Existing Home Sales: Inventory Radar or Sonar?

Sub-1 million units of existing inventory raise a debate around supply-demand across new, existing, and rentals.

We look at the latest numbers and provide some multicycle context to the inventory trend line and the swings in new vs. existing homes.

The “Where do I live question?” ties into the available supply of rentals plus new and used units to buy, so the total supply vs. demand equation will be about framing when those variables will hit a stabilization point.

The sum of existing and new supply is dropping, so the handicapping is about when rental rates find a floor and how diverse rental fundamentals will prove to be across regions whether in single family rentals or in multifamily structures.

With rolling starts in single family units down and multifamily likely past a peak, the forward-looking risk assessment needs to find a comfort zone as the equity markets appear to be signaling with the recent homebuilder rally.

Each month brings a series of ugly YoY comps in housing sales and plummeting YoY volumes, and that will roll on for a while until the calendar brings easier comps. Framing deep YoY declines quickly gets boring, and we start to hear an old one liner from a long-ago TV Show: “Thanks for the late-breaking news item… Have you heard about the Hindenburg?” In this note, we try to zero in more on the inventory topic and revisit the multi-cycle timelines.

Below we recount the usual YoY plunge and sequential changes, but we also look back across the period from before the housing bubble of 2004-2006. We then track the numbers across the housing market crash, through the wild swings in COVID, and then the latest mortgage spike and housing volume swoon.

The inventory line raises some topics to ponder…

The inventory line should start to play a much bigger role in the thought process as we roll into 2023. The combination of employment trends, inflation, the UST curve, and mortgage rates are still doing their thing, but finding the inventory bottom will get more realistic very soon as the peak selling season approaches.

According to Mortgage News Daily, which gets inputs from a wide range of sources, 30Y fixed mortgage rates were just over 6.1% to end the week. We are now well off the highs even if more than double the COVID lows. Mortgages are well down from over 7.3% in October. A 6% handle is not a new experience even during the housing boom of 2005 when 30Y fixed ran in the high 5% range most of the year and closed out at 6% handles at year end. 30Y mortgages stayed above 6% handles across 2006 as the housing market headed for its reality check on the recent history of easy credit, inflated prices, and too many unqualified borrowers (with many about to get a case of reset shock).

The inventory of existing homes is a crucial swing factor ahead with respect to how it can play into new home supply and the inventory of available rentals. The above chart details existing home sales inventory by units from 1999 to 2022. The steady decline in units across the post-crisis cycle is clear enough in the time series.

The chart also breaks out the median inventory number of 2175K from Jan 1999 to Dec 2022. This median is over double the Dec 2022 level. We show medians for the 2004-2007 boom years of 2900K or almost 3X current inventory levels. The median from Jan 2011 to Dec 2022 was 1880K vs. the recent 970K. We chose 2011 since that started with a period of sovereign turmoil that kept the QE and ZIRP going and saw a material downshift in the long end of the curve. We are about to revisit a debt ceiling crisis of the sort seen in the summer of 2011, but this one could have the opposite effect on rates if handled badly.

Today we have record payroll numbers, extraordinarily low unemployment, and rising wages, so that 2004-2007 level is an anomaly. Anyone with a whim and a pulse or an impulse (to lie) could get a high LTV mortgage with an appraisal based on an extreme market. Home value assessments were easy to support and fed the bubble and the securitization and counterparty excess.

Many of us have anecdotal stories of an acquaintance making $50K in wages affirming income levels well above that (at a significant multiple). Then there are the 125% LTV stories. The point is that backdrop was very different than today even with HELOCs back in vogue and Non-QM mortgages serving as a growing business line for various mortgage market players. Asset risk is rising again, but the backdrop is nothing like 2007-2008.

The declining inventory underscores the buyer and seller disruptions of the mortgage spike but also offers some hope. We now see an inventory low was reached in Feb 2022 at 850K for very different reasons (strong demand, low rates). Houses were still a hot item that month and the UST curve had not yet started its dramatic upward migration. During Feb 2022, the single family inventory months stood at 1.9 months.

