Iron Mountain: Credit Profile

We take an in-depth look at the credit fundamentals, financial performance, and shifting business mix of Iron Mountain. IRM is getting it done.

“Multiple expansion? Higher dividends? How hard could it be?”

We take a detailed look at the evolution of Iron Mountain and how the stability of the company’s credit profile has been recognized in the market and among its bank lenders.

The transitioning from old school paper and tapes storage to an expanded presence in data centers has been the main event in M&A and IRM’s effort to get some multiple expansion in its equity price while escaping the tag of “it’s only a low growth income stock.”

We look at the doubling of the asset base and total debt since the conversion to REIT status back in 2014 and how the business mix and capex trends have morphed across a cycle that was much more volatile in the broader market than in IRMs steady financial trend lines.

Credit Profile: Stable credit, strong asset protection, high margins, and manageable leverage…

We see Iron Mountain as a solid core holding in any debt portfolio that plays in the BB tier whether it be an IG portfolio dipping down or a HY Classic portfolio looking for industry diversity and a liquid and more defensive high-quality name in the issuer mix.

IRM has manageable leverage for the BB tier, extremely high gross margins, highly discretionary investment programs for growth, and plenty of opportunities ahead outside the legacy businesses.

Inside the legacy business, IRM has a very high customer retention rate as the company is offering more new services to help clients in their own records and information transitions. The newer cross-selling opportunities extend beyond the data center growth and include changes in the operating model that leverages product integration opportunities (“Project Matterhorn”). We also see new initiatives such as ALM (Asset Lifecycle Management) and a new reporting unit tied to that business line. The 2023 guidance is calling for around 9% revenue growth, 7% EBITDA growth, and 5% AFFO growth.

IRM can boast a proven track record that has allowed it to earn more respect from banks, bondholders, and stockholders after so much expansion in its history as a REIT (since FY 2014). The execution on their M&A and capex has offered some bragging rights. The comfort of the banks has been demonstrated across IRMs REIT years with higher lines and easing of covenants.

IRM is giving bullish forward guidance on their revenue growth prospects in the current market and is looking for 10% CAGR in revenue from the execution of their capex plan and business platform initiatives. Given the stable margin history, that sort of top line growth will fund a lot of capex while at least slowing the growth in debt.

