D.R. Horton: Bellwether Leader Weighs in but Real Test is Ahead

Excerpt from Footnotes and Flashbacks: Week Ending January 27, 2023

The #1 homebuilder by units and revenues reported this past week. DHI is always a good one to watch just ahead of the slew of homebuilder reports this coming week. The results were strong in context, but the real test for the builders lies ahead. The challenges of cancellation rates and mortgage uncertainty ahead resulted in minimal guidance from DHI and is a sign of the times.

The company has one of the strongest balance sheets in the business with cash + inventory ($25 bn) of over 4x total notes payable ($5.69 bn). The asset coverage and market cap of stock ($33 bn) tells a good story also. The inventory balance includes $2.9 bn in book value of rental properties.

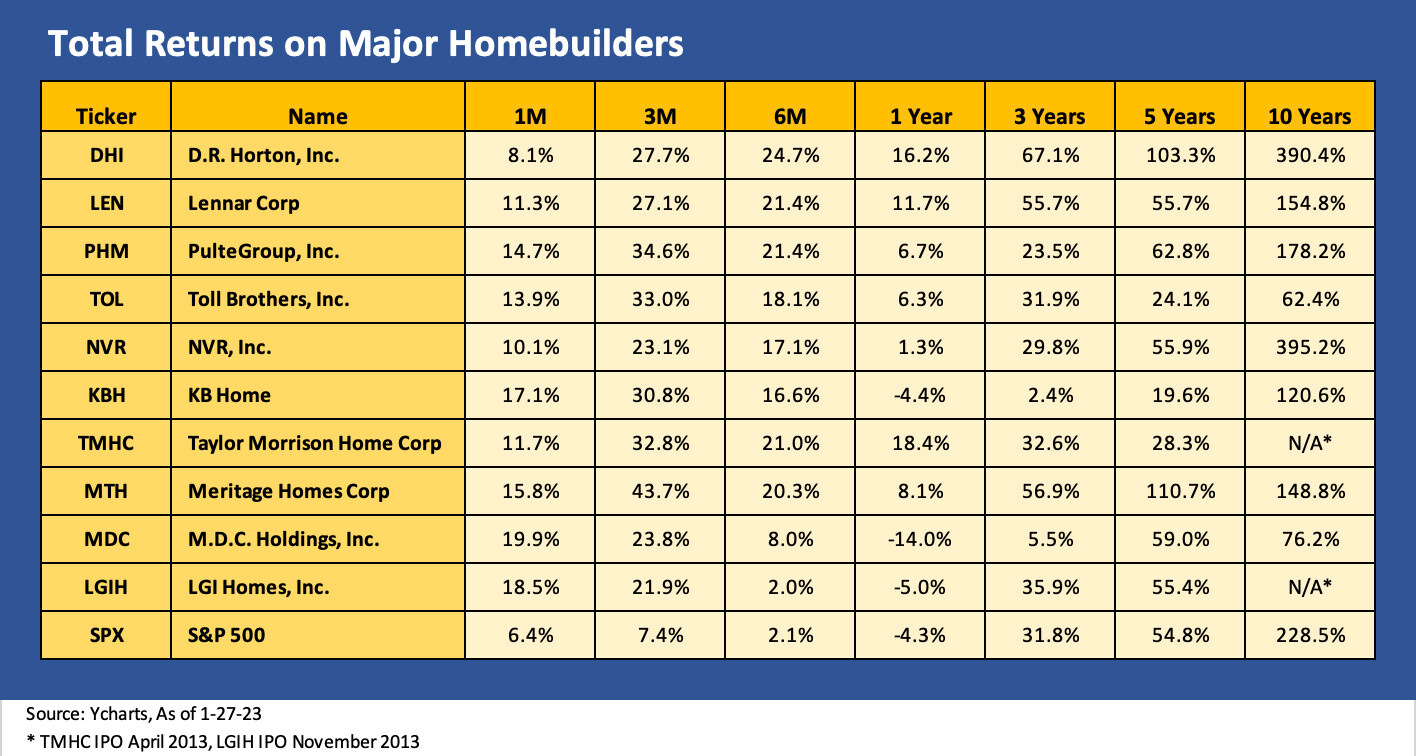

The peer group for the above list of 10 major builders might surprise some since the larger well capitalized names materially outperformed the broad benchmarks on a trailing 1-year basis dating back to before ZIRP ended and the time when mortgage rates really started to weigh on the housing markets. The builders were beat up early in 2022 but then have mounted a solid comeback as they defended their ability to navigate the shifting markets and strained affordability.

With mortgage rates down off the highs and a better understanding of the builders’ game plans and cash flow dynamics, the market seems better adjusted to how the builder cash flow cycle and strength of some builder balance sheets make this sector more interesting than the superficial reaction the builders often get. (In the interest of disclosure, I own both DHI and LEN stocks in small immaterial positions in my personal portfolio.)

The long-term anchor for the sector is the fact that there is a supply shortfall in housing that anchors builders over the next few years. The tough part is navigating the building and inventory cycle across this mortgage drama. A challenge is handicapping the timing of any downward migration on rates. We looked at some of these issues after 3Q22 (see Market Menagerie: Housing Questions to Ponder 10-27-22 and Market Menagerie: Homebuilders from the Horse’s Mouth 10-28-22).