The Fed tightening cycle kicked into gear in March 2022 and the drawdowns in inventory include that lack of sellers and the scarcity of buyers. Credit is more costly and tighter now with more flunking the QM test in income vs. debt. The total months inventory in Dec 2022 declined for total existing inventory to 2.9 months in Dec 2022 from 3.3 months in Nov 2022, but is still well above the 1.7 months of Dec 2021.

Potential buyers did not disappear…

The unit inventory number is the one we keep watching as we consider demographics and demand and a basic supply shortage relative to the interim need over the next few years. The question for this existing home inventory balance is where the buyers come from. Will they come from the crossover buyer who finds new homes too pricey or the post-rental buyer (first time or otherwise) who is considering the economics of their various options or their lifestyle priorities.

First time buyers are waiting in the wings with 50-year lows in unemployment and many job openings (see December Jobs Report: Mixed Feelings 1-6-23). The first-time mix comprised 31% of sales in Dec 2022, up from 28% in Nov 2022 and 30% in Dec 2021. The problem with the first time buyer and starter home segment is that they are often more vulnerable to flunking the credit approval process.

The potential homebuyer can be among those still saving for their down payments and not liking this market or those who already have the down payment in hand but don’t like mortgage rates and monthly payments now. Some will see the best options over the short term being in the rental markets. Local rental rates then get factored into the CPI math of Owners’ Equivalent Rent.

There is a natural base level of activity in housing and mortgages. I recall being on a roadshow long ago with Countrywide Credit management meeting bondholders (late 1980s). One analyst asked, “What if there are no buyers or sellers of homes?” While it was an odd question as framed, the answer was interesting. To paraphrase it, the basic answer was “demographics, population expansion, graduation, marriage, starting a family, death, divorce, relocation, progress in careers and income, loss of employment, foreclosure, retirement and cash raising, etc.” It’s always something.

Existing home sales vs. new home sales history…

Below we get more into the historical timelines on Existing Home Sales vs. New Home Sales. We note that new home sales numbers for Dec will be out next week. The overriding question from here besides the UST curve and mortgage rate moderation is how the cycle and jobs hold up. That is not a new discussion. There is an opportunity for a cash buyer to exploit the price pressure from high mortgage rates, and the cash buyer mix in Dec 2022 rose to 28% from 26% in Nov 2022 and from 23% in Dec 2021.

There is also the potential shift in consumer preference and what a homebuyer is willing to settle for and at what price (2 vs. 3 bedrooms, the location in general, the school system, etc.). Some people are allergic to renting, and some are not. The seller can decide that the home equity base monetization is still very high even if sequentially lower and pull the trigger. The buyer with the down payment can say “I can always refi later” etc. There are a lot of moving parts.

