Capital Goods: Cummins as a Microcosm in the "Cyclical Heavies"

Excerpt from Footnotes and Flashbacks: Week Ending Feb 10, 2023

What we look for from the industry leaders in capital goods such as Cummins in this current note is some useful guidance from their very close ties into customers and especially the big buyers in fleets. CMI benefits from the color they get from dealers who are close to replacement cycles and parts demand. Their guidance starts at sea level.

As we covered in our commentary on Caterpillar and CNH Industrial in a prior edition (see Footnotes and Flashbacks: Week Ending Feb 3, 2023), the deep cyclicals in Machinery and Equipment have the usual sensitivity to shifts in volume in key end markets that evoke the word “tonnage.” The Cummins business mix we discuss below is more volatile than most since it has a heavy exposure to the Class 8 truck market that is notoriously cyclical.

Cummins delivers strong 4Q22 results and guidance was constructive…

Cummins (CMI) is a major player in the global engine markets. I first followed the company in the 1980s when CMI was going head-to-head with Caterpillar and was facing the challenges left over from the brutal 1980-1982 downturn and deregulation of the transportation sector that sent more than a few fleets (and major truck OEMs) to early graves.

Since then, the US commercial vehicle manufacturers have consolidated across a few major players including some who are more vertically integrated. The commercial truck market is a regional one, however, so CMI offers a very good vantage point on one of the most cyclical subsectors in the freight and transportation space.

After a brutal supplier chain experience over the last few years that saw disruptions from sea (shipping and ports) to air (air cargo) and land (rail and trucking), the importance of the commercial vehicle markets and its personnel is appreciated. The trends in new propulsion and how that impacts the freight process will be one for policy makers to monitor closely to assure the climate challenge does not blow trucking costs or capacity out of the water (or off the road). That will be on the ESG menu of research items to watch.

The North American Class 8 and medium duty diesel engine market is highly concentrated but also brand sensitive. Cummins is a key brand in that space. In other words, a trucker will request a Cummins engine. The business is also tech-intensive from engines to emission control components that are coming into play more than ever. The segments boast higher margins than in Auto OE suppliers, and the manufacturers such as CMI generally have more pricing power. The exposure to imports is not a major factor and the capital intensity is an old school barrier to entry.

The short version of the industry history after the various sector crises is that CMI won and CAT lost in a head-to-head battle that also featured Detroit Diesel in later years. Detroit Diesel was purchased from GM by Roger Penske and turned into a very profitable sale to the vertically integrated Daimler by around 2000. Cummins now stands alone as the last major player and as a heavy-duty diesel independent with a strong position in medium duty as well.

The industry is still evolving as the next stage of post-ICE battles unfold. CMI has a good story around its acquisitions and investment strategies there but that needs more space and dedicated commentary. The fact that the capex programs are high and will stay high speak to CMI’s ability to stay a leader in the space. It also calls into question the desire of the truck makers to stay as vertically integrated in the future, creating more opportunities for CMI. Some truck makers may not want to bear that R&D and capex burden.

Recent decades included regular draconian tightening of emissions standards that caused “cycles within cycles” as replacement and “pre-buying” of trucks soared ahead of deadlines. The emissions demands were such that CAT exited the on-highway engine business. Technology problems at Navistar on emissions compliance almost bankrupted the company (long story for a different time). Navistar is now owned by TRATON in what has been a globally consolidating commercial vehicles market. That background is for other days and other commentaries.

We include Cummins in this weekly version since it is as cyclical as a major company can be, is swept up in the evolution of engines away from ICE and/or toward zero emissions and is investing heavily in new technologies. CMI is using free cash flow to reel in more assets that will help the company accelerate its product development. CMI fits into a lot of different trends but the main issue is the simple reality of the cyclical nature of the commercial vehicle customer base and related replacement cycles. CMI helps tell a story on recession risk for the US. North America comprises 58% of CMI revenue.

