Credit Crib Note: FedEx Corp (FDX)

We look at the credit risk and fundamental profile of FedEx Corp.

Credit quality trend: Stable. FDX has been through one of the most volatile periods in the history of freight and logistics over the past 5 years, but its balance sheet is stronger today than in 2019 despite a streak of almost $33 bn in capex from 2019 through F2Q24 (11-30, May fiscal year) and $39 billion in combined capex and stock buybacks. If we tack on dividends, the cash outlays climb about $43 bn. The ability to maintain lower leverage than FY 2019 and hold mid-BBB tier ratings with a stable outlook is impressive. That is especially the case while taking care of core capex requirements and balancing investments with shareholder needs via buybacks and dividends. There are challenges in execution risk and secular changes in their core businesses to go with the usual cyclical pressures, but they are well positioned to meet the demands.

Operating profile: FedEx is the #1 global express transportation company but the #3 transportation services provider globally behind Amazon and UPS (Journal of Commerce rankings). The value of freight and logistics infrastructure and the embedded investment in the asset base and technology support offer a major competitive head start and a barrier to entry on the capital investment demands. Air cargo and trucking operations (Ground or Freight segment) can face swings in capacity that can flow into pricing.

In addition, the business models of shippers as well as the freight and transport service providers are moving and evolving with the role of Amazon and the need for more change in the US Postal System. Meanwhile, major shippers are adjusting strategies with insourcing and JVs being part of optimizing costs and working capital management. This is a massive, diverse, and complex sector.

While global trade is a critical variable and trade conflict a risk, FDX generated around 72% of its revenue in the US while maintaining a strong position in Europe after its 2016 TNT Express deal. Among ongoing secular risks are shifting patterns of e-commerce supplier chain and logistics management and inventory planning. Major shippers sometimes take some of their operations in-house or work with Amazon, and that has been a major structural evolution of the industry. Other risks include the role of commercial airline cargo “belly” capacity and any related rate pressure from changes in commercial travel, geopolitical tension, or trade stress. The same will be true if tariffs get raised again after the election.

Even if volumes weaken more with a slowdown in global activity, the demonstrated pricing power of FDX has cushioned results across the tightening cycle and geopolitical disruptions that undermined many economies across 2022-2023. Yields have been resilient in some areas (detailed below in the operating metrics section) despite the recent softening of volumes while FDX wrestles with a global transformation and restructuring program to improve efficiency through steps to integrate its global network. Those programs are being executed through various initiatives carrying catchy names (DRIVE, Network 2.0, “One FedEx”). The ability to post improved profits with lower revenues is an indicator that the restructuring benefits from the various DRIVE initiatives are having effects.

Financial trends: The headlines from F2Q24 earnings were dominated by the FDX equity market sell-off after a downward revision in FY 2024 guidance despite reaffirmation of the EPS guidance. Solid cash flow and the ability to reinvest in a wide range of operational efficiency measures and restructuring initiatives is a key attribute supporting FDX financial prospects and credit stability. Capex is well above depreciation in its core earnings segments as FDX adapts to more demanding global market challenges in all aspects of its business.

Net debt has remained in a tight range since across FY 2021 and into FY 2024 with balance sheet leverage lower than those posted in 2019 and 2020. Revenue had grown materially since the pre-COVID period, but earnings growth had been struggling, in turn providing the catalyst for the wave of multi-year restructuring actions in a capital-intensive and tech-intensive global operation.

The steady margins across time highlight the relative financial stability of FDX even if margins remain well below FDX ambitions and require more operational restructuring actions to get them moving higher.

For the F2Q24 period (11-30) and YTD 6M period, FDX posted higher margins YoY for the quarter and YTD period despite lower revenue as restructuring actions and unit cost benefits trumped volume weakness.

Pricing power and the readily available use of surcharges to counter volatility in some key expense lines such as fuel and gasoline costs signal lower overall expense risk as well as reassuring FDX investors on the value of the pricing power they have demonstrated in many parts of their business lines.