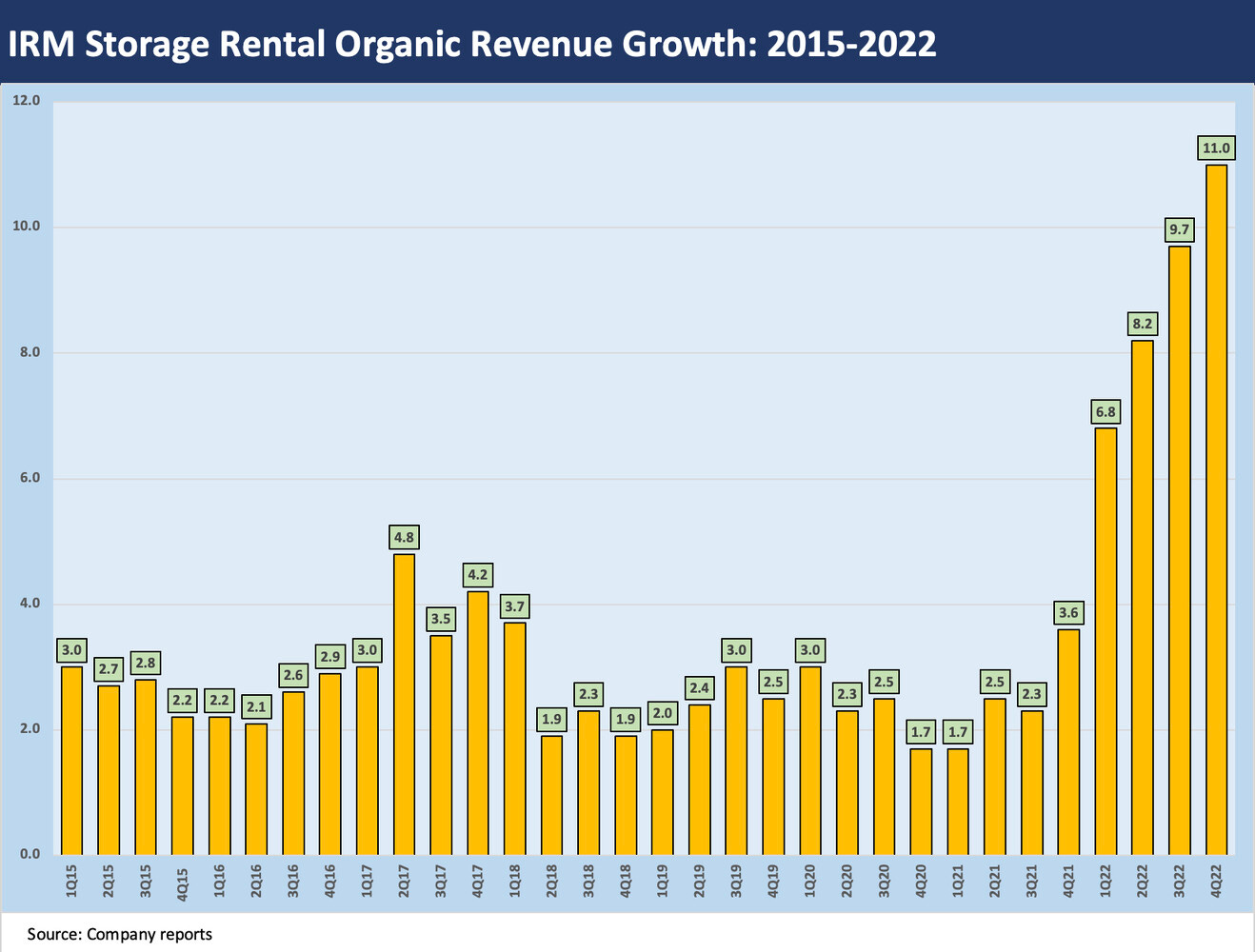

The pricing power and advantages of an inflationary backdrop for IRM have been a source of focus with the quarterly organic growth rates climbing so sharply since 2021. Some of the contractual terms allow for price escalators, and the results are evident in the margins and the organic growth rates. The company has perhaps been too blunt in the past on “praying for inflation” and they have moonwalked on that theme now that painful inflation arrived in 2022. The fact is that inflation brought the pricing benefits they had cited when questioned on the topic in earlier, low-inflation periods.

The pricing power and aggressive price hikes fall under the polite term of “revenue management,” but the fact of life for Iron Mountain is that they can pass on their costs with some additional price on top of that. The other side of the equation is that financing costs will rise in the future, and new issue debt will cost more as IRM expands and refinances.

The analytical framework for IRM is not the usual HY services fare as you gauge the steady rise in both sides of the balance sheet and make a checklist on “things that can go wrong.” The target of stable to rising dividends per share still demands more cash flow when equity financing is part of a merger (such as in the major Recall Holdings deal of 2016).

The IRM analysis flips from the more typical issuer asking, “What is my dividend target after my desired capex?” to “What are my additional growth capex needs after I satisfy my REIT dividend requirements and ambitions?” IRM could struggle to make its case on dividend growth but is positioning itself to get more growth multiple in its stock price. That is what keeps IRM equity bulls in the game.

The challenge to IRM in making its debt leverage case has been an uphill battle. When you start out as a leveraged services company, it is hard to shake that credit rating history even though many BBB REITs hang around 5x handle leverage (Debt/EBITDA). With an EV/EBITDA multiple in the low teens for IRM, the 5x handle case is an easy one to embrace for an asset rich REIT with high, sustainable, and steady margins. The credit agencies just have not moved on that topic for IRM.

IRM really does not have a visible path to get below 5x with their growth ambitions, dividend priorities, and capex and investment plans. The low teen EV multiple company’s EV trades well below Data Center medians and Self-Storage REITs, so there is a case to be made for the desired multiple expansion. It will take some more quarters of evidence, but the credit quality bias is for higher ratings based on actual risk and performance despite the rating agency foot dragging.

Looking at IRM in broader industry and capital markets context…

To the extent a cycle of stock price action tells a story, the vote in the equity markets has been favorable for IRM vs. the broad market of S&P 500 peers and relative to the longer tail of real estate equities. We detail some time horizons below.

The above chart plots IRM vs. the S&P 500 and the S&P 1500 Real Estate Index. We start back when IRM first decided to pursue the REIT conversion strategy in 2012 (finalized in 2014). For those who were not involved in the space at the time there were waves of “real estate asset types” pursuing the REIT strategy to gain pass-through status and juice up cash dividends for shareholders to broaden the investor base.

The IRS was starting to take political heat on the approvals given the tax advantages to the company. Those advantages also brought dividend demands, but the sense was that a long-established tax incentive was being abused. The short story was that the IRS approval was creating some doubts that whipsawed the stock, but IRM got it done in the end.

There were some data center REITs and others pending, but IRM’s physical real estate presence made sense as a REIT. The data centers also cleared the bar. Now IRM is in both types of real estate – Storage and Data Centers.

The above chart plots the same time series as the prior chart but starts at the beginning of 2019. We show the path of total returns and detail the performance in the boxes (pricing date 4-11-23). IRM soundly beat the real estate benchmark and the broad market S&P 500 across a period of slowing growth (2019), brutal pandemic disruptions (2020), the start of an inflationary spiral (later 2021 into 2022) and material Fed tightening (2022-2023).

As we detail in the financial metrics analysis further below, revenue growth and high margins stayed the course despite setbacks in organic Services revenue growth with COVID (the human interaction thing, etc.).

That year 2019 was semi-normal in that it was in the pre-COVID period, and the Fed had been raising rates gradually over the prior three years since the end of ZIRP in Dec 2015. The market saw a risk rally year in 2019 after a very bumpy 4Q18 selloff in stocks and risky credit. On the macro front, however, the Fed was easing in 2019 in the face of economic setbacks. The underlying factors of economic weakness in 2019 included softening investment tied to tariff skirmishes (it never went into full trade war mode).