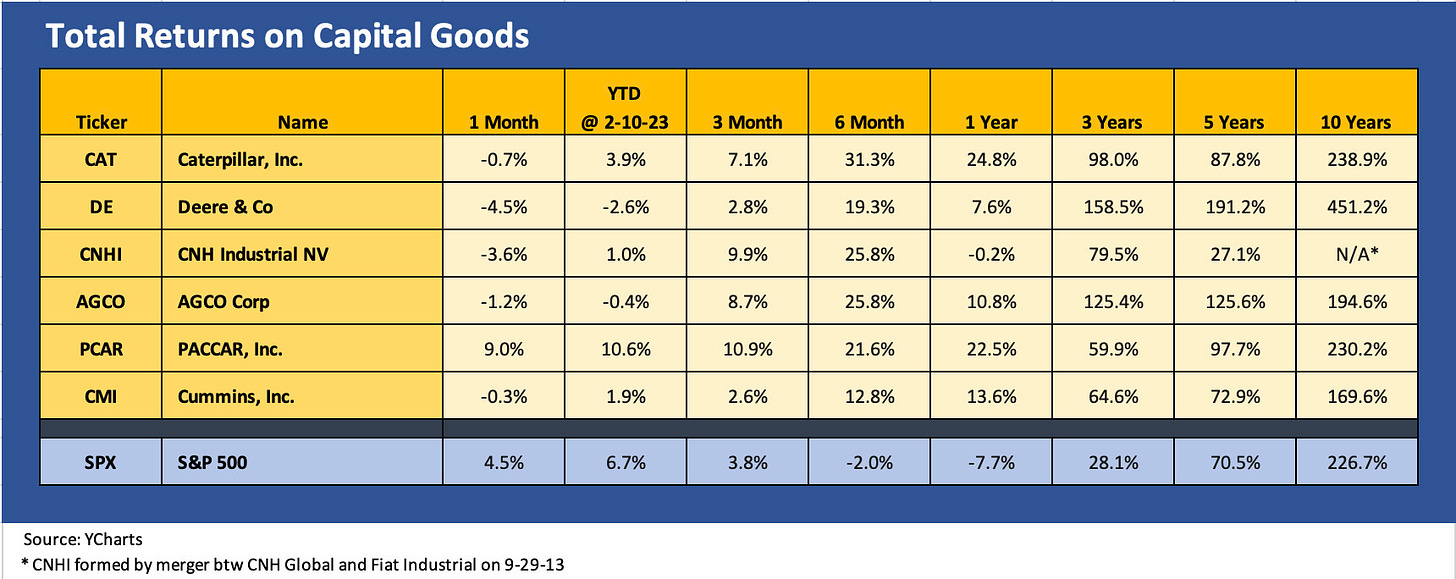

The chart above on trailing equity returns tells a story of either a cyclical peak and questions on valuation or it signals above average risk of recession. CAT is more tied to construction and DE, CNHI, and AGCO more tied to the agricultural markets. PACCAR is one of the Class 8 truck leaders with Daimler and Volvo. The equity markets are not showing a case of nerves, but the ability to keep investing in the face of flat or rising revenues is worth something in the cyclical debate. CMI and CAT earnings and guidance left us with the sense that there was not much recession risk in their expectations.

For its part, Cummins is guiding to higher revenues, EBITDA growth, and steady margins. Capex will be rising and free cash flow bountiful. The segment guidance from Cummins was dominated by the word “up” with a small side order of “flat to up” in the engine business. If we exclude the investment initiatives in the small “new power” business, we see three of four of the main operating segments (Distribution, Components, Power Systems) highlighting higher revenue ahead. The Engine segment framed flat to up 5% guidance but with stable double digit margins in the low-to-mid teens. Despite the inherent cyclicality of commercial vehicles, the aftermarket components and servicing operations are steady and lucrative, and CMI is the leader.

CMI also competes with CAT in the global power generation business. The combination of high investment expected in energy and mining and the China reopening story are X-factors on the upside. As much as North America – where CMI’s majority of customer markets are located – faces potential recession risk, the investment side of the ledger has been getting solid color this earnings season and CMI echoed that sentiment. The infrastructure bill, the IRA, myriad climate transition projects, and high oil prices are keeping the spending cycle rolling. Nonresidential construction may be mixed across the category, but power gen plays a big role there. The tonnage factor for heavy duty trucks also ties into that when such cycles are holding up.