Iron Mountain: Good Climb, Summit Unknown

We look at Iron Mountain bonds in relative value context.

On a relative value basis, we see IRM as a solid value in the BB tier that frames up well vs. BB tier risk peers in a soft landing or recession scenario given the strong cash flows, proven resilience of its profit margins, the business line strategy, and asset protection.

IRM stands out as “a peer group of one” and arguably does not get the focus it has earned as an S&P 500 constituent with a bit of an identity problem around who should cover it (REITs? Business Services?).

IRM ranks among the largest HY issuers (Top 20 in HY bond index debt) and a major BB tier name (Top 10 in BB tier index debt), and that makes the learning curve on the name worth the effort.

We see IRM bonds as a core Overweight in the BB tier mix with cyclical risks mitigated by the demonstrated staying power of its largest business line as it redeploys cash flow into growth areas in data centers and adjacent service business lines.

First…a note on our data sources…

Before we look at Iron Mountain relative value, we offer just a few points on the evolution of the Macro4Micro content mix. We could not get rolling on relative value opinions since we started the Substack offering in January 2023 (on LinkedIn since Last October) until we squared away our data sources for the debt markets. We now use the ICE Index, BondCliQ, and 7-Chord for those purposes. The streaming data services are especially helpful in seeing where actual trades took place vs. the usual uncertainty around the marks vs. the tradeable volume at any given price. We looked at recent trades and pricing in connection with this commentary. We don’t repurpose them for disclosure here in this report.

As someone who would flip through the pages of the Merrill Lynch pricing book way back in the 1980s delivered over to Newark at Prudential, the availability of pricing data has traveled a million miles. The size and breadth of the bond issuer base is in a different zone now as well.

Portfolio decisions and monitoring activities need a fundamental view first and a relative value view second. You cannot (or should not) make one without the other as one runs the name through the “portfolio parameter machine.” Resources have been thinned out over the years on Wall Street, and we are looking to keep the inputs flowing in what can at times seem to be an overwhelming scale of topics and risks.

The analysis and risk assessment can be pretty time consuming, and we are mostly looking to support our readers in that process. We now will be rolling out more relative value commentary. As a matter of process, we are already well underway on the “macro” in “Macro4Micro” and now it is time to build out the “micro” at the bond issuer level.

IRM relative value: cash flow, asset depth, track record, and strategy drive this story…

We like the 7.0% of 2029 IRM bonds issued in May 2023 for the coupon and the quality of the credit. Away from the quality issues and fundamental risks already discussed in our Credit Crib Note earlier today (see Iron Mountain: Credit Crib Notes 11-10-23) and our much more detailed credit profile (see Iron Mountain: Credit Profile 4-15-23, Iron Mountain: The Quiet Man 4-16-23), we see IRM in part as a name that gets too little attention on the street and from research providers. It has a lot of layers and disclosure, but the rental streams and services component of revenue are relatively straightforward with steady, high margins as the timeline has shown.

We looked at IRM bonds vs. services names such as United Rentals, ADT, and Aramark as well as vs. the BB credit tier composite. We view IRM as good value in that context and cheap to peers. IRM is a bit of a “bear” to work through in terms of the history and mix, but the story has been a very solid one that has performed well in equities after some years of misgivings about their ability to make the expansion plan work and get credit for a higher multiple as part of the data center expansion.

The conversion to REIT status has not helped their visibility as many REIT analysts on the street run away from it on the fact that their profile of storage is essentially a peer group of one and the data center analysts do not see it as a pure play. For an equity analyst to launch on it is also a lot of work. The banking business needs to be there, and that can only be whispered about in the post-TMT “new world” for research.

The BB tier rating often scares sell side REIT equity players who are more accustomed to investment grade REITs. The services analysts have more comfort with credit risk. In other words, IRM is cheap to the pack for reasons other than credit risk. The default risk of a BB tier name is exceptionally low at a fraction of 1%.

Ironically, IRM’s expansion plan and the BB tier ratings would be the better outcome for a while for stockholders since the last thing IRM wants to do is slow its growth rate down. Alternatively, the rating agencies could reassess how they look at a 5x leverage metric with so many BBB REITs in that zone (those would be the IG REITs with the bad stock performance).

