FedEx: Stability Counts, Complexity Challenges

We put FedEx equity performance in peer group context and offer a quick view on bond value as FDX has tight spreads for good reason.

We look at the relative value of FedEx within a BBB bond tier where the company is comfortable and stable in the mid-range.

The range of business lines and service offerings at FDX (broken out in their quarterly disclosure) is a reminder of how multi-tiered freight and logistics can be around capital intensity and the range of service offerings.

As FDX gears up for new segment disclosure and P&L reporting for their 2025 fiscal year (May 31 will end FY 2024), they are undergoing a wide range of operational changes to get their cost curve in line to generate margins more competitive with peers even as FDX heavily invests in its operations.

After going through the past 5 years of a global pandemic, war disruptions, erratic trade policies, and at the top of the list supplier chain chaos, FDX is coming out the other side with stable credit quality on a steady balance sheet.

We covered the framework of the FedEx story in our Credit Crib note yesterday (see Credit Crib Note: FedEx Corp 1-22-24). In this commentary, we revisit where FDX stock and bonds fit into the scheme of their respective markets.

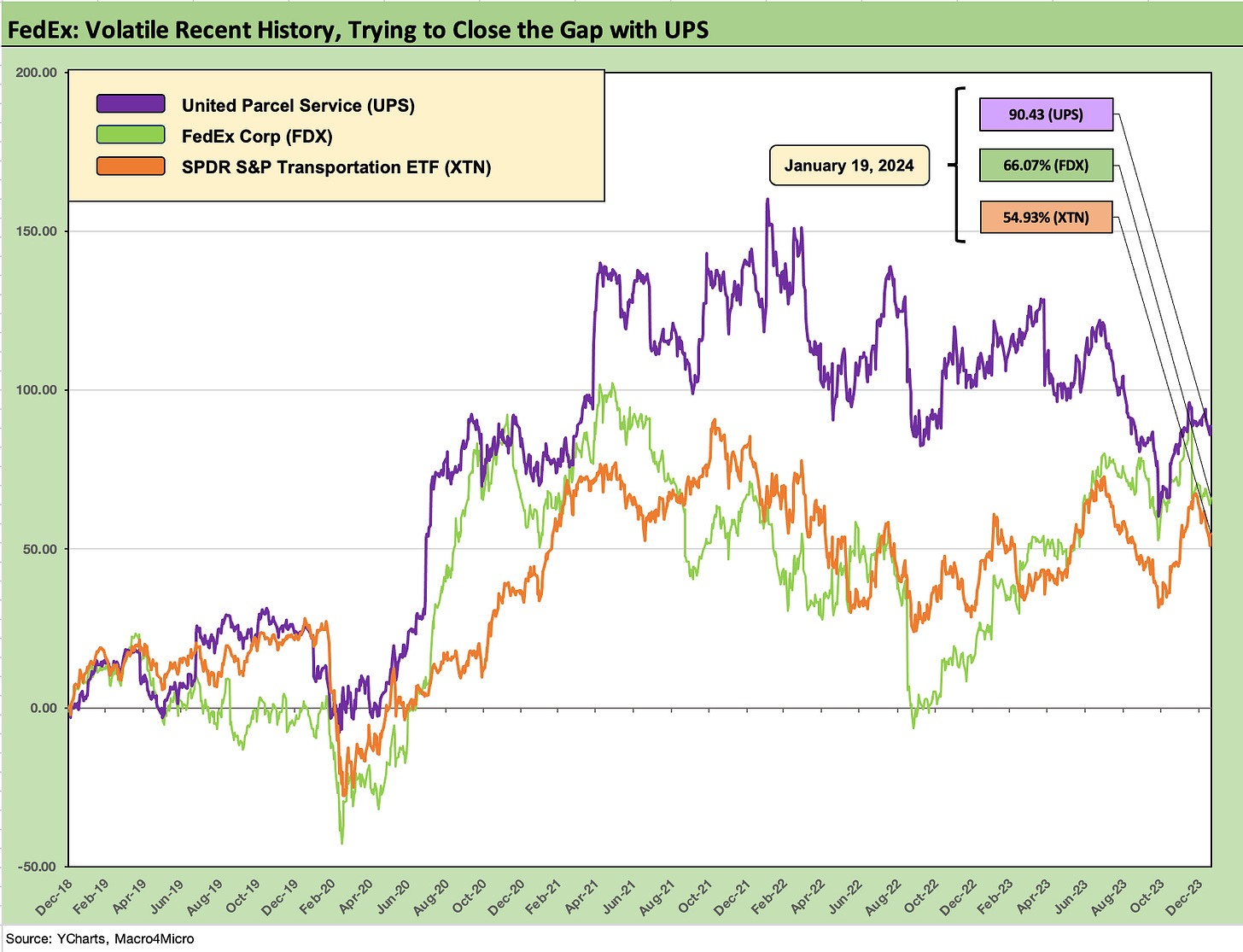

We see FDX equity showing the major swings down and back up across the post-COVID period as the market demanded better numbers out of them in 2022. FDX had materially diverged from UPS and is now playing catchup. The rally shows why they have undertaken such major initiatives to improve their core operating performance.