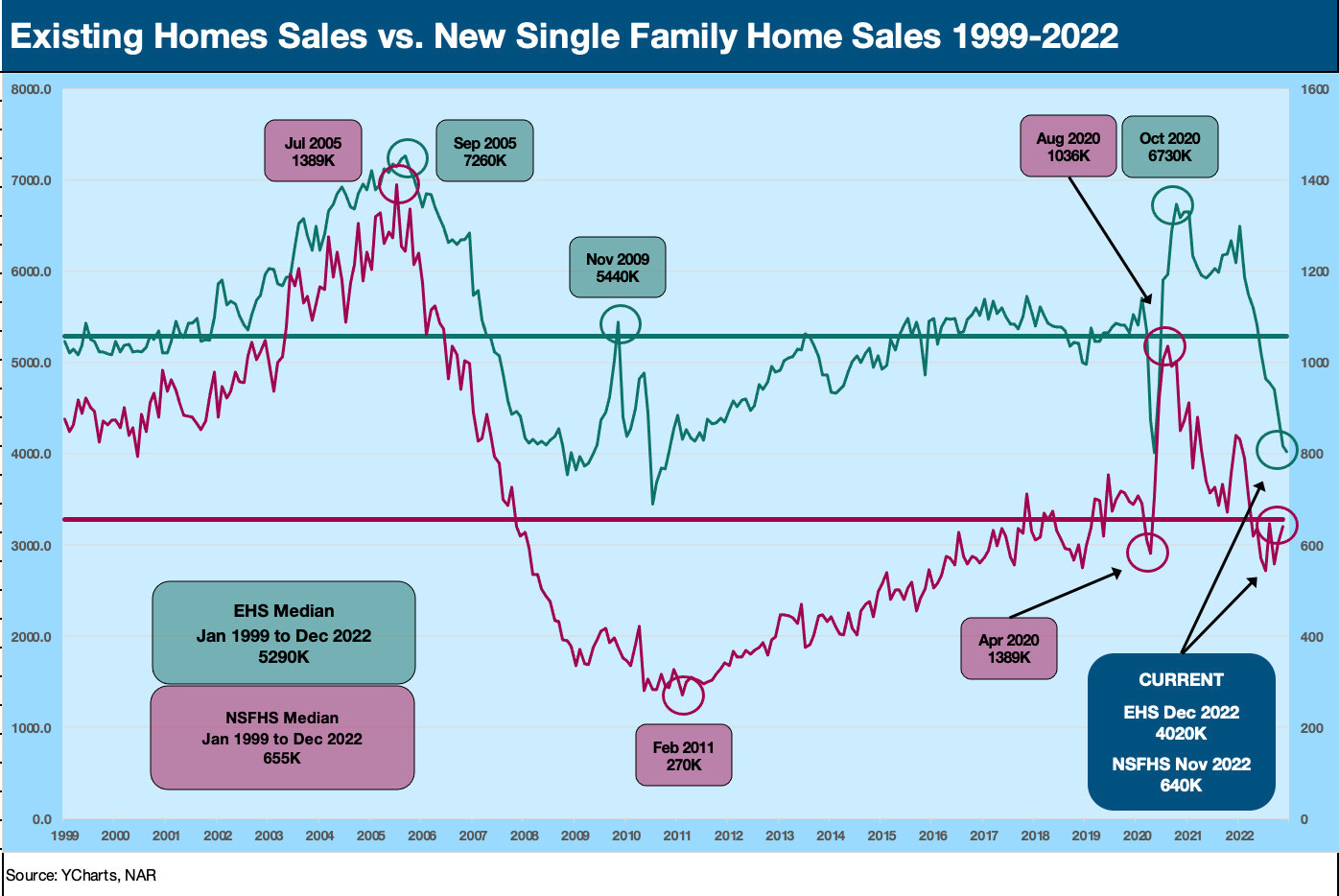

The above chart gives a sense of scale of existing vs. new homes. We post the historical time series on one axis to drive home the difference in volumes. Most people know this relative magnitude of existing vs. new, but the chart above hammers it home with a look at old vs. new since 1999. Total existing usually weighs in around 90% of the total of all home sales (new plus used).

The volume differential is self-evident, but existing home sales price medians are also distinct. For Dec 2022, the median price for existing home sales was $366,900. That was still higher YoY by 2.3% even if that comparison is subject to mix distortions. The last median price for new home sales (for Nov 2022) for $471,200. That is a big difference in price.

The above chart scale (left-right axis) allows for a better sense of the moves across the same time period for each category. We see the Existing Home Sales (“EHS”) median of 5290K well above the current 4020K in Dec 2022. The New Single Family Home Sales (“NSFHS”) median at 655K from Jan 1999 to Dec 2022 is modestly above the Nov 2022 level of 640K.

The low median for new home sales includes the brutal downturn after the housing bubble that saw a 270K low in Feb 2011. As the economy improved, employment steadily rose and ZIRP and/or QE became the norm, we saw a steady rise until the whipsaw of COVID. The rebound drove EHS to a level of 6730K in Oct 2020 – just before the vaccine. The COVID period essentially pushed the spring selling season into the fall. NSFHS also hit a post-crisis peak during COVID at 1036K in Aug 2020.