We looked at some of the point-counterpoint debates between bears and bulls on the name in our earlier credit profile on IRM. I have talked to bears and bulls alike on the name over the years. The breakdown is usually around the analytical framework and how to frame the dividend vs. the growth capex. The easiest way to look at the company in our view goes like this:

How much cash flow do they have before their dividend?

How much cash flow do they have after their dividend?

How much do they plan to spend of that cash flow to invest in growth capex?

How much will they borrow to fund that capex-driven EBITDA growth?

Isn’t growth in assets, debt and EBITDA related?

What is the logical mix of equity vs. cash funded capex on M&A and bolt-ons?

You get into a rhythm on the company’s disclosure once you have looked through it a few times.

The 7.0% 2029 bond makes for an unusual bond in the mix…

Under the scenario that rates decline materially, the call price of 103.5 in 2025 will cap the upside, and this is an issuer that will be like many in the HY market and operating in a constant state of refinancing and extension in the years ahead.

In IRM’s case, the refi and extension will be more about refinancing bank lines that it draws down in bolt-ons or add-on M&A. For many in the HY market broadly, many issuers will be facing low coupons being refinanced. For IRM, the 7% coupon could get redeemed and refinanced since IRM will be a regular issuer of bonds for both new money borrowing and financing. The 7% number is good in the meantime.

The “high coupon” part of the discussion is the rub in this market. As the maturity wall gets closer, many issuers will be refinancing into materially higher coupon debt. For example, the par-weighed coupons of the BB tier right now is around 5.34% and is closer to the 3M UST. The BBB tier is 4.3%.

The cash return of the bond story can make a difference now to those who used to get a higher cash yield on the IRM stock and not the bonds. The accretion story of steeply discounted, low-coupon HY bonds is much easier to find across the HY universe than a high coupon. A good credit with a 7% coupon and a 98 dollar price fits many bills for many types of portfolios.