In contrast, the credit markets reflect the demonstrated stability of FDX financial metrics with a narrow net debt level range across those volatile years and lower leverage than 2019. The consistency of the balance sheet even in the face of record capex and shareholder payouts is the easiest way to capture how they weathered the 2020-2023 volatility.

UPS is a mid-single A tier composite rating, so we looked at some rail bonds (e.g. CSX at a high BBB1 composite) and one good airline comp (Southwest Airlines (LUV) at a high BBB1 composite) among some others. FDX traded slightly wide to CSX and inside Southwest. LUV faces the very volatile industry backdrop but a balance sheet that has cash in excess of total debt (that is a rare airline!). These healthy operators with strong market positions and some major barriers to entry are clustered in a tight range.

FDX bonds may be tight, but they have earned it based on scale and performance in keeping their balance sheet in line while reinvesting heavily and enhancing shareholders via dividends and buybacks as we detail in the Crib Notes piece.

Freight and logistics useful for a read on current conditions…

There is a reason why names such as FedEx and UPS are looked at as useful bellwethers for the health of the overall economy. In its simplest form, the volumes don’t lie, and you don’t get buried in a lot of economic SAAR assumptions and survey samples that we see in many of the industrial and retail indicators we watch. Price x Volume from a large cap operator offers a view of the real action on the ground (and in the air) in the freight and parcel markets.

FDX publishes a daunting array of data each quarter on volumes (units, weight, etc.) and pricing/yield info in its quarterly supplemental disclosure. We looked at a sample of those in our Crib Note on FDX. The data points for now show a softer market that supports the Goldilocks or soft-landing school. If the Fed looked at the volume and pricing at FDX, they would put that in the “not too hot to ease” column UST bulls are expecting.

