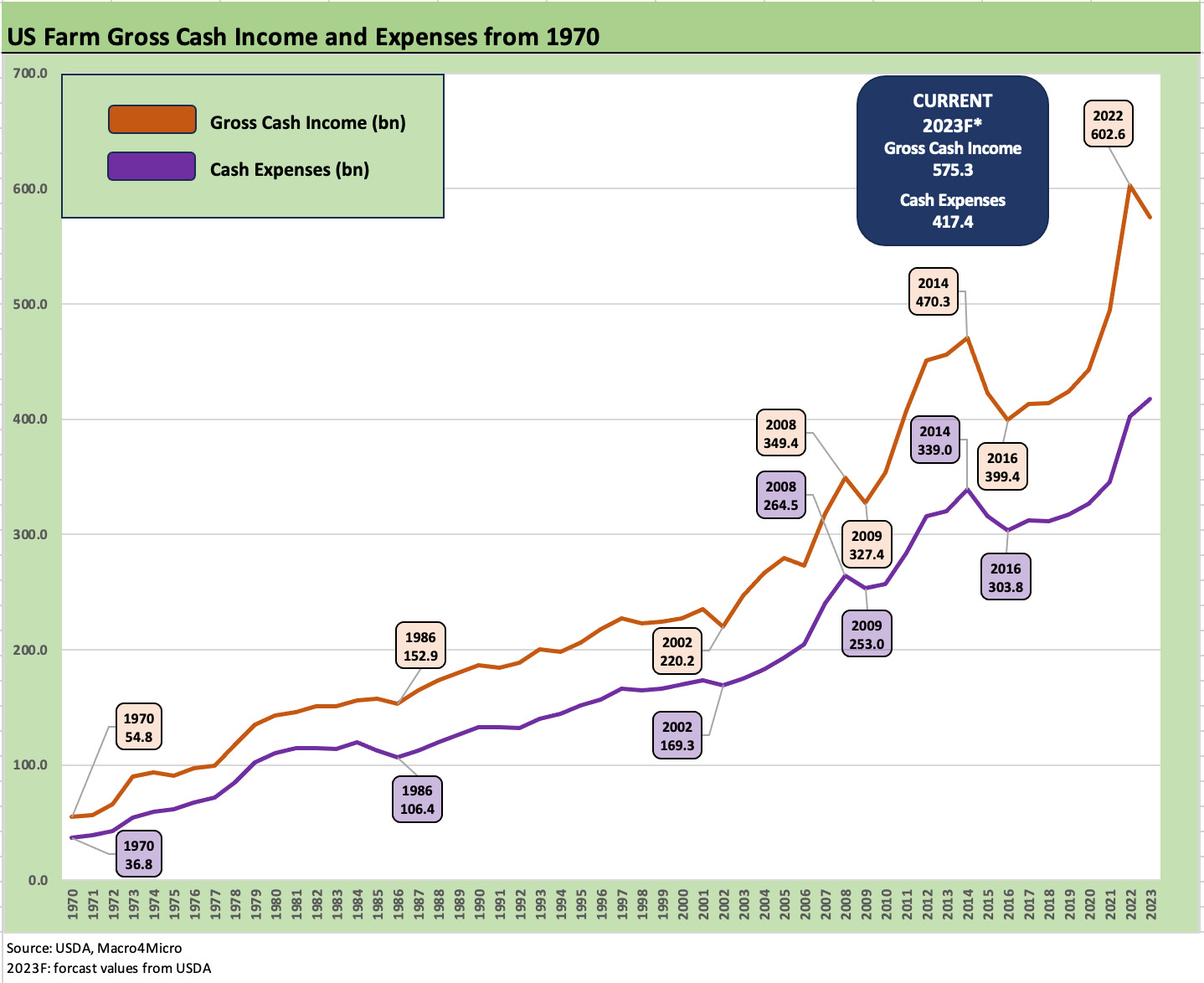

We look at the longer-term trend line in cash receipts and expense levels in the farm sector as the US ag sector continues to be one of the competitive advantages globally for the US.

In this note, we update the final asset quality disclosure of John Deere Capital Corp (JDCC) for FY 2023 (10-29-23 FY). We had looked at Deere in detail in an earlier note (see Credit Crib Note: Deere & Co (DE) 11-28-23). Filling in the official JDCC asset quality had to await the 10K.

We also address some macro angles on the farm sector and give some history on a critical part of the US economy and trade picture that competes in a very unstable world. The chart at the top tells a story of farm sector cycles using cash receipts and expenses from the USDA. The main takeaway is that “growth” is the word even if just based on demographics and more mouths to feed.

The $575 bn in gross cash income estimate for 2023 (updated Nov 2023) includes over $509 bn in commodity receipts across crops and animal products. The remaining $66 bn of the $575 bn total adds in various other income line items including $12 bn in direct government payments. The cost side has a range of line items that the USDA details (we did not reproduce the income statement table here) but it nets out to an estimated net cash income of $158 bn for 2023.