IRM pushed right through the 2019 macro jitters, and then the challenge really got tougher with COVID. IRM fell behind the broader market and real estate and then the market started seeing some of IRM’s investment and expansion strategies paying off as it ran by the real estate sector and then overtook the broader market during the inflation and yield curve migration periods.

Getting into the business mix …

The above chart breaks out the revenue mix, asset mix, and capex across the global IRM operation. The chart sequence details that the largest business – Records and Information Management – is generating revenues off an asset base that is funding an aggressive capex program in Data Centers. The expansion programs and optimizing of business mix risks are serving as catalysts for Revenue and EBITDA growth.

As we cover in sections below, the growth is seen on both the Rental line and in Services Revenues. “Services” in the Global RIM business faced the risk of stagnation, but new Services lines are being created in such business lines as ALM as detailed below. Those have favorable growth prospects and are more tied into data end markets.

The expansion of data centers has been part of a strategic acquisition program to leverage its position with a customer base that includes around 95% of the Fortune 1000 plus a very long and growing global tail of SME business (Small and Medium-sized Enterprises). The growth trajectory for IRM ahead is underscored by how much their addressable market has grown in less than a decade.

In their fall 2022 investor meeting, they describe their addressable markets as having grown 13-fold to $130 bn as they moved beyond traditional business lines.

The growth has been about more than Data Centers. Before the Data Center push but after the REIT conversion of FY 2014, IRM was expanding the Global RIM business with a transformational deal closed in 2016 with the acquisition of Recall Holdings Ltd for $2.17 bn (heavily equity financed with $363 mn in cash and $1.84 bn in stock as valued at the time).

The Recall deal marked a major leap into Asia and more growth markets in the international operations. The expansion path since then has been heavily about Data Centers. As we detail below in the segment section, both business lines have high and steady margins.

In the past, IRM has at times struggled in telling its longer-term story with its “peer group of one” business mix. Moving the needle on such a large global company with a massive legacy business and transforming it into a hybrid information storage and data center business is no small challenge. The pie charts above tell the story on how dominant the asset and revenue base of the Global RIM business is, even at the end of 2022.

The programs to accelerate the integration of acquisitions or more efficiently structuring the global enterprise necessitates a lot of planning and action across the enterprise. That is when they announce a new multiyear streamlining program with a “mountain moniker” (Project Summit in 2019, Project Matterhorn in 2022). Those periodic overhauls are all part of a very ambitious growth strategy and are to be expected.

In addition, periodic setbacks in stock prices and spreads usually come when there is a slower integration than expected or when the restructurings cause investors to revisit handicapping the ability to keep doing what IRM has been doing (according to the stock market – succeeding). With the big bang acquisition of Recall Holdings in 2016 to expand their global footprint, there was some expectation that M&A would be the key driver. Since then, however, the bulk of the heavy lifting has been capex as we detail in this report. In the pie chart above, we see the lion’s share of capex in Data Centers.

Time in the IRM weeds…

IRM offers mountains of detail on its operations in frequent roadshows as well as its quarterly and annual reports. The supplemental materials each quarter offer oceans of data (like most REITs). That said, IRM is not an easy company to follow. The fact remains that more than a few major street firms cannot decide whether to cover it as a leveraged services equity, a traditional REIT, or not to cover it at all.

As a Top 100 HY index name for years now, IRM is a name to know whether as an S&P 500 member, a major bond issuer, or a real estate borrower. The company matches up assets and liabilities with multi-currency borrowing programs in loans and bonds, so that cuts across markets with its multinational asset and revenue base.

The company has been a frequent bond issuer in recent years after IRM switched to REIT status and embarked on a multiyear expansion plan. The mix of free cash flow deployment and borrowing grew with its Data Centers and international expansion. With well over $15 bn in equity market cap, over $10 billion in total debt, and as a member of the S&P 500, IRM is still working hard to tell its story.

With almost a decade as a REIT since the start of FY 2014 (more than a decade since it decided to pursue the REIT conversion in 2012), the history now offers data points and gut checks on the ability to execute, and the report card has good grades from the equity markets and a relatively deep base of investors/lenders on the credit side.

The top-down financial picture…

The next sections get into the financial trend lines and the segment details. We look at the financial statement metrics and break out the organic growth trends. Much of the organic growth is about pricing power and capex-driven expansion with ambitious reinvestment. Tactical acquisitions fit in the picture, but the M&A in the growth markets has not been the main theme. The RIM business was the biggest acquisition in 2016. The data center business is still in the buildout stages and reinvestment mode, so it would be too soon to start calling anything a bolt-on. As noted earlier, the legacy RIM business was 84% of sales in 2022.