A run through the Dec 2022 existing home results…

In terms of the YoY plunge, the 34% YoY slide in Dec 2022 for existing home sales (“EHS”) is not much different than what one would expect framed against the end of 2021. The same is true for the 33.5% decline in single family home sales and the -38.5% YoY decline in existing condo and co-op sales volumes.

The full year numbers for 2022 posted a -17.8% decline vs. full year 2021 after 11 straight months of sequential monthly declines. Only Jan 2022 was up from the prior month. The mortgage impact story is an old and oft-covered one, so we don’t need to revisit the badly impaired affordability metrics here. Among notable stats for the full year 2022, the annual share of first time buyers was 26% or the lowest since NAR has tracked that indicator.

As discussed earlier, our main focus for the existing home sales metrics from here is trying to discern what the consistently declining inventory numbers in units will mean across various regions for local rental conditions and how that will dovetail with the near record number of total homes under construction and a still very high build rate for single family (most under contract but many not depending on the builder). The chart above updates the YoY declines for total existing homes and single family only.

We will get to sample some disclosure on the key supply topics (spec count, the % mix of “under construction” that are also under contract, cancellation rates, etc.,) as more major builders weigh in starting next week with DR Horton (#1 builder) on 1/24 followed by Pulte (#3 builder) on 1/31 along with MDC on the same day. More will roll out in February.

The rolling fiscal years have been offering monthly updates (e.g. LEN and KBH for the Nov 2022 quarter and Toll Brothers for the Oct 2022 quarter). The builder color can help frame the strategic response across various categories of incentives to mitigate cancellation risks and wind down new community sales. The builders need to be creative with current sales and pricing plans without blowing up their pricing structure and driving even more cancellations and revenue loss.

The inventory factor in existing home sales…

We have already cited some of our views on why existing home sales tell a story that helps frame downside risks in pricing and the health of the rental market (see Market Menagerie: Existing Home Sales – Hammer Meets Nail 12-21-22 and Market Menagerie: Existing Home Sales – Supply Swing Factor 11-20-22). To reiterate, existing home sales is typically over 90% of monthly total home sales (new and used) and the EHS supply posts lower average prices than new home sales and comes in a wider range of offerings. It is the housing market’s version of the “used car market” but with much bigger ticket items. The homes usually (not always) have material positive equity in this market. Unlike used cars, the Existing Home has long term appreciation value (obviously that varies over short term).

The price trends and mortgage rate factor will determine “how much house” a homebuyer can buy if a buyer needs a mortgage. The rising mix of cash buyers in Dec 2022 numbers shows some are willing to pay the full freight now. Some will buy now and pick a more opportune time later to finance part of the price. The theory is that in future periods the monthly payments will be lower and the value of the home higher. That is the time to free up some liquidity. The math and opportunistic buying makes sense for those with the cash or the backstop (“Bank of Mom and Dad,” etc.).