The chart shows where the income side had its ups and downs across the years, but the trajectory is going one way across the cycles – as in higher. Which ag enterprises (the family farm vs. the mega-players) will be the winners is not our topic here, but this current cycle still showed family farms accounting for a substantial majority of production (well over 80% of production was family farms per USDA).

The scale of the demands on suppliers to the farm sector includes more efficient and high quality (and connected) equipment. That is where Deere tells a great story and where Deere’s financial services operations play a key role with so many family farms.

Notable trends in JDCC asset quality…

The timeline in the chart from 2019 to 2023 drives home the strength of the farm sector in 2021 and 2022. The much larger asset base and gradual downturn from the peak ag sector year of 2022 is flowing into a rise in net write-offs back to levels in line with 2019.

Looking back across time for some of the worst years in write-offs, we see peaks in FY 2017 at 0.25% and FY 2016 at 0.23% vs. the 0.15% of FY 2023. That 0.25% peak in 2017 is a low peak relative to the routine allowance cushion of around 0.29% at year end. The allowance level vs. receivables still could move higher in FY 2024 as the ag cycle turns down.

Nonperforming assets as a share of total stood at 0.75% at FY 2023, which is up from FY 2022 but in line with 2020-2021 and below 2019. The provisioning line is understandably higher on a much-enlarged earnings asset base with total receivables at FY 4Q23 up by 21% vs. the end of FY 2022 and +40% over FY 2021. Deere is growing with the industry and has also still demonstrated pricing power.

The JDCC asset base comprises a substantial majority of the Deere financial services operations although Deere has some global financial services units under other subsidiary entities. With the agriculture sector so important in the US economy, a look at Deere and the credit quality and financial health of its customer base is as much part of the “macro call” as it is due diligence on a company that is a massive issuer in the markets.

As we cover in the DE Crib Note, Deere and JDCC are very active across a range of unsecured debt and securitization markets. As a de facto “all-purpose bank” for the farm belt, JDCC is also active in revolving charge accounts that are relied upon by merchants in the ag sector. JDCC is thus a critical part of the dealer operations as well as the working capital cycles of family farms. That makes it an important player quite literally in the economic food chain.

Some macro level color…

The above chart drives home the size of the farm sector asset base. Based on the most recent data released in Nov 2023, the USDA cites an asset base in the farm sector of $4.09 tn set against debt of $520.7 billion of debt for farm sector net equity of $3.57 trillion.

There is no shortage of data and research at the USDA to delve into. Ag cycles can march to their own beat wrapped around commodity prices (supply and demand like any commodity) but also have material swings based on government support. Trade wars hurt the ag sector – badly. That entails more government relief.

Volatile times on the horizon…

The US ag sector and the world are gearing up for what is likely to be a tumultuous year in geopolitics and an election season where trade and tariffs should be prominent topics.

In a Presidential debate on tariffs, trade and agriculture, Biden could lead with this to Trump, “If I am so old and senile, how come you don’t know that the buyer pays the tariffs – not the seller – and you collected zero from China as they slammed our ag sector with tariffs in retaliation.” Sadly, by that point, they would be shouting over each other anyway. My bet is there won’t be any debates since they won’t agree on rules (like answering the questions and using a mute button to prevent interruptions). The reality is the farm sector is about as important as any industry can be. Protecting the sector is important.

The farm sector is safe to describe as systemically important and one where the US has demonstrated its competitive advantage across the years. As a result, the ag sector is often the target of retaliation when the US engages in tariff battles. Trump may in fact love his “beautiful farmers” since so much of the farm belt is clearly in the red camp in politics, but excessive tariffs can deface the beautiful farm sector when countries such as China and the EU retaliate. After the tariff battles and retaliation, very costly bailouts needed to get legislated even as tariffs were causing inflationary pressures or adverse margin impacts in other industries.

There has been more than a little commentary in the past on the cost of the farm bailouts. One view is that the farm bailouts ended up costing more (net of recoveries and repayments) than the “auto bailout” and “Wall Street bailouts.” It is not the farmer’s fault since they did not start the tariff wars. The to-and-fro battles on the topic that we have seen over the years support the factual view that the farm bailout could have been avoided and the bailouts cost to taxpayers did in fact cost more than the autos and the banks outlays net of repayments and proceeds on securities sold. As usual, people will choose their own facts.

We are not trying to get lost in the mix of moving parts (cash receipts, crops vs. animal products, direct government payments, etc.) but the simple point is the farm sector is systemically critical and growing and will remain a key economic anchor for the US in global trade. Deere is right at the heart of that farm sector ecosystem with finance and equipment. It has $111 bn in market cap for a reason.