Some more equity market comps and performance context…

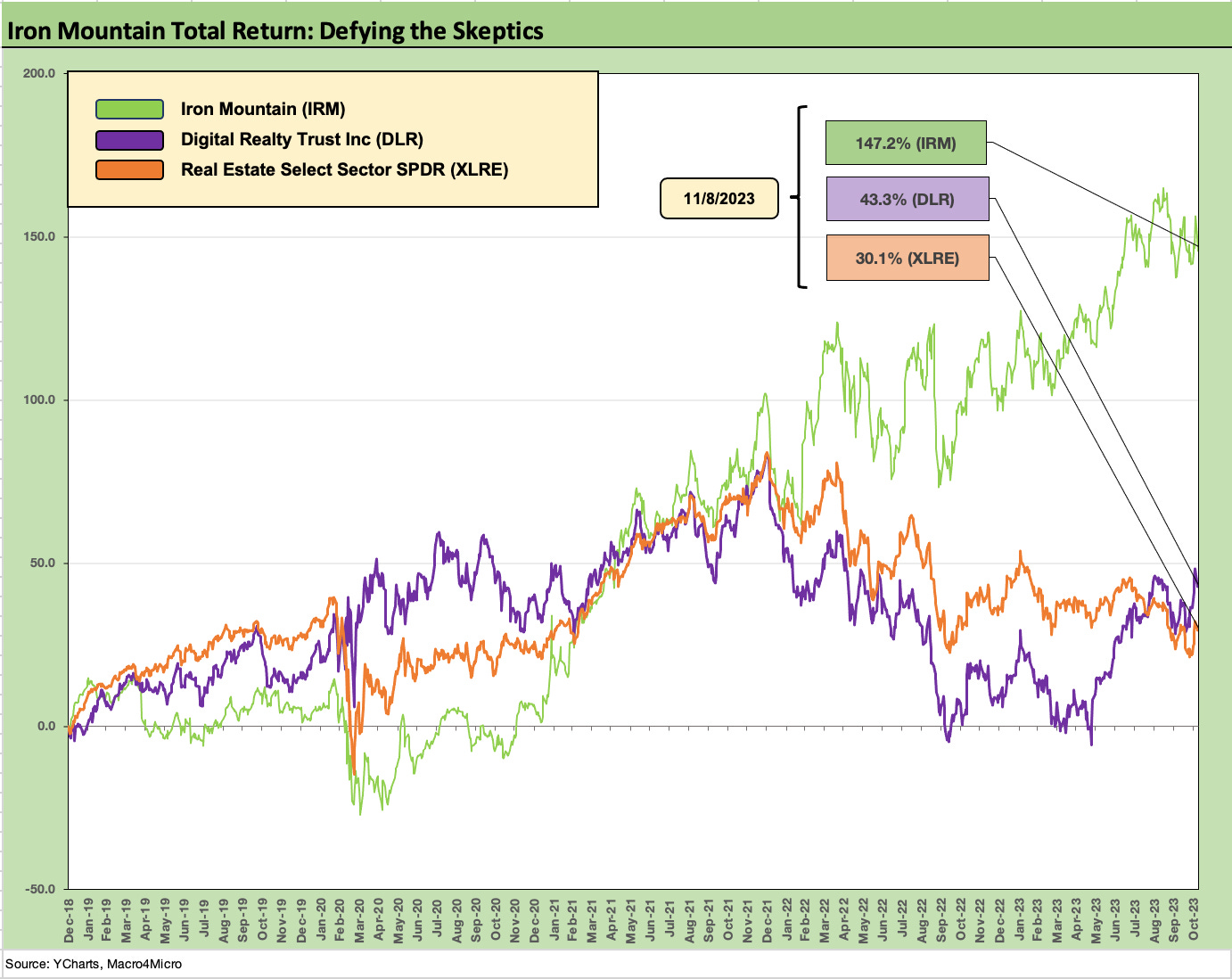

In the chart at the top of the piece, we plotted IRM equity vs. Digital Realty (DLR) as a pure play data center REIT and the XLRE ETF for a vantage point on REITs and real estate operators. We start the clock at the beginning of 2019 right after the final Fed hike in 2018 (before the 2019 easing) and ahead of the COVID crisis. IRM has been an exceptional performer since the 2016 Recall transaction and initial big push into data centers.

As we see the XLRE results in both charts above, the real estate names have had a very tough time as they get battered in the tightening cycle. IRM does not depend on the real estate asset value component as much as many of the other real estate names. For IRM, the regular exercise of their rental pricing power and lease escalators is the core cash flow driver.

That mixed story around the real estate value topic was part of their challenge with the IRS in distinguishing themselves from being a service company. From our vantage point at the time, they had better qualifying criteria than many other companies that scrambled to be called a REIT.

The strategic plan for global scale and data center expansion…

Iron Mountain has certainly been extremely busy over the past decade as it started its REIT conversion in 2012, was effective by 2014, and then it continued a multiyear overhaul of its expanded global footprint and heavy investment in data centers. The above chart and the table below underscore the tangible impact IRM’s strategy and execution has had in the equity markets.

In the section just above, we look at a broader mix of companies including some more benchmarks, data centers, and self-storage REITs looking across a mix of shorter and longer time horizons. We line them up in descending order of total returns for the YTD period.

In the interest of disclosure, I own no IRM now. I have intermittently bought and sold IRM stock over the past few years but have not had any positions in their bonds. I approach income stocks with somewhat of a credit analyst’s mentality on cash flow generation strength and demands on that cash flow. I was happy to own IRM equity, and it worked out well. I probably should have just held them the whole time, but the equity market was getting spooky, Washington a bit deranged, and I was building cash by selling some winners.

I also owned Digital Realty and watched that somewhat wild ride unfold as the shorts and longs squared off over the prospects for data centers. I sold DLR as well (flat) just on the fact that the ride was more than I expected, the 3% handle yields are not exciting in the new post-tightening world, and the position was a decent way to build cash without too much foregone income with 5% handle UST easing one’s pain.

The net upshot…IRM is a good value, underrated, and worth the time outlay given its major role as a debt issuer who will be back in the market as it continues to grow.