The surcharge flexibility was supportive during the worst of the 2022 refined product spikes and related inflation surge.

Cyclical volume will remain the bigger challenge after the 2022 revenue peak with global industrial production under pressure in multiple markets and the Express and Freight segments showing some of the headwind effects.

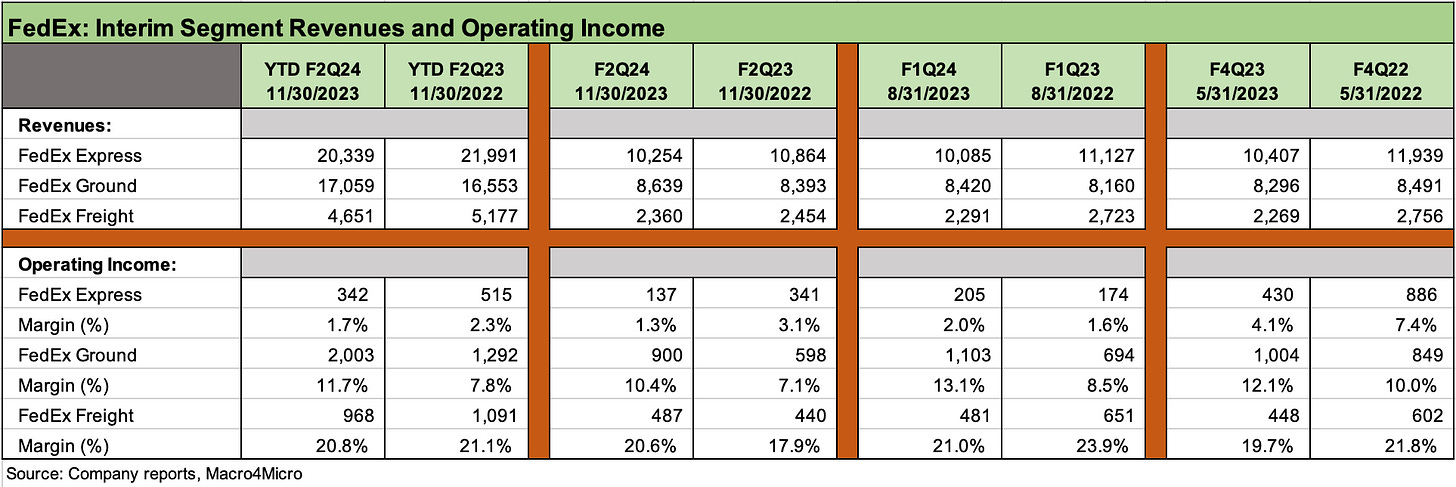

The segments that we detail above include the revenue and profitability trends for the three reportable segments that disclose earnings. The results show a mix of cyclical volume weakness in some key markets while highlighting the mitigating effects on earnings and margins from the benefit of the DRIVE initiatives to improve network efficiency and fixed costs.

Transportation segments that report both revenue and operating income are detailed above while the fourth reportable segment is the FedEx Services segment (not shown), which provides a wide range of technology and support functions that get charged to the transportation segments.

FDX is promising a new “re-segmented structure” in the first quarter of FY 2025 to reflect the new operating model of FDX that integrates Express and Ground operations while leaving the LTL trucking business (“Less Than Truckload”) as a stand-alone operation.

The above breakdown highlights the weakness in Express margins with Ground posting favorable trends and the smaller Freight unit steady.