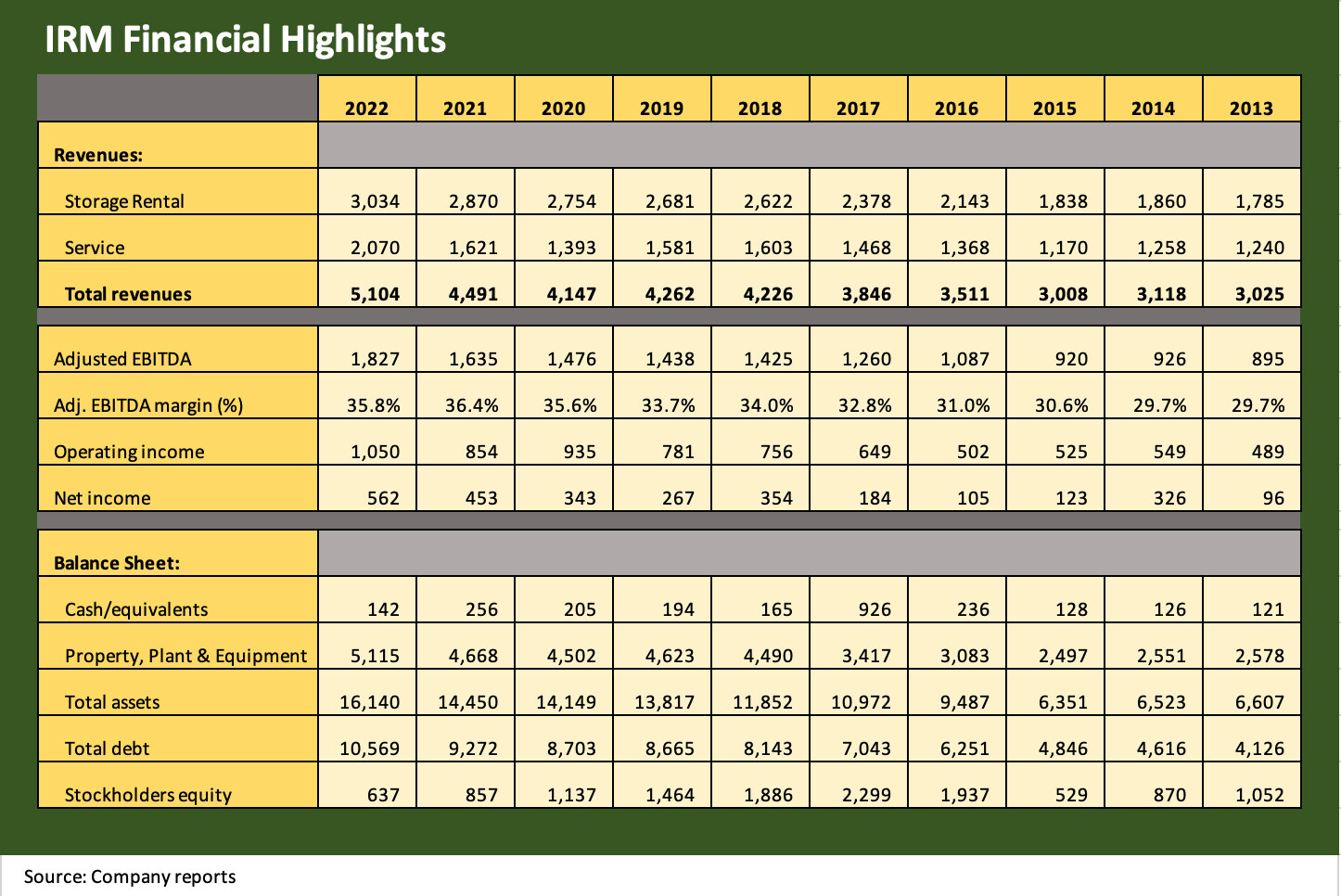

The above chart frames a lot of information starting in 2013 in the year before the 2014 REIT conversion. We post asset and debt growth in the bars and EBITDA trends in the line time series. Steady, rational, and disciplined growth is more about hindsight since there were plenty of skeptics on the ability of IRM to keep retooling their business mix and global operating profile.

IRM has earned some benefit of the doubt at this point. The banks and stock market has given them that benefit. The bond markets are still holding back on that confidence in many cases and especially the credit rating agencies.

On the timeline scoresheet, revenue has grown by $9.5 bn since 2014 or by more than 2x. Debt has grown by $6.2 bn or by over 2.5x. EBITDA is up by just over 2.0x. The question gets back to “How much leverage do you feel is appropriate on a company that has broadly expanded by geographic market exposure, diversified its business mix into growth areas and in both storage and service offerings? What subjective bonus points do you give to a company that has grown so much with margins so stable?” That falls into the category of “opinions,” but there are a lot of REITs with similar leverage (using Debt/EBITDA) in the investment grade markets that have less favorable profitability trends and fewer opportunities in growth markets.

Back in 2014, Net Total lease Adjusted Leverage was 5.4x. At year end 2022, the same metric was 5.1x. As detailed below in the leverage section, the max Lease adjusted leverage allowed under the credit agreement is 7.0x with a “permitted acquisition” allowing leverage to move to 7.5x.

Definitions and carve-outs with the banks have morphed over time and the “rent-adjusted” factor moved lower from 8x to 6x in 2018. We would argue that a much larger and more diversified IRM is less risky today. That includes secular risk (“the death of paper and physical documents” objection) to absolute financial risk in a company that is valued in low teens for an EV multiple when so many company have EV/EBITDA multiples well above that.