The mix by price segment…

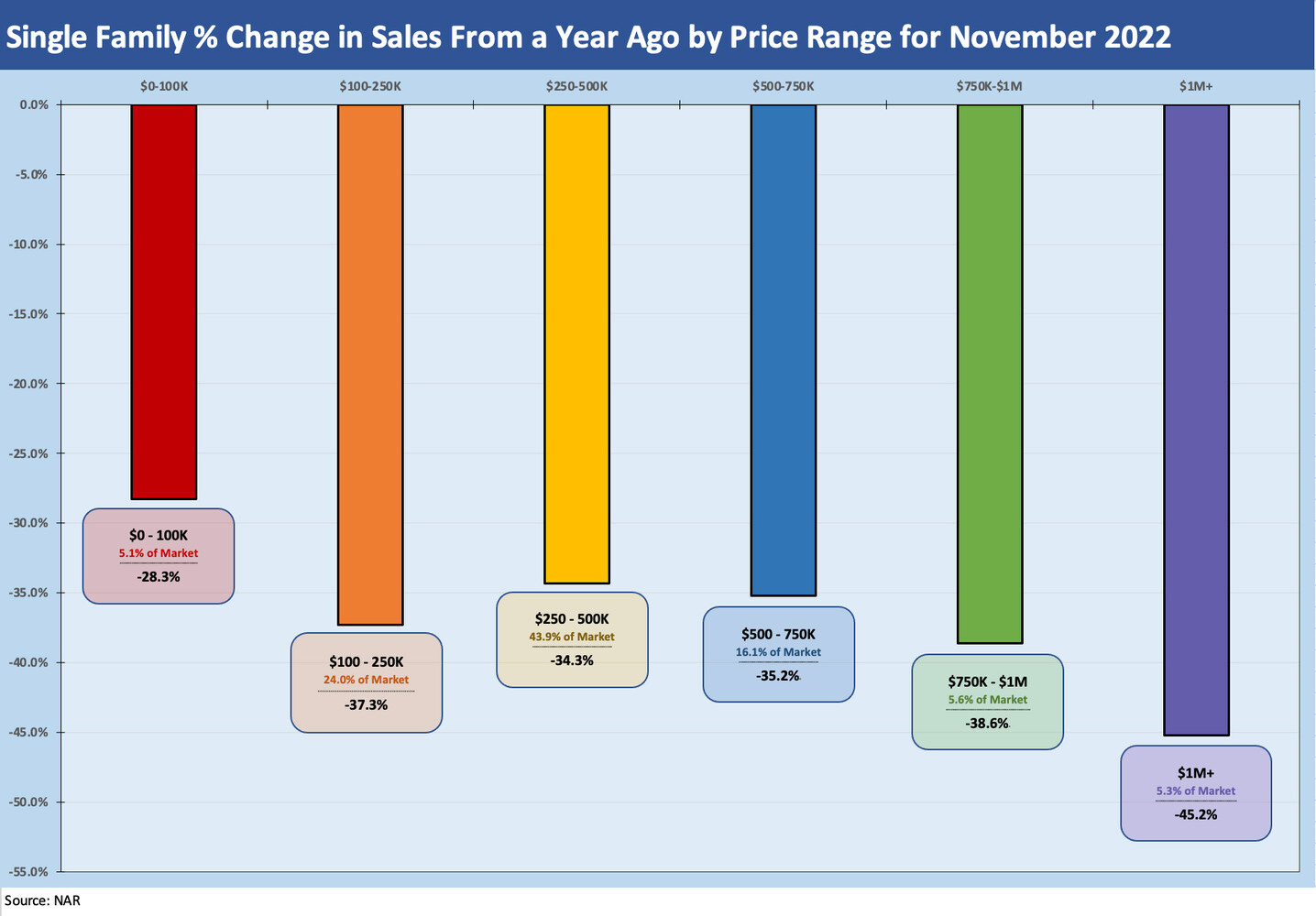

The chart above updates the mix of existing home sales by price range and what share of the markets falls into that price range. We see the decline in existing home sales by price range. The biggest decliner is the $1M+ band at -45.2% decline and the $500-$750K band at -38.6%.

In terms of the share of sales across the price bands, we see a decline in the $250-$500K market to 43.9% from 48.5% of the US in Nov 2022. That takes that price bracket back to where its share was in Oct 2022. We saw a large increase month-over-month share in the $100-$250K bracket with the increase from 14.6% in Nov 2022 to 24.0% of the US in Dec 2022. That marked a rebound to Oct 2022 levels.

The South has the highest regional share in its price mix in the $250-$500K range at 51.5%, while the West has a higher relative mix than other regions in $500-$750K range at 29.3% (the West is 38.4% $250-$500K). As we all know, CA has some very high prices. The West has by far the largest share in $1M+ price range at 14.5% with the Northeast a distant second at 6.3%.

Existing home sales in COVID context…

Earlier in the commentary we looked across the time series since 1999. The chart below plots each month alongside the same month for each year 2020, 2021, and 2022.

The above chart documents where the current numbers for the Dec 2022 total existing home sales numbers fit into monthly history since 2020. The bar chart simply frames the low points for COVID vs. today. The two red bars tell a simple story that Dec 2022 just dipped below the COVID low of May 2020. The homebuyer and home seller have both pulled back.