Durables: Visibility Limited, Transport View Cloudy

We look at the latest durables orders and shipment trends as the numbers stay in the soft zone.

The 0% change in total durable goods orders is not exciting by any stretch, but the ex-transport equipment line ticked higher to +0.6%.

The Boeing noise will be an important X-factor as the year goes on especially over whether big ticket transportation items see disruptions in delivery schedules.

Another wild card is whether EV volumes start to generate more excitement (even if the auto OEMs are losing money per unit).

With ISM numbers for manufacturing on the unfavorable side and industrial production mixed in durables, the capex outlook remains on the side of the UST bulls even if the consumer sector says otherwise.

Order rates are not setting any fires, but they also are not signaling imminent contraction with orders-ex Transport higher. The above chart tells a simple story for now. More specifically, it wasn’t negative. We saw plenty of negative months in the timeline as detailed above as the inflation spiral and tightening cycle played out.

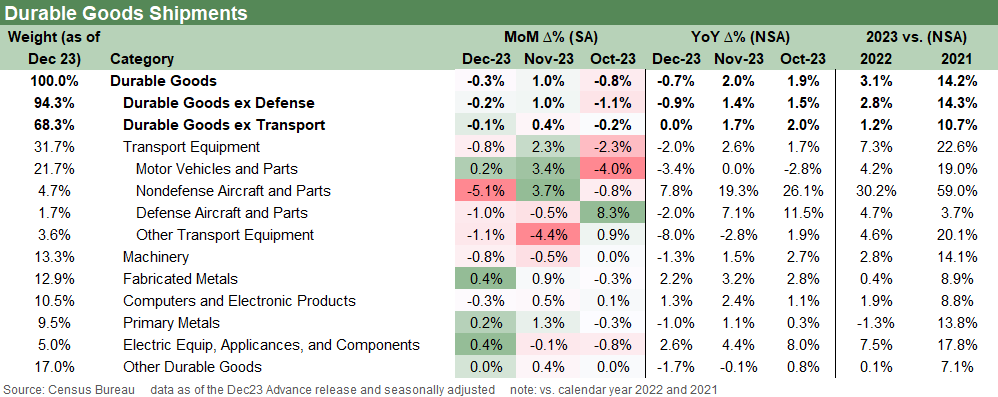

The above chart breaks out a range of categories, and we see plenty in positive territory across a range of products. Nondefense aircraft will be on the front burner of watchlists ahead as investors try to handicap what will go on with Boeing 737 MAX production and certification. In autos, the market will have an eye out for any setbacks along the EV chain spending from suppliers to finished goods.

Interest rates will remain a swing factor for more vehicle production and housing and how that flows into the related goods sector lines above. Autos essentially had a recession in volumes already in 2022, so lower rates could also fuel more incentives and drive more new vehicle purchases.

The above chart frames the shipment rate, and the heavy weighting of declines flows back into the concerns around where the capex rate is right now as opposed to where it might be later in 2024. Capex plans may (or may not) reflect more confidence in the macro and UST curve outlook. Industrial production trends have been shaky of late (see Industrial Production: Steady Course, No Signs of Fade or Flourish 12-15-23) but staying short of signaling recession.

The overall takeaway from the durables report is more of the same mixed picture, but the FOMC will put this in the “OK to ease column.”