In terms of leverage and the 4.5x to 5x target range, we now take with a grain of salt their earlier talk of organic deleveraging to below 5.0x within a few years. We see IRM as all about growth and expansion over the intermediate term. The IRM valuation challenge revolves around being able to deliver dividend increases and/or gain a multiple growth bump whether that multiple is PE, EV, or FFO multiples. Dividend increases have lagged in recent periods, but the stock has still done well as Data Center success gets more visibility.

The above chart puts some line items to the analysis. The numbers tell a growth story that is evident throughout the IRM chart collection. Despite a small dip in 2020 on COVID effects that hit services, the themes of capex-driven growth and pricing power are key factors. We see one major M&A deal in the Global RIM business over the past decade and one midsized deal in Data Centers. Running across the lines from 2013 to 2022, the trend is one of consistent growth and steady, high margins within a narrow range despite the tumult of the years.

The breakdown of revenues into Storage and Services needs some clarification since that mix shows up in both major segments and in the “Corporate and Other” segment that is mostly services with the new ALM expansion. Each line item – Storage Rental and Services – sees organic growth disclosure from IRM. In addition, each segment gets a breakdown in organic growth as well.

The anomaly of the book value of stockholders equity…

One item that has come up over the years for those new to IRM includes the quirks of REITs or IRM’s history and how to frame traditional book value leverage. IRM posts a very small book value of stockholders’ equity at $637 million vs. an equity market capitalization of well over $15 billion.

For the old school debt to cap metrics, the relationship of book value net asset protection and liquidity simply does not work. The numbers were too distorted by the special dividends tied to the IRS requirements and the recurring REIT dividend requirements. The Debt/EBITDA metric still is the best leverage metric to use in the mix. We discuss that trend elsewhere in this commentary.

IRM’s history back before its REIT transformation shows a $2 bn equity base in 2009 and just below that in 2010. Given the high rate of dividend payouts and the history of the “E&P purge” (Earnings & Profits) as part of the IRS rules of REIT conversion, the equity base was materially reduced back in 2012 and 2014 after IRM had already engaged in over $1 bn in stock buybacks in 2010-2011.

Cash flow and its deployment to highly accretive capex and dividends is the main analytical focus here. If you need a debt/cap numbers, you can track market value adjusted leverage.

Funds from operations, liquidity, dividends…

The above chart details Funds from Operations (FFO) in NAREIT format as well as normalized FFO. They detail those nuances in their quarterly filings and break out the reconciliation of the line items. The Adjusted Funds from Operations (AFFO) covers all IRM operations after a line for “Normalized FFO.” The chart above breaks out the time series for capex, parent cash dividends paid (“paid” vs. declared), and cash paid for acquisitions. Those are the big uses of cash across the years, but the capex line will be the main event for years to come with respect to driving EBITDA.

A recurring theme in the IRM financial statements is that IRM has continued to grow its balance sheet on both sides – assets and debt. The capex and acquisition activity over the years has been accompanied by rising EBITDA running alongside rising debt. That trend is tied into the cash flow generated and deployed as noted in the above funds flow table.

The company runs a balance sheet consistently in the 5-handle leverage range (adjusted leverage metrics in the credit agreement use ease adjusted leverage metrics) with a 4.5x to 5.5x long term target range. The moving parts of the funds flow will likely continue to result in higher debt and higher EBITDA tied to the EBITDA accretive returns on the capex, which is dominated by growth capex each year. Opportunistic asset purchases and aggressive capex will be the reality as illustrated in the above chart, but the REIT years at IRM have shown the ability to execute.

Capex the critical driver of growth…

The table below provides details on the breakdown of growth capex and recurring capex needs. During 2022 the mix was almost 94% growth using total cash paid for capex as the focal point. Over the trailing 5 years that included a pandemic, the mix of growth capex was 80%.

The September 2022 “Investor Event and Site Tour” offered up a substantial amount of information on the IRM game plan that looks to drive 10% growth in revenues. Capex was a major part of the plan discussions.

The high margin RIM business and its impressive free cash flow was the key factor in the cash flow redeployment into the Data Center segment. IRM highlighted that many data centers need to use equity to fund big growth capex plans, but they have the high margin cash cow of the Global RIM business to tap into with its 70% handle gross margins.

Looking out over the intermediate term, Data Centers will get a significant majority share of the estimated $4 bn in capex expected over the next four years. This was cited in the September meeting. The general range for capex will be around 16% of revenues based on IRM’s guidance.

The mix of growth capex vs. recurring capex is an important one for IRM in getting comfortable with the aggressive cash flow allocation. In a recent presentation (March 2023), IRM cites $1 bn in capex for 2023 with only around $150 for recurring and $850 for growth.

IRM indicated that almost 75% of the growth capex is targeted for data centers and of that around 85% is pre-leased. That pre-leased stat is a pretty compelling soundbite on risk management in capex commitments. Management went out of their way to highlight the heavily de-risked capex programs they are running now when in early years they would have committed to more capex capacity “on spec.”