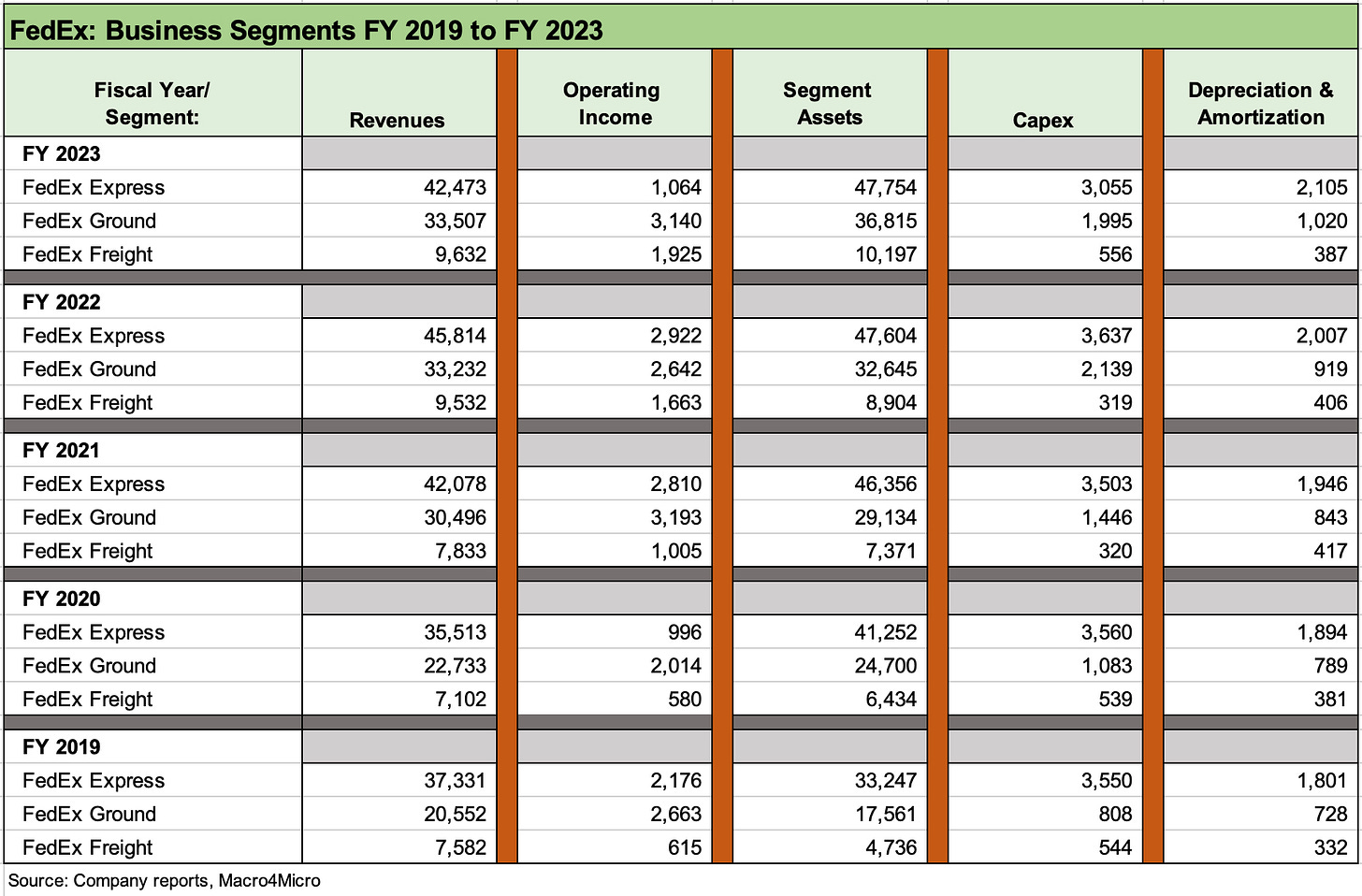

The annual results above for the three main transportation segments also break out the capex, assets, and depreciation for each segment.

The main takeaway is high capital intensity and a massive asset base but with capex well in excess of depreciation. Aircraft and related equipment comprise the largest line item in consolidated capex over the past 5 years at over $10 bn, package handling and ground support equipment is next at $6.6 bn, and facilities third at just over $5 bn (see capex details further below).