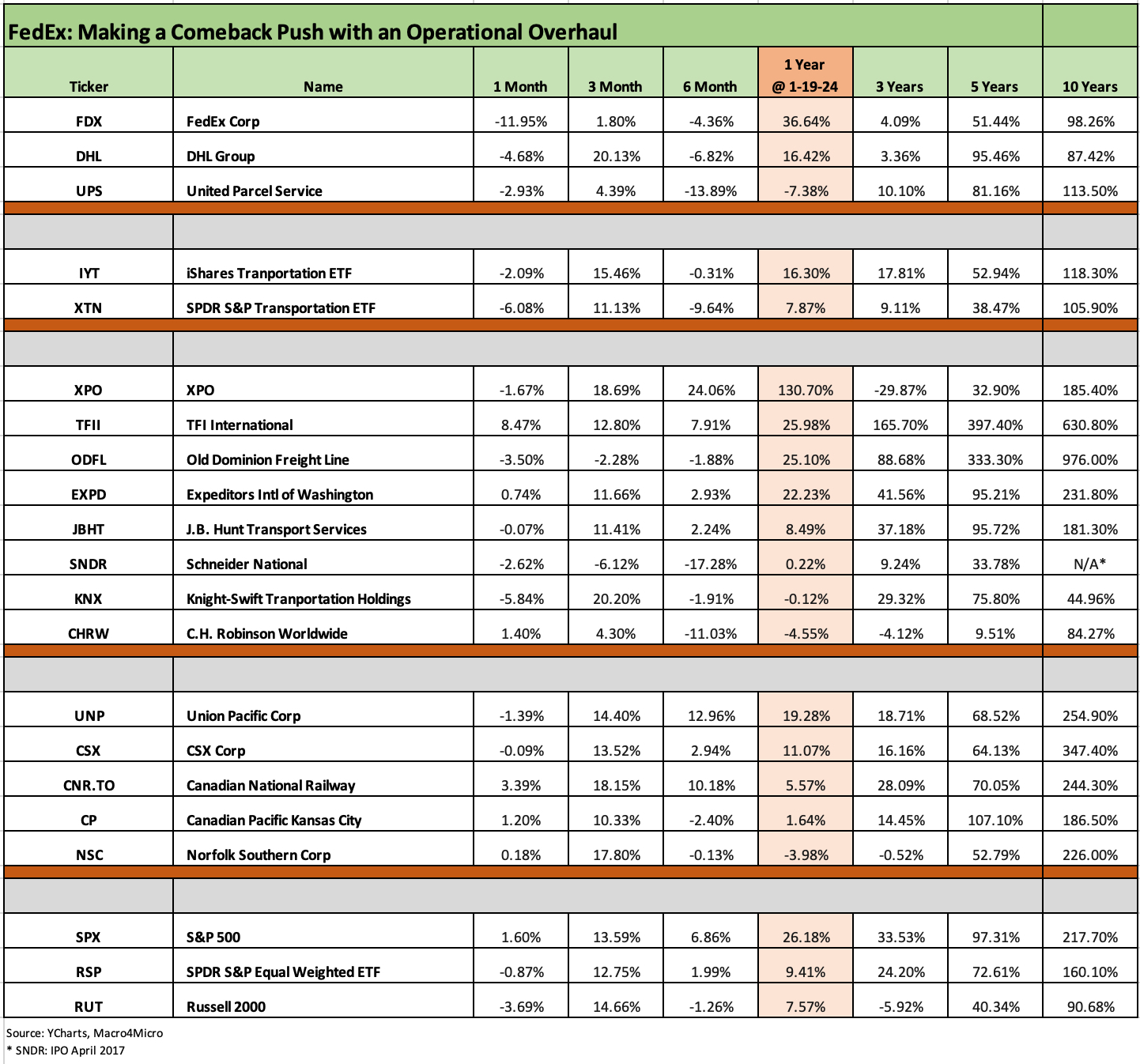

The checklist of names in the stock chart below shows some of the companies that connect the supplier chains, manufacturers, service providers, and consumers. If activity in the US or globally is weak, the parcels, the supplier chain inputs, or the finished goods should show some signs. The materials, finished goods, and documents have to get from Point A to Point B. In manufactured goods (such as the automotive chain), that can sometimes be point A to Z with a few round trips across borders between the A and Z (notably China, Mexico, Canada, Europe) with sea, air, and land all part of some journeys.

A much greater appreciation for the complexity of freight and logistics (and the need for more private-public dialogue) was gained after the COVID supplier chain meltdown. If we are going to follow macro trends, we should be watching these sectors. The fact that some of these names are major stand-alone debt issuers is another reason.

There are more trade rags covering the space than ever after the COVID supplier chain meltdown, but the old school grandaddy is the Journal of Commerce (the JOC). When we started CreditSights long ago, the JOC and American Metals Market (both in daily hard copy!) were “go to” periodicals as I looked for macro signs. The raw materials and the flow of goods are always worth watching. These have all been rolled into high price digital publications and data sources now.

In the “old days,” the Dow Jones Transportation Average was often used as a key economic and market indicator. The US service-heavy economy and global trade is more complicated now, but so are supplier chains and working capital management. How else could Amazon get to be #1 in yet another business line?

The above stock table frames FDX in the context of a broader peer group even if the natural, narrow peer group from an operating standpoint would be UPS or even DHL in many business lines and service offerings. Amazon competes with FDX as do a range of truckload and less than truckload (LTL) operators and rails. To reflect this diversity of business lines, we throw a broader range of names in the peer group and post up their trailing time horizon returns above.

We don’t include Amazon, who at this point should probably be viewed as a “sovereign” bond that happens to have equity also. The ability of Amazon to leap into the leadership position on transportation and freight services should not be surprising given the synergy with retail services and intrinsic focus on working capital management.

Amazon’s extensive fleet of delivery vehicles and smart warehouses reflect the growth opportunities in services in the freight and logistics sector. That is true whether the status quo remains the rule in global trade growth or whether reshoring actually plays out and thus ends up as more than just another short term political sales pitch. The role of Amazon is an X-factor that keeps the heat on the other providers to keep investing in the quality and efficiency and pricing strategies in their operations.

Trade policy, politics, logistics, and the ball of confusion…

The table above underscores that there is a lot going on in a world with very complex supplier chains that will face more than just the challenges of Houthis firing missiles. The US-China geopolitical tension, the threats by Trump to slap a 10% universal tariff on all imports, and the intrinsic risks of trade battles after the 2024 election will challenge global purchasing managers and how shippers and logistics service providers need to plan.

We take the 10% tariff threat seriously even if we need to consider the attention span haircut that comes with the source. After all, even the wizards of congressional finance (Paul Ryan, Kevin Brady) thought a 20% Border Adjustment Tax was the key to bringing jobs home and overhauling (a.k.a. lowering) corporate income taxes. That was in 2017.

That “BAT tax” revisit is a story for another day (post-election), but the Senate last time shredded it on the steps before it got in the door. We wrote on it at the time in prior lives. It was a plan that entailed massive assumptions on the dollar getting extremely strong and offsetting the intrinsic inflationary impact of the tariff. The bill was seen as an expense dagger for many companies with major global purchasing plans. It certainly would have ended up with Last Rites for retailers (some died anyway).

For a company such as FedEx, the reshoring theme can shift the volumes and the mix, but FDX’s role as among the dominant freight leaders would offer plenty to do either way. They have the US-centric asset base to have an advantage in the US. US-centric freight service providers would be the winners. That 10% tariff plan by Trump is more likely part of his general impulse control issue. At this point, there are no details. 2020 had no GOP platform (that was very strange), so tariff issues are a long way off.