Whether you view that RIM segment free cash flow as serving dividend needs and incremental debt driving the additional investment, the main point is that both sides of the balance sheet grow as do revenues and earnings while keeping leverage in the 5-handle range for the foreseeable future. We look at capex at the segment level further below.

Dividends as a key driver of any REIT but especially this REIT…

The dividend priority while aiming to invest heavily for growth makes total debt “reduction” (vs. reducing leverage) a low priority. The company targets a dividend payout in the range of a low to mid-60% of AFFO. Meanwhile, capex will run higher on average in the years to come. We had a number of conversations on IRM over the years, and this could be a typical excerpt:

Bear: “They are borrowing to pay their dividend. That’s a no-no. They are screwed.”

Me: “No. With a couple of exceptions along the way, they are funding their dividend with cash flow. They are borrowing to fund incremental growth investments that are accretive to EBITDA. Their priority is growth.”

Bear: They can’t keep running the cash flow after capex and dividends like this.”

Me: Yes, they can. Subject to trends in their data center performance. The ability to cut capex planning is there also. If they cut their dividend to redeploy to capex and less debt growth, their stock will get hammered and the attempt to get a growth multiple damaged. They can handle this leverage and need to build a strong following in their stock. If they keep growing the data center operations, the 60% AFFO payout will bring a higher dividend and a higher multiple.”

I had this discussion with numerous Bears around 5-6 years ago, and IRM has delivered. We do not see this as “chicken and egg.” We see it as “cart and horse.” The horse is growth capex and balance sheet expansion tied to EBITDA growth. The reality is that IRM stock has done well, but they still have not hit that sweet spot of steady dividend growth and multiple expansion at the same time. That is still their ambition. If they redeploy dividends to capex, they lose shareholders. If they redeploy capex to dividends, they sacrifice their growth plan. In other words, they stay the course with the horse ahead of the cart.

As a footnote to the dividend timeline in the table above, we would highlight the trend is one of steady growth in the annual dividend payout whether by dividend increase or more shares outstanding or both.

The distortions in 2014 and 2017 should be noted. Without getting too far into the weeds on the dividends, the 2014 dividend line includes a combination of a catch-up dividend and special distribution tied to the midyear timing of REIT conversion made retroactive to the start of the 2014 fiscal year. The special distribution was part of the “E&P purge” (undistributed earnings and profits) that was required by IRS rules as part of REIT conversion. The 2017 reduction in cash dividend was simply tied to the fact that the fourth dividend was paid in early January 2018.

Debt will keep going higher along with revenues and earnings. The company makes the case that leverage eventually will be reduced organically by way of rising EBITDA. They have indicated in the past that they can get below 5x leverage that way. We shall see. They actually don’t have to be below 5 to be a BB. IRM could in fact be a BBB with 5x handle leverage. The agencies are supposed to explain the criteria on credit metrics a bit better with so many smaller REITs at 5 handles.

Getting below 5x leverage has not been the case since the REIT conversion given the simple fact that the company is seeking to grow out of its traditional business mix through a combination of acquisitions but mostly via high capex. That means getting down below 5.0x will be a high hurdle. The credit agreement gives some EBITDA “definition support” to the measurement of EBITDA to get it down to the current 5.1x.

From our standpoint, a 5x handle works fine for stable credit quality. The ability to raise the dividend has been challenged in recent years with such a high capex profile.

High gross margins as the cornerstone…

The above chart details the history of revenues and gross margins at the consolidated level, for the Storage rental revenue stream, and for Services. For 2022, revenues were up 13.6% in total and +17% on a constant currency basis with EBITDA up 15% currency adjusted.

In its recent presentations, IRM went through a diverse checklist of new business awards including new business initiatives such as in the emerging ALM business (Asset Lifecycle Management) that we discuss further below in the “Corporate and Other” segment profile.

The Storage Gross Margin has always been an eye opener that helps explain why IRM could pursue the REIT conversion as a logical plan and keep investing. The tight range in the low-to-mid 70% handle gross margins in storage is rare indeed. The high gross margins have been in place across the history of IRM as a REIT. As detailed in the chart, the Services margins are also quite strong but just seem low vs. Storage. Consistency is also a theme in those margins as well. The two together have left IRM with a long stretch of mid to high 50% handle gross margins in a tight range.

The organic revenue growth story line…

The period after the worst of the pandemic has been characterized by impressive organic growth even as the capex and acquisitions have been a key driver of revenue and earnings. Execution history on deals is important to a forward-looking view of the various investments and new initiatives in the “Corporate and Other” segment where the company is hatching more initiatives (notably ALM). We look at those issues in the segment discussions further below.

The above chart frames the recent spike in organic revenue growth as pricing drove the rise. The inflation effects for IRM have been a net positive for the top line that helps keep margins high. As we detail below, the weakness in Services was what drove negative numbers during COVID.

For the full year FY 2022, the organic growth rate of total revenues was +12.1% with +8.9% in storage and +17.6% in Service. Acquisitions added another +14.1% in growth in Service revenues.