The Express segment is “where the aircraft live” along with the extensive vehicle and facilities infrastructure and over 245,000 employees at FY 2023, including the much-enlarged European operation that came with the 2016 TNT Express acquisition.

The Ground and Freight segments have picked up some volume from the bankruptcy and ongoing liquidation of Yellow where the capacity balance will be tight but subject to the utilization plan of the buyers who have the flexibility to hold some capacity in reserve for more favorable markets or to rationalize their pro forma asset base.

Expense risks include the ongoing challenge to pressure FDX to treat contract drivers and contracted personnel as full time employees.

The operating metrics provided by FDX in its quarterly and annual disclosure is quite extensive and broken out across a wide range of service offerings, but the main takeaway is that the segment data captures revenue trends (pricing and yield) and volume (units and pounds/tonnage). We select some notable metrics above for the main reportable segments.

The wild ride cuts across COVID, the volume rebound during the 2021 boom, the Russia-Ukraine disruptions and fuel spikes of calendar year 2022, and then on into a mixed period where volumes have softened but some pricing power was still available with an assist from surcharges.

The challenge in FY 2023 included a broad weakening of volumes as detailed in the chart while FY 2024 has continued with weakness in Express volumes for the YTD period but with firmer results in the Ground segment and a favorable swing factor on the cost side.

In other words, the weakness in volumes and erosion of some revenue enhancements (e.g. lower surcharges) requires that FDX get more efficient to make its case with shareholders. The effort is seen in the new wave of initiatives the company has been rolling out.

The above chart highlights the ability of FedEx to maintain a strong balance sheet and keep net debt within a narrow band even in the face of a volatile period across the COVID crisis, supplier chain stress, logistical challenges across the globe that were unprecedented in scale with the pandemic, and a fuel price spike with the Russia-Ukraine war.

Debt % cap is lower in FY 2024 than in FY 2019 with a healthy base of balance sheet liquidity and available unsecured bank lines.

FDX has $3.5 bn available in its two bank lines with the 3-year credit agreement ($1.5 bn) expiring in March 2025 while the 5-year ($2 bn) expires in March 2026.