The above chart frames the timeline for organic growth in storage revenues. Pricing drives the story including rental contract provisions for some that kick in when inflation triggers escalators.

The above chart shows the Services only piece of organic growth and the effects of lockdowns under COVID. The 2Q20 collapse is easily explained. The shift in services mix ahead will include more growth opportunities in the Asset Lifecycle Management revenues.

Business Segment Performance…

The above chart details the segment performance of the Global Records and Information Management (RIM) segment. The low 40% range EBITDA margins are impressive, and the relative capex needs are light in the context of the scale of the business. Segment capex was only 13% of segment EBITDA. That means very healthy cash flow is freed up for dividends or growth capex. In IRM’s case, the Data Center segment and the need to pay out a high rate of cash flow to shareholders uses all of that cash flow and more.

For all of FY 2022, the organic growth rate of the Global RIM segment was +10.8% with +6.8% in Storage and +17.7% in Services. Pricing and volume were both favorable.

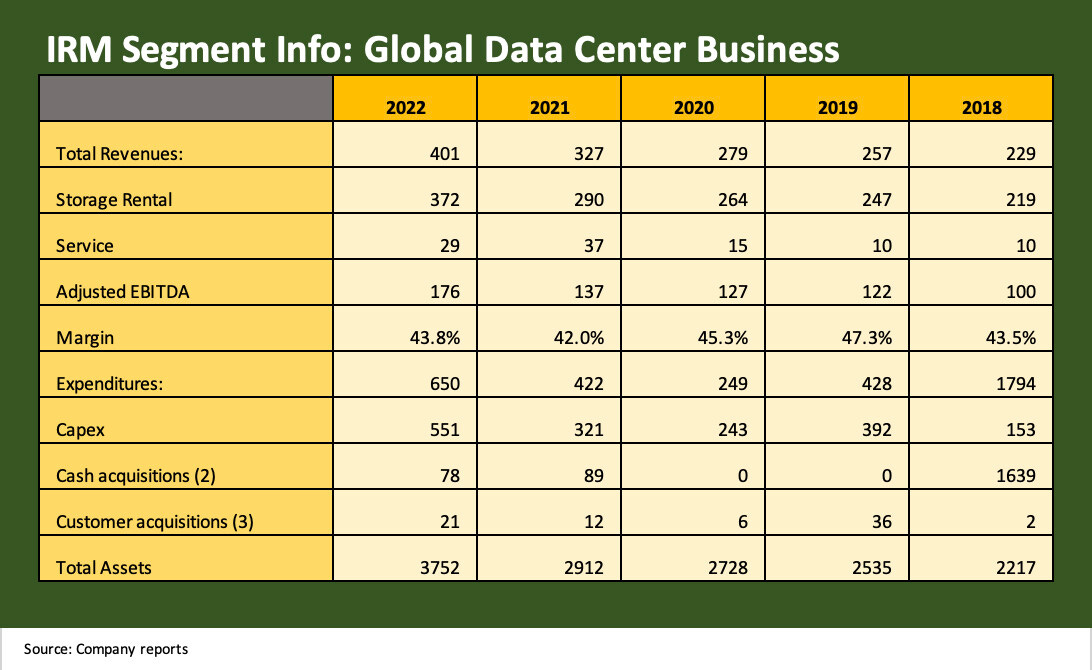

The Data Center business is where the addressable market has exploded in scale for IRM as a company. We see the high rate of capex and generally smaller acquisitions across time except for the $1.34 billion IO Data Center acquisition that closed in Jan 2018. The other major M&A deal IRM entered into was in the traditional RIM business with the Recall Holdings acquisition (heavily stock financed) back in 2016. In other words, much of the expansion in data centers has been part of a multiyear capex buildout. The expansion has not (so far) been about elephant hunting deals.

During 2022, Global Data Centers posted +22.6% organic growth with +27.9% in Storage and -18.8% in the segment’s small Service revenue line. The Data Center segment revenue mix is 93% Storage and 7% Services.

The above chart shows the evolving “Corporate and Other” segment results and financial profile. The segment includes the Fine Arts and ALM business as well as the usual array of corporate and administrative cost centers. Thus, the negative EBITDA with all the corporate overhead dumped into the numbers.

ALM (“Asset Lifecycle Management”) is a space that IRM sees as having a lot of potential. The headlines on the sector broadly frame electronic recycling and disposition as one of the rapidly growing areas that also requires chain of custody and security assurances.

The Revenue mix in this segment is more Services-centric with 86% of the revenue classified as Service and 14% Storage. For the segment, organic growth was +22.1% with Service +29% and Storage +7.5%. Acquisitions added +215% with the ITRenew deal.

Even beyond the e-waste features (i.e., the end of the asset life), the ALM business is getting a lot of attention in trade literature/commentary as an emerging business line. The addressable market is estimated at $15 bn now and expected to grow to $30 bn in a few years according to the company’s presentation in the fall.

IRM offers solutions on services such as remote wiping, storage, logistics, decommissioning, and recycling among others. Acronyms such as “ITAD” (“IT Asset Disposition” or “IT Asset Destruction”) and terms such as E-Waste Recycling are making the rounds. The potential for recurring revenues and global contracts is appealing to IRM’s footprint in adjacent business lines. The same target customer bases overlap in most cases. The company entered the hyperscale decommissioning business already in data in 2022. The rate of “refresh” with new technology and need for physical decommissioning make the ALM business a natural for IRM.

IRM gives a good sales pitch on the ALM topic. IRM indicates they are already a major vendor for some of the largest cloud players. They see “hundreds of millions in revenues” in this business over the next 5 years.

Over the long term, ALM is framed as an emerging opportunity with addressable markets “measured in tens of billions of dollars.” The details IRM provided on Investor Day showed how ALM services fit into their core competencies. They gave a good set of examples of services provided to some major customers that fit well with IRM’s ALM solution mix.

One customer was a major data center operator and the other was a major bank dealing with acquisition challenges in the form of redundant data systems. Projects included removing hard drives and processing servers.

The potential for recurring service revenues and growth makes intuitive sense. As a global corporation, IRM can target its current client base, utilities, and government bodies as they evolve their data and systems strategies. There will be a lot of work to do, revenue to book, and skilled labor needs to go with it.

The ALM business makes a leap with an acquisition…

The Corporate and Other segments saw more revenue and posted a major acquisition line in 2022 with an 80% stake in ITRenew which was acquired in Jan 2022 for a net purchase price of $718 mn. The $1.73 bn in assets and the $407 million in Revenues makes this “Corporate and Other” somewhat distinctive as a segment to explore in coming quarters.

These operations are in the Corporate sector, so ALM does not have a “Segment Name” yet even if ALM is a reporting unit. As an aside, we recently posted a credit profile on D.R. Horton (the #1 homebuilder). They had housed Single Family and Multifamily Rental in an “Other” segment until it earned its stripes as a stand-alone segment. This may be one of those cases with ALM, which is just getting underway as a growth business for IRM. At some point, this business will need to have better reporting transparency to get the equity markets on board for modeling.

The ALM operations strike us as an extension of the Data Center business and even in part the RIM operations. IRM had an “ITAD” operation that was housed in the RIM segment but now is part of the ALM reporting unit in “Corporate and Other.” We suspect that IRM did not want to drop the results of this newest business into the legacy segments with subjective allocations. That would also upset the optics of the impressive segment P&L of the two lead segments. We are a bit murky how this expanding operation fits into the REIT IRS rules but that is a topic we will try to understand.

We get into the line items of IRM’s total and net debt levels above, and we see the steady rise in total debt across the past five years with a slow period in 2020 during COVID. Earlier in this commentary, we looked back across a longer time horizon to show the steadily tracking rise across total assets, total debt, and EBITDA across the years since REIT conversion. This just gives more detail.

The leverage metrics as required by the Credit Agreement (Revolver, Term Loan A, Term Loan B) have remained within a range from 5.0x on the low end (2017) to 5.7x on the high end (2019). The leverage required by the banks is based on “Net Total Lease Adjusted Leverage” using an EBITDAR-based leverage test. The maximum leverage allowed under the credit agreement covenant is 7.0x and IRM was at 5.1x at year end 2022.

The definitions and carveout language in the Credit Agreement for EBITDA and definitions of “lease adjusted” morph across time, but the main point is that the banks have eased covenants, increased the commitment ($1.75 bn to $2.25 bn), and extended the maturity to 2027 during the March 2022 credit agreement amendment. The same applies to the $250 mn Term Loan A although the Term Loan A was refinanced and extended (vs. amended). Term Loan B matures Jan 2026. The max leverage was increased from 6.5x to 7.0x while the Net Secured Lease Adjusted Debt limit of 4.0x was removed.

IRM is one worth researching…

The great thing about REITs is the extensive disclosure, and that makes IRM one that can be researched in rigorous detail. The tougher part is that you need to look at as much of the disclosure as possible when a company is transitioning is legacy business mix in the way IRM has been doing.

In the case of IRM, the disclosure frames a good operating story around the company’s performance across the years as they seek to transform the company. The fact that they have a “peer group” of one in mix makes it harder to use direct peer group comps. It is that distinctive leadership in the RIM business and its 70% gross margins that makes IRM such an interesting and differentiated company in debt and equity markets alike.

Disclosure…

By way of background, I picked up coverage of IRM back in 2016 when I was at CreditSights since it was too big of a HY bond issuer to be left unattended. IRM was a well-known brand name and a service provider to CreditSights (where apparently their pricing power was amply demonstrated). The street was not broadly stepping up in covering the name (in debt or equity). IRM seems to be one of those names in debt coverage that gets assigned and is not requested as a coverage duty. It is not “single B sexy” for HY followers and is not held broadly in IG portfolios.

In the interests of disclosure, I could not buy IRM stock when I was covering the name as a bond at CreditSights. I have no positions now after I sold down IRM for gains in 2022. During 2021-2022, I had been actively managing some stock positions in IRM. The equity does tend to swing around for such a large cap income stock. The dividend gets a lot of attention but is not quite as compelling as the old days before so many Fed hikes.