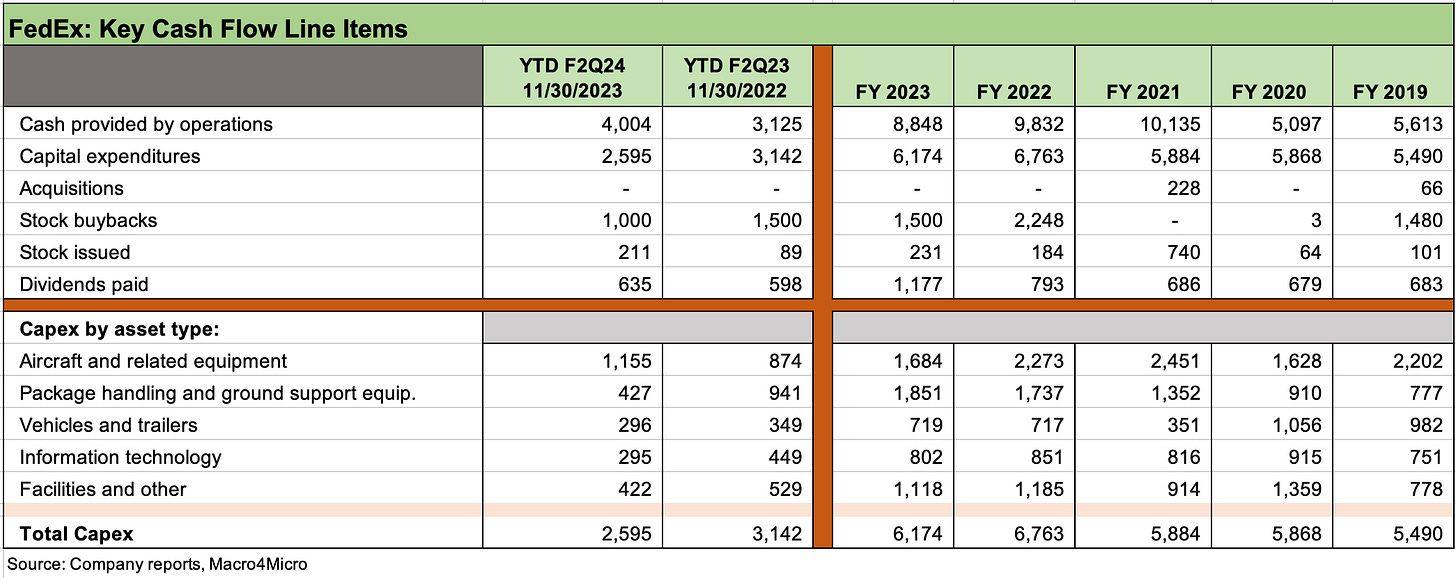

The cash flow line items detailed above drive home the heavy capex and buyback program running alongside a series of dividend hikes in recent years that leaves the quarterly dividend payout almost double the per share amount of late 2019.

Capex details are broken out by major category with peak years in capex seen in 2022-2023 at more than $6 bn with the FY 2024 capex total estimated at $5.7 bn, down $500 million from FY 2023.

The stock buyback program was approved at $5 bn back in 2021 with $1.6 bn remaining under the authorization as of 11-30-23. FDX indicated it will repurchase another $1 bn during the remainder of FY 2024.

On the pension front, FDX has several plans and it shifted new non-union employees to defined contribution plans after 2020. The US defined benefit plan was underfunded by -$1.6 bn at 5-31-23, which amounts to just under 2.6% of FDX market value of equity (1-22-24). The drain rate (pension benefit payments % ending plan assets) was a very manageable 5.1%.

FDX had no minimum required contributions for the defined plan for FY 2024 but made contributions of $400 mn in the first half of FY 2024 and will make another contribution of $400 in 2H24.

FDX also has a legacy OPEB plan at FY 2023 with an unfunded balance of $1.2 bn with the most recent year posting a benefit payout rate of only $107 million. The main OPEB plan is capped with most benefits no longer subject to inflation under the terms of the health care plans.

Highlights and Histories

In the freight and logistics sector broadly, more service providers have diversified their mix through alliances and acquisitions as companies seek to offer integrated end-to-end logistics and supply chain solutions in a global market that saw many operational reassessments after COVID.

FDX capex intensity creates massive barriers to entry in some of its business lines, but the asset base across Air Cargo and Ground operations and the related infrastructure provide major competitive advantages that translate into pricing power when markets are healthy.

The expansion of FDX service offerings mandate a high rate of sustained investment as well as structural changes in how its asset base is managed as seen in the DRIVE initiatives and related planning around asset utilization and efficiency improvements (Network 2.0, “One FedEx” integration plan, and the Tricolor Strategy on priority vs. off-cycle scheduling and owned vs. third party fleet).

During F4Q23, FDX announced “One FedEx” to consolidate FedEx Express, FedEx Ground, and FedEx Services under one corporate umbrella in what may sound logical but marked a material departure from the traditional operating model. FedEx Freight, the LTL trucking operation, will continue to be a stand-alone operation.

FDX acquired TNT Express back in May 2016 (deal announced April 2015 with a valuation of $4.8 bn at the time) and materially expanded the Express operating base in Europe. Full integration of TNT was not completed until 2022.

FDX operates multiple major operating hubs in the Asia-Pacific region including China, Japan, and Singapore.

Among the more notable competitive pressures include the growing delivery, vehicle, and related asset base of major retailers (Walmart, Costco) who embraced more insourcing even as Amazon became the all-star of pandemic delivery success and continues to build out a massive fleet and smart warehouse infrastructure.